Lemon_tm/iStock via Getty Images

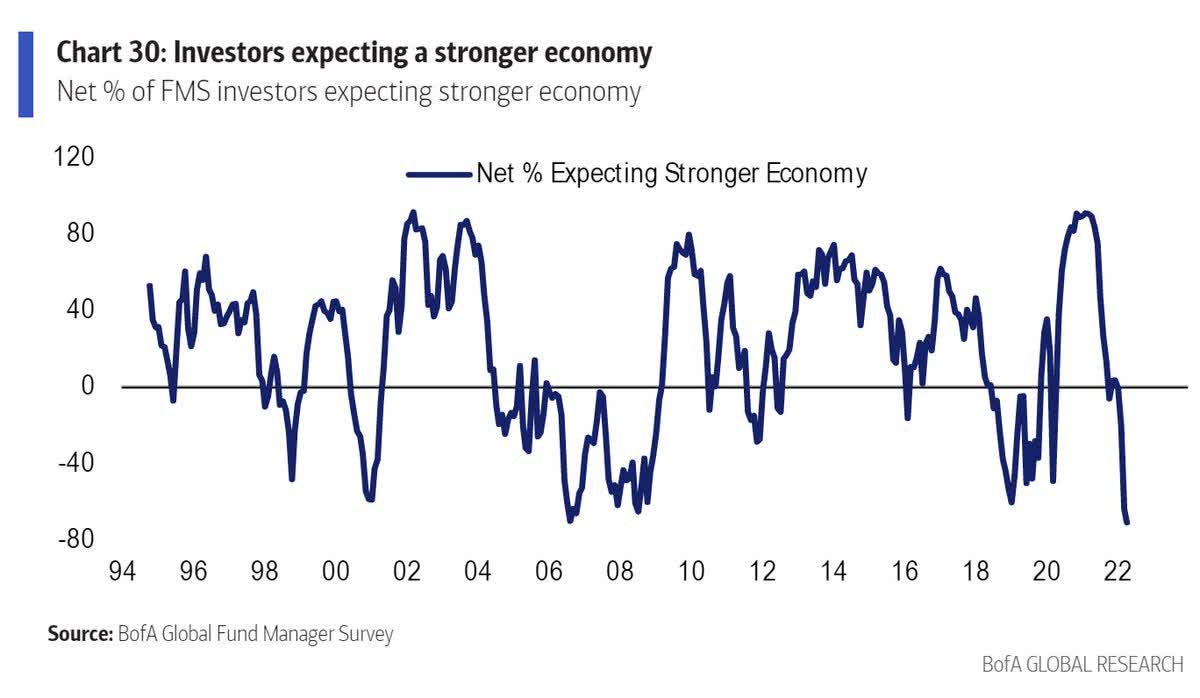

Spikes in agriculture, fossil fuels, and housing (housing makes up a third of CPI) pushed inflation (a lagging indicator) in March to the highest reading in 40 years. Amid negative real wages, consumers have less cash for everything, and corporate profit margins are under pressure. Add in a rate shock–the bond market has already sold off enough to push borrowing costs up at the greatest rate of change in decades–and you have reliable ingredients for a significant global downturn. Not surprising then that the Baltic Dry Shipping Index has fallen 64% from its peak last October, and other economically sensitive commodities like lumber, iron ore, steel rebar, oil, and copper are all well off their highs. Fund managers expecting a stronger economy have fallen to levels only seen during past recessions (as shown below since 1994).

Author

This is how high prices end up curing high prices and why central banks are unlikely to hike rates nearly as much as presently forecast. No wonder government bond prices rallied on the CPI announcements yesterday.

Today, the Bank of Canada is expected to deliver delivered the first of several 1/2 percent increases in its base interest rate. At the same time, nearly half of Canadian households recently surveyed by Nanos say they have already cancelled a major purchase or are having difficulty covering basic necessities. We will soon see how long inflation-fighting remains top of the policy to-do list.

Disclosure: No positions

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment