Sander Meertins/iStock Editorial via Getty Images

It’s easy to understand why the market doesn’t especially like HeidelbergCement (OTCPK:HDELY) at this particular time. What isn’t as easy to understand, at least not for me, is how anyone could believe that this company should trade at close to 5-6X P/E when it’s active in one of the most significant infrastructure segments available.

In this article, I will revisit my fundamental thesis on HeidelbergCement and put the risks next to the upside. And let me tell you – the upside here is exceptionally formidable.

Let’s see what we have here.

Revisiting HeidelbergCement’s upside

As I mentioned in some of my base articles, HeidelbergCement is one of the largest building materials companies on earth – period. After completing the M&A of Italcementi, it became the largest aggregate producer for construction aggregates at the time and is now one of the world’s largest producers of building materials.

While the company’s asset base isn’t as shiny as some of its competitors, because this M&A came with a lot of trouble-laden assets, the company still has a significant upside. In 2020, HDELY was ranked as the 678th largest company – in any sector – in the world.

It works in 60 countries with 67,000 employees working at over 3,000 production sites, operating over 135 plants with an annual capacity of over 175 million tonnes. Additionally, the company has over 1,500 ready-mix sites and over 600 quarries where aggregate is sourced.

In a way, it’s not all that odd that the company has been punished since Ukraine was invaded, because the company does operate 3 cement factories in Russia. What’s more, HDELY lacks some of the efficiency seen in the company’s competitors, such as Holcim (OTCPK:HCMLY), and Vicat (OTCPK:VVCTY).

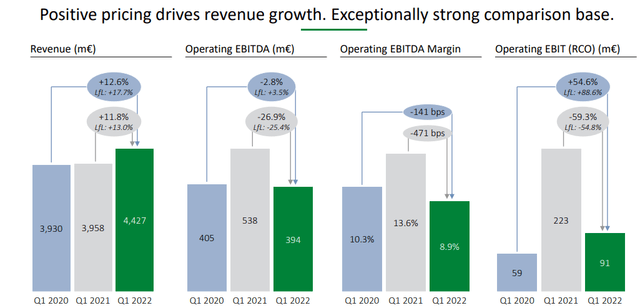

If you recall my base article on the company, the results for 2021 were absolutely stellar. HeidelbergCement saw a near-double digit sales revenue increase, a 6% EBITDA increase, and above all, a successful across-the-board price hike increase and fixed cost management that preserved the company’s operating margins and profit – despite the aforementioned, sub-par asset quality in context to competitors. These trends were further confirmed by the most recent set of quarterly results, which were also impressive – even if some of the weaknesses we can expect started to materialize.

HeidelbergCement Results (HDELY IR)

Yes, the company is pushing pricing, but that’s not enough to offset what’s happening here. Combine this with macro impacts and Russia’s problems with its 3 sites, and we can see why the operating EBITDA and margins might continue to show declines going into the coming quarters.

The company reports very strong top-line growth, driven primarily by pricing. Demand was fine – the pricing was even better. Also some weather effects in 1Q22 – floods and rains in Australia, and some weather in the US as well. The company also reported a strong start to the commercial excellence program, with results and pricing already well above and beyond its targets. €236m have been secured, another €350M are targeted, and the company more than quadrupled this target, now aiming for €2B.

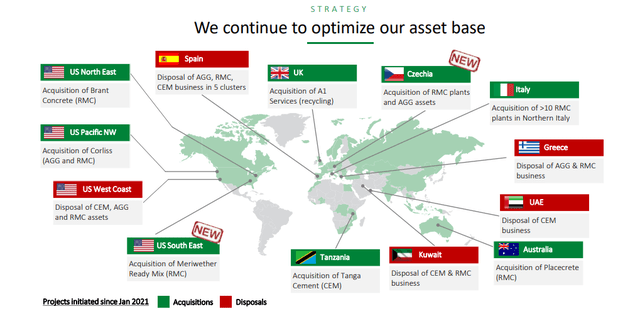

HDELY is continually working on its asset base, disposing of bad assets and keeping the good ones, as well as trying to make the company less complex. Current targets for disposal are Spanish, US, Kuwaiti, UAE, and Greek.

HeidelbergCement Portfolio (HDELY IR)

The company’s most recent 2022E guidance calls for a very strong revenue increase based on pricing, with a slight increase in EBITDA and RCO, all on an LFL basis. I would moderate these assumptions to a modest to light drop in EBITDA and efficiency, with ROIC dropping below 9%. Leverage should continue in the corridor of 1.5-2X.

In part, the company’s unfavorable bottom line results are due to extremely strong YoY comparison bases. But there’s also the simple fact that pricing and cost pressures will continue to be on the very heavy side, with everything from energy costs to wages being affected. This calls for discounting – there is no doubt in my mind about this.

But how much discounting?

Like most of HDELY’s peers, the company is internationally diversified. Because of this, regional trends are important. NA is seeing solid trends for 1Q22, with Revenue and EBITDA improvements. These are similar trends to regional/national peers such as Martin Marietta (MLM). Pressures in NA derive primarily from high freight rates, but for now, the demand continues to be positive, and causes the company to expect good trends for 2022.

In Europe, things are much more unclear.

High energy prices are in no way able to be offset by price increases, leading to profitability pressures in the company’s home markets. Still, every European company in this sector and adjacent sectors have these issues. Furthermore, HeidelbergCement was able to record some significant revenue and EBITDA increases in parts of Europe where pressures aren’t as pronounced, such as Southern/Western Europe, where the energy mix is much more favorable than in eastern or central Europe.

Strong trends were seen in the Middle East and Africa, which remain relatively unimpacted by COVID-19 trends, and saw significant volume demand and price increases. Egypt is still a turnaround market, but positive results are improving on a QoQ-basis.

Without the Russia/Ukraine situation, I have no doubt that we would be in a very positive situation for the company. However, with energy prices skyrocketing and macro now in chaos, things have taken a turn to the negative.

Looking at the company’s valuation, I would want to express very clearly that it almost feels like “cheating”, buying this great company at such a valuation.

I’m not kidding myself that we might not be in for a world of low valuation for a period of several years – but given the overall upside, once we see reversal, that 100%+ reversion will do magic for our returns – even if we have to wait for them.

Many of the company’s fundamental upsides remain.

Indonesia is going to be a significant growth factor, and the company’s portfolio optimization makes a lot of sense. Unlike with its M&A in the USA of Hanson, HDELY managed to get a very appealing price for Italcementi. These aren’t the most attractive assets in terms of profitability, but demand is high.

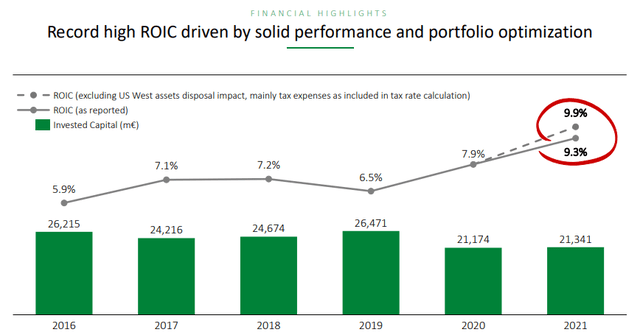

I really want to take a moment to emphasize just how the company has improved actual ROIC, one of the more crucial metrics for a concrete/cement company. Even if this dips for a little bit due to the current situation, the improvements here are through-cyclic.

HeidelbergCement ROIC (Heidelbergcement IR)

None of the negatives will significantly make HeidelbergCement an unappealing investment. What’s changed is that the continued trajectory for the 2025E targets has been broken – and it seems doubtful that all of the company’s targets will be realized, if things continue along this line. As a small note, a sale of business activities in US west will color EPS with non-recurring sales gains of close to €500M.

Energy is crucial to HDELY. The pricing for Energy is skyrocketing. The company will have to raise prices and push efficiency to compensate. But this does not change a very positive demand situation – not just in Europe but across the globe.

I expect marginal impacts before from this mix – I now expect impacts to be more than marginal, coming in at levels that will matter for 2022E EPS and beyond.

Let’s look at what this does to valuation.

Updating my valuation on HeidelbergCement

As before, I’m only slightly working over my current models. Unlike many other analysts, I don’t shift my target due to the market having a hissy fit – which is what I see the market as mostly having here.

The main impact I’m calculating and adjusting for my forward modeling is a margin impact due to lower margins from energy pricing and inflation.

I’ve also added an adjustment for carbon prices, allowing for another 50-100% increase after the 200% Co2-price increase in 2021 – but I now expect this to perhaps taper off, because the EU are going to have to adjust their ESG policies to the current macro, which doesn’t allow for the “green push” we’ve otherwise been seeing for the past few years.

HeidelbergCement remains one of the more cheaply-valued cement companies in all of Europe. It’s also now the highest-yielding cement company out of its peer group, with high coverage in terms of the dividend. From a peer perspective, the company is now, in my view, over 100% undervalued to where it should be trading.

I give the higher weight to DCF and NAV. For NAV, I’m remaining at a 0.8% sales growth, but I’m lowering my expected EBITDA growth rate to 0.1% per year to reflect pricing pressure, updated now as of July of 2022.

This means that the DCF implies an EV/share of around €71.5/share. For NAV, the changes are equally subtle, with a slight reduction in EBITDA multiples especially for Europe and APAC to reflect Macro, reducing the implied NAV/Share to €88/share.

