People’s United Financial Inc.’s (PBCT) earnings per share ratio is likely to decrease this year mostly because the company’s net interest margin is quite sensitive to interest rate changes. Due to the composition of the loan portfolio and deposit mix, PBCT’s average yield is more responsive than funding cost to interest rate cuts. Moreover, the COVID-19 pandemic will likely drive up the provisions charge for loan losses, thereby dragging earnings per share. Overall, I’m expecting PBCT’s earnings per share to decrease by 4% year-over-year in 2020. The December 2020 target price suggests a significant potential for capital appreciation, making PBCT an attractive investment for high-risk tolerant investors with an investment horizon of more than nine months. For the near-term of four to five months, the COVID-19 pandemic presents high risks. I’m expecting the epidemic to end in the mid of the third quarter of 2020. If it lasts longer, then earnings may see further downside. Due to the risks posed by the pandemic, I’m adopting a neutral rating on PBCT.

Margin to Suffer from Gap in Rate-Sensitivity

PBCT has a low deposit beta because of the high proportion of low rate-sensitive core deposits in the company’s total deposit mix. As at the end of December 2019, checking, savings, and money market deposits made up 79% of total deposits. At the same time, the rate-sensitivity of the loan portfolio is high because of the high proportion of floating-rate loans in total earning assets. As at the end of 2019, floating-rate loans made up approximately 44% of total loans. Due to the mismatch in these sensitivities, PBCT’s net interest margin, NIM, is likely to suffer from the recent interest rate cuts.

According to a simulation on interest rate sensitivity conducted by the management, a 100bps rate cut can lead to a 2.1% decline in net interest income. The following table, extracted from the latest 10-K filing, shows the results of the simulation.

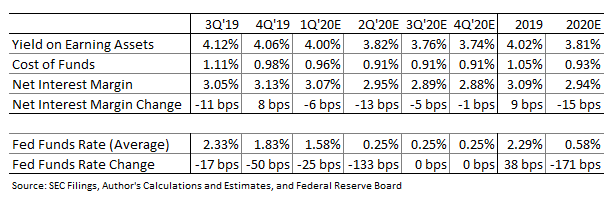

Considering the simulation results, I’m expecting NIM to decline by 6bps in the first quarter, and then by a further 13bps in the second quarter of 2020 on a sequential basis. The following table shows my estimates for yield, cost, and NIM.

Loans to Decline Due to Planned Run-off

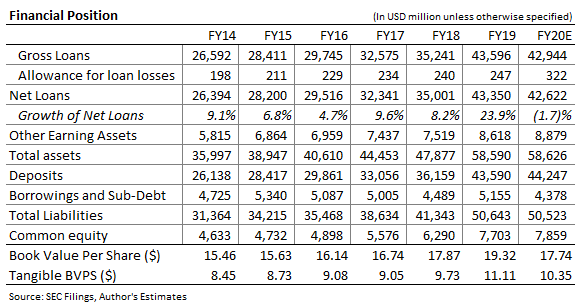

PBCT’s loan portfolio size is likely to contract this year from the 2019 year-end level. As mentioned in the fourth-quarter conference call and investor presentation, the management is planning to run-off around $1.3 billion worth of loans acquired from United Financial and around $737 million worth of New York Multifamily loans. Moreover, the COVID-19 pandemic will likely slow down loan origination in the first half of the year. Furthermore, PBCT has historically relied on merger and acquisition activity for earning assets growth. The epidemic and presidential elections this year are likely to push any merger plans to next year, which will affect loan growth in 2020. Consequently, I’m expecting net loans to decline by 1.7% this year, as shown in the table below.

The decline mentioned above is on a year-end comparison basis. The average loan book size will be higher in 2020 compared to 2019 because of the acquisition of United Financial towards the end of last year. Due to the higher average loan balance, I’m expecting net interest income to be 6% higher in 2020 compared to 2019.

Expecting COVID-19 to Increase Provisions Charge

The management expected provisions charges for loan losses to be in the range of $40 million to $50 million this year, according to the investor presentation. As the presentation was held before the COVID-19 pandemic, the guidance excludes the impact of the epidemic. Considering the effect of the pandemic, I’m expecting the provisions charges in 2020 to be above the management’s guided range. I’m expecting PBCT to book provisions charges worth $52 million, which suggests a provisions-to-gross-loans ratio of 12bps for 2020 as opposed to a ratio of 7bps in 2019.

Earnings Per Share Likely to Decline by 4%

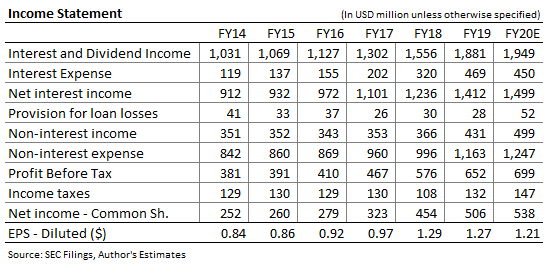

As mentioned above, compression of NIM and an increase in provisions charge are likely to drag earnings this year. On the other hand, the planned conversion of United Financial’s system in the second quarter of 2020 is likely to cut costs and provide some relief to the bottom-line. Overall, I’m expecting net income to increase by 6%, and earnings per share to decrease by 4% year-over-year in 2020. The difference between the growth rates for earnings and earnings per share is attributable to shares issued for the acquisition of United Financial. The following table shows my estimates for key income statement items.

The COVID-19 pandemic presents risks to the earnings thesis. I’m expecting the epidemic to end by the mid of the third quarter of 2020. If the pandemic lasts longer than my expectations, then the growth of loans and non-interest income can miss my expectations. Moreover, provisions charges can exceed my expectations if the pandemic gets prolonged beyond the third quarter. Furthermore, if interest rates go into negative territory, then the NIM can see further downside.

Offering Attractive Dividend Yield of 6.6%

I’m expecting PBCT to forego its annual dividend raise this year due to the prospects of a decline in earnings. Instead of increasing dividends, PBCT is likely to maintain its quarterly dividend at the current level of $0.1775 per share throughout 2020. There is very little threat of a dividend cut as the dividend and earnings estimates suggest a payout ratio of 58.5%, which is lower than the five-year average of 66.4%. Moreover, PBCT is well-capitalized, which minimizes the threat of a dividend cut from regulatory requirements. The company’s tier I capital ratio stood at 10.7% at the end of 2019, as opposed to the minimum regulatory requirement of 8.0%. The dividend estimate implies a dividend yield of 6.6%.

High Price Upside for High-Risk Tolerant Investors

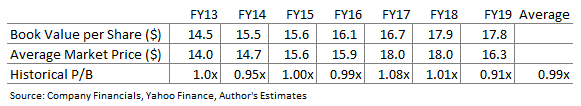

PBCT has traded at an average price-to-book value ratio, or P/B, of 0.99 in the past, as shown below.

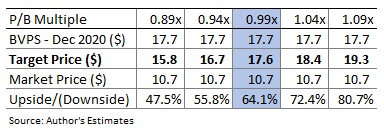

Multiplying the average P/B ratio with the forecast book value per share of $17.7 gives a target price of $17.6 for December 2020. The price target implies a 64% upside from PBCT’s March 23, 2020, closing price. The following table shows the sensitivity of the target price to the P/B ratio.

The high price upside suggests that PBCT is a good investment for a holding period of more than nine months. However, due to the high level of risks, the stock is suitable only for high-risk tolerant investors. I believe the high riskiness of the stock and the prospects of earnings decline will keep PBCT’s stock price depressed in the near-term of around four to five months. Consequently, I’m adopting a neutral rating on the stock for the near-term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and risk tolerance before investing in the stock(s) mentioned.

Be the first to comment