FerreiraSilva/iStock Editorial via Getty Images

Petrobras (NYSE:PBR) is South America’s largest oil company and one of the world leaders in developing new offshore oil fields. It has produced an incredible amount of oil over the years, and at times been a compelling – if volatile – investment.

Investors have bought back into the company’s story once again. With high fuel prices, Petrobras has been able to pay down debt and resume paying simply massive dividends. After a sharp share price rally, however, it might be time to take some chips off the table on Petrobras, particularly with political risk remaining a major concern in 2022.

The Dividend: Great For Now, But Not A Permanent Feature

Normally, in analyzing a dividend, I’d talk about the current yield and how well it is covered out of earnings and free cash flows. In this case, I can’t really do that, at least not to a specific level, since Petrobras has a variable dividend policy. In good years, it tends to pay out absolutely gigantic dividends, in poor years, the dividend can go away almost entirely.

Now that management has gotten the company’s debt load under a key threshold, it’s committed to returning far more capital to shareholders, and is currently going for a 60% of free cash flow payout. Given that FCF for oil companies is highly volatile, there’s a wide range of potential outcomes as far as the dividend goes.

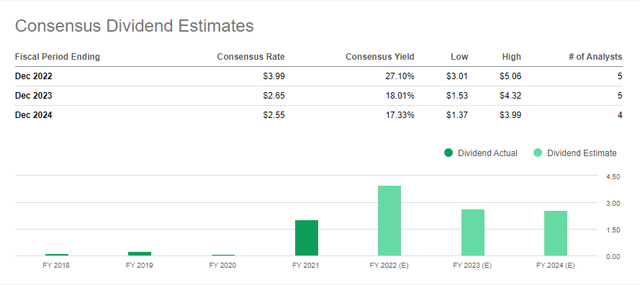

PBR Dividend Estimates (Seeking Alpha)

As you can see, Petrobras paid very low dividends prior to 2021. It has not proven to be a reliable all-weather income stream. However, it’s certainly paying out incredible yields now.

The 2021 distribution was more than 10% of the current stock price, and analysts are looking at something like a 27% payout this year. Even for fiscal 2022, note, however, that there’s a range of estimates between $3.01 and $5.06 for the dividend. That’s why I’m uncomfortable saying what PBR stock yields today. It’s a very high, but imprecise, figure.

Going forward, analysts see the dividend dropping significantly in 2023 and 2024. It’s likely to remain well into the double-digit yield range, at least based on what we know today, however, there’s a clear downward trajectory. No analysts think the dividend will stay up at $5 per share, and at least one analyst sees the dividend retreating sharply back toward $1.50 per share.

If you get one thing out of this article, it’s that Petrobras has an irregular dividend policy. Yes, the yield will likely be above 20% this year. And that’s amazing. If oil prices stay as high as they are now and the local politicians let them keep earning market rates on their fuel sales, Petrobras could remain a cash gusher for years to come as well. But there’s also a chance that dividends could return to something closer to what was seen in 2018-2020.

Brazil’s Politics: Always Unpredictable

Speaking to the dividend point, a major concern is that the government will limit profits for Petrobras going forward.

In March, for example, Petrobras’ then-CEO Joaquim Silva e Luna was called to testify in front of a Senate committee about rising fuel prices.

“We have seen successive increases in fuel prices in the country, which contrast with the abundance of dividends paid. Especially in the face of recent events of international instability, one wonders what role Petrobras plans to play going forward,” said Senator Jean Paul Prates, a member of the Workers Party.

Not long after, Silva e Luna was removed from his post as the head of Petrobras. The Bolsonaro government initially hinted at putting in a new CEO who would limit fuel price increases. However, at least for the time being, it appears Petrobras will be run with the ability to keep pricing discretion and in line with global oil prices. That’s a win for PBR stock. For now.

However, Bolsonaro represents the ostensibly pro-business wing of Brazilian politics and was still seemingly willing to meddle in the company’s affairs ahead of an election. We can only imagine what might happen come this fall if the socialist opposition wins the next presidential election.

The betting markets currently have leftist Lula da Silva at around 70% odds of winning, with Bolsonaro at a 30% chance of securing re-election. Bolsonaro has been closing the gap in the opinion polls as of late, but he started from a huge deficit, given Brazilians’ frustration with the handling of COVID-19 and the economy.

Regardless of who wins, uncertainty will remain for Petrobras with even Bolsonaro not being a reliable option for foreign investors. Given Brazil’s high levels of inflation and income inequality, it’s simply going to be hard to maintain popular support while pushing through huge fuel price increases.

More broadly, even under the latest pro-business administration, Brazil remains a very complicated market.

Here’s a ranking of economic freedom in the Americas, as per the Heritage Foundation which calculates a freedom index for every country annually. The ranking is out of all the world’s nations, and I’ve listed the ranks for the major Western Hemisphere economies below:

- #15 Canada

- #20 Chile

- #25 United States

- #51 Peru

- #60 Colombia

- #67 Mexico

- #133 Brazil

- #144 Argentina

As you can see, there’s a massive gulf between what I’d consider to be the capitalist economies in the Americas and the other two. Of the large economies with well-developed capital markets, all of the Americas are in the top 67 globally except Brazil and Argentina. Chile, notably, at No. 20, is ahead of the United States despite all the recent hand-waving around Chile’s supposed turn to the left.

The other two, however are way down there. Brazil, at No. 133, is only slightly ahead of Argentina, and Argentina’s history of financial instability is well known.

For all of Petrobras’ amazing profits and dividends today, it’s just hard to own in such a hostile environment to business and foreign shareholders. We’ve seen what’s happened to Russian equities and the value of the Chinese ADRs over the past year. Both Russia and China also rank well outside of the top 100 in the Heritage Index of Economic Freedom as well.

There’s a difference between investing in an oil major such as Exxon Mobil or Suncor (SU) where you fully own the assets and have strong property rights, or buying something like Petrobras where you’re a minority shareholder riding alongside an unpredictable government. During hard times, you get to share equitably in the (low) profitability of a state-influenced enterprise. When times improve, however, don’t count on the politicians letting minority shareholders fully participate in the upside.

PBR Stock Bottom Line

All that said, I can’t be too negative on Petrobras. I’ve long been a bull on energy, and I’ve turned more optimistic on Latin America as well given the rise in commodities more generally. I’m loaded up with Mexican, Colombian, and Chilean names at the moment, and have even been sniffing around in Argentina and Brazil, which I generally am reluctant to invest in. A rising tide can lift all boats.

So, to be clear, I think there’s a decent chance you’ll make money if you own Petrobras, at least in the short-to-intermediate term.

That said, is it the best play on the energy industry? I’m far from convinced that it is. A lot of people own it for the double-digit dividend yield. But that yield can drop dramatically if the company becomes unprofitable again, which is certainly possible if oil crashes another time, or if Petrobras gets caught up in more political problems in Brazil.

A company like Exxon Mobil, by contrast, made it through the awful 2014-2020 energy bust without ever cutting its dividend. It has an amazing balance sheet. And, incredibly enough, it’s actually still a value stock even after running up to a dramatic degree over the past year.

Morningstar’s Allen Good has XOM stock’s fair value at $96 a share, meaning that Exxon Mobil is close to 10% undervalued today. That fair value estimate assumes a long-run oil price of just $60/barrel. Unless you’re wildly bearish on oil, it’s hard to see the price of crude ending up much below $60 anytime soon, meaning there’s still a decent margin of safety in Exxon shares despite its large rally.

By contrast, Mr. Good has fair value for Petrobras at just $11.20 per share, again assuming the same $60/barrel long-term price of oil. I believe we’ll see oil much closer to, say, $80-$90 long-term and that will support a price of Petrobras stock that is higher than where it trades today. But big safe names in far better geographies are still available at solid values. I don’t see a need to go reaching for yield in less favorable political situations.

The issue with a long thesis here is that, in my view, we can merely rent the stock until the presidential election. I personally don’t see how Petrobras or other Brazilian natural resource plays are investable if we see a Lula da Silva government. And even under Bolsonaro, should he be reelected, political questions will remain. In a country with significant structural economic problems, it’s hard to have confidence that Petrobras will be allowed to fully profit from the current high energy price environment.

Be the first to comment