alvarez

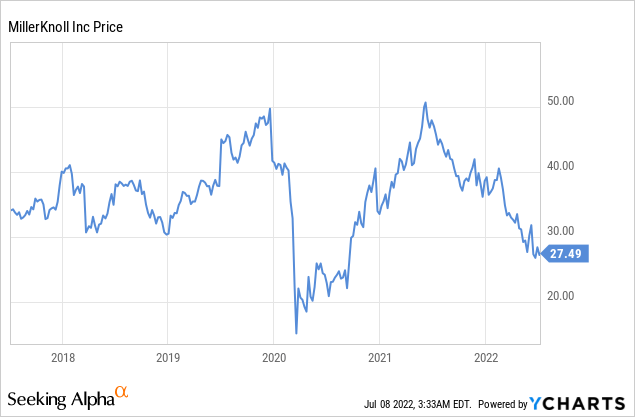

Shares of MillerKnoll (NASDAQ:MLKN) are almost back to its COVID lows despite a booming business posting strong revenue numbers, and a so far successful integration with its large Knoll acquisition. The main reason shares are down so much is that inflation has been eroding profitability, but the company is fighting to get the business back on track with price increases and looking for supply chain improvements.

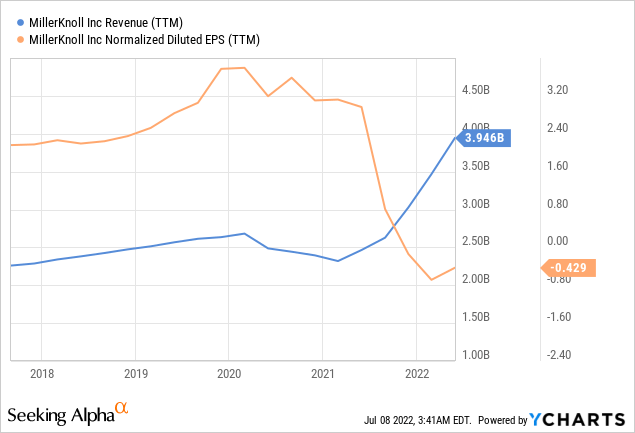

To better appreciate this divergence between revenue and profits, we are graphing trailing twelve months revenue against normalized diluted earnings per share. Most of the revenue growth can be attributed to the Knoll acquisition, but there has been organic revenue growth as well. Despite a booming business, earnings have all but collapsed, and the biggest reason is contracting gross profit margins due to inflation headwinds.

Financials

So far, MillerKnoll has made good progress towards its goal of delivering $120 million in cost synergies, having captured $66 million in run rate cost synergies at the end of their fiscal 2022. Supply chain mitigation efforts helped return lead times and reliability to near-normal levels for almost all products and geographies.

Consolidated net sales in the most recent quarter (Q4) were $1.1 billion, an increase of 77% on a reported basis and 23% organically over the prior year. The international business had a superb performance with record sales of $136 million in the quarter, an increase of 28% over last year on a reported basis and up 37% organically. Demand continued to exceed prior year levels with orders of $1 billion, up 47% over last year and an increase of 4% organically.

Inflation continued to eat at profit margins, but there is a clear improvement trend from the trough of ~33% gross profit margin in the previous quarter (Q3). For Q4, gross margin was 34.8%, 160 bps lower than one year earlier. This was primarily due to inflation in the form of higher commodity costs. Fortunately, on a sequential basis, gross margin improved 180 bps, as the company is beginning to see the impact of price increases. The company expects additional improvement as these price increases continue to drive further margin expansion in future quarters.

For Q1 2023 the company is guiding to revenue in the range of between $1.08 billion and $1.12 billion, and adjusted earnings per share between $0.32 and $0.38.

Profit Margins

The best indication so far we have seen from management that they are confident that profit margins will continue to improve as price increases flow through is the answer they gave an analyst during the most recent earnings call (emphasis added):

Alex Fuhrman – Analyst

It looks like now with the guidance in Q1, several quarters of pretty solid improvement relative to the 33% or so gross margin rate that we saw in the third quarter, I know it’s tough to have visibility multiple quarters out and you’re only guiding to the one quarter. But just as you think about what you know today given labor costs, material costs, what you’ve got in terms of already announced price increases that maybe have or haven’t been fully realized in your business.

I mean should we think of this kind of, call it, 35% or so gross margin that you’re guiding to in Q1 as being a base that you would hope to be expanding off of in future quarters? It seems like there are so many dynamics pushing and pulling in both directions. Just curious kind of based on what we know right now, what would you expect the base case on gross margin to be in the second and third quarter of the year?

Andrea Owen – CEO

I mean, Alex, we definitely expect it to be a base that we expand off of. And I’ll caveat that by saying provided nothing else happens in the world that could impact that from a macroeconomic standpoint. But as you look at the price lag, particularly in the contract business, we have not realized all of the price increases that we’ve put in place yet. We planned for more if we need to, to offset cost increases. So, I think, it’s fair to say that’s a good base to build off of.

Jeff Stutz – CFO

Yeah. No. I think that’s right, Andi. The only thing I would add is we would be disappointed — very disappointed if that didn’t happen. I said last quarter and I’ll say it again, I think our belief is that we’ve got enough pricing that’s been done. And again, we’re contemplating the need for potential more. We can get this business back to levels that were at or above pre-COVID and we’re nowhere near that right now. And so, we should see a continuous improvement in margin as we move through the balance of the year.

We, therefore, expect that as profit margins get back, or exceed, pre-COVID levels, earnings per share should move back up near their previous records, given that sales have not been an issue so far.

Balance Sheet

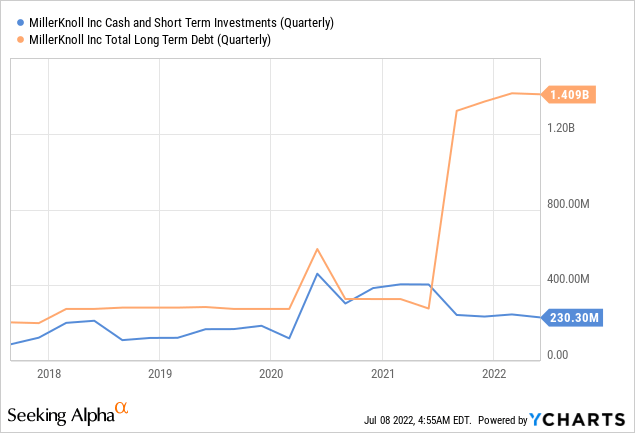

The balance sheet is a lot less solid than it used to be before the Knoll acquisition, which had a large cash component. Debt is now at ~$1.4 billion, while cash and short-term investments add up to ~$230 million.

We expect the company to put much effort into deleveraging once profitability improves. This should certainly be a priority for the company.

ESG

During the last earnings call, management made an announcement that they introduced their 2030 sustainability goals in the quarter. These goals are shared across all of their brands. They are targeting reducing their carbon footprint by 50%, designing out waste, and stopping the use of single-use plastics. They also plan to source better materials by using 50% or more recycled content, and purchasing materials that are responsibly and sustainably produced.

Valuation

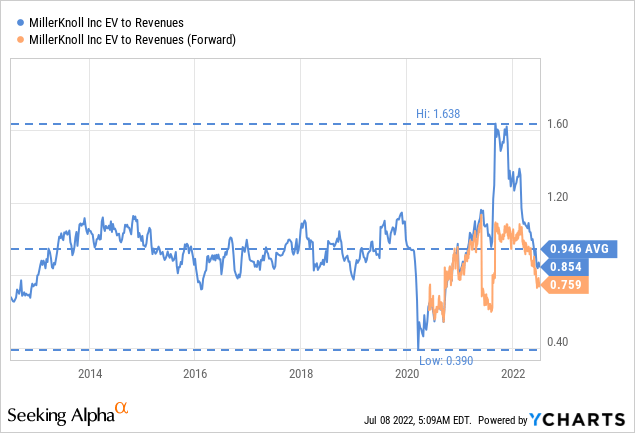

Given the current profitability issues due to inflation, it is difficult to value the company using earnings. Using EV/Revenues, shares are trading below their ten-year average, and the forward multiple looks very cheap at ~0.75x.

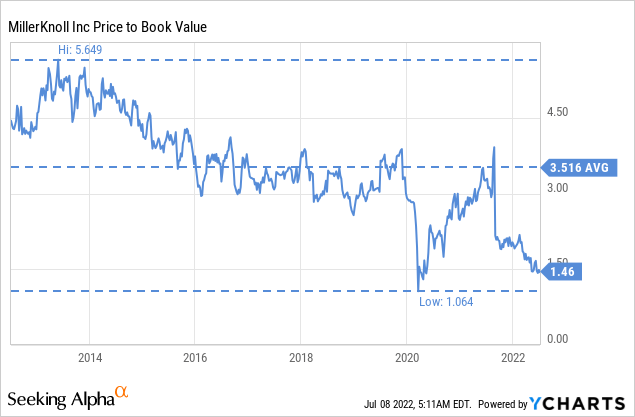

When measured using price/book, shares look even cheaper, at less than half the ten-year average. Using this measure, shares had not been as cheap since the COVID crisis.

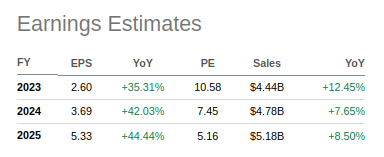

Based on forward estimated earnings, shares look cheap as well. For example, shares are trading at only ~5x analyst estimates of earnings for FY2025.

Seeking Alpha

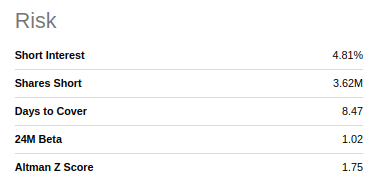

Risks

While shares certainly look cheap, there are a few risks to consider. One is that profitability has been severely affected by inflation, even if management sounds confident it should improve going forward. Another risk is that the balance sheet is a lot weaker after the Knoll acquisition, and that management will have to make a lot of efforts to deleverage. We don’t expect any meaningful dividend increases or share repurchases until the company has deleveraged. The Altman Z-score has decreased considerably due to the amount of debt added to the balance sheet and the profitability decrease.

Seeking Alpha

Conclusion

We believe MillerKnoll shares are extremely cheap, but they come with significant risk. Our thesis is that management will succeed in restoring profitability levels through supply chain efficiencies and price increases. If inflation were to moderate, that would also certainly help restore profit margins to their pre-COVID levels. Analyst seem to agree, assigning relatively high earnings estimates for future years. At ~5x earnings estimates for FY2025, we believe shares are a bargain, just be aware of the risks. If profit margins are restored to what they were before the inflation impact, shares should be able to rise significantly, maybe even double in a short period of time. We are, therefore, rating the shares ‘Strong Buy’ at these levels.

Be the first to comment