RomoloTavani

I have concerns. I don’t like the cut of the stock market’s jib heading into the second half of the year. Unlike so many years in the past when economic growth was sufficiently sluggish and the market was all hopped up on monetary stimulus, this year I look around and see a starkly different market environment where risks are seemingly lurking in all different directions.

The following are five particular risks that I am monitoring as we move through the rest of 2022.

1. Summer Flash Crash

A risk to consider as we continue through the rest of the summer is the potential for the onset of an unexpected flash crash on any given trading day. Although I would assign this risk a relatively low probability, the odds are measurably higher this year than they have been in the recent past. If a flash crash were to occur, I would consider the most likely timing coming anywhere between the start of August and Labor Day in early September.

Why the worry about a flash crash? Because a number of the pre-conditions that sparked past flash crashes are in place today.

First, the stock market is already in decline, having fallen into a downtrend dating back as far as Thanksgiving of last year depending on your U.S. stock market benchmark of choice.

Next, the U.S. Federal Reserve is not actively engaged in lowering interest rates or quantitative easing (QE). Instead, they are raising interest rates and quantitative tightening like a central bank that got caught way behind the curve in preventing a major inflation outbreak. Thus, liquidity is increasingly draining out of capital markets.

Lastly, market liquidity becomes increasingly light as the summer progresses and more and more institutional traders head out for vacation. August in particular is a notoriously light month for trading liquidity.

What might a flash crash look like in 2022? Consider two previous flash crashes that have taken place since the Great Financial Crisis.

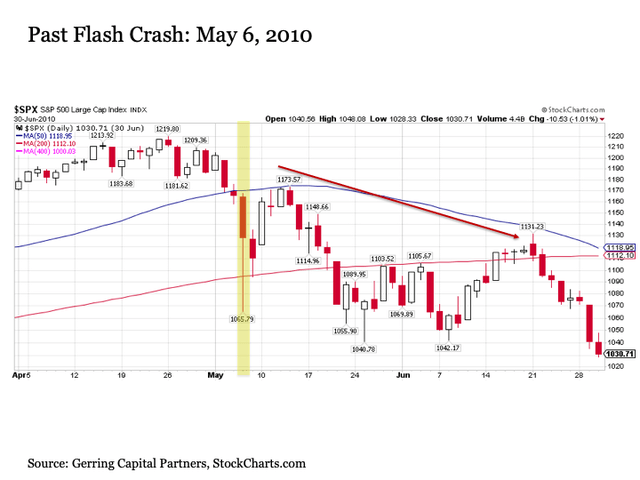

On May 6, 2010, the S&P 500 Index suddenly plunged by nearly -10% before quickly finding its footing and recovering much of its lost ground by the end of the trading day. While the S&P 500 eventually rallied through mid-May, the 50-day moving average was definitively broken as a result of the flash crash, which ultimately led to stocks failing on their retest at what became this key resistance level before rolling back over to the downside. It turns out that the May 6 flash crash foreshadowed the further downside that eventually came through the end of June. At the time, the Fed has just ended its first quantitative easing program, which left the stock market without its liquidity crutch that investors have come to know and be addicted to in the years since.

