Jeremy Poland/iStock via Getty Images

Water stocks have become a big investment theme over the past decade. The world’s population continues to grow, and water scarcity is an increasingly pressing problem. Climate change could further accelerate concerns. Absence of reliable clean water is already a huge problem in large parts of the Middle East and Africa. Increasingly, it is proving to be a hazard in developed countries as well, with water scarcity playing a major role in regional economic planning across the Rocky Mountain west as well.

Here’s where Pure Cycle (NASDAQ:PCYO) enters the equation. The company is a Denver-based water utility that offers investors several ways to profit as it addresses water use in the state of Colorado.

From the jump, it’s important to realize that Pure Cycle is a hard company to value. There’s a lot going on here, and much of the company’s assets are tilted toward future value rather than delivering profits today. However, the firm’s ambitious move into real estate development greatly accelerated the timeline for creating shareholder value out of Pure Cycle’s assortment of holdings.

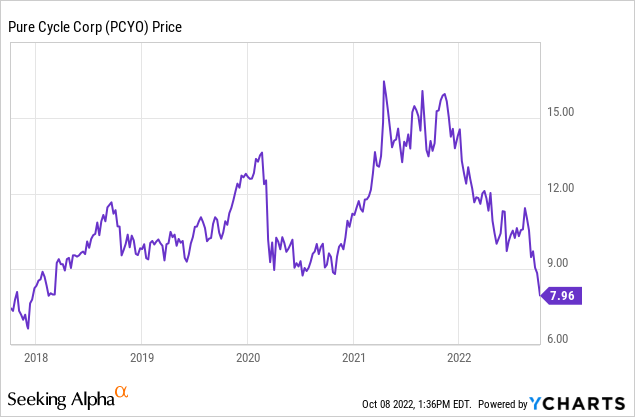

Unfortunately, with the housing market now rolling over, investors have cooled on the company’s business plan. Shares are off by half from their 2021 peak and are now near 5-year lows:

I’d argue that Pure Cycle’s broader business plan still makes sense, though, and that investors willing to ride out the down housing cycle will be rewarded on the other side.

What Does Pure Cycle Do?

Pure Cycle is a Denver-based land and water resource management company. The firm was founded decades ago to provide water and wastewater services and acquire water rights.

Pure Cycle’s water rights and land are primarily east of the currently developed Denver metro area. This area moves away from the mountains and into the dry prairie east of the Front Range. Historically, this area has been less attractive for development. However, developable land near the mountains has largely been used up. In addition, the creation of the far larger Denver International Airport in the 1990s far east of the city of Denver proper has pushed development in Pure Cycle’s direction.

The company smartly bought up a major land parcel during the 2008 housing bust at a discounted price, grabbing 930 acres for just $7.5 million. The Denver housing market, like other sunbelt areas, saw a substantial decline in activity during and shortly after the financial crisis. While Denver didn’t make the same sorts of housing headlines as a Phoenix or Las Vegas did, it saw similar internal dynamics.

Fast forward a decade and Colorado housing prices leapt to new highs. This put aggressive growth back onto the menu. Pure Cycle was able to position that land purchase, Sky Ranch, into an active homebuilding development site and has begun earning a generous return on its prior investment. In addition to selling lots to homebuilders, Pure Cycle is also retaining some homes of its own in the development to rent out, which will add another cash flow stream.

Sky Ranch, 2021. (Google Maps)

Traditionally, Pure Cycle’s largest source of revenues was from selling water to commercial users such as oil drilling companies. As there are significant amounts of oil and gas industry operations around Denver, this has been a meaningful revenue stream for Pure Cycle. It’s never anything dramatic, but half a million dollars of quarterly revenue can help out for a company the size of Pure Cycle. These commercial water revenues largely dried up with the plunge in energy prices in recent years, but 2022 has seen oil and gas activities pick back up.

So, how are things looking for Pure Cycle heading into what appears to be a sharp reversal of fortunes for the housing market, both in Colorado and nationally?

Pure Cycle: A Small Operating Business Facing A Housing Slowdown

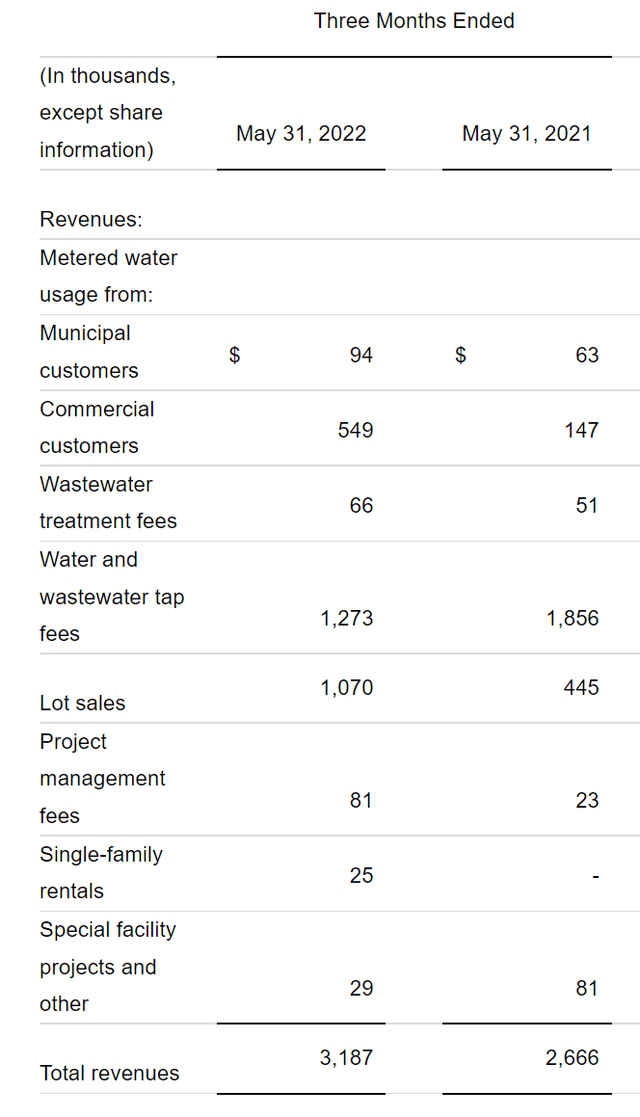

Pure Cycle still doesn’t have all that much going on in the way of revenues. Here are results from the company’s Q3:

PCYO quarterly revenues (10-Q)

Total revenues were $3.2 million, which was up reasonably from the same period of last year. The underlying water utility is still not generating much revenue though. The company earned less than $100k each from municipal water, and wastewater fees, respectively. Commercial revenues were up sharply, likely in tune with higher oil prices, but even so, $549k of quarterly revenue isn’t going to add too much support to the valuation of a $200 million market cap company.

The biggest sources of revenue this quarter were from lot sales and water and wastewater tap fees. This is indeed what you expect to see with the Sky Ranch development continuing.

However, most investors probably aren’t going to be willing to model these housing-related revenues growing in the near-term given the sharp downturn in the housing market that we’ve seen in recent months. And, as it is, an annualized $13 million of revenues is not a huge number given the market cap here. People have to take a multi-year perspective to holding the stock, as you don’t get the present valuation based on 2022 financial results.

The long-term value from Pure Cycle’s water rights, land holdings, and future water utility business are still there. None of that has changed. But to the extent that people were playing this as a 2022 and 2023 housing story, that seems to be off the table for the time being. If you push back the development timeline, say, five years, you have to recalculate the windfall profits off the land development with a much higher discount rate.

