stefanamer/iStock via Getty Images

During times of economic dislocations, investment prices rarely reflect true value. In reality, buying opportunities, that wretched term, create themselves. The question always becomes, when? For Cirrus Logic (NASDAQ:CRUS), a severe price dislocation is in progress. The company reported a record June quarter that won’t be a one-off. From recording the record, management discussed at the call and the following investors’ conference afterward, a treasure trove of valuable audio.

The Basis

We begin a long-term vision with an Apple (AAPL) theme, followed by non-Apple revenue. For Apple, our belief suggests that unit sales for each of Apple major products equals: 210 million iPhones, 65 million iPads, 45 million Apple Watches and 20 million iMacs. Investors may find the information at this site, Business of Apps, a little more than valuable.

The Growth

Management clearly stated a forward path for increased ASPs which are most likely with Apple. Perhaps, the most important recent announcements were at Cirrus’ presentation with KeyBanc. Cirrus’ CFO, Venkatesh R. Nathamuni, added clarity to the enjoyable future audio sounds:

- Revenue for fiscal ’23 is an incremental growth year.

- Fiscal ’24 is about “reasonable” growth.

- Driven primarily by high-performance mixed signal products.

- New content.

- An unannounced new category.

- Top customer involved without details, but is unique and differentiated. (In our opinion, built with Apple’s input.)

- “Combination of those 2 product areas” should bring growth in fiscal ’24.

- 22 nm codec/Fiscal ’25

- Definite, a major customer. (Apple)

- Substantial performance improvement.

- Substantial space and power usage saving.

- “Represents more features and capabilities and so you do typically expect to see some ASP accretion…” (Our estimate is $1+ increase or $200-$400 million annually.)

The CFO summarized,

“So if I were to step back, I would say fiscal ’23, fairly de minimis growth, but still growth, we think. And then in fiscal ’24, we’ll see more growth primarily driven by the fact that we have increased attach rates with existing products as well as some incremental content and some new content or a new category, I should say. And then fiscal ’25 to layer on top of that when we introduced the 22-nanometer codec, that should add on additional capability.”

Continuing, Nathamuni discussed further details with its laptop opportunities, mostly non-Apple. These devices could have up to four amplifiers, a codec, haptics power management and charging. In summary, Nathamuni spoke, “And I think there’s a distinct possibility that it could get to about the same level of content that we have in some of the smartphones — in the flagship smartphones.” That is heading into the $6-$8 ASP range, by the way. Nathamuni also upped the PC SAM opportunity to “$1.2 billion to $1.3 billion from $1 billion by fiscal ’26.”

The following table summarizes revenue using the above basis.

| Revenue | 2022* | 2023 | 2024 | 2025 |

| iPhone ** | 1,200 | $1,500 | $1,750 | $1750 |

| iPad *** | $260 | $300 | $400 # | $500 |

| Watch **** | $50 | $50 | $50 | $50 |

| PCs ***** | $150 | $300 | $500 | $800 ## |

| Android Misc | $200 | $200 | $200 | $200 |

| Totals | $1900 | $2400 | $2900 | $3300 |

* Revenue estimated using the above unit sales could be significantly low. For example, iPhone unit sales could be significantly higher.

** ASP: codec $2, 3 amps $1.50, 3 – 4 camera continuous controllers $1.25, power management $1 = $5.5. In 2023, Cirrus adds two new products that we have valued at $1-$2. In 2024, Cirrus adds a new codec adding $1+ in ASP.

*** ASP variable but estimated at $4.0.

**** ASP approximately $1

***** Management noted a few quarters ago that last year was $50 million. The company won sockets in many new PCs.

# At some point, new sockets won in the iPhone will migrate toward tablets. We estimate that, in time, the tablet ASP will be equivalent to the iPhone at $7.

## In time, past experience suggests that Cirrus wins at least 55% of the TAM.

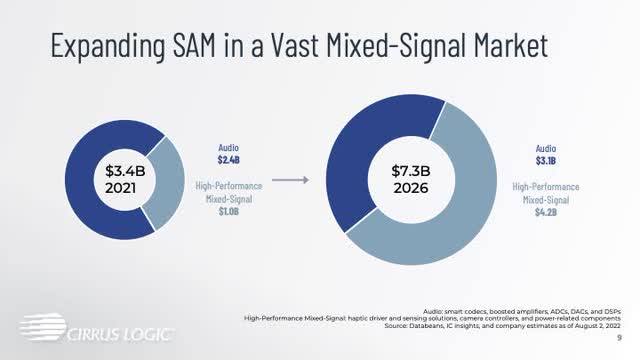

Several growth potentials are not in our above table, including revenue growth from increased 55 nm chips capacity now limiting Android revenue and valid estimates around a new product line. Regarding 55 nm capacity shortages, management stated in the shareholder letter, “Near term, we are working with our partners to expand capacity where possible, and we continue to prioritize supply towards key customers seeking to maximize total smartphone unit volumes in light of these constraints.” Cirrus always puts in its presentation a SAM slide which follows:

In 2021, Cirrus generated about 1.8 Billion or 55% of the total market share. Using 55% of $7.3 Billion, Cirrus revenue might be $4 Billion plus. We view our $3.5 Billion with a very conservative eye. Our gut feeling is that the above estimate is short.

We are providing a link to Cirrus employment section, something we have followed for over 2 decades. It is now at a record number from what we have observed so far.

Coming Quarterly Report

As stated in our opening, the markets are dislocated, with extreme energy and inflation issues abounding. Apple seems somewhat immune thus far. Canalys’ preliminary September’s smartphone analysis shows Apple up 3% in market share and, after a little math, up 10% year over year in unit sales. Although the Pro line demand remains strong, a recent report from Seeking Alpha counters enthusiasm with purportedly drastic cuts in iPhone 14 Plus orders. We view September at the top end of guidance $490 million plus, with guidance not above $550 million for December. Last year, Cirrus generated $550 million in that quarter, maximum or close to it for its production capacity. Although new capacity is shortly coming online, the new capacity isn’t generally for existing products, rather for new ones coming. Yes, management is again working diligently toward gaining more 55 nm chip capacity.

For the September quarter at a 50% margin rate plus $123 million cash expenses plus 23% tax rate and 55 million shares, earnings might equal $1.80 in line with last year. Note: Cirrus’ high tax rate is temporary and might disappear immediately from changes in the law, but if not, will disappear gradually within three years to 13-15%.

One More Thing

Investors often, rightfully so, challenge management on the subject of dividends. We have ourselves. In our view, an answer is on its way. Management at some point will be forced into it. Some history: Two decades ago, a former CEO purchased several small companies using stock, a venture that failed. With a new CEO and CFO, Cirrus repurchased that 30 million shares issued, understanding clearly the dilutive effects. This failed event created a culture within the company in managing share count, which now is near 55 million. During periods of cheap evaluations, Cirrus has a history of repurchasing extraordinary amounts, something we are now expecting. But, at recent purchase rates, Cirrus’ count will or could drop to 50 million or less. Investors, management have to ask, how low can they go? A company can have too little stock, which creates trading problems or buyout risk. And by the way, neither is fixed by stock splits.

Cash flows at Cirrus’ likely potential future increase dramatically. For example: $4,000 million times 0.51 margin minus $550 million in cash expenses times 0.85 equals $1,200 million per year in cash. At 50 million shares, that equals $25 a share. From our article, Defining The Type Of Investment For Cirrus Logic, the company issues approximately 1.6 million shares in stock options. At $25 earnings, repurchasing 1.6 million shares requires about $400 million. Without buying back stock, the company’s extra cash equals $800 million. A continual cash addition of $15 – $20 per share creates interesting structural issues. Remember, $4 worth of dividends costs $200 million. In our view, management’s resistance toward dividends will be pressured, though still a few years out.

Investment & Risk

First, let’s consider the downside risk from market perception; it’s markedly in place. A hold on the stock is back in place. Some might suggest a sell. Yet, thus far, Cirrus’ businesses aren’t seeing the dire decline. High-end markets have a level of insulation for the short-term. Management’s song of growth includes critical wording for two of the three growth vectors. The 3rd, PCs, are greenfield yielding growth regardless of the volume. Never has the premium turntable played such high quality music of growth. The question becomes when. For us, patience defines the atmosphere, but at some point investors might consider increases in long positions as a must. The music of growth is just too clear. Regardless, it will be rocky. And before we leave this subject, our worry is with the March quarter. Europe, with its huge energy issues, will just be exiting a winter, one that might prove costly in many ways.

Still, the crisp growth vision is crisper and the harmony is divine. Cirrus’ design ins require 2-3 years with Apple. With management’s willingness to share a path two to two and a half years out means that they have joint efforts in place. Apple is committed. Timed purchases seem in order in spite of market uncertainty. Note: We have set aside a level of cash to purchase sometime between now and January.

Be the first to comment