piranka

Looking for a contrarian income investment? Sometimes that’s necessary in order to find value. Why buy at a premium when you can buy at a discount? When buying closed-end funds (CEFs), buying at a deeper than historical discounts to NAV can be a successful strategy over the long run.

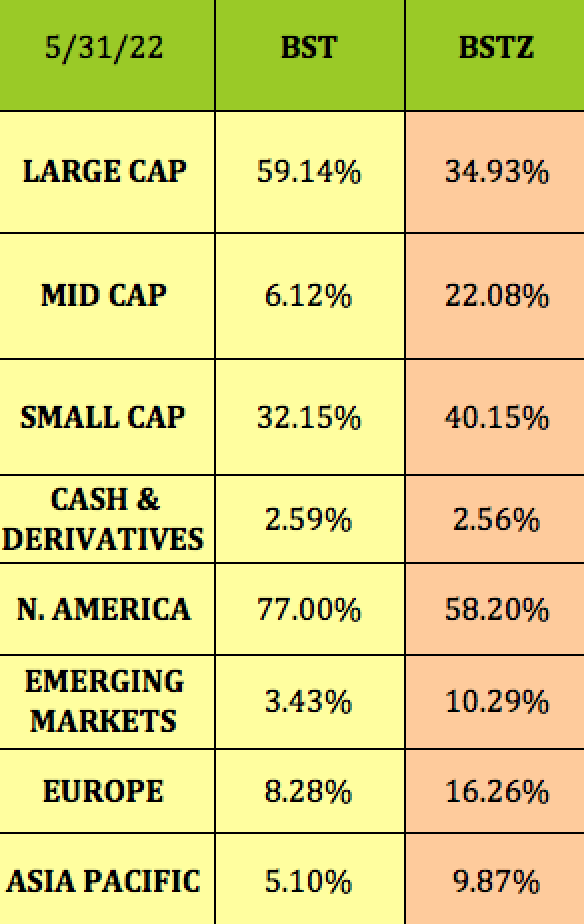

BlackRock Science And Technology Trust (NYSE:BST), and its younger sibling, BlackRock Science and Technology Trust II (NYSE:BSTZ), which IPO’d in 2019, are 2 popular sister Tech funds which cover different aspects of the Tech sector. BST focuses on large caps, while BSTZ favors small caps and more cutting edge companies. BSTZ also has more exposure to non-US regions:

Hidden Dividend Stocks Plus,

Profiles:

BST is a perpetual closed-end equity fund. BST commenced operations in October 2014 with the investment objectives of providing income and total return through a combination of current income, current gains and long-term capital appreciation.

Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology (high growth science and technology stocks), and/or potential to generate current income from advantageous dividend yields (cyclical science and technology stocks).

As part of its investment strategy, management sells covered call options on a portion of the common stocks in its portfolio.

(Source: BST site)

BSTZ is a limited-term closed-end equity fund. BSTZ commenced operations in June 2019 with the investment objectives of providing total return and income through a combination of current income, current gains and long-term capital appreciation.

Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology.

(Source: BSTZ site)

Both funds share the same management team.

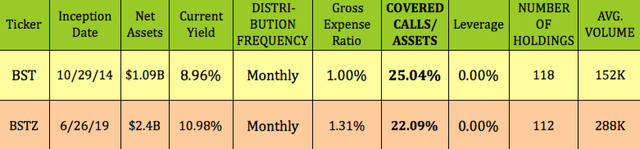

BSTZ is much larger than BST, with $2.4B in Net Assets, vs. $1.09B for BST. Both funds have had heavier volume in 2022 – BSTZ’s went from 111K in October ’21 to a 288K average currently, while BST’s average volume grew from 125K to 152K.

BST has 118 holdings, vs. 112 for BSTZ. As noted above, both funds sell covered calls – BST had ~25% of its portfolio overwritten, while BSTZ had ~22%, as of 5/31/22:

Performance:

Although contrarian investing can yield good long term results, you may have to grin and bear some rough times until your picks turn positive.

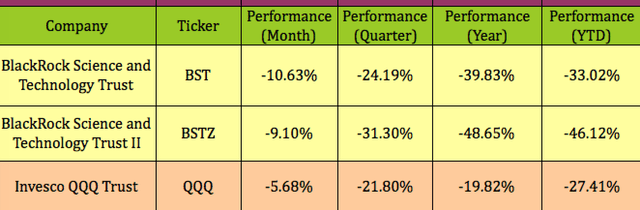

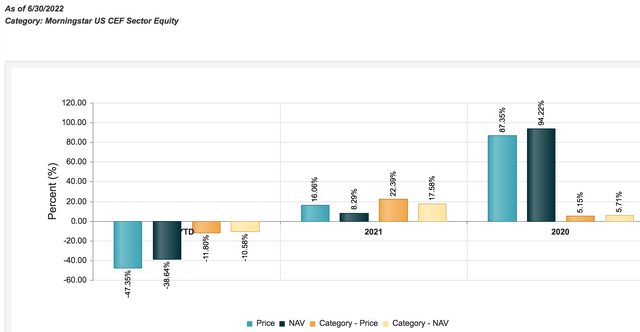

BST and BSTZ are good examples of this currently. Both funds have underperformed so far in 2022, with BST down -33%, and BSTZ down -46%, also lagging the NASDAQ 100 over the past year, month and quarter:

