Christian Feldhaar/iStock via Getty Images

Investment Thesis

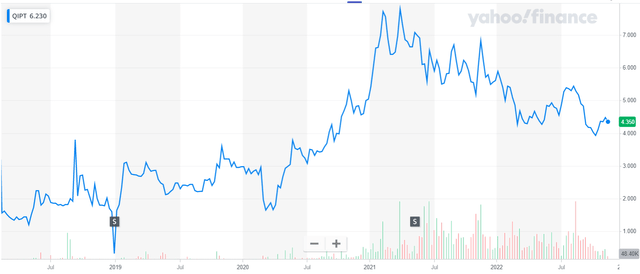

We have been following the Quipt Home Medical (NASDAQ:QIPT) story closely for several years and wrote about it back in 2018-20 (see articles here, here and here) when the stock was trading below $2 and the company was going through a massive transition (new management, VMD spin-off, cybersecurity breach etc.). The stock has experienced meaningful appreciation since then via organic and inorganic growth and QIPT is on track towards a $200M run rate revenue in the near term. The new management team has rectified most of the issues noted in our previous articles (bad debts, access to capital, M&A acceleration) and the company has established a successful template towards expanding nationally in a growing market. Since hitting a share price high of ~$7.8 in early 2021, the stock price has declined to the mid $4’s. We believe this is largely due to the overall market downturn and some temporary headwinds including a supply chain issue at one of its vendors which doesn’t actually have a significant impact on QIPT and is expected to be resolved. The company is at an inflection point once again with fundamentals detached from its valuation and this has created a compelling opportunity for investors to establish a long position in QIPT and take advantage of several catalysts which we discuss in this article. We believe the stock remains undervalued compared to its peers and has 85% – 150% upside.

QIPT share price action (Yahoo Finance)

Company Overview

QIPT is engaged in the sale and rental of in-home health monitoring equipment (aka Durable Medical Equipment or DME) in the United States. The company’s products and services include sleep apnea and PAP treatment, non-invasive ventilation equipment, oxygen concentrators, vehicle lifts and power mobility equipment (among others).

The company has historically grown through acquisition of various businesses operating in the fragmented home monitoring segment with the goal of consolidating market share in multiple regions and integrating the cost structure to drive margin expansion. The company has operations across 94 retail locations in 19 US states and services more than 200,000 unique patients annually.

QIPT product offering (Company Material)

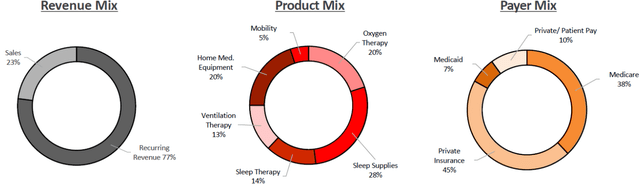

QIPT Operational Metrics (Company Materials (https://quipthomemedical.com/investor-presentation))

Recent Performance and Developments

Recent Financial Results

The company’s financial performance over the past few years has been quite stellar with management executing on its strategy to deliver high single to low double digit organic growth coupled with constant inorganic growth via successful acquisitions. Given that QIPT is ultimately a consolidator of DME providers, the acquisition and integration of smaller companies is the key value driver for this business; we will discuss this concept in more detail in the following sections.

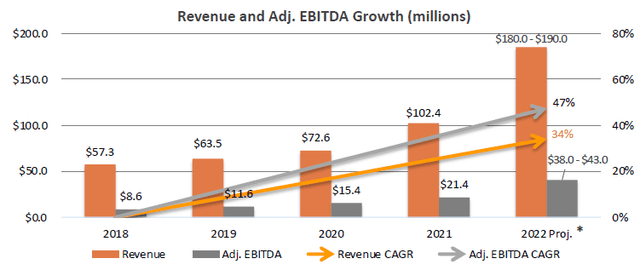

QIPT Financial Performance (Company Material)

As can be seen from the chart above, the company has managed to expand its EBITDA margins continuously from 15% to approaching 22-23% today. The company has come out strongly from the challenging pandemic years and the overall results are a strong reflection of the management team’s credibility, especially when considering the state this business was in a few years ago when the team took over.

