shironosov/iStock via Getty Images

Blessed is he who expects nothing, for he shall never be disappointed.”― Alexander Pope

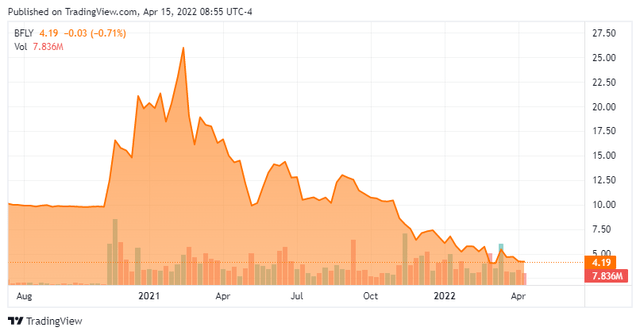

Today, we take our first in-depth look at a small cap healthcare concern. Like so many brought public via a SPAC over the past two years, the shares have become a ‘dumpster fire‘ since debuting on the market. However, the company does possess some intriguing technology. Moreover, a director stepped up to the plate and added over $2.2 million to his core stake in the company one month ago. A potential sign of a turnaround on the horizon? We try to answer that question via the analysis below.

Company Overview:

Company Website

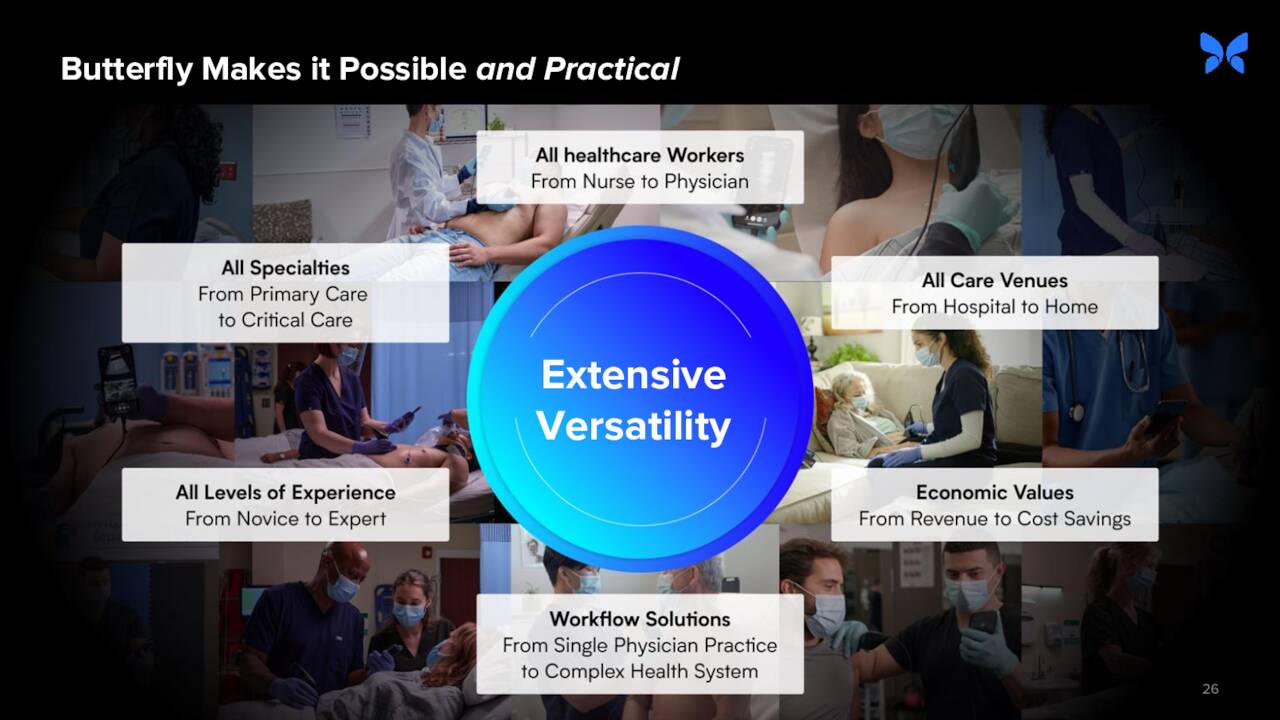

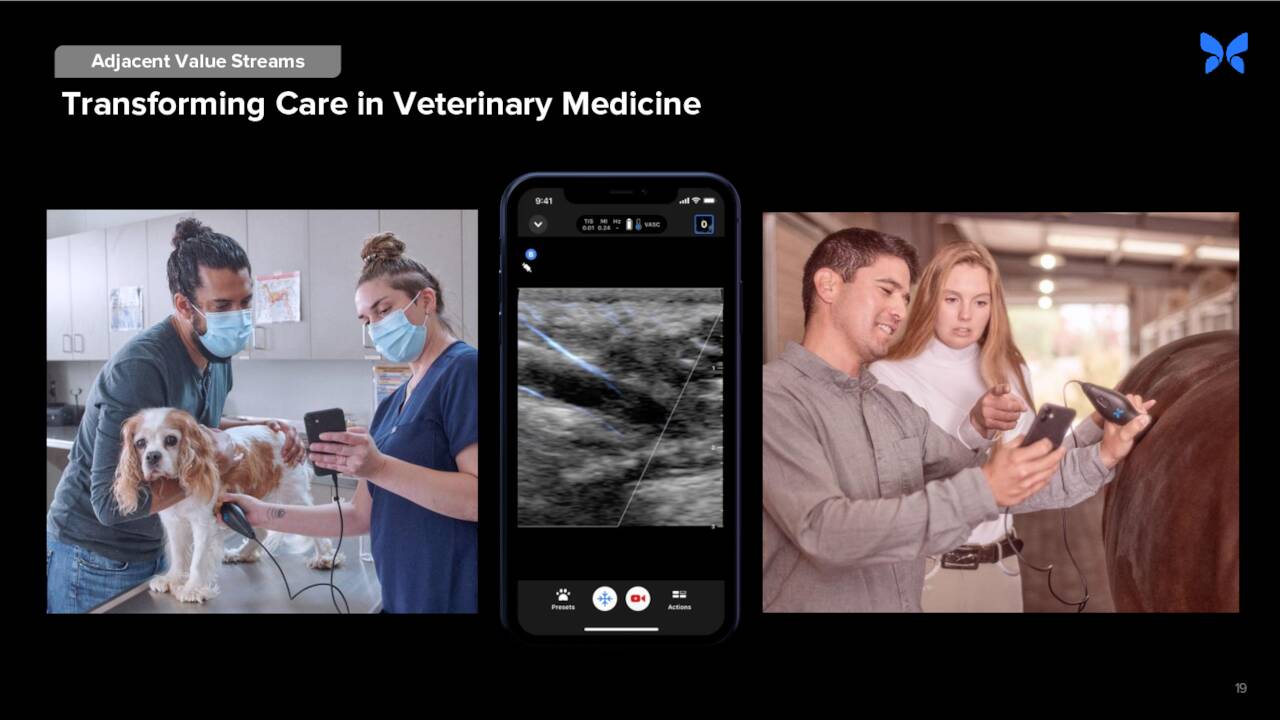

Butterfly Network Inc. (NYSE:BFLY) is headquartered just outside of New Haven, CT. The company offers groundbreaking and potentially ‘best-in-class‘ ultrasound solution and the world’s only single-probe, whole-body handheld device, powered by Ultrasound-on-Chip™ technology. The cheap cost and mobility of the solution has many potential uses from third world clinics, domestic first responders as well as use at veterinary facilities. Its core product offering costs around $2,000, far below other ultrasound solutions. The company came public by merging with a SPAC called Longview Capital in early 2021.

The company gets revenues from both product sales as well as subscriptions/support services. The stock currently trades just above four bucks a share and sports an approximate market cap of $850 million.