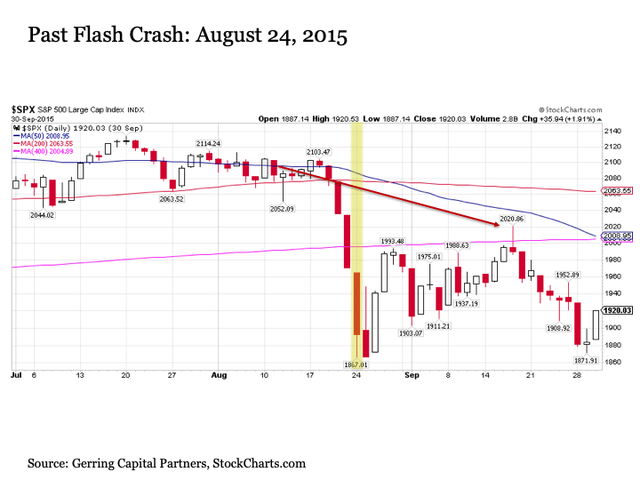

On Monday, August 24, 2015, the S&P 500 opened a new trading week by immediately plunging -5% at the open. The market eventually regained its footing and closed off of the opening lows, but proceeded to retest the flash crash lows the next trading day. The S&P 500 proceeded to retest broken support at its ultra long-term 400-day moving average by the end of August before grinding back lower over the next month, ending September back at the flash crash lows. What led to the flash crash? At this point, the Federal Reserve had ended their third QE program a little less than a year ago and was gearing up for their first quarter point interest rate increase since before the Great Financial Crisis. The market had already been declining hard to close out the previous trading week, China stocks had fallen more than -8% in the hours leading up to the U.S. market open on Monday during a period where Chinese policy makers had shifted to unwind a stock market bubble they had previously artificially inflated only a few months earlier.

When examining current conditions and comparing what took place during these past two notable episodes, the key conditions are in place to spark a flash crash between now and Labor Day. Whether a spark ignites the dry brush of capital markets in the coming weeks remains to be seen, as it remains more likely that markets pass through the rest of the summer without notable incident even if it continues to grind to the downside. But the potential is sufficient enough that investors should be prepared for the possibility.

2. Major Fall Correction

What concerns me more than a flash crash as we continue through the remainder of 2022 is the potential for a larger and more sustained stock market correction in the fall.

Why the fall? First, September is historically the worst month of the year for stock market returns regardless of the market environment, averaging a decline of roughly -0.5% on average since 1950 according to the Stock Trader’s Almanac. Of course, it’s not as though this average comes from stocks consistently falling by around -1% each and every September. In a number of calendar years, stocks have posted robust results including a near +12% gain in September 1982. Instead, the month lands in negative territory on average for having some of the most notorious monthly returns in stock market history. These include -15% in 1931 and 1946, -14% in 1937, -11% in 2001, and -10% in 1974 just to name a few.

Next, if September gets the ball rolling down the hill, October is historically where the excrement hits the fan. The mere listing of the dates speaks for themselves for anyone familiar with stock market history: October 2008, October 1987, October 1929, October 1907. And these are only a few of the past Octobers where stocks were punching investors squarely in the chin.

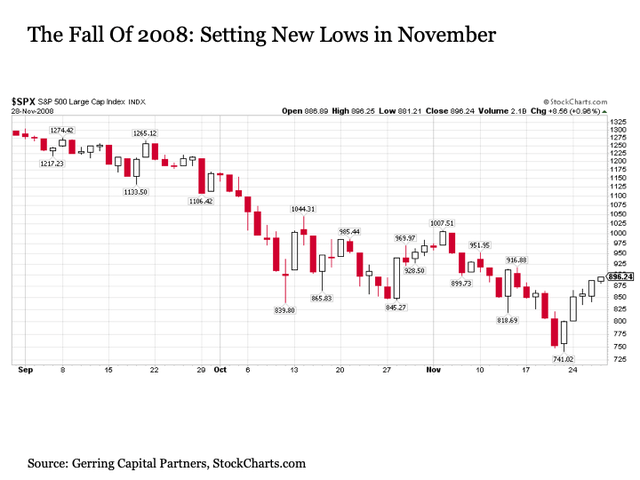

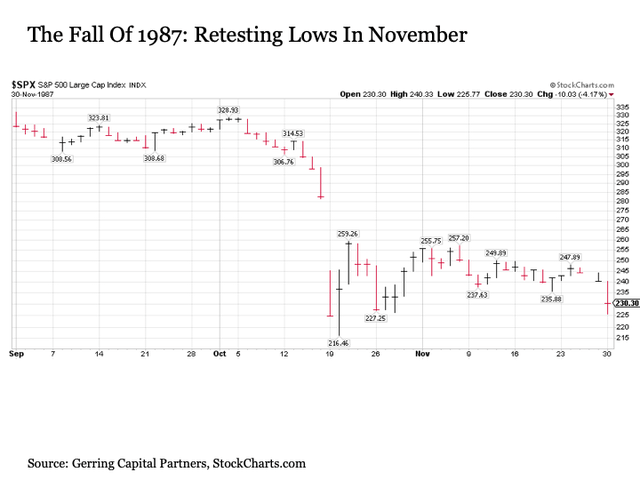

Lastly, we should not overlook the threat of November, which can sometimes be overlooked because historically it is more often than not a positive month that begins the ramp up into December, which is one of the best months of the year on average. But when the fall has turned ugly for stocks, the declines will often extend into the first couple of weeks of November if not longer. The chart below highlights how this played out in the fall of 2008 (setting new lows) and the fall of 1987 (retesting the lows).

