Justin Sullivan

Meta Platforms (NASDAQ:META) is one of the most debated equities, as the shift to the Metaverse has created dissension throughout its investor base. As 2022 comes to a close, shares of META have fallen -64.72% YTD and are -66.14% lower than its 52-week high of $352.71. Some investors sold, some went along for the ride, while others are tearing through the investment case, determining if the current price is an opportunity. META is no longer a top-10 holding in S&P 500 index funds, and a rebound isn’t guaranteed. As a long-term shareholder, that has been incorrect as I have remained bullish throughout the downturn, I believe META will rebound in 2023. Mark Zuckerberg proved he is capable of making tough decisions, and it looks like what Brad Gerstner outlined in his open letter struck a chord. From a numbers-driven analysis, I believe shares of META are inexpensive. If the market rebounds in 2023, META would be a prime candidate to benefit from a sector rotation into tech. The 800-pound gorilla in the room is TikTok, and if TikTok is banned in the U.S., META is the largest winner, and it could make shares go parabolic from its current valuation.

TikTok is facing scrutiny, and upcoming bans are a possibility

The battle for TikTok continues to intensify. Currently, TikTok is being erased at a state level, and there is growing support for this to extrapolate to the government and possibly an outright national ban. Recently Governor Kristi Noem of South Dakota signed an executive order blocking TikTok from state devices. Similar actions have been taken on the state level by Alabama, Georgia, Iowa, Maryland, Nebraska, New Hampshire, North Dakota, Oklahoma, South Carolina, Texas, and Utah. On Friday, Nancy Pelosi threw her support behind banning TikTok on government phones as part of a spending bill being voted on this week. The Senate has already passed a bill to jeep TikTok off U.S.-issued devices as concerns have been raised about data being shared with Chinese authorities. Senator Marco Rubio has been pushing legislation for an outright ban of TikTok across the U.S., supported by GOP Rep. Mike Gallagher and Democratic Rep. Raja Krishnamoorthi. Mr. Rubio has introduced the measure in the Senate, and Gallagher and Krishnamoorthi in the House. Where this leads is anyone’s guess, and while the wheels of legislation grind slowly, this could be a matter that both sides of the aisle will overwhelmingly support.

The wheels are in motion, but how far the TikTok bans progress is anyone’s guess. There is a possibility that TikTok will get banned from all state and government-issued devices and that it stops there. There is also a possibility that some states won’t go as far as South Dakota and that the bill this week doesn’t pass with the TikTok provision. There is also a possibility that TikTok will be deemed a threat to national security, and an outright ban nationwide will occur. I don’t have a crystal ball and will not speculate about what may occur when it comes to how far the TikTok bans will go. Hypothetically, if TikTok does get banned in the U.S., it would be a momentous decision that would have strong ramifications for META, Alphabet (GOOGL), and Snapchat (SNAP). The amount of activity occurring on TikTok would most likely be absorbed through Facebook, Instagram, YouTube, and Snapchat. In addition to an influx of content, views, and revenue, one of the largest competitors stealing market share will be nonexistent in the largest market for these companies. I am not sure how it can be quantified how much a state and government-issued device ban would positively impact U.S based social media companies, but if an all-out ban occurs, it would most likely create a rising tide that lifts all ships.

The negative perception on the Metaverse could hinder a recovery

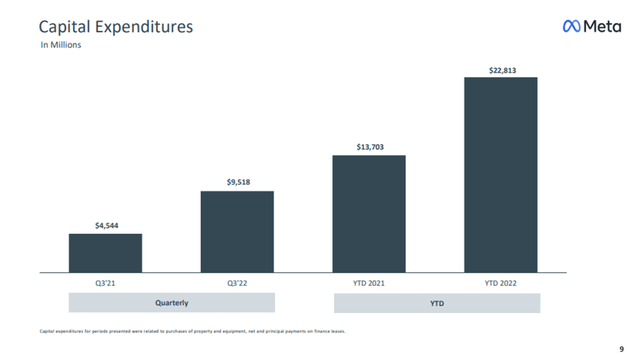

An open letter from Bran Gerstner (can be read here) seems like it resonated with Mark Zuckerberg, even if that’s not the case. Roughly one month later, Mark Zuckerberg addressed employees that were laid off as META started implementing cost-cutting measures. Mr. Gerstner hit the nail on the head and became a champion of META shareholders who didn’t share the same vision as Mr. Zuckerberg pertaining to the Metaverse. META has spent more than $10 billion annually on building the Metaverse as the next evolution of how society interacts with technology. The Metaverse has become a sore spot as many feel too much capital is being poured into the project without any quantifiable metrics as to how it will benefit the top and bottom line, especially since early adoption rates aren’t encouraging.