M&A and Footprint Expansion

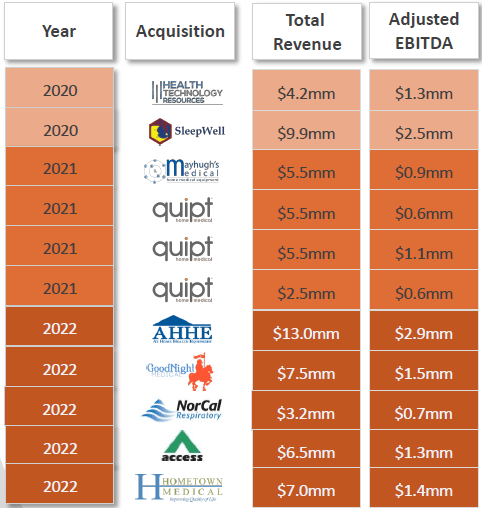

The company has closed 11 acquisitions over the past 2 years. This has allowed them to expand into several new states across the U.S. and has provided access to new retail locations which are important for this type of business (while the equipment they sell is usually delivered directly to a patient’s home by an RT, customers often prefer store visits to discuss and get fitted). Another key “asset” which comes with acquisitions in this space is relationships with large insurance companies which the sellers have already established. Since private insurers make up a key payer group for QIPT, these pre-established relationships carry significant value. Given QIPT’s scale and experience in M&A, the company has established a robust template for identifying and integrating smaller companies into their ecosystem. The overall margin expansion of QIPT while engaging in a meaningful amount of M&A evidences management’s ability to integrate quickly and extract synergies.

A key concept to note with regards to M&A which QIPT engages in is that of Multiple Arbitrage. QIPT has on average acquired companies for 4x EBITDA whereas it has traded several turns higher than that over the past couple years (6-8x). This means that the EBITDA which comes with these acquisitions should instantly add value equal to the difference in multiples between the acquired entity and the buyer.

QIPT acquisition history (Company Materials)

Increased Access to Capital

One of the key issues facing the company a few years ago when we initiated our coverage was access to funding. This has largely been alleviated with QIPT finding sufficient capital through equity and credit sources to fund its M&A activity. Recently QIPT has secured a significant increase to its credit facilities ($110M) which we think is going to be a major catalyst towards value creation. Based on historical average, this capital should allow QIPT to add ~$25M of EBITDA, however there could be significantly more upside to this as we enter a potential recession which could drive down acquisition multiples of smaller players.

National Insurance Contracts

The company recently signed its first national insurance contract with United Health which should expedite patient onboarding. Similar contracts with other large insurers could be likely in the future.

Valuation

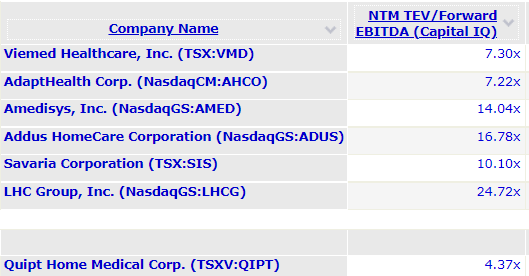

QIPT has experienced sustained share price weakness over the past 18 months however this is in-line with its peers (see share price chart for VMD and AHCO over comparable period). We believe the key reasons for this is market wide headwinds, however these do not point towards a deterioration in fundamentals. This situation has created a compelling opportunity to buy shares at a discount. One reason for the downward pressure has been an industry-wide product recall for Philips sleep devices. Philips is not a material supplier to QIPT but the product recall has exacerbated general supply chain headwinds which is weighing down on valuations.

In terms of comps, QIPT is clearly undervalued compared to peers despite having a higher revenue growth rate over the past year. While a slightly lower multiple is justified for QIPT given its exposure to CMS reimbursement rates and the fact that its EBITDA isn’t fully comparable to some of the other comps (QIPT has much higher rental income, the cost of which is not accounted for in EBITDA; rather it shows up in amortization), the current discount still appears too wide and disconnected from fundamentals.

QIPT comps (Capital IQ)

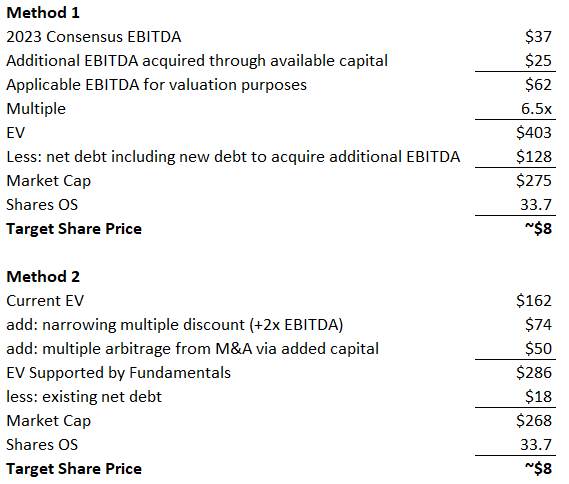

Below we arrive at a potential valuation for QIPT using two different methods which yield approximately the same result; 85% potential upside in the near term using conservative estimates. Note that the second method leverages the Multiple Arbitrate concept which we discussed earlier. Also, we are using a fairly conservative multiple of ~6.5x on QIPT’s 2023 consensus EBITDA which is still below all the peers listed above. If we use slightly more optimistic assumptions (i.e. lower multiples on acquired companies and higher overall multiple on QIPT); we can easily see 150% upside on today’s price.

QIPT Valuation (CapIQ, Author computations)

Potential Catalysts

Industry Tailwinds

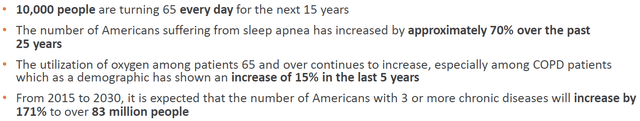

The aging US population and increases in cost of providing in-patient healthcare have created demand for more efficient delivery systems that allow for a reduction in hospital re-admissions and reduce costs. The trends listed below support sustained organic growth in the multi billion dollar DME market which QIPT will benefit from.

Industry tailwinds (Company Materials)

Dry Powder for Inorganic Growth

As mentioned above, QIPT has significant capital available through its recent credit facility expansion. With a potential recession looming, smaller DME providers will likely be available for purchase at much lower valuations. This will benefit scaled players such as QIPT to benefit from the Multiple Arbitrage scheme. According to company materials, there are over 6,000 unique DME providers in the US

Scale Benefits

As the company scales, it will be able to streamline its costs further and expand margins. QIPT has already successfully exhibited this over the past few years.

Positioned as a Prime Acquisition target

According to the company, ~70% of the DME market share is held by 10 companies. Based on our research, there are around 4-5 large companies in the US that surpass $1B in revenue with very few mid-size providers similar to QIPT. This makes QIPT a prime target for the larger players who would likely not focus on very small acquisitions given that they don’t “move the needle enough”. This phenomenon is very apparent in the M&A world where mid-size providers in consolidating markets often get valued at a premium given their rarity. It is pertinent to note that QIPT’s CEO (Greg Crawford) used a very similar playbook at his previous company (Patient Aids) which was acquired by QIPT in 2015 for a premium valuation. We believe QIPT’s performance and acquisition strategy since he took over as CEO in 2017 mirrors that of his previous business and the company may be headed in a similar direction.

Risks

Impacts of Competitive Bidding Process

QIPT is subject to CMS reimbursement rates which can sometimes be uncertain. Given the high inflationary environment, CMS has recently announced rate increases of 8-9% for 2023 which should be a positive for QIPT.

Equipment Refresh Cost

Given that QIPT finances equipment to and derives a significant amount of revenue through rentals, increases in equipment cost can hit free cash flow and deteriorate returns to shareholders.

M&A Integration

As with any company which engages in significant M&A activity, QIPT is subject to integration risk which can lead to higher costs for a certain duration post deal closing.

Conclusion

Overall market downturns can lead to compelling opportunities to buy solid businesses at a discount, we believe QIPT falls in this category. The company has exhibited robust fundamentals, a reputable management team with an enviable track record and a market which presents favorable conditions for organic and inorganic growth. We recommend value oriented investors to consider taking a long position in QIPT with an expectation of 85% – 150% upside in the near term.

Be the first to comment