NAV is, as I’ve mentioned previously, colored by the replacement value of the company’s assets, and will continue to be high regardless of impacts here. The simple fact remains that it’s extremely expensive to replace the company’s assets at current or future market costs. That makes the ownership of these assets, even if they’re old, extremely attractive simply on the base assumption of demand.

I’m not shifting much on my overall PT here – I come to a mixed PT of around €82/share here, which is above the S&P Global share price. For the native ticker, the average share price from 19 analysts is now down to below the €70/share level, with the high at around €85/share, compared to a 2021E high of around €102/share. The analysts believe this company has a long way to reversion, and indeed that might be the case. If we ask S&P global analysts, the average upside is around 40% here. I obviously believe it to be higher than this.

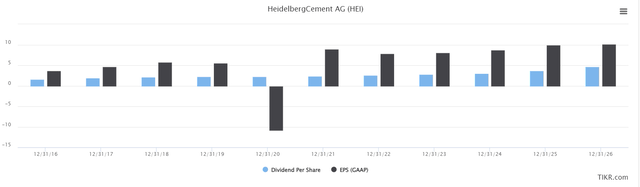

My bullish case is based on the, in my opinion, conservative assumption that earnings aren’t going anywhere. While we might see a small drop down to around €8/share for the native in EPS, this would come to around a 9-10% EPS drop, but it would still be materially higher than any time before 2019 in recent memory.

Also, I currently don’t see a reason for this level to deteriorate further, rather staying flat at around that €8/share mark, even if the company experiences further pressure to the bottom line. Efficiencies and volume, coupled with demand and the company’s asset base will, I believe, carry the torch here. Assumptions from S&P Global are for EPS to grow at an average rate of 10-11% until 2026, and for the dividend to continue growing double digits.

S&P Global forecasts (Tikr.com)

Why then, would I be shortsighted enough to ignore the long-term game here?

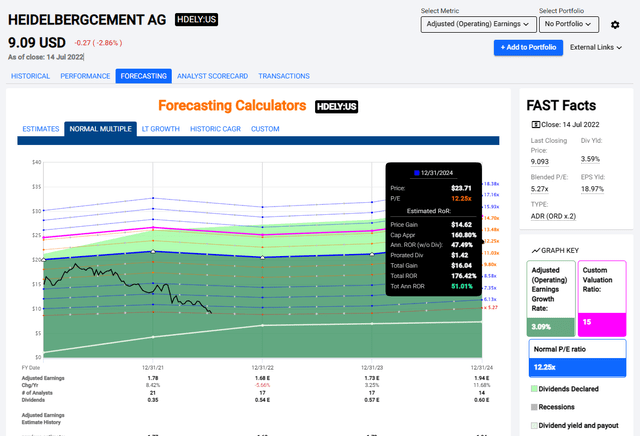

If we look at the ADR, HDELY, we see a similar potential upside. The ADR currently trades at no more than 5.27X P/E. This is a trough valuation based on the company’s typical P/E of 12.25X, more than 100% the current level, for a company with a BBB credit rating and very low leverage. The upside, even if we only see slight growth, is 16.6% even on a forward P/E of just 6.1X.

If we see any sort of reversion to the mean, that upside of RoR 46% until 2024E, becomes an RoR of 176%.

HeidelbergCement Upside (F.A.S.T Graphs)

How likely is this, you might ask. I believe that in the long term, the upside and returns are fairly clear and likely. However, getting there could take years. The good part is that Heidelbergcement trades at a yield of over 5% here – that yield alone should be enough to elicit interest on your part, given the low payout ratio of well below 50% of earnings here, and how very basic the need for the company’s products is.

Energy costs will impact things here – macro will impact things as well. But “this too shall pass”. It might take a year, two, or three. And at this point, the company is trading close to a level it hasn’t traded since COVID, and the recession before then.

That makes this company a “BUY” here.

My view of this target change is that the company’s 20 following analysts are overreacting, and failing to recognize the potential in this investment. On a 10-year basis, the company’s trough has been around €30-€40, and highs of €92. I successfully invested in HeidelbergCement between 2014 and sold in late 2017, making a return in the triple digits.

My intention is to do the exact same thing again.

So I will keep buying.

Thesis

I view the overall thesis for HeidelbergCement as positive. Despite cost inflation and macro risks, the upside for the company is solid, and a full upside seeing a 80€+ valuation calls for a 150%+ RoR inclusive of dividends. That’s what I’m looking for, in a 3-5 year period.

If you’re unwilling to hold this for a longer term, you shouldn’t be investing in this company. If you’re willing to wait a few years, while knowing that the company you invest in will be delivering a solid yield and you’re exposed to a superb, fundamental business… then you’re in good company with HeidelbergCement.

My portfolio is currently ~3.5% exposed to HeidelbergCement, and I’m looking to increase that substantially.

Be the first to comment