tadamichi/iStock via Getty Images

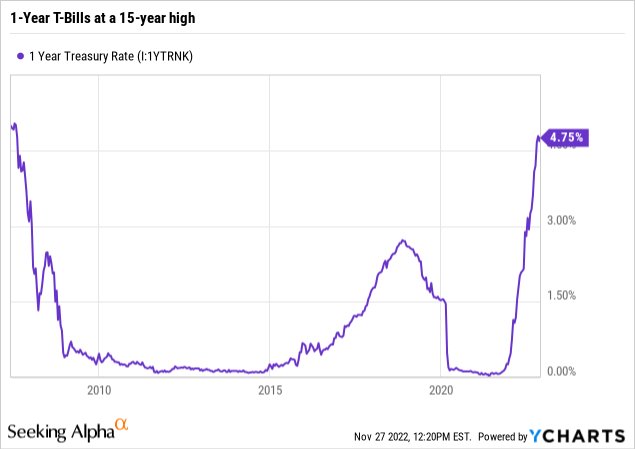

The yield on 1-Year U.S. Treasury Bills celebrated Thanksgiving last week by closing at the highest interest rate since the summer of 2007. More importantly, at 4.75%, that rate is well above the average dividend yield of high-quality stocks, and rivals the payout of riskier, longer-maturity bond asset classes (corporates, high yield, munis).

That creates literally a generational opportunity, though it is a fleeting one. But if there were ever a time for investors to search for something to get them through the next 12 months of this manic market, this is that time. With that in mind, I recently pulled something out of my decades-large investment strategy closet: a simple, straightforward method to create a 1-year portfolio.

This is not just any portfolio. Because unless you are concerned about the U.S. Government not paying you what you are owed for lending them your money for 12 months, you can lock in a worst-case 1-year return, while not capping your upside. As I see it, this is the “holy grail” of investing: your loss is limited, but your gains are not.

This sets up an opportunity not seen for a very long time. T-Bills and other zero-coupon Treasuries can be used as a base to create an “insured” portfolio with unlimited upside potential. Here’s how it works, combining T-Bills with whatever “growth” investments you choose.

The “T-Bills Plus” Strategy

Discounts…just in time for holiday shopping?

T-bills are discount instruments. That means that you pay less than $100 now, and the U.S. Government gives you $100 back at maturity. The difference is your total yield over that period. So, if you buy T-Bills that mature in exactly 1 year, your annual yield to maturity can be calculated by comparing the interest you will receive on the T-bills (the difference between what you paid for them and $100), and dividing by what you paid for them now.

That discount structure makes it easy to think like this: if you know that every $X you pay for T-Bills now will return $100 in a year, that’s a profit you can count on. That is, unless the U.S. Government defaults, in which case we all have much bigger problems.

3-Month and 6-Month T-Bill yields are in the same general area as 1-Year rates right now, so this allows you to “ladder” a T-Bill portfolio without sacrificing much yield. With the potential for rates to go even higher into 2023, or at least not crash, this just allows more flexibility for the strategy.

It’s all about that base

With the confidence of knowing that a set amount of your investment will be returned to you on a specific date (or dates, if you ladder the T-Bills), you are free to use the other portion of the strategy to try to enhance that return you just locked in on the first part. What do you invest in? That’s entirely up to you. But you have an infinite number of choices. If you want to take that fixed return of 4-5% on the first part of the strategy and try to parlay it into a higher return, you can use the other portion of the portfolio to buy income-oriented investments.

If you are bullish on dividend stocks or dividend stock exchange-traded funds (“ETFs”), you’ll add some cash flow to the total return, while having the upside potential of those stocks. Likewise, if you are uber-bullish on the stock market for the next 12 months, you can load up on your favorite stocks and/or ETFs, and know that if it goes the wrong way on you, your losses will be partially offset by the return you have already set up for yourself via the T-Bills portion. Think inflation is going to stay high, and that commodity prices will roar higher? Take that route, and use the T-Bills portfolio base to get you part of the way toward combating the hyper-inflation you anticipate.

Whether its stocks, ETFs, mutual funds, options, futures, some combination or something else entirely, the “growth” side of this portfolio is limited only by the personal preferences of the investor. Want to set it and forget it for a year? Tactically-manage your way through the growth part of this, rotating sectors, themes, asset classes, or all of the above? Prefer to ladder the T-Bills and re-address every 3-6 months? Regardless of what you decide to do here, you know what the other part of the portfolio will look like later on. To me, that’s the type of peace of mind we haven’t had as investors since 2007.

Putting a portfolio together

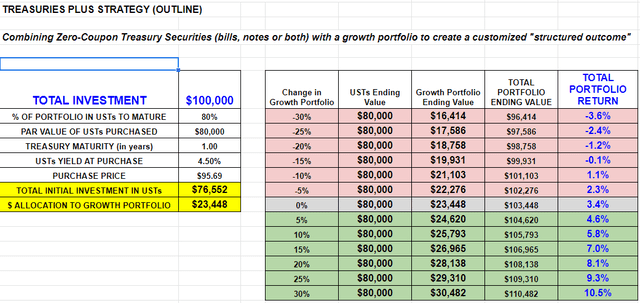

Here is a spreadsheet I designed to show the strategy in action, at a high level. This is NOT investment advice, simply a pro-forma, hypothetical example. This is purely to highlight the variables an investor can work with when crafting this type of portfolio, and how the reward/risk tradeoff can work.

