Robert Way

Investment Thesis

It has been an incredible few years for Lululemon Athletica Inc. (NASDAQ:LULU), with the company benefitting from huge tailwinds throughout the Covid-19 lockdowns as people across the globe ditched office attire for comfortable athleisure products.

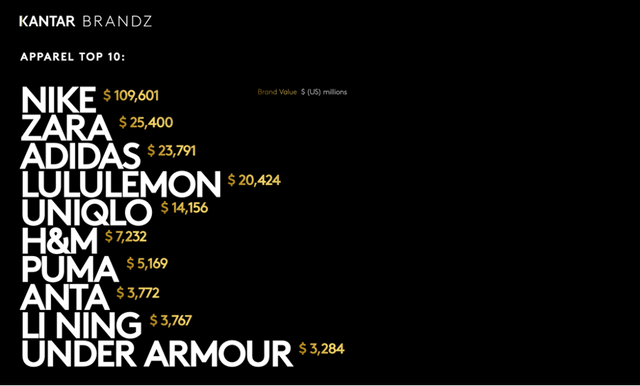

Over this period, Lululemon’s brand became increasingly valuable – in fact, according to the Kantar BrandZ Most Valuable Global Brands 2022 Report, Lululemon was the 4th most valuable global brand in the apparel category.

Kantar BrandZ Global Report 2022

I detailed my investment thesis and analysis on Lululemon in a previous article, and will summarize my thesis as follows: brand power is key in apparel, and Lululemon has successfully built a strong brand over the past few years. This has enabled it to benefit from superior margins and pricing power, all whilst the company continues to innovate with its new products. This should continue to enhance the brand value, which will be paramount for Lululemon’s long-term success.

Whilst 2020 and 2021 were standout years for Lululemon, the current environment in 2022 is completely different. The world is reopening and people are having to dig out their office clothes, economies are facing substantial inflation that hasn’t been seen in over 40 years, and many of Lululemon’s core markets have plunged into a recession. If the pandemic years set Lululemon up for success, then 2022 is setting the business up for failure.

This latest earnings season in particular has seen companies sharply cut guidance, lay off tens of thousands of staff members, and paint a rather gloomy picture about the shape of the global economy. Lululemon may have successfully navigated the macroeconomic storm so far this year, but will it finally start to crack when it has to report on the latest quarter?

Here’s what investors should be watching when Lululemon’s Q3 results come around.

Lululemon’s Latest Expectations

Lululemon is expected to report its Q3’22 earnings on Thursday 8th December, and there are several key items that investors should keep their eyes on.

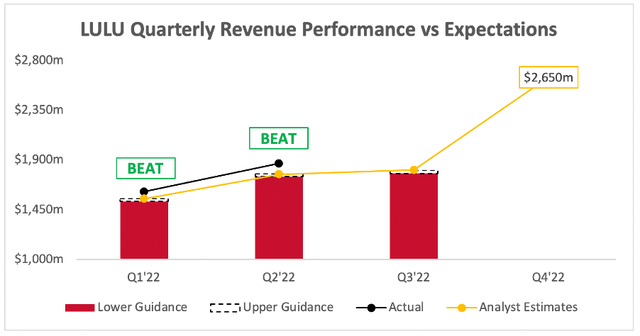

Starting with the headline numbers, and analysts are expecting Q3 revenue of $1.81B, representing YoY growth of 24.8%. This is slightly ahead of management’s $1.780-$1.805B guidance, so it would appear that Wall Street is feeling pretty optimistic ahead of Lululemon’s Q3 results – perhaps surprisingly optimistic, given the difficult macroeconomic environment.

Looking ahead to Q4, analysts are expecting Lululemon to deliver revenue of $2.65B, which would represent YoY growth of 24.5%. I think management’s Q4 revenue guidance will arguably be the most important part of this earnings report, at least for anyone with a short-to-medium term time horizon, as it will give an indication on just how hard Lululemon expects to be hit by the likely oncoming recession.

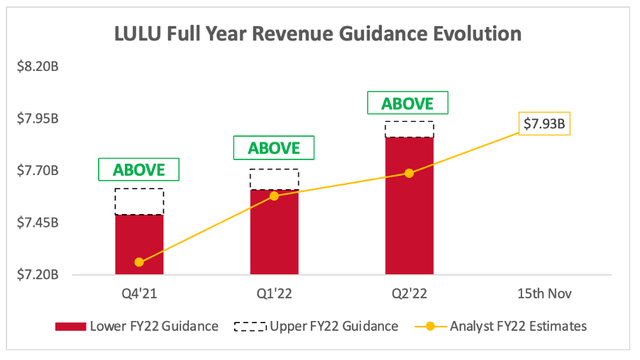

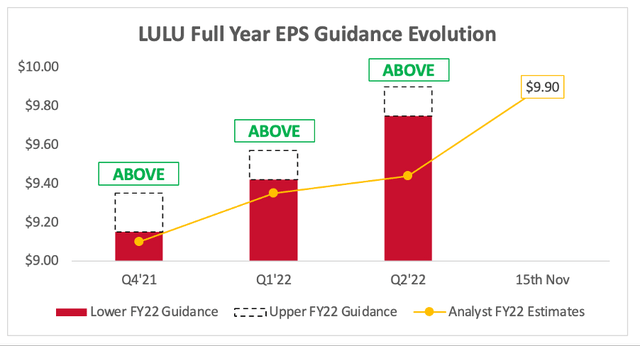

On the plus side, management have a habit of pleasantly surprising both analysts and shareholders when it gives revenue guidance. This is particularly obvious when you look at the company’s full year revenue guidance evolution over the past 9 months, as the FY22 revenue outlook has been raised time and time again, above analysts’ estimates.

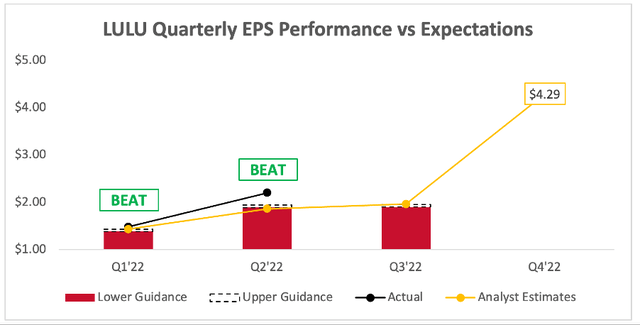

Moving onto the bottom line, and analysts are expecting Lululemon to deliver EPS of $1.96, which is once again above management’s guidance range of $1.90-$1.95. It appears analysts have realized that Lululemon tends to beat any and all estimates, so they are setting the bar a bit higher.

Lululemon’s margins in 2022 would’ve been under pressure, as soaring energy costs and inflation battered the company’s supply chain. Yet, once again, management have continually beaten analysts’ bottom line estimates, and consistently raised Lululemon’s full year EPS outlook.

If any investor wanted to see evidence of pricing power, then Lululemon’s ability to continue delivering exceptional margins whilst feeling substantial cost pressure is exactly what shareholders are looking for. Combine this with the fact that CFO Meghan Frank mentioned on the Q2 earnings call that Lululemon hasn’t seen any resistance to its ~10% increase in prices, and you’ve got a company that is flexing its pricing power muscles.

Clearly, Lululemon has seen success with its headline numbers over the past few quarters – so much so that Wall Street has increased its expectations for Q3, which would make a beat by Lululemon this quarter all the more impressive.

Aside from these headline numbers, what else do investors need to be aware of heading into Lululemon’s Q3 earnings?

Currency Risk Could Worsen This Quarter

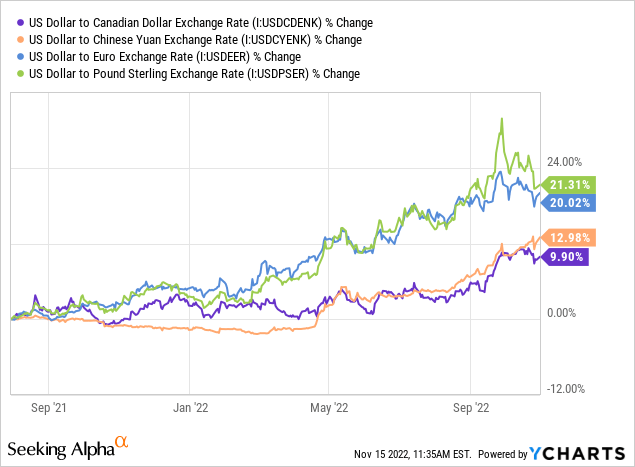

Another macroeconomic trend that has impacted a lot of companies this year is the strong US dollar.

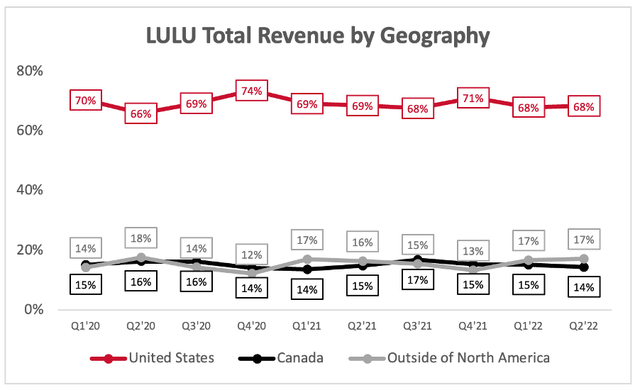

This has severely dented the revenue that US-based businesses have brought in from markets outside of the United States, and Lululemon is no different. The company saw its comparable sales grow 25% on a constant dollar basis in Q2, compared to the 23% growth otherwise – so, a 200bp FX headwind.

All in all, some headwinds faced, but nothing too dramatic for Lululemon yet. This is because the company saw 68% of its total Q2 revenue come from the United States, however, investors might be in for a bit more pain in Q3, as the US Dollar strengthened mightily against the Canadian Dollar (Lululemon’s second largest market) from August through to October this year.

This is something that investors should bear in mind. The USD to CAD exchange rate in Lululemon’s Q3’22 fluctuated between 1.27 and 1.38; in Q3’21, the exchange rate fluctuated between 1.23 and 1.28. I’m not trying to precisely calculate the expected impact, but this will undoubtedly add some pressure to Lululemon’s revenues from Canada.

Lululemon’s Key Business Trends

There are a few trends worth touching on ahead of Lululemon’s Q3 earnings.

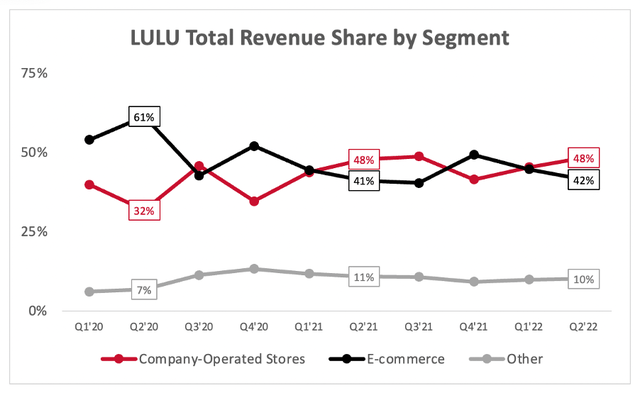

Firstly, it’s worth taking a note of the revenue share by segment for Lululemon. During the pandemic, unsurprisingly, the E-Commerce segment made up the bulk of Lululemon’s sales, however over the past year or so it’s been fairly evenly split between E-Commerce and Company-Operated Stores.

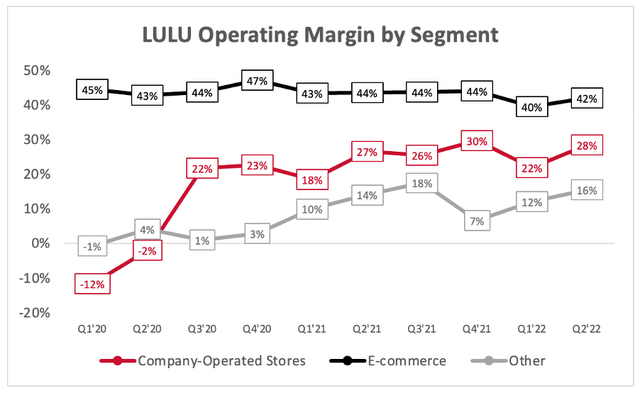

The potential downside of this is the fact that Lululemon’s E-Commerce revenues return much higher EBIT margins, which have been consistently above 40% for the past few years. Compare that to the Company-Operated Stores, which often return EBIT margins in the range of 20-30%.

Don’t get me wrong; I really like Lululemon’s omnichannel approach, and I think the in-store and online experiences work hand-in-hand with each other. But as an investor, it’s important to see either one of two things (or ideally both): E-Commerce sales making up over 40% of overall sales (the more the merrier), and EBIT margins continuing to expand within the Company-Operated Stores segment.

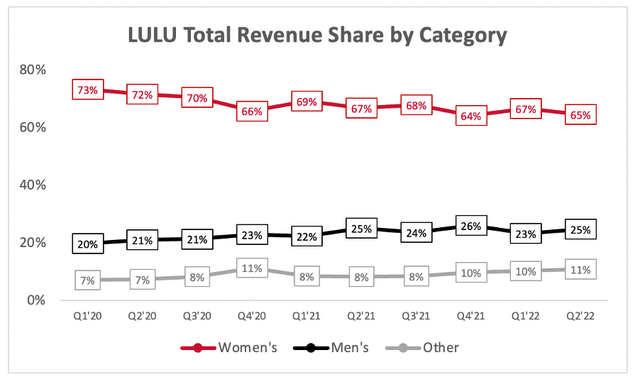

Another interesting trend to watch is Lululemon’s ability to expand into men’s apparel. The company has seen pretty decent traction on this front over the past few years, with men’s products making up 25% of total revenue in Q2’22 compared to 20% in Q1’20.

Looking at this from a 2Y CAGR perspective, men’s products have grown at a 56% CAGR whereas Lululemon’s women’s products have grown at a 37% CAGR; both impressive, but really promising to see this traction in a growth area like men’s products for Lululemon.

Quick Take: Lululemon’s Core Financials

I’ll also take a quick look at Lululemon’s financials, and there are a couple of items that I’d like to focus on.

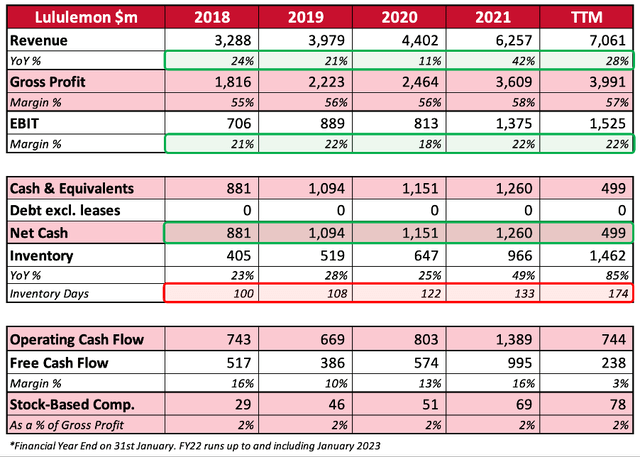

Starting with the trailing-twelve-month trends, and a couple of the positives. Lululemon has seen fantastically consistent revenue growth over the past few years (especially if you normalize for the pandemic) and has achieved this all whilst keeping EBIT margins between 18-22%.

I think investors can also see some evidence of pricing power in Lululemon’s gross profit margins; with supply chain costs increasing, investors might expect gross margins to decrease, but the fact that they remain consistent demonstrates that Lululemon was able to increase its prices in line with the cost increases.

Lululemon has an extremely strong overall financial profile, especially considering that it consistently had a net cash position with no debt.

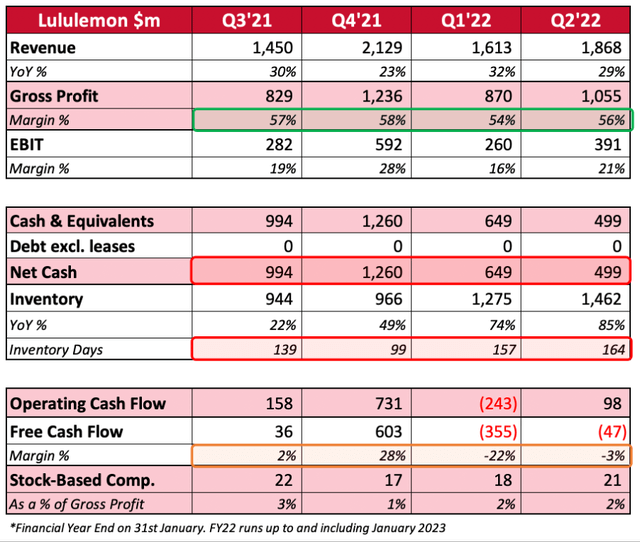

Yet as we can see in the quarterly trends below, that net cash position has fallen rapidly; but why?

Well, it all has to do with the fact that inventory levels have gone through the roof in recent quarters. This is more apparent when looking at Lululemon’s inventory days metric, which is a rough way to indicate how many days inventory is held for before it gets sold. When a company has too high an inventory level, there is a risk that it will have to discount that inventory in order to clear out the warehouse for newer products to come in – a risk to margins, and to Lululemon’s pricing power.

It’s also worth noting the impact that rapidly increasing inventory like this has on the rest of the financials; namely, it reduces the net cash position (because that cash has been used to purchase excess inventory, and sales are not keeping up) and also reduces free cash flow (because the company is seeing more cash go out in order to purchase additional inventory).

CEO Calvin McDonald did speak about this ramp up of inventory on the call:

In terms of inventory, we remain comfortable with both our quality and quantity, and we are well positioned for the fall season. As you recall, for much of last year, we were under-inventoried and not able to fully maximize our business. This year, we are in a much better position to deliver product innovation to our guests wherever and however they shop with us.

There have been plenty of stories out there in 2022 of retailers who overstocked on inventory for a variety of reasons, namely, to mitigate the risk of supply chain disruptions, and then suffered from having too much stock and ended up discounting as a result. Combine this with an environment where the consumer is weakening, and overall demand is slowing, and Lululemon does run the risk of succumbing to the same fate.

LULU Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Lululemon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

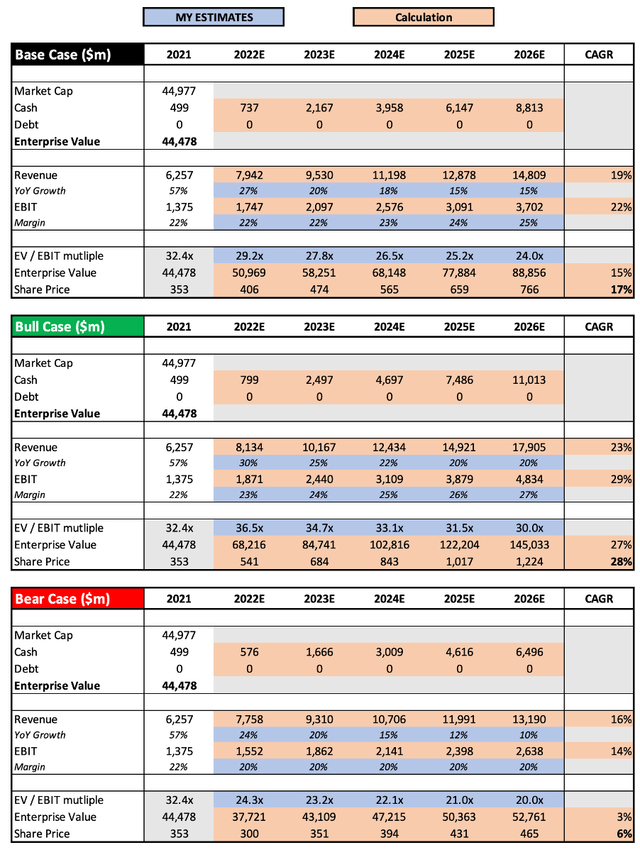

I have only made one or two tweaks to this model compared with my previous article, which involve slightly increasing margins for operating cash flow and EBIT. This has not had any material impact, and all my previous assumptions remain the same.

Put all this together, and I can see Lululemon shares achieving a CAGR through to 2026 of 6%, 17%, and 28% in my respective bear, base, and bull case scenarios. As such, I believe shares are currently attractively priced given the quality of this business.

Bottom Line

Virtually all companies have been hit by macroeconomic headwinds over the past year, but it’s made one thing absolutely clear – some businesses are head and shoulders above others, as has been shown by certain companies’ ability to handle whatever has been thrown at them.

Lululemon has been in this category so far in 2022, and despite the difficult macroeconomic environment, I have no reason to doubt management’s ability to navigate this storm.

I believe that the current share price is attractive, although I should make it clear that my time horizon is a minimum of three years; there could certainly be better buying opportunities for Lululemon over the next 12 months, especially if it does succumb to macroeconomic pressures.

Given all this, I will reiterate my previous ‘Buy’ rating on Lululemon shares.

Be the first to comment