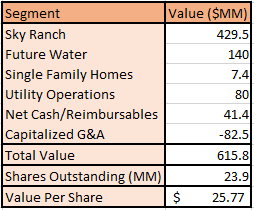

How bad is the hit versus today’s price? Not so bad, I’d argue. Here’s fellow author Safety In Value’s sum of the parts work for Pure Cycle from this spring to give one set of ballpark figures:

PCYO sotp analysis (SA Author Safety In Value)

I’d argue for discounting future water more than that, as there is very little operating business today and the timeline for that becoming monetizable is fairly uncertain. And now we should probably assume some discount to Sky Ranch as well as it will likely take longer to sell — and perhaps at lower prices — to account for the sharp downturn in homebuilding and much higher interest rate environment.

Still, if we trim Sky Ranch to, say, $300 million and future water to $100 million, that would still leave the total value of the sum of the parts at around $450 million on shares outstanding of 24 million which gets to a net asset value of $19 per share. I doubt PCYO stock will trade at fair value as there is uncertainty around the timeline to development, future capital allocation decisions, and so on. Institute a dividend and generate more recurring revenues, and maybe the stock trades at calculated NAV. Until then, some discount is in order.

Is the right stock price $8 though? Probably not. There’s still a good chance Sky Ranch itself will be worth a lot more than $8/share on its own. It might take quite a few years to realize that potential and the timeline will get more challenged with each additional rise in mortgage rates. But the asset is still well-positioned in a fast-growing major American urban area. It will be built sooner or later.

PCYO Stock Verdict

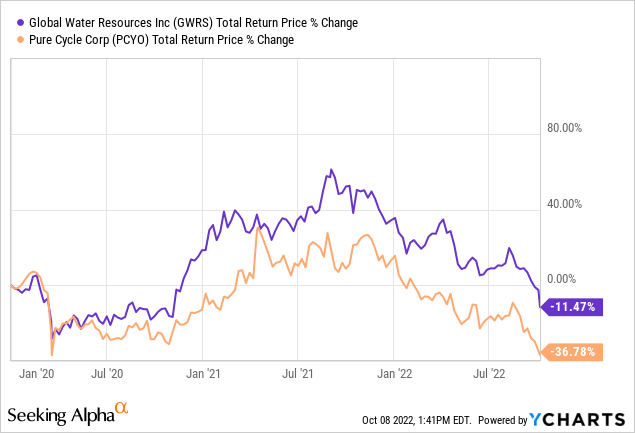

In a lot of ways, I see this as the Colorado version of Arizona’s Global Water Resources (GWRS). There, Global Water is rolling up small Phoenix and Tucson area water utilities to build a large operator in one of the country’s fastest-growing metropolitan areas. Thanks to favorable local regulation, huge industry investments in fields such as semiconductors and EVs, and sunny weather, Arizona will be one of the most economically successful states in the country in coming years. Global Water is a unique vehicle to profit off that, and I have owned shares for a while now.

Since the pandemic started, Global Water and Pure Cycle have traded in tandem, though Global Water has outperformed a bit:

The market seems to share my view that these are very similar equities in terms of what drives them and their role in a broader portfolio. Pure Cycle has some factors, such as oil exposure and its own housing development, to bolster its upside. On the other hand, Global Water has a generally more favorable regulatory environment, M&A flywheel, and faster economic growth in its service areas to look forward to.

I personally like Global Water’s model and outlook a little better than Pure Cycle and thus only own the former. However, both have now fallen far enough that either one should generate strong returns from this starting point. If you prefer Colorado to Arizona from a business perspective or are more upbeat on the housing market than consensus, this could be a great time to buy PCYO stock.

And, longer-term, I believe there is value in stashing some of these water rights names in a portfolio during steep sell-offs. Water scarcity will only continue to grow as a theme in investing, and valuations in this area could soar to unanticipated heights during a future event which catalyzes the need to focus on this usually sleepy industry. There are relatively few publicly-traded water assets today, which adds additional scarcity value to a stock like Pure Cycle.

Be the first to comment