The strategy, in table format (Rob Isbitts / ModernIncomeInvestor.com)

I assume that the T-Bills are 1 year to maturity and yield 4.50%. In this example, I wanted to have those T-Bills end the year at a value of $80,000 out of the $100,000 total, and that cost me $76,552.

So, knowing that my T-Bills will end 1-year time frame at 80% of the total portfolio value ($80,000 out of $100,000), I can focus on using the remaining $23,448 to pursue a return that is not set as the T-Bills portion is. Note that I have not specified the strategy here. I just want to show what the probabilities look like.

For example, take the grey row in the right-side table. If I hid my non-T-Bills investment under my mattress for a year, earning zero return, that plus the return on the T-Bills I invested in would turn the $100,000 into $103,448, for a return on the full portfolio of 3.4% over the 12-month period.

The pink area shows what happens if that $23,448 non-T-Bill investment went south. Note that even if the “growth” portfolio segment lost 15%, I’d still essentially break even. Alternatively, if the growth portfolio gained 15%, add that to the fixed return on the T-Bills and the total portfolio return ends up at 7.0%. Remember, you can’t lose more than the ending value of the T-Bills.

So theoretically, if I put all of the growth money in, say, options, and they all expire worthless, my portfolio is still at $80,000 from the T-Bills. I locked in a worst-case scenario of a 20% loss. I didn’t include that in the table, since I aim not to be that careless!

2 other important decisions in this strategy

In addition to what I mentioned earlier about how to invest in the T-Bills (ladder them, “bullet” them out 1 year, or otherwise), and the infinite ways you can run the growth portfolio, there are two other key variables here.

One is the decision about how much of the total portfolio to count on having at the end of the period. In other words, how much you want to end up with in the value of the Treasury Bills. Because, depending on what your objective is, you can put very little at risk or a lot at risk. You can put enough in the T-Bills so that they mature at 100% of the starting value. You won’t have much upside over the T-Bill yield, but you will have some.

There’s also no rule about going beyond 1 year with the T-Bills. For instance, according to the St. Louis Fed’s website (fred.stlouisfed.org), 2-year zero coupon Treasury Notes yielded 4.48% as of November 24. So, you could take $100, invest about $91, know that in 2 years you will have about what you started with. Whatever you turn the other $9 into is your profit on the $100 total.

But what about?…

Note that Wall Street firms have created investment products for decades around this concept. But if you want to take matters into your own hands, be your own “insured portfolio” manager, save the costs and gain the flexibility, this is a strong alternative approach to consider.

Also, I have stuck with Treasuries for the preservation piece of this portfolio structure. Others may be comfortable with “credit” bonds such as Corporates and Munis. I am not. If the goal is to lock in a return on a part of the portfolio, I refuse to let credit risk, even a little, enter the picture.

Let’s recap

Why am I pounding the table for investors to identify and consider this portfolio strategy which I have not really written about much for at least a decade? Because the situation fits it.

* You can buy 1-Year T-Bills at the highest rates we have seen in a very long time. That’s your “insurance.” That rate is likely to jump around a bit, given the obsessive market focus on what the Federal Reserve will do about short-term interest rates. But 4-5% is a reasonable range to expect during the time an investor learns about this strategy, contemplates it, researches it and ultimately acts if they do act on it. The bottom line is that T-Bills are extraordinarily cheap when viewed in the context of the role described in this strategy.

* The equity, bond and commodity markets all have one thing in common right now. In all cases, the next 12 months has the potential to bring a very wide range of possible outcomes. Perhaps investors can always say that. But I think this is the most unique time in history for investing to a 1-year time frame. Because by this time next year, we’ll know how the Fed’s historically-sharp rate increases have impacted the economy and markets. We’ll know whether a high single-digit rate of inflation was a phase, or the start of something longer-term.

* We’ll also know whether the S&P 500’s 2022 flirtation with the 3,500-3,600 level ends up marking a firm bottom to the bear market that began this year. Or, if it that was just a warmup for a multi-year decline in stock prices, a la 2000, 2001, and 2002.

That’s why I am emphasizing the beauty and simplicity of this 1-2 punch, the structure that is the “T-Bill Plus” portfolio approach, making a comeback after more than a decade in the investment dungeon. After all, T-Bill yields were near zero for the better part of 13 years. That’s not salad days. It is a salad decade!

There are many ways to construct portfolios today. That’s been my craft for 30 years. There are so many techniques, allocation mechanisms, and an unprecedented array of investment options we now have to strategize with. But as someone who spent a career doing this for others, and more recently entered the life phase where strategies like this are more important (less accumulation, more protection and income than in the past), this simple method gives you plenty of upside potential, with the comfort of defining your realistic worst-case outcome in advance.

This article was intended to introduce a modern portfolio concept. I welcome comments, questions and feedback in the Seeking Alpha comments section. I consider this to be one of the most opportunistic areas of portfolio-building of our time. But depending on how rates and markets evolve, the time window in which to consider it is the biggest unknown.

Be the first to comment