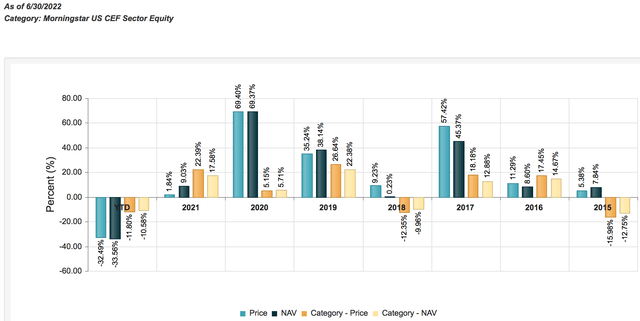

Looking back further shows BST outperforming in 2017-2020, and lagging in 2021:

BSTZ, which IPO’d in 2019, outperformed 2020 and lagged in 2021:

Holdings:

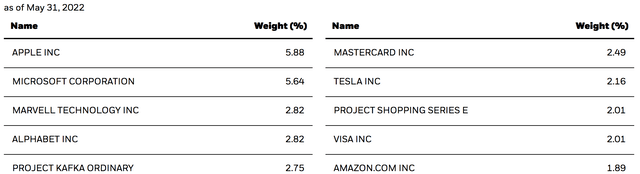

BST’s top 10 positions include mostly well-known big cap tech stocks, such as Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA), in addition to Project Kafka, forming 30.5% of its portfolio.

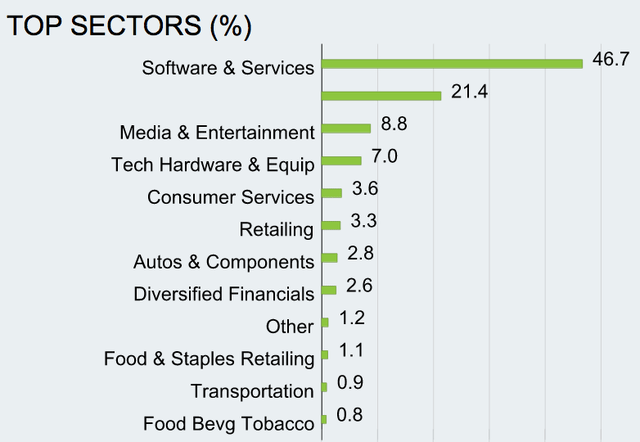

As you’d expect, BST’s top sector is Tech-related – Software & Services, with a 46.7% weighting, as of 3/31/22.

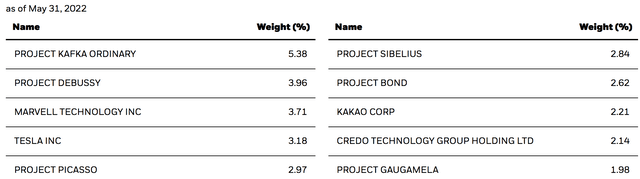

BSTZ’s top 10 also holds some familiar big cap names, but is more eclectic, with several lesser-known holdings, forming ~31% of its portfolio:

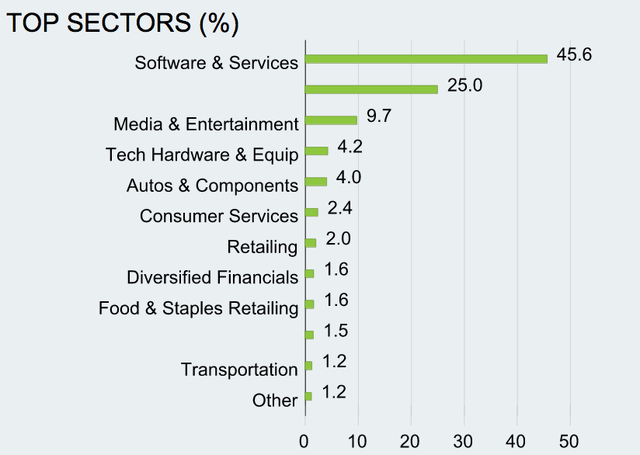

BSTZ’s top sector is also Software & Services, with a similar weighting, but with a lower weighting in Tech Hardware & Equipment than that of BST.

Parting Thoughts:

At some point, the Tech sector will once again be in Mr. Market’s good graces, as it was for the previous several years. Of course, no one knows when that’ll happen – you’ll need a strong stomach and some staying power to persevere over the long run. Another strategy for current holders of BST and BSTZ would be to bring their cost average down during this downtrend, with an eye to a more positive long term era for these 2 funds.

If you’re interested in other high yield vehicles, we cover them every weekend in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment