bgwalker

Thesis highlight

I believe Duolingo (NASDAQ:DUOL) is undervalued today. Duolingo has become a dominant player in the language-learning industry thanks to the massive troves of user data it has amassed, which it has used to train AI models and tailor its lessons to individual students. The rise of mobile devices and online education has led me to expect that the digital learning industry will be worth significantly more than the current $315 billion.

Company overview

Duolingo is a language-learning app created specifically for mobile devices. This organization not only aids in the translation of web content, but also instructs students in learning language.

Learning can be done anywhere and anytime today

A shift to mobile devices is reshaping entire industries. More and more industries, from retail to entertainment to food delivery, are seeing a rise in the popularity of mobile, app-based experiences among consumers. In my opinion, consumers will retain a strong preference for mobile experiences due to their on-demand convenience.

Not only is mobile usage on the rise, but so is the trend toward education that takes place entirely online. The shift from traditional to digital methods of teaching and learning has been slow in the educational sector. Global Market Insights estimated that the e-learning industry is worth more than $315 billion in 2021. This enormous sum accounts for less than 10% of total global education expenditures. However, COVID-19 has initiated a major shift toward online learning, and this trend is expected to persist for some time. I think this is a very promising trend, and I don’t see any reason why this number won’t continue to increase.

As a current user of DUOL, I can attest to the platform’s efficacy and convenience. Online students, I’m positive, are looking for exciting, mobile-first experiences. This is because users have grown accustomed to the sophisticated user interfaces found in mobile games and social media apps. Online learners, in my opinion, will not only demand a compelling user experience, but also the flexibility and customization afforded by mobile apps.

Therefore, I have no doubt that the worldwide market for D2C language learning online is sizable, growing, and evolving. As people look for more affordably priced, convenient, and high-quality options online, I anticipate a rise in digital spending as a result of this trend away from offline options. This is in particular due to the fact that the offline industry is currently controlled by niche players who charge premium prices for their services. In addition, consumers who previously would have not attended offline courses but now opt to subscribe to online courses should drive increase in digital language learning spend. This is supported by a DUOL survey from 2021 found that nearly 80% of American users of Duolingo weren’t formally studying a language before signing up for the service.

Moreover, DUOL has a great chance to reach more students all over the world if it broadens its platform beyond language teaching. I think DUOL could reach a larger audience if its scalable platform were applied to fields besides English language, arts, and mathematics.

First mover advantage has given DUOL a strong brand lead and large data moat

Duolingo has spent the last decade perfecting its brand down to the appearance of every button and the tone of celebration that play when a user finishes a Lesson. Duo, the green owl mascot, and a host of other characters who represent the culture of the target language bring the brand to life and keep students interested. In addition, the TikTok account is an integral part of Duolingo’s brand extension strategy, as it features characters in videos that receive millions of views without any paid promotion. In my opinion, this has resulted in a substantial boost to DUOL’s profile and credibility.

Moreover, DUOL has constructed the biggest set of language-learning data, largely due to the over half a billion exercises performed daily on its platform, as stated in the prospectus. This is a huge perk because it allows DUOL to develop innovative AI models, which in turn power future product features that boost user interactions and productivity through methods such as personalized teachings. I think DUOL has done well fundamentally because the vast majority of the information they gather for analytics is in the type of tracking events. In this context, “data points” refer to information about a learner’s actions, such as when they opened the app. Learners’ actions, along with contextual information like the device they used, are reported to DUOL via tracking events. The Duolingo app is equipped with code that, in essence, produces tracking event data for all of the relevant events across all supported platforms.

In addition to collecting data precisely, DUOL’s machine learning capabilities allow it to use that data to enhance the learning process. For instance, DUOL can learn to predict the likelihood that a particular learner will answer any given exercise correctly by evaluating every learner’s answer to every exercise. Based on these observations, DUOL is able to create personalized lessons with just the right level of challenge for every student.

Scalable platform with flywheel effect that increases as DUOL grows

My opinion is that DUOL’s strong flywheel effect is the primary factor in its rapid expansion and increased market share. The freemium model employed by DUOL allows non-paying customers to become dedicated users, which in turn increases the likelihood of a successful upsell to paying customers. In addition, it facilitates the massive scale of users and data that DUOL’s machine learning algorithms demand, leading to robust user engagement and effective education. This is fantastic and worthy of praise because proof of DUOL’s effectiveness builds trust in the brand and encourages others to try the product on the strength of positive word-of-mouth. Moreover, this allows DUOL to shift its focus from short-term direct-response marketing to long-term product enhancements.

When it comes to accommodating a growing number of students, DUOL’s technological foundation and freemium subscription model are well suited for the task. This is done in a way that facilitates the efficient development of learning materials that are in line with standards, and DUOL’s assessment tools facilitate the ongoing refinement of educational offerings.

Expanding beyond language learning

After using the DUOL platform for language learning, I am convinced that the same DUOL approach to education could be applied to other subject areas. Actually, in 2020, DUOL released Duolingo ABC, an app aimed at teaching young children to read (which was recognized by the Time magazine). I believe that DUOL’s platform and expertise in product development, gamification, and data-driven analytics will help new products like Duolingo ABC deliver measurable success. If DUOL expands its scope to cover more types of education, I’m confident that they will be able to attract a larger audience.

Valuation

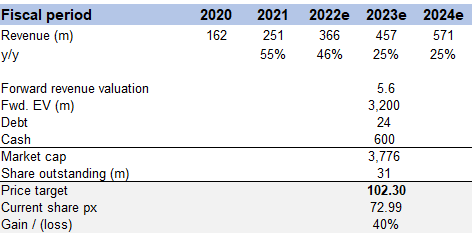

My model suggests a price target of $102.3 in FY23. This assumes that revenue will continue growing at a quick pace as DUOL continues its growth momentum, and the forward revenue multiple will be 5.6x in FY23e.

Own valuation

Given the growing size of the market, I anticipate DUOL will be able to sustain its rapid expansion beyond the projected results for FY22 (which are based on management guidance). In my opinion, DUOL will maintain its current valuation of 5.6 times forward revenue as the company’s growth profile and runway are expected to remain consistent through FY23.

Risk

Competition risk

Numerous companies in the online language-learning market release new offerings on a monthly basis, creating intense competition. In order to maintain its market dominance and avoid the innovator’s dilemma, Duolingo must constantly improve its platform with new features.

Recession

Duolingo could face challenges in discretionary spending due to its direct-to-consumer exposure. Subscriptions could be cut if users feel their purchasing power is dwindling due to economic factors like a looming recession or rising prices.

Exposure to advertising industry cyclicality

As advertising is a significant source of revenue for Duolingo, the company is vulnerable to fluctuations in the industry. In FY21, advertising contributed 15% of the company’s revenue.

Conclusion

DUOL is currently underpriced, in my opinion. Duolingo has amassed massive amounts of user data, which it has used to train AI models and personalize its lessons for individual students, propelling it to the forefront of the language-learning industry. Since the use of mobile devices and online education is on the rise, I believe that the digital learning industry will be worth considerably more than the current $315 billion in 2021.

Be the first to comment