Getty Images/Getty Images News

Introduction

The November 2022 CPCA Monthly Analysis says that once the promotion period of electric vehicles has passed, the replacement of fuel vehicles by electric vehicles in China will be irreversible. A December 5th Financial Times article explains that Chinese auto companies are well positioned to compete on a global level since 40% of the cost of an electric vehicle is in the battery. Per the November 2022 CPCA Monthly Analysis, car companies outside of China are relatively slow with respect to high-end electrification efforts. These and other factors point to BYD (OTCPK:BYDDY) having excellent potential in the coming years. My thesis is that BYD will continue increasing their sales of battery electric vehicles (“BEVs”).

BYD makes some models that come in either the battery electric vehicle (“BEV”) version or the plug-in hybrid electric vehicle (“PHEV”) version. I like to focus on the models that come in the BEV-only version.

At the time of this writing, 1 Chinese Yuan equals $0.14.

Irreversible Replacement

The November 2022 CPCA Monthly Analysis says that electric vehicles provide more economic vehicle costs than internal combustion engine (“ICE”) vehicles. The translation from Chinese is a bit confusing but some of my takeaways are that the high-end potential for EVs is huge, EVs are economical for car owners and the role of EVs replacing ICE vehicles is irreversible:

The high-end potential of self-owned brand electric vehicles is huge. China’s passenger car system is a complete and complex tax system, coupled with high gasoline prices, the space for demand in the passenger car market has shrunk in recent years. However, electric vehicles have more electrified products, more diverse power combinations, a more friendly tax system, and more economical vehicle costs. Therefore, the products in the electric vehicle market will be more abundant and diverse, and the intelligentization of electric vehicles will bring greater benefits to our consumers. Driving pleasure and more usage scenarios, the platform of electric vehicle products has more natural intelligent and convenient control advantages. After the promotion period of electric vehicles has passed, the role of electric vehicles in replacing fuel vehicles will be irreversible.

Given considerations like the ones above and the fact that BYD no longer makes ICE vehicles, BYD should be able to continue using their electric focus such that they keep increasing their sales of BEVs.

Batteries

A Financial Times article from December 5th talks about the importance of batteries in the EV space. Noting that 40% of the value of an EV is in its battery, the article implies that battery makers like BYD can disrupt legacy auto companies by selling BEVs directly as well as supplying batteries to competitors:

While China was relatively late to develop a car industry that can compete with Europe and the US on engine technology, the shift to electric gives it the chance to overtake traditional automotive heartlands. Some 40 per cent of the value of an electric vehicle is in its battery, so the country that supplies that battery wins a huge chunk of the market. “The new world, the electric vehicle world, will be defined clearly by battery costs,” said Thomas Schmall, head of technology at Volkswagen.

Non-Chinese Car Makers Are Relatively Slow With Electrification

BYD has been making more luxurious models like the Seal which competes with the Tesla (TSLA) Model 3. BYD’s Yuan Plus competes with the Tesla Model Y. Tesla will remain a formidable competitor but other car companies outside of China have been slow in their electrification efforts per the November 2022 CPCA Monthly Analysis:

The high-end demand in China’s auto market is generally strong, and the penetration rate of new energy will inevitably reach a high level. Since the current imported cars and joint venture luxury cars are relatively slow in high-end electrification, the high-end market naturally has market space for independent electric vehicles with more tax policy advantages and product advantages. Therefore, the high-end potential of self-owned brand electric vehicles is huge.

BYD isn’t named directly above but it is obvious that they should benefit as demand for luxury BEVs increases in China and BYD is able to use tax advantages that foreign BEV makers can’t replicate.

BYD’s BEV-Only Models

We have to understand BYD’s current BEV models in order to conjecture with respect to future unit numbers.

BYD Seal BEV Sedan or Atto 4 outside China

Length: 4,800mm

Price: from 222k yuan

China launch: July 2022

November wholesale units: 15,356

Comparison: Tesla Model 3 Sedan

BYD Global has a short video showcasing the Seal:

An August article from Wheels explains that the new BYD Seal BEV goes by the name Atto 4 and it is a rival to the 280,000 yuan Tesla Model 3 sedan. Here is what Wheels says about the Seal dimensions:

Measuring 4800mm in length, 1875mm in width and 1460mm in height, the BYD Seal is around 160mm longer but 58mm slimmer than the Model 3 – and similar in size to a Toyota Camry.

The CPCA November 2022 retail sales report shows that Tesla sold 111,917 Model 3 vehicles in China in 2022 through November. I believe more BYD Seal sedans will be sold in China in 2023 than Tesla Model 3 sedans. The CnEVPost November sales breakdown shows that Seal wholesale units climbed from 0 in August to 7,473 in September to 11,267 in October to 15,356 in November.

BYD Yuan Plus BEV SUV or Atto 3 outside China

Length: 4,455 mm per InsideEVs

Price: from 150k yuan per Paul Tan’s Automotive News

*China launch: July 2021

November wholesale units: 29,402 which includes all Yuan models

Comparison: Tesla Model Y SUV

*Currently the Yuan Plus is only available as a BEV but past Yuan models came in ICE and PHEV versions. As such, the launch date and the unit number comparisons from 2021 can be confusing.

