Sundry Photography

Broadcom Inc. (NASDAQ:AVGO) has outperformed its semi peers, as represented by the Semiconductor ETF (SOXX) in 2022. Accordingly, AVGO posted a YTD return of -14.5% compared to SOXX’s -32.5% return.

The market’s confidence in CEO Hock Tan & his team has been clearly demonstrated. Coupled with robust profitability and solid execution, it has not been beset by the oversupply challenges that some of its peers faced.

Hock Tan accentuated that the company continues to scrub its backlog to assess “true” demand and avoid over-shipping. He articulated:

We don’t believe we are shipping beyond true demand. We continue to scrub, to basically judge orders, the backlog we have, and we also take pains to only ship to customers who can consume it pretty much within the same quarter before we do it. And so as far as we can tell, based on what we see as a willingness of our customers to exempt and consume the products we ship, that’s what we see right now. (Broadcom FQ4’22 earnings call)

But, investors need to consider that management was also reticent in guiding for FY23, even though it telegraphed that the company is “fully booked” for 2023.

We believe management remains concerned over the impact of worsening macro headwinds, given the Fed’s hawkish stance through 2023. Even though Hock Tan highlighted that the company had not observed any changes to its order visibility, management’s reluctance to guide needs to be considered.

Notwithstanding, management is confident that enterprise spending outlook and hyperscaler demand remain strong. DIGITIMES forecasts on the data center segment in 2023 are consistent with Broadcom’s optimism. Furthermore, AWS (AMZN) is still expected to continue hiring despite Amazon’s recent layoffs as “business is still growing rapidly,” corroborating the strength in the hyperscalers’ outlook.

As such, we believe the market had correctly anticipated AVGO’s robust performance for FY22, as it formed its bottom in October (pre-Q4 earnings).

Hence, investors need to ask whether the recovery from its October lows has captured its near- and medium-term upside.

We remain constructive over Broadcom’s execution through the cycle. That said, we think AVGO’s valuation is well-balanced, its near-term upside has likely been reflected in its recent surge.

Furthermore, analysts continued to pencil in lower revenue and profitability growth through FY23, as it laps a highly remarkable FY22. Therefore, the risks of a global recession may not have been reflected in its current valuation.

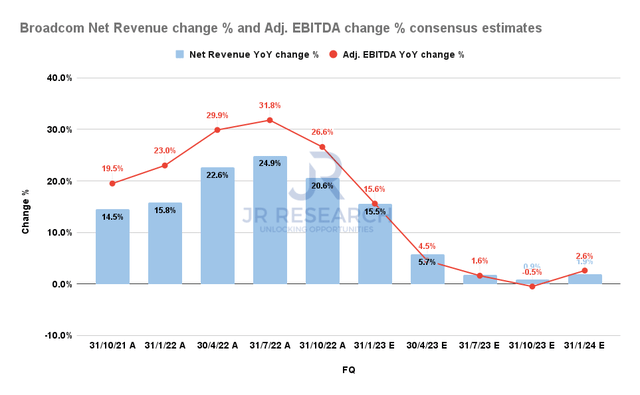

Broadcom Net revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As seen above, the consensus modeling for Broadcom’s FY23 operating performance suggests a marked deceleration from FY22’s outperformance.

We believe management was already aware of the Street’s modeling and therefore had an opportunity to address the analysts’ concerns. Consequently, it was somewhat surprising that Broadcom was not ready to guide and help lift worries over significant growth deceleration through 2023. Truist also highlighted its frustration as it articulated:

Investors hoped for explicit guidance, explicit backlog, and explicit lead time commentary, but management was unwilling to provide these, considering well-documented macro headwinds. – Seeking Alpha

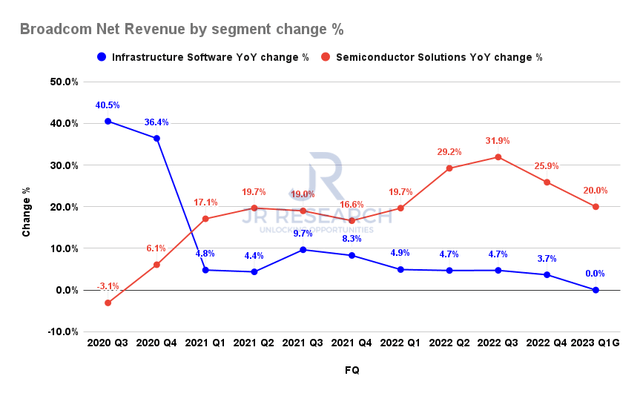

Broadcom Net revenue by segments change % (Company filings)

As such, we believe these estimates are credible, as Broadcom’s guidance for Q1 suggests that its growth has continued to decelerate from the highs in Q3’22.

Hence, with potentially slower growth moving ahead, a material re-rating from the current levels could be less likely if the market anticipates increased risks of earnings compression linked to a global recession.

Takeaway

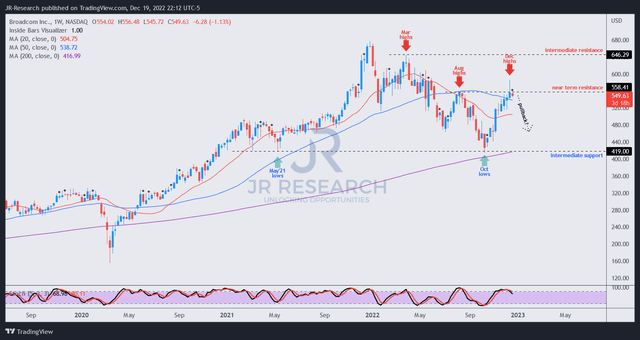

AVGO price chart (weekly) (TradingView)

AVGO’s October lows re-tested the levels last seen in May 2021 and were successfully defended by the bulls.

Hence, we believe those levels, if re-tested successfully again, could provide a reasonable entry zone for investors still waiting on the sidelines. However, there’s no guarantee that AVGO will revisit those levels and could also consolidate above its 200-week moving average (purple line).

Therefore, investors should continue to monitor closely for constructive consolidation, which should provide lower-risk entry levels as the market attempts to price in a hawkish Fed.

Given the increased likelihood of a global recession, we believe it’s vital for investors to assume a more substantial margin of safety to mitigate potential downside risks.

Coupled with the recent rejection by the sellers at its critical resistance zone, we urge patience for now.

Maintain Hold.

Be the first to comment