March Company Presentation

Fourth Quarter Results:

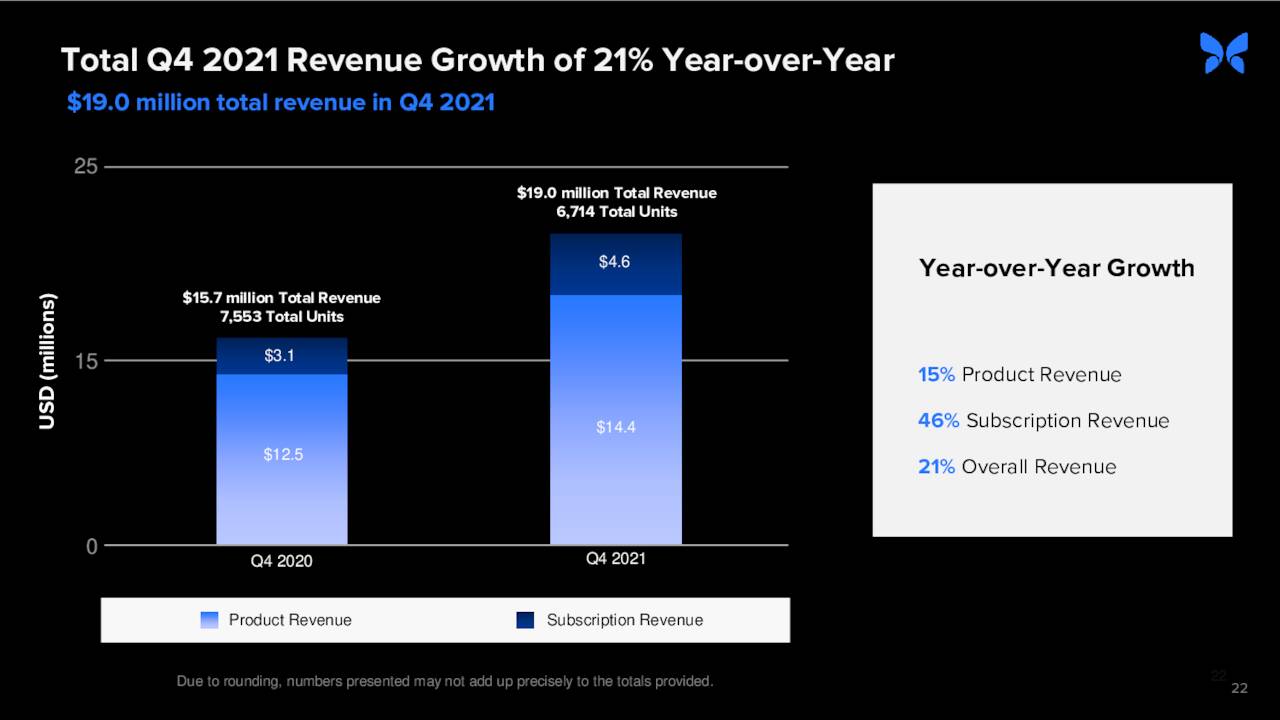

On February 28th, Butterfly Network Inc. posted fourth quarter results. The company posted a GAAP net loss of 8 cents a share during the quarter. Revenues rose 21% on a year-over-year basis to $19 million. Both numbers were above consensus estimates. Here is a breakdown of sales during the quarter.