Similar to the Tesla Model Y SUV, the Yuan Plus sells at a lower price point such that it does not appear in the CPCA’s list of high-end SUVs. BYD Global shows the Atto 3 in action:

The CnEVPost November sales breakdown shows Yuan wholesale units as follows:

The CPCA November 2022 retail sales report shows that the BYD Yuan Plus SUV BEV did well for the first 11 months of 2022 with sales of 146,358 units. For comparison, Tesla’s Model Y had sales in China of 285,927 units from January to November 2022:

Yuan Plus Sales (CPCA November 2022 retail sales report)

*The BYD Song is the #1 SUV above but most of the units are PHEVs as opposed to BEVs. The same type of situation applies to BYD’s Tang SUV above in the #14 spot.

BYD Dolphin BEV or Atto 2 outside China

Length: 4,070/4,125 mm per PushEVs

Price: from 94k yuan per Paul Tan’s Automotive News

China launch: August 2021

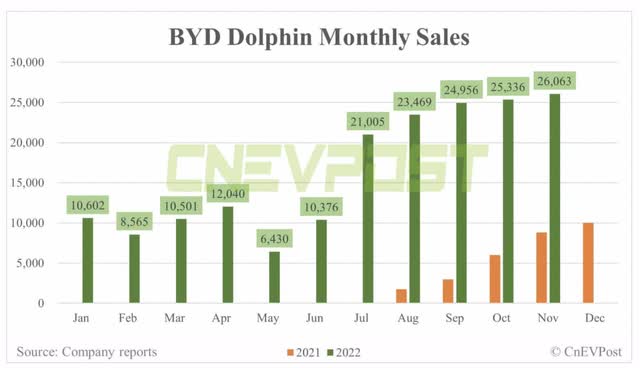

November wholesale units: 26,063

Comparison: Per Carsguide, it has the same wheelbase as the Nissan Leaf but its overall length is shorter.

InsideEVs shows this small affordable BEV:

CnEVPost reports that the first two markets for the Dolphin outside of China are Japan and Colombia.

The CnEVPost November sales breakdown shows wholesale units as follows:

Looking at cumulative units from January to November in the CPCA November 2022 retail sales report, the BYD Dolphin BEV went up 899.3% from 17,830 units in 2021 to 178,178 units in 2022:

Dolphin YTD Sales (CPCA November 2022 retail sales report)

Image Source: CPCA November 2022 retail sales report

*BYD’s Qin and Han models come in at #3 and #5, respectively, above but these are largely PHEV units as opposed to BEV units.

At a relatively low price and a length of just over 4,000 mm, the Dolphin has some similarities to the SAIC GM (GM) Wuling, which is just under 3,000 mm in length but it is more like a Toyota Corolla in terms of dimensions. The point is that profit margins can be challenging for vehicles that are small and inexpensive. WIRED says that the profit on each Wuling Hongguang Mini EV is just $14. Fiat Group World shows that the Wuling Mini EV looks tiny compared to the Tesla Model Y:

Wuling Mini (Fiat Group World)

Combination PHEV And BEV Models

Per CleanTechnica, BYD’s top BEV/PHEV combo models for October 2022 were the Song Plus (mostly PHEVs but it had 6,086 BEV registrations), the Qin Plus midsize sedan (12,189 BEV registrations), the Han (13,347 BEV registrations) and the Tang.

Valuation

BYD and Tesla are selling around 100,000 BEVs per month each at this point and they are well ahead of the competition on a global level. One difference is that almost all of BYD’s sales are in China whereas Tesla has sales spread out across China, the US and Europe. In China, the BYD Seal and the Tesla Model 3 are in a somewhat high-end space with respect to sedan BEVs; the BYD Yuan Plus and the Tesla Model Y skew towards the high end of SUV BEVs. In the long run, I like BYD’s economic prospects with BEVs more than their prospects with PHEVs, particularly their higher end BEVs like the Seal and the Yuan Plus. I think the higher end BEVs like the Seal can have better unit margins than their lower end BEVs like the Dolphin. Berkshire Hathaway has sold 1/4th of their BYD position recently and I doubt the stock is a screaming buy given this consideration. I’m guessing that Berkshire envisions BYD selling a substantial number of low end and low margin Dolphins in the years ahead.

I used Google Translate for the top 10 YTD list of high-end SUVs in China with a starting price of more than 300k yuan or $42 thousand. Tesla has a nice profit margin on the Model Y and the list below shows that they sold nearly 286 thousand through November. The BYD Yuan Plus competes with the Tesla Model Y in some ways but it is not in this list because it is priced under 300k yuan. I’d like to see BYD have success with high end brands on the BEV side in the same way we have seen others have success with luxury brands on the ICE side like VW Group with Audi and Toyota with Lexus:

High end SUVs (CPCA November 2022 retail sales report through Google Translate)

My overall valuation thoughts haven’t changed much since my October 26th article but the stock has come up in price since that time. 2 BYDDY ADRs represent 1 regular share. Combining A shares with their H share equivalents, BYD’s 2022 interim report shows a total of 2,911,142,855 shares. We divide this in two and then multiply by the December 19th BYDDY share price of $51.77 to get a market cap of $75 billion. I think Mr. Market is somewhat reasonable with this market cap relative to the amount of cash that can be pulled out of BYD from now until judgment day. However, I think the stock price increase since late October has out-climbed the improved business prospects.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment