zorazhuang

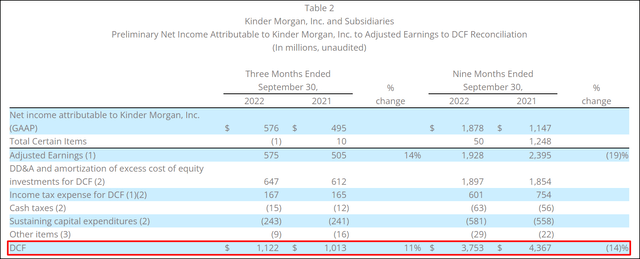

Kinder Morgan (NYSE:KMI) put up a strong earnings sheet for the third-quarter last week that included an 11% year over year increase in distributable cash flow and a 7% year over year increase in adjusted EBITDA. Additionally, the pipeline company confirmed its outlook for FY 2022 — which Kinder Morgan raised in Q2’22 — and maintained a very low payout ratio based off of distributable cash flow. Unfortunately, Kinder Morgan’s stock dropped by 5% the day following earnings which creates a buying opportunity for dividend growth investors that like to collect a solid 6.3% dividend yield!

Strong Q3’22 earnings sheet

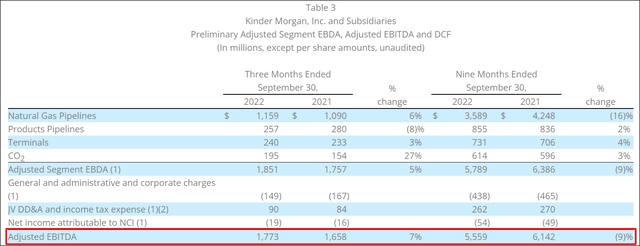

Positive momentum in Kinder Morgan’s natural gas and CO2 businesses carried over from the second-quarter to the third-quarter and both segments once again delivered impressive results. The natural gas pipeline business generated $1.16B in earnings in Q3’22, showing 6% year over year growth. The natural gas pipeline business is Kinder Morgan’s bread and butter and had a 63% earnings share in the third-quarter (based off of earnings before depreciation and amortization). Kinder Morgan’s CO2 segment also continued to do well, growing earnings 27% year over year to $195M, chiefly due to improved pricing for CO2 products. Kinder Morgan’s adjusted EBITDA was up 7% year over year to $1.77B.

Kinder Morgan’s distributable cash flow grew 11% year over year to $1.12B due to broad-based strength across business segments. Distributable cash flow is a much better figure than earnings to focus on for midstream companies because cash flow is less susceptible to manipulation than earnings figures.

Low payout ratio translates to safe dividend payments

Kinder Morgan’s dividend, which currently amounts to $1.11 per-share annually, is very safe since the pipeline owner and operator covers its payout with distributable cash flow. In Q3’22, Kinder Morgan paid out slightly more than half, 56.6%, of its distributable cash flow which gives the midstream firm room to grow its dividend payment and make new investments into its pipeline system.

|

KMI |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

|

Distributable Cash Flow |

$0.44 |

$0.48 |

$0.64 |

$0.52 |

$0.49 |

|

Declared Dividends |

$0.27 |

$0.27 |

$0.28 |

$0.28 |

$0.28 |

|

DCF Payout |

61.4% |

56.3% |

43.4% |

53.4% |

56.6% |

(Source: Author)

Because of the low payout ratio, I believe Kinder Morgan’s dividend is sustainable during a recession which in itself has a lot of value for dividend investors.

Strong guidance for FY 2022 confirmed

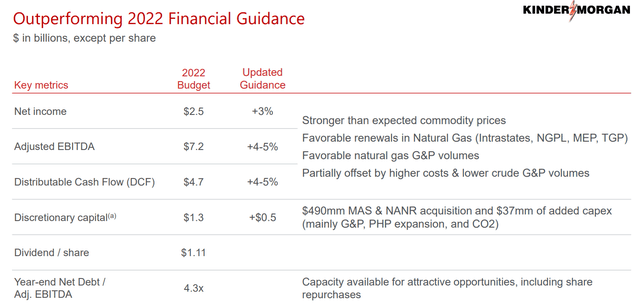

Kinder Morgan confirmed its guidance for FY 2022 and continues to expects $7.2B in adjusted EBITDA and $4.7B in distributable cash flow. Due to strong performance in the company’s natural gas pipeline and CO2 businesses, Kinder Morgan said in the second-quarter that it sees up to 5% upside in its base case for both adjusted EBITDA and distributable cash flow.

Attractive yield and valuation

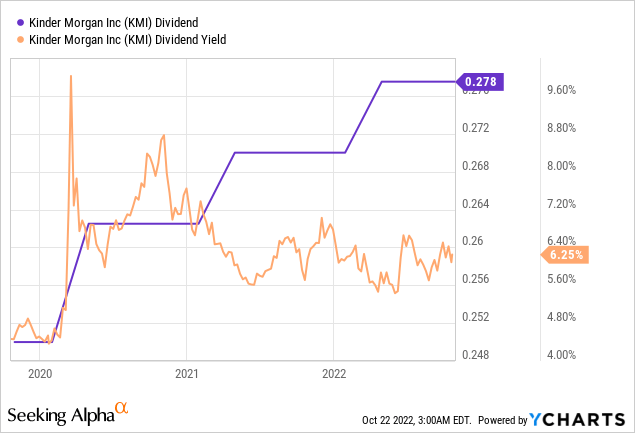

The most appealing aspect of Kinder Morgan is the 6.3% dividend yield combined with the low DCF-based payout ratio… both of which practically guarantee that the dividend will keep growing going forward. The current dividend is $1.11 per-share annually, or $0.2775 per-share quarterly, and Kinder Morgan has said that it plans to grow its dividend at 3% annually.

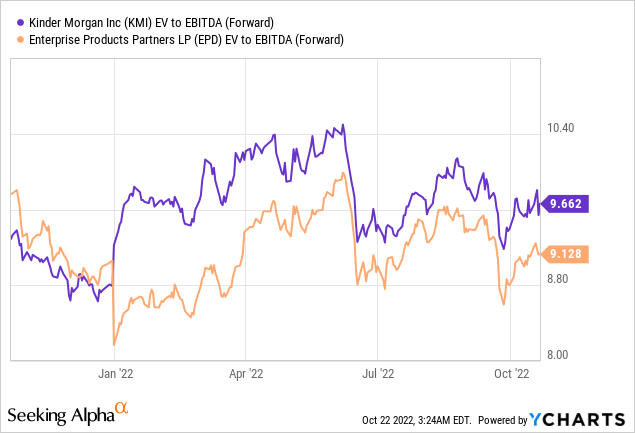

Also appealing, but perhaps to a lesser degree than the high dividend yield, is Kinder Morgan’s valuation. Kinder Morgan’s price dropped 5% the day after Q3 earnings, which creates an opportunity to buy the company at a discounted valuation. Based off of adjusted EBITDA expectations for next year ($7.53B), Kinder Morgan is selling at an Enterprise-Value-to-EBITDA ratio of 9.6 X. Enterprise Products Partners (EPD), a large rival for Kinder Morgan in the pipeline industry, has a comparable Enterprise-Value-to-EBITDA ratio of 9.1 X.

I like Enterprise Product Partners a lot due to the midstream firm’s consistent dividend growth, higher yield and slightly better valuation than Kinder Morgan.

Risks with Kinder Morgan

Kinder Morgan is a defensive investment for dividend investors as the company provides crucial energy products that customers need even if the US economy gets weighed down by a recession. Additionally, Kinder Morgan has regulatory risk as the fossil fuel industry is currently not a favorite of the US government which seeks to advance green energy sources. If the US government continues to limit the expansion of mission-critical infrastructure that serves the fossil fuel industry, Kinder Morgan’s long term growth prospects in the energy industry may get hurt.

Final thoughts

Pipeline owner and operator Kinder Morgan is a buy on the drop. The company’s third-quarter results were solid regarding EBITDA and distributable cash flow growth, and Kinder Morgan maintained a low payout ratio in Q3’22 as well. The outlook for FY 2022 was also confirmed, which makes it even harder to understand why the stock price dropped after earnings. Both Kinder Morgan’s valuation and the dividend yield are attractive for investors that seek long term exposure in the US energy industry!

Be the first to comment