March Company Presentation

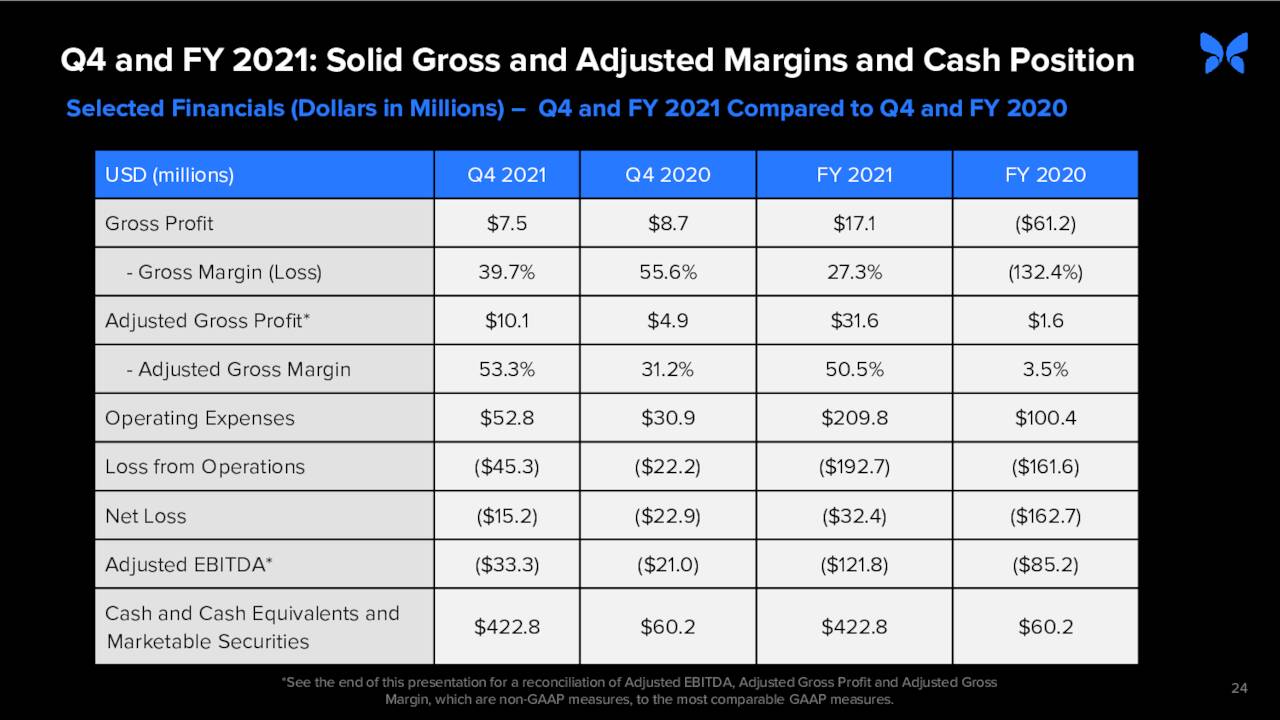

It should be noted, revenue growth was lower for the fourth quarter than the entire year as sales rose 35% overall in FY2021 for Butterfly. It also should be noted that gross margins shrunk to 39.7% from 55.6% in 4Q2020. This was due to the fact that operating expenses rose sharply in Q4 and for all of FY2021. Butterfly Network attributed this ‘to the build-out of personnel and services to support growth initiatives and expenses related to being a publicly-traded company.‘

March Company Presentation

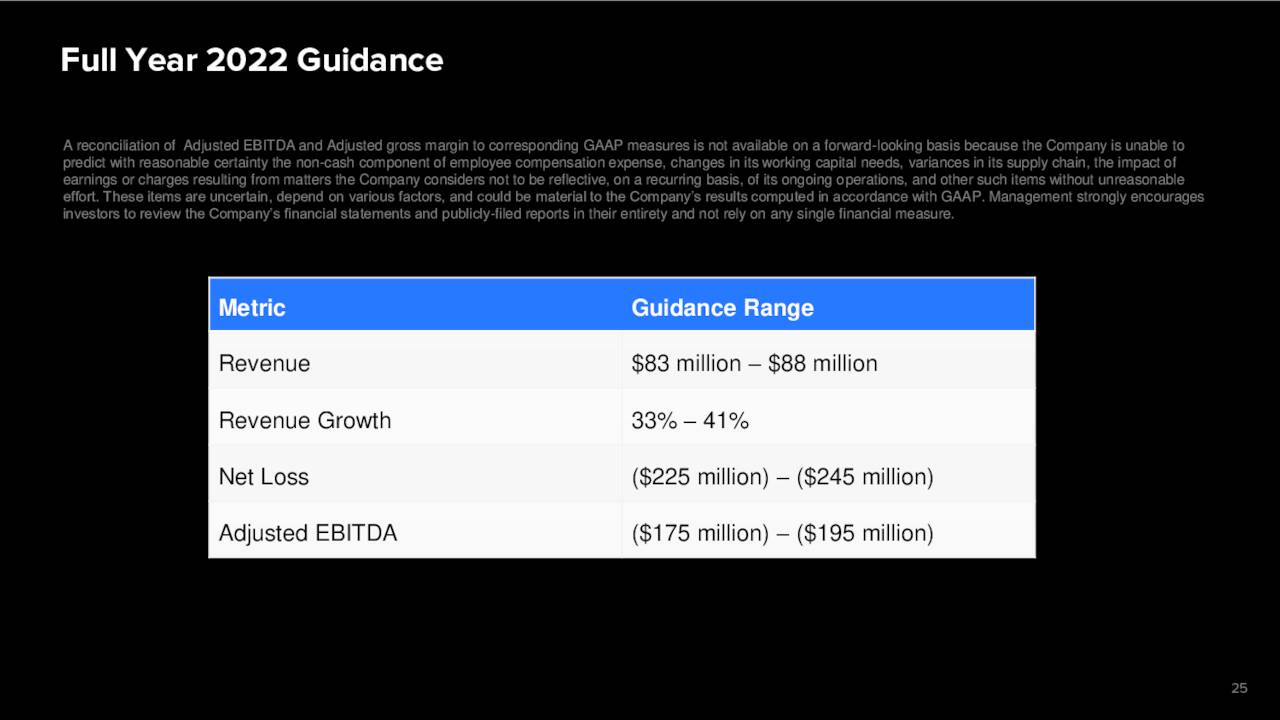

Management also offered up guidance for FY2022. They expect overall sales to be in the range of ~$83 million to $88 million, which would represent ~33% to 41% growth over FY2021. Butterfly’s net loss for FY2022 is projected to be in the ~$225 million to $245 million range, assuming no change in the fair value of its warrants.

March Company Presentation

Analyst Commentary & Balance Sheet:

Despite a sizable market capitalization, the company gets little coverage from Wall Street. Only two analyst firms have chimed in on Butterfly Networks over the past half year. On November 16th, Cowen & Co. (COWN) maintained its Outperform rating but ratcheted down its price target from $20 to $12 a share after the company significantly missed its third quarter expectations. On March 1st of this year, UBS (UBS) reissued its Neutral rating but cut its price target to $5.50 from $7 previously after the company’s fourth quarter results were posted. The company ended the fourth quarter with just over $420 million in cash and marketable securities on its balance sheet against just under $55 million of long-term debt.

A director of company bought 500,000 worth of shares at $4.50 per on March 15th. Other insiders have sold just under $1 million worth of stock in aggregate so far in 2022. The same director bought just over $2 million worth of stock in late May of last year, soon after the company debuted on the market. The purchases were made at the $11 level, which haven’t turned out to be prescient to this point. Nearly 15% of the company’s shares are currently sold short.

Verdict:

The two analysts that follow the stock have the company losing approximately $1.15 a share on revenue of just under $85 million. This would represent sales going up a third from FY2021’s levels.

March Company Presentation

The products the company are rolling out have great promise across a variety of users. That said, Butterfly Network has failed to live up to its promise to this point as a public company. When it first came public as a public company, projections called for $78 million of sales in FY2021, the company delivered just over $60 million. Revenue projections were nearly $325 million for FY2024 on its ‘roadshow’, something that is little more than a pipedream at this point.

Now, the company should probably get a mini-mulligan for the ongoing headwinds to sales traction the Covid pandemic has created. That said, the company should burn through just over half of its net cash hoard in FY2022 and probably will come back to raise additional capital at some point over the coming 12 months. Therefore, the bet here is to sit on the sidelines for now.

It is easier to forgive an enemy than to forgive a friend.“― William Blake

Bret Jensen is the Founder of and author of articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment