FotografiaBasica

Roughly a month ago, Altria Group, Inc. (NYSE:MO) was outperforming the market by a wide margin. In fact, in early June, the stock was up over 10% for the year while the market had fallen double-digits. However, a series of pronouncements by the Food and Drug Administration (FDA) and the Biden administration, coupled with downgrades by analysts, sent MO shares into a tailspin.

Altria is a resilient company wrestling with consistently decreasing demand for its products. Over the last few decades, cigarette use has fallen in the US, yet MO still managed to grow its revenue. Can Altria continue to buck the trend? The company’s efforts to diversify met with poor results, and analysts’ projections for the stock are mixed .

Why Did Altria Stock Drop In June?

The first of several blows landed in early June when a Morgan Stanley (MS) analyst revised her rating on Altria to Underweight from Equal-weight. Citing broad macroeconomic factors, she lowered the price target on MO, and the shares dropped from roughly $54 to just over $50 in one day.

Through the middle of June, the stock continued to slide, albeit at a far less precipitous rate. One could reasonably assume that MO was simply falling along with the broader market. However, on the 22nd of June, The Wall Street Journal reported the FDA would soon ban Juul Labs e-cigarettes.

Once again, MO cratered, falling 9% a share in one day. However, while reviewing the causes of the stock’s fall, I noted pundits focused on the ban of Juul products. Lost in the uproar was a separate move by the FDA, spurred on by the Biden administration, to eliminate nearly all nicotine in cigarettes.

The next day, Bank of America (BAC) analyst Lisa Lewandowski reduced her price target on MO from $58 to $50, citing headwinds from regulatory issues related to JUUL. However, that was followed by a reversal of course by Morgan Stanley with an upgrade on the stock, along with this note to clients:

We are moving to Equal-weight from Underweight following the stock’s recent underperformance and believe that the shares are now appropriately discounting our cautious view. We remain cautious on fundamentals and long-term structural positioning, but given the stock’s recent underperformance, with the shares down -21.4% in June to date … we believe the market is more appropriately pricing in our concerns.

Last but not least, Barclays analyst Gaurav Jain closed the month of June by downgrading MO to Underweight while dropping the price target from $53 to $36. While I can’t give Jain credit for foresight (I’m referencing the gargantuan drop in the price target) I must praise him for the most poetic use of the English language I’ve encountered in the downgrading of a stock.

We see Altria as a melting ice cube, i.e., entering a decline that will be hard to reverse, similar to newspapers, cable companies, and printers, so we believe it deserves a low multiple.

So from around $54 to a hair over $41, therein lies the path Altria took to its 52 week low.

The Latest Quarterly Results Reveal A Great Deal

Altria reported Q1 2022 results near the end of April. Net revenue declined 2.4% year-over-year to $5.9 billion. At the same time, volume at Marlboro, Altria’s biggest moneymaker by a wide margin, dropped 5.8% year-over-year, and overall cigarette volume fell 6.3%.

The company’s total smokeable products shipment volumes dropped by 6.4% to 21.1 billion units in the quarter.

For those that do not follow the company closely, this might appear to be a very bad quarter and a portent of things to come. For investors familiar with the stock, this rates as a fairly typical MO earnings report.

That’s because despite the drop in the volumes sold, Altria’s adjusted EPS increased by 4.7%, fueled in part by stock buybacks that reduced the share count by 2.1%. Although revenues dropped 1.3%, that is largely due to the divestment of the company’s wine business.

This points to the strength of Altria’s business model. From 2011 through 2021, Altria’s revenue rose from $23.8 billion to $26.0 billion, a CAGR of 0.9%. However, adjusted EPS increased at a CAGR of 8.4%. A remarkable feat for a company experiencing a drop in demand for its products.

While the percentage of Americans that smoke tobacco has consistently fallen over the years, a variety of factors work in Altria’s favor to counter the secular decline.

Ironically, one advantage lies in the actions of the government entities that are besieging the tobacco industry. The FDA imposed restrictions on new tobacco products that essentially eliminates the competition. New products must undergo a lengthy approval process through the FDA. Once approved, the draconian advertising restrictions levied on tobacco companies hamstrings the marketing of new products

Another form of leverage for Altria lies in its Marlboro brand. Marlboro has been the top-selling cigarette brand in the US for nearly a half century. Despite a steady decline in the number of smokers in the US over the years, MO has been able to offset volume declines with regular price increases, in part due to the popularity of its premium brand.

Furthermore, according to Morningstar, the US is the fourth most affordable market for cigarettes among OECD nations. Look no further than Australia, where a pack of cigarettes costs $35, to compare prices across borders. In contrast, Americans pay about $8.00 a pack, leaving quite a bit of room for Altria to hike prices.

Altria’s Efforts To Diversify

The beleaguered Juul Labs is one of Altria’s efforts to diversify away from traditional cigarettes. In 2018, MO paid $12.8 billion to acquire a 35% interest in the electronic cigarette company. At the time, Juul held a leading share of the vaping market. However, the company attracted lawsuits and government restrictions for marketing to underage users.

As a consequence, Juul’s revenue declined by 11% in 2021, resulting in a loss of $259 million. Altria’s hoped for path away from cigarettes led to a morass. If there is a bright spot in all of this, it is that MO had written down the value of its Juul position to $1.6 billion prior to the FDA banning sales of its products.

Since Juul has been a net negative, and the company had already written down the “asset”, it seems that the market’s reaction to the FDA’s stand on Juul is overdone. Furthermore, a federal appeals court has placed a hold on the FDA’s ban.

Along with Juul, MO has another initiative designed to move the company away from tobacco. In 2019, Altria purchased a 45% share of Canadian cannabis company Cronos Group (CRON) for $1.8 billion.

The positive side of Cronos is that the company routinely beats quarterly estimates, and revenues are growing at a rapid pace. The negative side of CRON is that the company is losing money. With a market cap of just under $1 billion, Altria’s investment in Cronos is underwater. However, CRON has little debt and holds about $1 billion in cash. Morningstar forecasts Cronos will become profitable in 2028.

There is another major effort by Altria to diversify away from tobacco products. Unfortunately, if you are familiar with the term, “the third time is a charm,” that doesn’t apply to Altria’s stake in Anheuser-Busch InBev SA/NV (BUD).

MO has around a 10% interest in AB InBev, but much like its positions in CRON and Juul, that investment has soured.

Originally, Altria held shares in SABMiller, but the latter company was gobbled up by AB InBev in 2015. This left BUD saddled with debt, and that eventually translated into dividend cuts.

Then the pandemic resulted in the closure of bars and restaurants, creating an additional headwind for AB InBev . Beer volume dropped 13.4% during the first half of 2020, causing a 12% year-over-year decline in revenue and a 24% drop in EBITDA. To make a long story short, investors in the company have not fared well following the SABMiller deal.

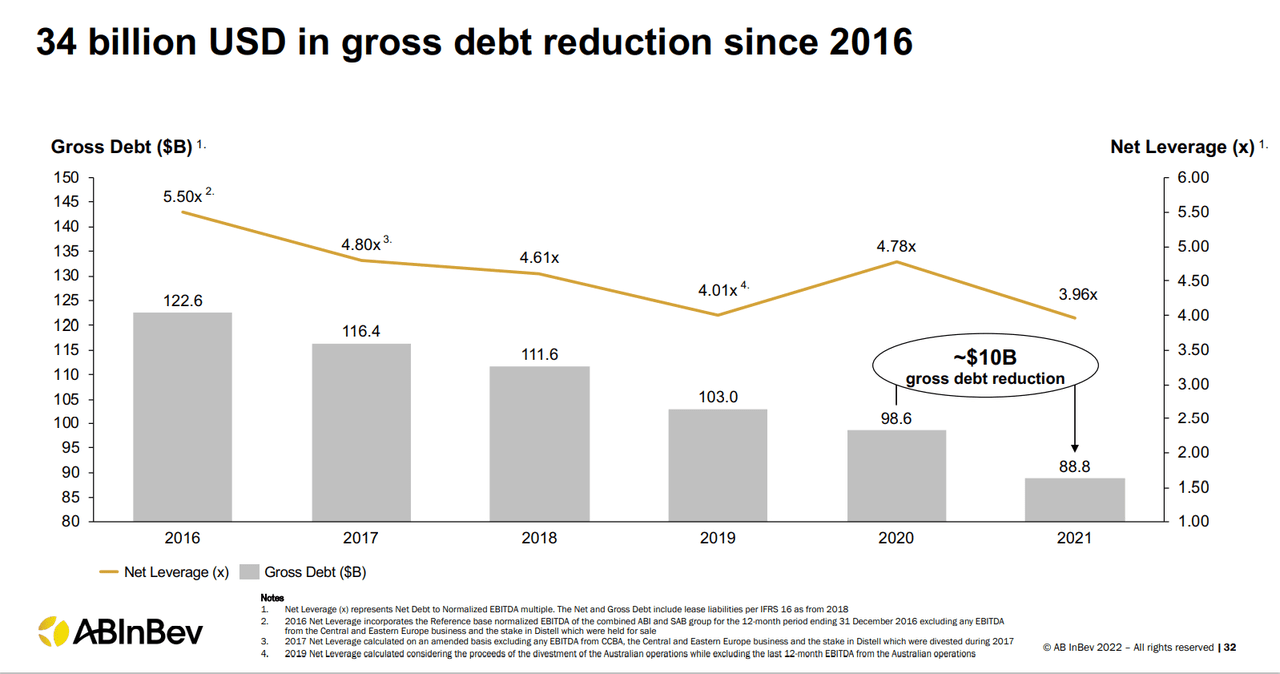

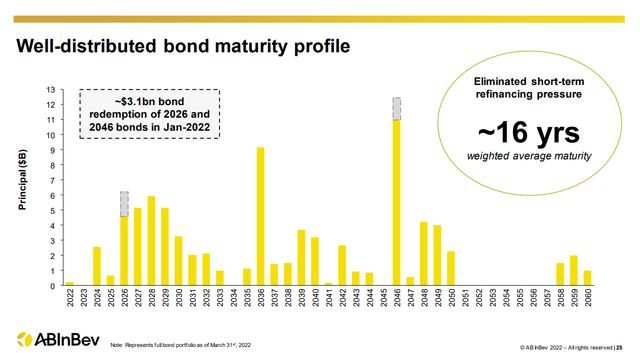

However, management has worked to improve the company’s balance sheet: total debt dropped to just over $90 billion as of June 2022, and Standard & Poor’s rates the company’s long-term debt at BBB+/stable.

Seeking Alpha

Seeking Alpha

Furthermore, AB InBev, with roughly 38% of the global beer market, is now the largest brewer in the world. BUD boasts 18 brands that generate more than $1 billion a year in sales. The company also holds a 62% economic stake in Ambev, which has a dominant share in Argentina (77%), Brazil (64%), and Canada (41%).

This scale provides the firm with a degree of leverage with vendors and retailers. The company also sports a gross profit margin in the range of 50% to 60%.

While AB InBev has struggled for some time, I think it is reasonable to assume the firm’s dominant position in its industry, coupled with successful efforts to deleverage, will likely lead to better performance in the stock in the future.

Moving On

I note that MO bulls tend to point to on!, Altria’s oral tobacco nicotine brand, as a potential source of growth. In Q1, on! shipment volume increased 99% year-over-year. Furthermore, the retail market share for on! grew markedly. Unfortunately, the product has only captured 4.1% of the market share, and the leader in this category, Zyn, holds a 64% market share.

On a completely different note, research from over a decade ago indicates nicotine is just one of several addictive substances present in tobacco. However, researchers have been unable to pinpoint the additional causes of addiction. If this research holds true, government efforts to reduce nicotine levels may not curb smokers’ appetites for tobacco products.

This extra chemical is an additional thing that makes smoking harder to give up. This is a formal proof that some tobacco substances are more addictive than nicotine is.

Penelope Truman, Institute of Environmental Science and Research

MO Stock Basics

Altria’s long-term debt is rated A3/stable by Moody’s, and BBB/stable by Standard & Poor’s and Fitch.

The current yield is 8.52%, the payout ratio is 76.39%, and the 5-year dividend growth rate is 8.09%.

Altria’s forward P/E of 8.59X is well below the company’s 5-year average P/E of 14.19X. MO’s 5-year PEG ratio, per Seeking Alpha, of 1.70X is also below the firm’s average PEG over the last five years of 1.90x.

However, Yahoo Finance calculates the 5-year PEG ratio as 6.31x, while the P/E ratio is roughly in line with SA’s.

What Is The Target Price For Altria Stock?

MO currently trades for $41.79 a share. The average one year price target of the nine analysts that rate the stock is $47.56.

The average price target of the four analysts that rated the stock following the most recent earnings release is $42.50.

Is MO A Buy, Sell, Or Hold?

For many years, Altria has managed the annual drop in cigarette sales by raising prices. It is reasonable to question how long this strategy can prevail, but it has proved effective for decades.

Viewing the loss of Juul as a major blow to the company is a non sequitur. MO had written down the “asset” prior to the FDA’s move, as Juul has been a failure. In fact, management guides for an adjusted diluted EPS growth of 4% to 7% in 2022, while noting that forecast assumes Altria would no longer be distributing IQOS products. Analysts forecast 5.5% annualized earnings growth over the next five years.

Altria generates over $21 billion in annual revenue, and $8.2 billion in FCF.

On the negative side, Morningstar projects the volume decline rate of U.S. cigarettes at approximately 4% per year. While MO is attempting to diversify away from cigarettes, its attempts to transition to other products has been ineffective.

Largely due to valuation and the robust yield, I rate MO as a BUY.

I do so with the understanding that MO appeals to investors seeking passive income from a dividend stream. While I agree that Altria is not a sleep-well-at-night investment, I think the recent drop in share price will insulate stockholders for the short to mid term.

Altria’s 8.75% dividend yield is more than five times that of the S&P 500’s. While I am limiting my investment in MO due to secular headwinds, (I increased my position in the stock while conducting my investigation for this article) I am happy to use the dividend income to add to other investments.

Be the first to comment