StockCharts.com StockCharts.com

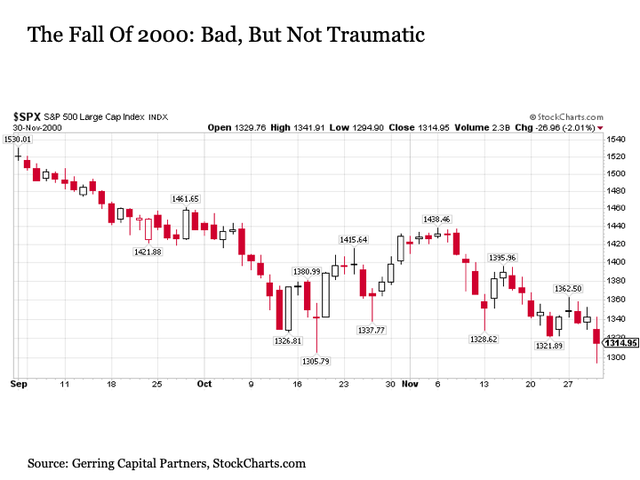

Whether stocks hold their own or fall further into a correction remains to be seen. If anything, I might anticipate a more measured correction in stocks through this fall similar to what we experienced in the fall of 2000 as the tech bubble was still in the early stages of unwinding.

Nonetheless, the key to watch to determine whether we are setting up for a major, or even a minor, fall correction is how stocks perform in September. If stocks are increasingly falling downhill as we make our way through September, the probability for a subsequently ugly October into early November would increase measurably. And we certainly have no lack of fundamental, technical, or behavioral reasons at this point why stocks may not descend into such a fall correction.

3. Financial Contagion

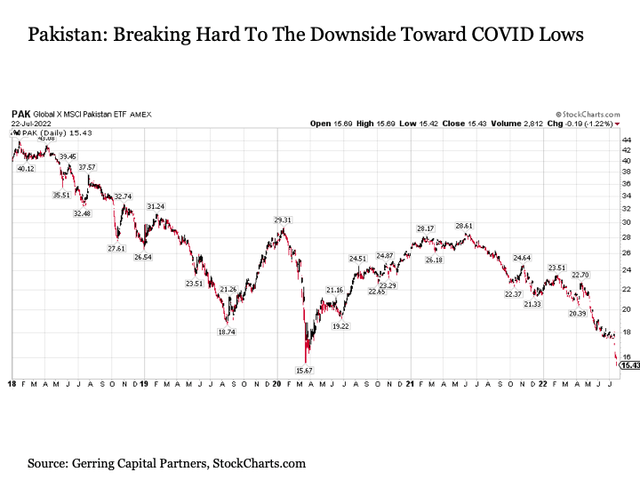

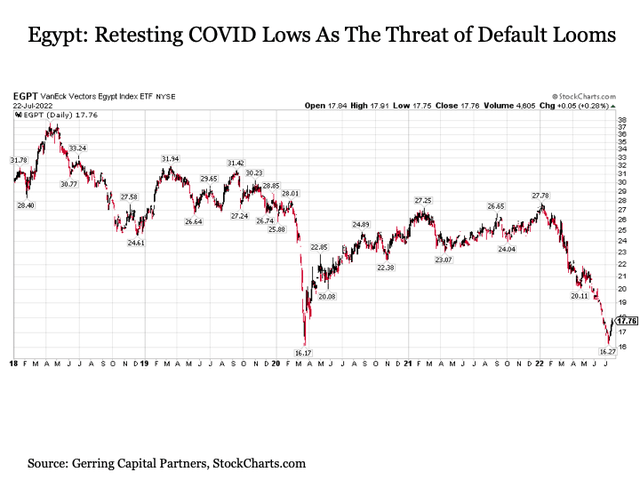

Another potentially market destabilizing event between now and the end of 2022 is the possibility that deteriorating financial conditions for a number of sovereign borrowers across emerging markets could descend into a full-blown crisis spilling over into global developed markets similar to what we saw in the late 1990s. A few markets have already defaulted including Sri Lanka most recently, and several other countries are at very high risk of following suit including the Ukraine, Ethiopia, El Salvador, and Ghana to name a few. But the two countries that I am currently watching most closely for their broader financial market implications are Pakistan and Egypt. In both cases, their credit default swaps have blown own substantially in July from already elevated levels. Moreover, the stock markets of both countries suggest that more difficulties may lie ahead, as both are currently retesting COVID lows and appear poised to eventually break through to the downside.

StockCharts.com StockCharts.com

Now the primary concern is not that U.S. investors are going to be directly hit if Pakistan or Egypt (or another at risk country) enters into default. Instead, the primary worry is the compounding ripple effect of a growing number of emerging market defaults. For the more overseas countries tumble into default, the more likely we may see a flight of capital out of countries that are perceived to be next in line, which could eventually start to become destabilizing. This would be particularly true if it turns out that a hedge fund or hedge funds that nobody has yet to hear about but soon might end up having some esoteric allocations to these more at risk areas of the world and end up getting caught way offsides on their trade in the process. More simply, how many Long-Term Capital Management inspired situations might bubble to the surface if conditions start to unwind across emerging markets. And who will come to the rescue this time if they do? After all, while the Fed back in 1998 had the flexibility to provide some interest rate cuts while coordinating a rescue, today’s Fed is busy right now battling a blazing inflation firefight.

4. COVID Resurgence

While it’s nothing like we saw back in January (at least not yet), COVID cases are once again on the rise worldwide. Over the past month alone, we have seen the 7-day moving average of daily new cases nearly double toward 1 million per day, as the latest Omicron BA.4 and BA.5 subvariants take hold. While the 7-day moving average of daily COVID related deaths remain close to its lowest levels since the start of the pandemic, hospitalizations are on the rise and both of these metrics could continue to climb in the coming months.

While a resurgence in COVID cases is not likely to result in the types of economic shutdowns in U.S. seen earlier in the pandemic, it does have the potential to create further disruptions in economic activity across the globe. More specifically, we have seen how persistently disruptive the COVID pandemic has been on global supply chains, and a renewed surge in cases continuing into the fall could either compound or prolong these effects even further.

Such an outcome would be particularly problematic for the Fed’s fight against high inflation even if the U.S. economy officially falls into recession through the second half of the year, as the possible decrease in supply could exceed the reduction in demand, thus keeping prices stubbornly high.

Monitoring the daily new cases date as we continue through the rest of the summer including country specific data will be important to determine whether any surge in COVID cases will have any pronounced economic impact.

5. Unexpected Geopolitical Development

Heading into 2022, few people were expecting that Russia would actually follow through with its threats to invade Ukraine. But by late February, the invasion was underway and both sides have become firmly entrenched in what is shaping up to be a more protracted war.

To this point, markets appear to have become comfortable with the fact that no side in the fight has any interest to take radical steps (i.e. Russia using nuclear and/or chemical weapons to resolve the war to their advantage). But what if it turns out that these lines are eventually and unexpectedly crossed? What would be the response from the West including the United States? And what would be the spillover effects on commodities prices and risk assets?

Of course, the potential for radical action is not limited to Russia, as it is possible that another geopolitical shock could present itself somewhere else around the world. For example, many worry about China taking potential action against Taiwan at some point in the near future. This is just one of many examples of the types of shocks that could present themselves in a world that continues to drift away from globalization and toward more nationalist perspectives.

At present, I assign a low probability to either a more radical development in the Russia-Ukraine war or another issue cropping up around the world between now and the end of the year. But these outcomes can sometimes be the most challenging to predict or anticipate.

Bottom Line

Investors have no shortage of risks to monitor as we look ahead through the remainder of the 2022 calendar year. Some are more pressing than others, but all bring with them the potential for a more pronounced pullback in stock prices if any come to pass.

As a result, and from a portfolio risk management standpoint, investors will be well served to not become complacent as we continue through the remainder of the summer and into the fall. Instead, watch various risk indicators closely and be prepared to reduce stock and stock-adjacent risk asset categories even further in warranted.

Be the first to comment