Khanchit Khirisutchalual/iStock via Getty Images

Thesis

The electronics peripheral industry saw accelerated growth after the Covid-19 pandemic hit in 2020, with companies like Logitech (NASDAQ:LOGI), one of the market leaders, experiencing major tailwinds. Since the second half of 2021, things have looked a lot different. Growth has slowed and a technology-led market pullback has led Logitech’s stock on the downhill path. In this analysis, I explore the industry’s prospects, the company’s financial attributes and its valuation.

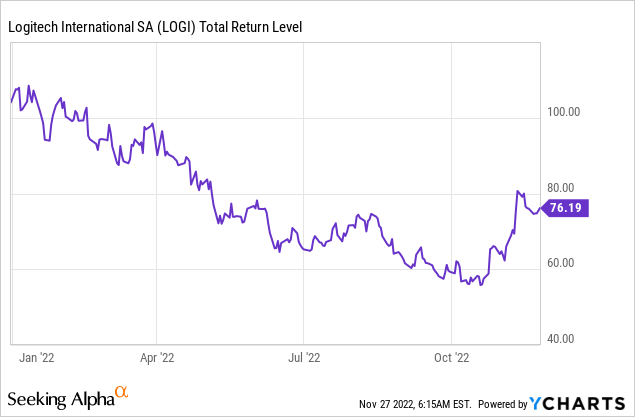

Troubling 2022 Stock Performance

2022 has marked a disappointing year for stocks so far, with all major indexes despite the recent recovery, still recording major YTD losses. The Nasdaq has retreated by almost -30%, dragged down by high-valuation, previously high-flying technology stocks. Even more conservatively valued, hardware companies like Logitech have recorded significant losses. LOGI has seen a YTD 30% decline and is now trading at $59 ($9.6B market cap), 33% lower than its 52-week highs. The stock yields a 1.64% dividend, similar to the S&P 500’s average and somewhat higher than the Nasdaq one.

Consumer Electronics Face Headwinds

The broader consumer electronics market has been facing major headwinds over the past year or so. After record sales and growth numbers in late 2020 and 2021, persisting supply chain disruptions and worsening consumer sentiment have led to slowing growth in 2022. The sector is a highly cyclical one and its discretionary nature for both businesses and retail customers is likely to lead to a contraction in the space if the U.S economy enters a recession.

The Computer Peripherals and Video Game Market

Logitech’s products are mostly catering towards two segments of the consumer electronics market customers. Computer users and video game players, both looking to purchase items from a wide range of peripherals to enhance their experience.

The computer peripheral industry is a relatively mature one with a number of competitors battling in terms of price and product differentiation. Growth and profit margins, as a result, are lower than those in other segments of the information technology sector. However, due to the rapid technological advances in consumer electronics, the industry’s growth forecasts are still attractive.

According to research provided by futuremarketinsights.com, the computer peripherals market is expected to reach $1.217T by 2032, implying a CAGR of 10.6% for the period 2023-2032. For 2022, the market size is estimated at $443B. Decreasing prices, digitalization of the economy and continuous innovation are expected to fuel demand. The video game industry is expected to continue to see fast growth through 2030, increasing the demand for peripherals as well.

On a short-term basis, as we have now entered the holiday season and the market is looking to recover some of 2022’s losses, the outlook for the stock is mostly positive. Both video game and electronics sales are increasing in December and holiday spending might help to boost sales and deliver some upward momentum for the stock.

Financials Show Signs of Struggle

After strong financial performance for the fiscal years 2021 and 2022 (ended in March 2022), where the company achieved record sales and profits, so far into the 2023 fiscal year signs of a decline are evident. In both the Q1 and Q2 earnings releases, Logitech reported declining revenue, EPS and profit margins. Cash flow from operations increased, however, from -$63M (quarterly) in Q2 2022 to $73M in 2023. Sales were down -12% YoY for the second quarter (7% in constant currency) reflecting the challenging global macroeconomic environment. EPS declined even more sharply, from $0.81 a year ago to $0.50.

While recent results are skewed to the negative it is important to note that both the 2021 and 2022 fiscal year represented what many analysts call “fluke” years for the technology sector. This was due to the overwhelming demand for electronics and peripherals as remote working and staying-at-home consumers spent significant amounts towards needed technological products to facilitate their new, Covid-imposed lifestyle. Compared to 2020 or 2019 numbers, the company is still set to perform well, in the near term. Through 2026, analyst forecast mid-single-digit growth for revenue and double-digit increases for EPS.

When it comes to Logitech’s balance sheet, the company displays a financially healthy picture. Logitech maintains a large cash balance of $870M (almost 10% of market cap), while an over 2x current ratio indicates that no liquidity concerns are bound to arise any time soon. The company carries little long-term debt as well. Cash flows from operations have increased over the past few years, as the company generates positive free cash flow consistently. Overall, Logitech’s financial statements indicate a healthy, well-run company that has low levels of long-term risks.

A Growing Dividend & Buybacks

Logitech has been able to maintain a safe, growing dividend for the past decade. While the current yield of 1.64% is around the market average, the growth prospects appear attractive. Dividends have grown at a 9% CAGR since 2018. The company has also been marginally decreasing its share count for the past few years. In total, Logitech returned $276M in Q2 to shareholders via dividend payments and share repurchases.

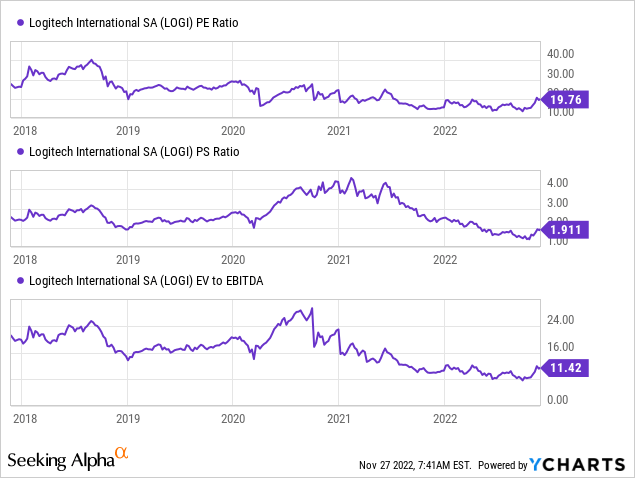

Improved Valuation

After the recent drop in stock price, Logitech’s valuation multiples have returned back to relatively attractive levels. The stock trades at a 19.8x P/E, a 1.9x P/S and 11.4x EV/EBITDA. All 3 valuation metrics mentioned stand below their 5-year averages. On a non-GAAP basis, Logitech’s implied P/E is even lower, at 15x, a bit lower than the current market average as well.

Final Thoughts

After all things are considered, while the recent drop in sales and EPS, coupled with the stock’s disappointing 2022 performance has scared off many potential investors, over the mid-term, I believe that Logitech presents an attractive risk-reward tradeoff. The peripherals industry is expected to continue to grow, while the company maintains a healthy financial outlook and a reasonable valuation. For these reasons, I would rate LOGI as a buy.

Be the first to comment