PM Images

Sometimes investment prospects can defy your expectations. A great example of this failure can be seen by looking at Mettler-Toledo International (NYSE:MTD), a firm that is focused on the production and sale of precision instruments and the provision of related services. Fundamentally, the company seems to be rather robust, with even the most recent financial data coming from management looking rather bullish. Even so, the high trading multiples the business was trading for warranted a ‘hold’ rating in my book, but the company has since handily outperformed the broader market.

A great company that delivers

Back in August of this year, I wrote an article calling Mettler-Toledo International a great science-oriented firm. Management had done incredibly well over the prior few years, growing the company’s top and bottom lines. Based on my understanding of the company, I believed then that the trend would continue for the foreseeable future. But at that moment, shares were trading at very high levels, leading me to rate the enterprise a ‘hold’ to reflect my opinion that the high expense that the market demanded from incoming investors would result in shares generating returns that more or less match the broader market moving forward. Since then, the company has blown past my expectations. While the S&P 500 is down by 1.1%, shares have rocketed higher, generating an upside for investors of 18.7%.

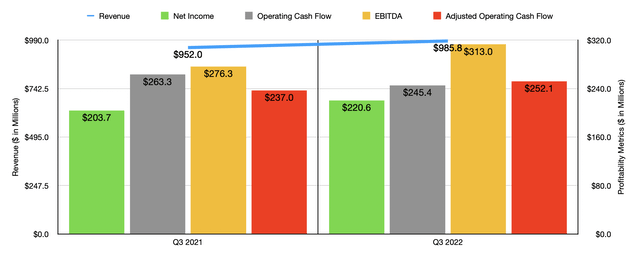

This strength from the company comes on the back of strong fundamental performance during the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about it. During that quarter, sales came in strong at $985.8 million. That’s 3.6% higher than the $952 million generated at the same time one year earlier. To some, this may not seem like a meaningful increase. But it’s worth noting that had it not been for foreign currency fluctuations, growth for the company would have been even higher at 10% year over year. Even though the performance was weak in Europe, the company benefited from robust demand elsewhere. In the Americas, sales jumped by 11%. Throughout Asia and the rest of the company’s global operations, excluding Europe, sales grew by 7%. In Europe, meanwhile, the company reported a 12% decline in revenue.

This increase in revenue brought with it improved profitability. Net income, for instance, totaled $220.6 million in the latest quarter. That’s 8.3% higher than the $203.7 million reported only one year earlier. Much of this improvement came as a result of the company’s gross profit margin rising from 58.4% in last year’s third quarter to 59.3% in this year’s. This year-over-year increase was driven by improved profitability across both the products and services sides of the firm. And according to management, the increase was driven by favorable price realizations and increased sales volumes. This came even as higher material costs offset some of the improvements. Another benefit involved selling, general, and administrative costs, which decreased from 25.3% of sales to 23.7%. But management did not give specifics on why that was. Other profitability metrics also followed suit. Admittedly, operating cash flow did worsen year over year, declining from $263.3 million to $245.4 million. But if we adjust for changes in working capital, it would have risen from $237 million to $252.1 million. Meanwhile, EBITDA for the company also increased, climbing from $276.3 million to $313 million.

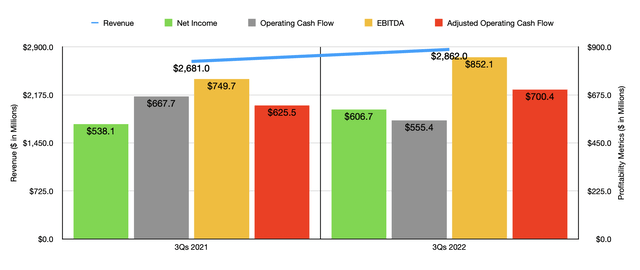

This strong performance was instrumental in helping total results so far for 2022. For the first nine months of the 2022 fiscal year, sales came in at $2.86 billion. That’s 6.8% higher than the $2.68 billion generated the same time last year. Net income rose from $538.1 million to $606.7 million. Operating cash flow still fell, declining from $667.7 million down to $555.4 million. But if we adjust for changes in working capital, it would have improved from $625.5 million to $700.4 million. And just as was the case in the latest quarter, EBITDA improved year over year, climbing from $749.7 million to $852.1 million. Management has used these strong results to justify buying back significant amounts of stock. So far this year, the company has dedicated approximately $825 million to share buybacks. They recently had $1.2 billion left on their share authorization program. But since then, they have increased that by adding another $2.5 billion in potential buyback capacity.

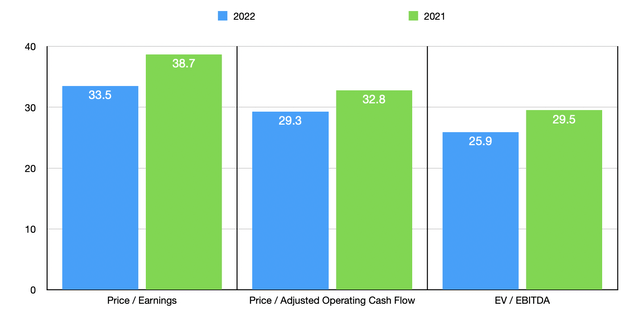

When it comes to the 2022 fiscal year in its entirety, management believes that revenue, on a local currency basis, will rise by around 10%. Earnings per share, meanwhile, should come in at between $38.95 and $39.05. At the midpoint, that would translate to net income of $890 million. No guidance was given when it came to other profitability metrics. But if we annualize the results experienced so far for the 2022 fiscal year, we would get adjusted operating cash flow of $1.02 billion and EBITDA of $1.22 billion. Based on these figures, the company is trading at a forward price-to-earnings multiple of 33.5. The forward price to adjusted operating cash flow multiple would be 29.3, while the EV to EBITDA multiple would be 25.9. As you can see in the chart above, while shares of the company are expensive, they are cheaper than if we were to value the company using data from 2021. As I do with most articles that I write, I also decided to compare Mettler-Toledo International to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 29 to a high of 40.5. In this case, two of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was between 20 and 72.6, with one of the five being cheaper than our target. And when it comes to the EV to EBITDA approach, the range was between 18 and 79.8. In this scenario, four of the five companies were cheaper than our prospect.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Mettler-Toledo International | 33.5 | 29.3 | 25.9 |

| Illumina (ILMN) | 40.5 | 72.6 | 79.8 |

| West Pharmaceutical Services (WST) | 30.4 | 29.5 | 20.2 |

| Agilent Technologies (A) | 33.9 | 34.5 | 23.7 |

| Waters Corporation (WAT) | 29.0 | 32.0 | 21.0 |

| ICON Public Limited Company (ICLR) | 39.2 | 20.0 | 18.0 |

Takeaway

Based on all the data we have at our disposal, I still conclude that shares of Mettler-Toledo International look very pricey at this moment. Yes, the fundamental performance of the enterprise has been impressive, and I fully suspect that growth for the company will continue moving forward. But given where shares are priced today, I have a difficult time being overly optimistic. Operationally, the business is great and should do well in the long run but, given its lofty trading multiples, I don’t think a more cautious approach is necessarily a bad thing for investors. For those reasons, I still am rating the company a ‘hold’, but I could not blame somebody for disagreeing with me and picking up the stock.

Be the first to comment