Marcos Silva

Overview

DiDi Global Inc. (OTCPK:DIDIY) is commonly known as the “Uber of China,” although it also operates across other markets such as Australia, Mexico, Russia, Taiwan, and Chile. Didi is not diversified across other direct-to-consumer logistics businesses and is more comparable to Lyft, Inc. (LYFT) in the sense that it is a purely a digital ride-hailing company.

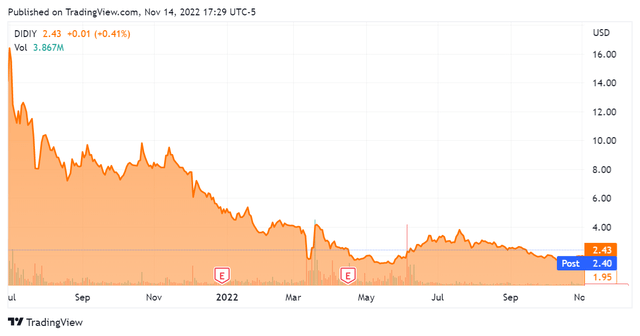

Conducting an initial public offering at $14 a share, the security saw a near instant decrease in value. Amid investigations by the Chinese government and a subsequent fine for $1B USD, shareholders voted to delist DiDi Global from the New York Stock Exchange in Q2 2022. The company is now trading over-the-counter here in the United States. While expected to re-list in Hong Kong, that move was put on hold in late Q1 2022, and there has not been an update on this since.

Now trading at $2.43 as of this article, Didi presents a potential event-driven trade in the event that it fully delists from American exchanges in the wake of a new IPO. While this is unlikely, the large scale and high profile of the company warrant a review of its financials.

SeekingAlpha.com DIDIY 11.14.22

Financials

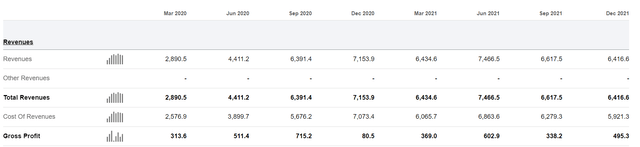

Didi experienced headwinds throughout the pandemic as its U.S.-based peers did. While it notably posted a strong Q2 2021 that exceeded revenues of any previous quarter, it then saw two straight quarters of declining revenue.

SeekingAlpha.com DIDIY 11.14.22

Throughout this time, operating income continued to be negative as well, with a notably strange tripling in its operating expenses for Q2 2021 that then returned roughly to baseline quarter-over-quarter.

SeekingAlpha.com DIDIY 11.14.22

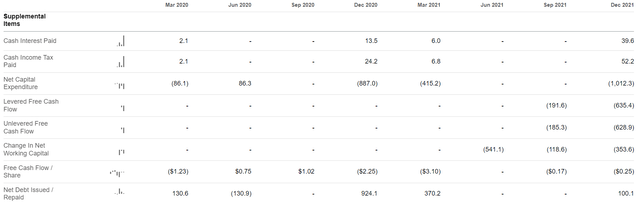

The company also continued to bleed cash throughout this period. While the reporting is exceedingly spotty, it seems that the company greatly accelerated its cash loss in its final formal reporting period.

SeekingAlpha.com DIDIY 11.14.22

Very quickly I am beginning to see that these financials are missing far too much data to review properly. Additionally, the variance in the numbers is strange; a tripling in operating costs during a random quarter, and an accelerating cash loss in its final formal reporting period; there is no clear trendline.

It is also concerning that cash flow metrics are not readily available for its pre-listing period. The only bright spot may be a shrinking free cash flow per share, but that metric does not carry weight within the greater context.

Conclusion

Upon even a cursory look at DiDi Global Inc.’s financials, the picture is indeed concerning. Thinking on the set of facts around this security, I find it fair to assert that DiDi is fundamentally embroiled in the geopolitical situation between the United States and China. The bigger picture around this is that the cold fact that there have been numerous cases of improper financial reporting as well as outright fraud – see Luckin Coffee (OTCPK:LKNCY) – with Chinese-based firms listing in the United States, and this smacks as a much larger instance of one of those situations. While I cannot assert this with absolute confidence, it looks to be the case, and appearances are important.

Bolstering this argument is the spotty pre-IPO reporting and the rapid delisting from NYSE. The timeframe in which this all occurred has no immediate comparison in recent memory. Since the company has now delisted from NYSE, its financials are no longer subject to standard audit and as such cannot be considered remotely reliable.

Thinking critically, I am very skeptical that Hong Kong financial authorities, now owned directly and completely by mainland China, would be looking to purchase back these shares at any point in the future. There is simply no incentive to do so. This action would crimp the USD holdings of the Chinese government. Since the U.S. dollar is the preeminent global currency, holdings of hard currency represent a valuable asset for any other country – with China very much included.

While a deep dive into geopolitics is outside the scope of this website or this article, that unfortunately appears to be the driver DiDi Global stock. There is no credible bull case to make for this security, and there is a broad array of reasons – outlined above – for why this investment cannot even be evaluated properly.

Taking all of this into account, I do not believe this stock really has any value at present. It is fair to assume that DiDi Global Inc. stock will head towards zero as investors continue to exit – and I would advise doing the same as quickly as possible.

Be the first to comment