tomeng/iStock Unreleased via Getty Images

Stellantis N.V. (NYSE:STLA) completed a successful merger in January 2021, when both Fiat Chrysler Automobiles, an Italian-American conglomerate with several recognized and high-end brands to its name, merged with the French PSA Group. This made the newly-formed corporation the sixth-largest automaker globally and a crucial player in the industry, given the number of brands. The company is also listed on the Italian Borsa Italiana, the Euronext Paris, and the New York Stock Exchange as STLA.

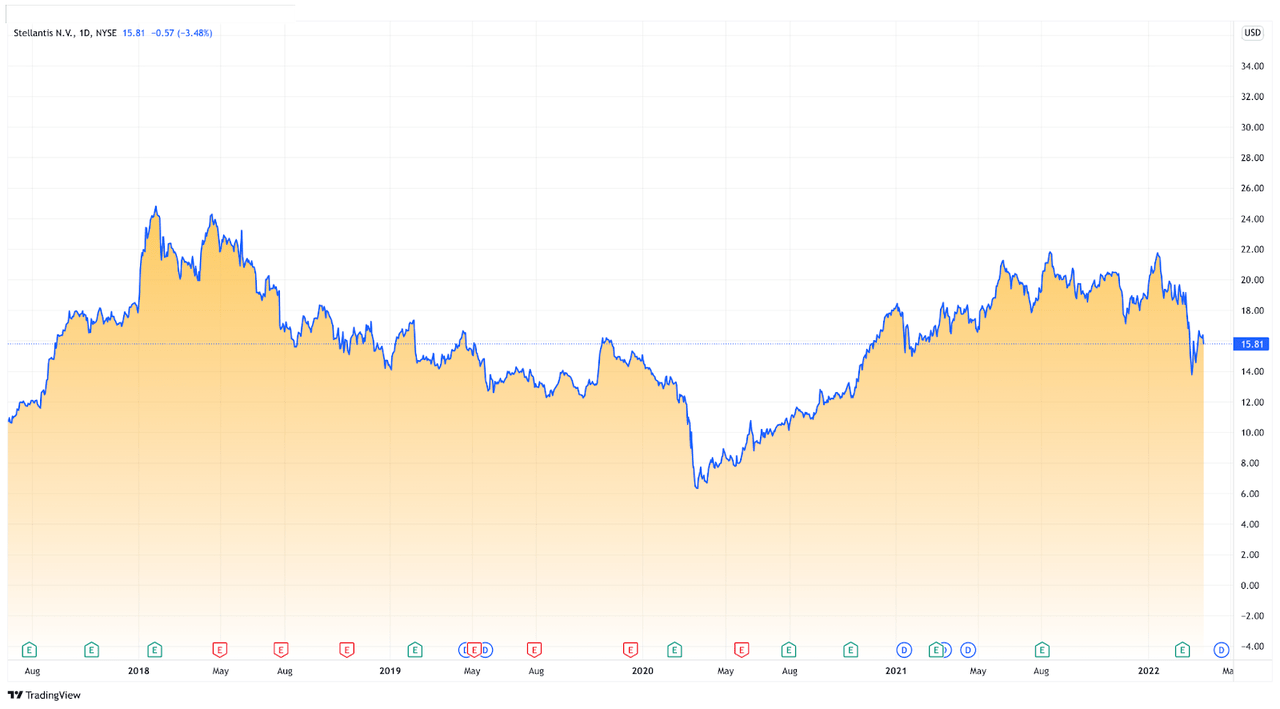

tradingview.com

Given the ease of restrictions and slow resolution of the supply chain crisis, Stellantis was expected to have a stellar year, reporting gains, especially in shipments where the company’s brands are recognized. A brief overview of the business and the market at large quickly reveals the company’s secure financials and its leading place among the car manufacturers.

Company Profile

Stellantis N.V. is a recently formed car manufacturing corporation that arose from a merger between Fiat Chrysler Automobiles and PSA Group. The May 2021 50-50 cross-border merger made the company the fourth-largest automaker globally by volume. The company now manages approximately 400,000 employees spread across the multiple countries it operates in. While the company’s headquarters are in Amsterdam, its operations are global, overseeing the supply of its multiple brands. The brands include Jeep, Chrysler, Peugeot, Alfa Romeo, and 12 other car brands more popular abroad than in the US. To manage such an extensive portfolio, the company has multiple assembly plants across Africa, Asia, Europe, South America, North America, and Australia.

A year after the $52 billion merger, Stellantis has had enough time to manage operations, helped with the appointment of Carlos Tavares as CEO, who formerly oversaw PSA. The company will need to figure out the best way to market its different brands to different regions of the world. Different brands have appeal depending on which region of the world you are looking at, and Stellantis has a large enough portfolio to cater to many different markets. As a result, the question that remains is how well the automotive industry is doing in all markets.

Automotive Industry

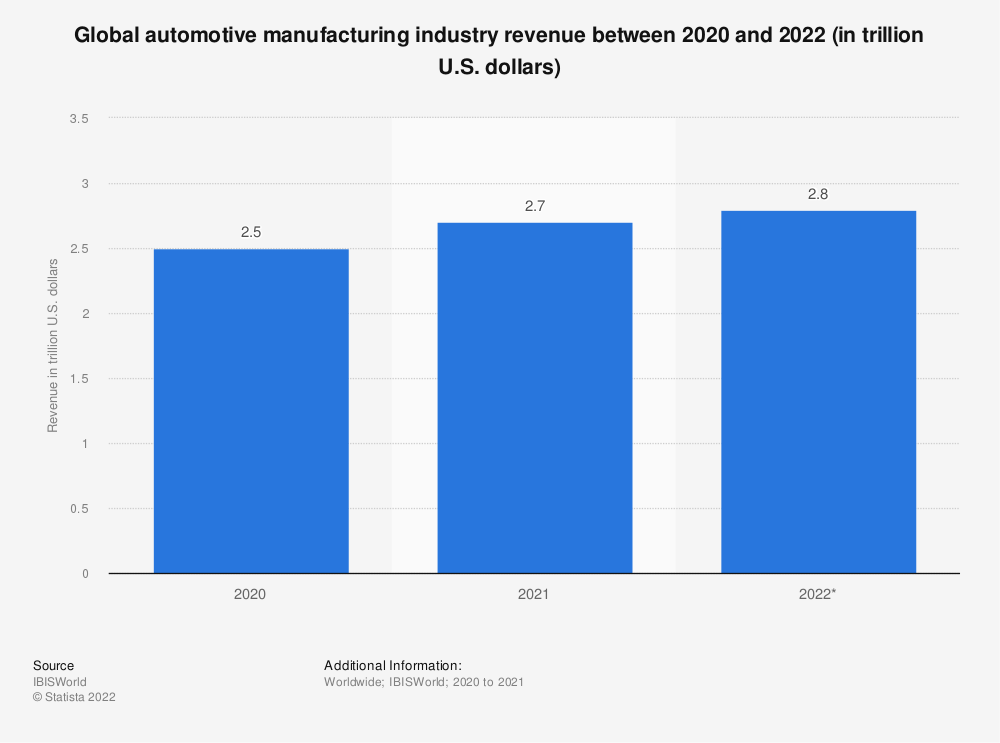

statista.com

The global automotive industry hit all-time highs last year by topping $2.7 trillion in revenue by the end of the year. This represents a $200 billion appreciation from the year before and is expected to rise by at least $100 billion in 2022. Technological advancements in vehicle manufacturing, such as self-driving vehicles and the transition into electric vehicles (EV), have and will continue to contribute to the growth of the industry. With both the pressure and support to transition into cleaner energy, these will also help ensure that the industry remains unaffected by environmental concerns by providing acceptable solutions. Of course, numerous other factors contributed to growth, including the slow but sure resolution of the global supply chain crisis, among other things.

Stellantis is well placed to supply the entire global market with the vehicles they need and is working towards addressing the environmental concerns that surround the automotive industry. The company is seeking to target the North American and European markets with low emission vehicles, or LEVs, manufactured by many of the company’s brands. The market is expected to grow much faster in Europe, with the company estimating 14% sales in 2021 and 70% by 2030. The company’s expectations for the US are expected to reach 40% LEV sales by 2030. The company’s roadmap has a lot ahead of it and offers enough to show faith in the company’s ability to manage changes. So how did the company perform in its first year after the merger?

Financial Analysis

Car sales shot up in 2021, so it would only be natural to analyze the revenue and income Stellantis reported for that year, as these go hand in hand. The company ended the year with $164 billion in net revenue, which was not only a massive leap from the nearly $60 billion reported in 2020 but still higher than what was seen in 2019. This rapid rise came as a direct result of the merger, which saw an increase in North American shipments, which managed a total of 1.764 million shipment units in 2021. South America was reported to have shipped 811 thousand units in the same period. Still, it was Europe that took the cake, with 2.877 million units shipped, over a million more units than what North America reported. Asia, which is globally the largest market, saw a mere 216 thousand combined shipment units, highlighting the need for the corporation on other markets where it may already have an advantage. How did the company manage this influx of revenue?

Research and Development (R&D) expenditure almost doubled year-to-year, growing from $2.73 billion in 2020 to $5 billion in 2021. However, it was in Sales, General, and Admin expenses the bulk of the revenue was invested in, with 2021 seeing an increase from $4.8 billion to over $10 billion in the space of 12 months. All of these chipped into what could have been the company’s profit, but where necessary investments as the company ramp up production and shipments for the growing demand, while also looking to the long-term future of the company. Still, net income applicable to common shareholders was reported at over $16 billion in 2021, compared to the mere $2.5 billion the year before.

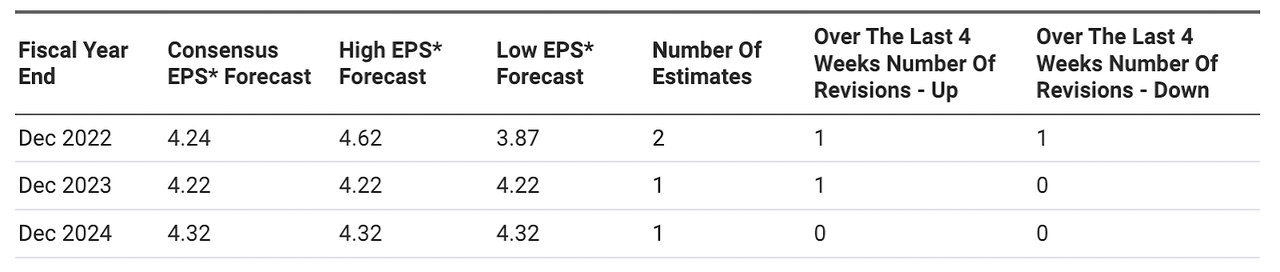

nasdaq.com

All of these figures need to account for the merger, which naturally resulted in a complete shift from previous figures reported. The earnings per share consensus for 2022 is currently at $4.24 and is expected to maintain more or less the same in the following two years. In February, the company also announced a total distribution of approximately $3.7 billion from profits of the year, corresponding to about $1.14 per common share.

Recent Developments and Risks

Stellantis has laid out a long-term strategic roadmap that goes all the way to 2030. The company’s primary focus continues to be centered around Europe, with most brands either being native or familiar to that continent and the United States, where some brands are also originally from, and a select few are recognized as high-end import vehicles. For this, the company has set aside approximately $33 billion of investments through 2025. Most of this will go into the transition into smart vehicles and efficient vehicles that boast both advanced software technology and reduced emissions. Semiconductors also presented an issue throughout the past year, with the company seeing dips in sales in the third quarter due to a lack of chips, further highlighting the need to invest in better and more efficient technology. In the event that this continues, Stellantis may suffer due to its capital expenditure in ramping up production, but a bottleneck on actual production capabilities due to a lack of supply in the chip department. However, as the supply of semiconductors continues to ramp up, the issue might soon solve itself – the number of vehicles manufactured and sold will directly benefit from a resolution to this problem.

In terms of other risks, Stellantis is particularly prone to economic declines. In an expanding economy, consumers buy far more newer cars than in a recession. Given that there is still significant risk of an economic downturn in the near future, this could lead to a worst-case scenario where not only do sales decline, but the loss in income for Stellantis coupled with burning its existing cash on ramping up production leads to a troubling outcome. This is, however, a risk that exists with all automakers. If anything, Stellantis is less prone than others due to its market dominance and global consumer distribution.

Key Takeaways

Whether it’s a crisis in Eastern Europe, a global chip shortage, a global supply chain crisis, or even a global pandemic, many issues can negatively impact any car manufacturing company. Stellantis can tackle this by doing what most smart companies have opted to do in past times of difficulty, consolidate to form a stronger group. While the merger was in the works since 2019, it nevertheless could not have come at a better time, helping the company profitably navigate from 2021 to the coming years. Stellantis has secured its position as one of the largest players in its industry, and it has climbed there on a steady financial foundation. In the years to come, this will likely continue, and the company will retain its dominance in the automotive industry as it expands along its current-decade strategic roadmap.

Be the first to comment