During Mark Zuckerberg’s address, he discussed cost-cutting measures that are occurring due to the impacts of the macroeconomic downturn, increased competition, and ads signal loss on revenue. META is scaling back budgets, reducing corporate perks, reducing its real estate footprint, and restructuring its teams to optimize efficiency. While these will help bridge the gap, Mr. Zuckerberg made the decision to reduce its workforce by 13% or 11,000 people. While these decisions could help increase margins, it doesn’t address the concern about Metaverse spending. Mr. Zuckerberg indicated that it would be a mistake to reverse its capital allocation decisions on the Metaverse as he believes it will be fundamentally important to META’s future success.

The Metaverse has become a controversial topic, and it’s clear that the investment community and Mr. Market do not share Mr. Zuckerberg’s vision or opinion. The reality is that new data will emerge each quarter, and if the situation pertaining to the Metaverse doesn’t improve, the negative stigma following META won’t dissipate. This could significantly hinder META’s chances of recovering because if the analyst and investment community don’t get behind this idea, it will take a lot more to lure investors back into META. I believe the perception can be fixed if Mr. Zuckerberg reduces the capital allocation toward the Metaverse by 50%, as it would still allow him to deploy billions to build the Metaverse while drastically improving profitability and FCF. We will get our next set of numbers in a month from now, and it will be interesting to see what Mr. Zuckerberg says on the conference call.

META is the most undervalued big-tech company,

I constructed a valuation premise for equities by reverse engineering Apple’s market cap as it’s the most profitable company in the world. If you’re interested in reading through the entire thought process, it can be read here. The premise is that companies are in the business of turning a profit, and regardless of which sector you do business in, the math doesn’t change. $1 of revenue and $1 of FCF is still $1, and 10% growth annualized is still 10%. It’s math, it can’t be manipulated. If AAPL generates the largest amount of net income ($99.8 billion) and FCF ($111.44 billion), why should any company trade at a larger valuation or multiple than AAPL? When I had written this premise for another article AAPL’s market cap had been within 1.52% of a valuation methodology that combines the total equity on the balance sheet and 20x its FCF in the TTM.

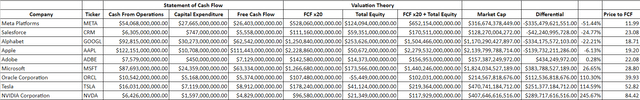

I compared META to the following companies:

Steven Fiorillo, Seeking Alpha

Of these 9 companies, META generates the 4th largest amount of cash from operations, and FCF. In the TTM, META has produced $54.07 billion in cash from operations, and allocated $27.67 billion toward capital expenditures, placing its FCF at $26.4 billion. On a pure price-to-FCF multiple, META is trading at 11.99x its FCF. To provide some context, NVDA trades at 84.42x, TSLA at 52.82x, ORCL at 39.93x, MSFT at 28.80x, CRM at 23.08x, ADBE at 22.08x, AAPL at 19.2x, and GOOGL at 18.71x. META generates the 4th largest amount of FCF in the group and trades at the lowest price to FCF multiple.

I decided to include total equity because the equity on the balance sheet is what shareholders would be left with after the assets are sold off to negate liabilities if bankruptcy was to occur for any company. Since there is quantifiable value in a company’s equity, I wanted to combine it with a multiple on FCF to establish a valuation methodology. Since Jerome Powell spoke, the markets have retraced, causing many of these companies to decline. Today, META has a market cap of $316.67 billion. META has $124.09 billion in total equity on the books, and 20x its FCF is $528.06 billion. Based on this methodology, META should be valued at around $652.15 billion. META’s current market cap trades at a -51.44% discount to my valuation methodology of total equity + 20x FCF. If you look at ORCL, they have -$5.45 billion of equity on their books and generate $5.37 billion in FCF, which would place their valuation at $102.03 billion based on my method, yet their market cap is $214.57 billion, and it trades at a 110.30% premium. Some companies in this peer group I selected seem to trade at a discount, while others trade at a premium. META looks to trade at the largest discount, and I do believe they are one of the best value plays in tech today, despite the Metaverse debacle.

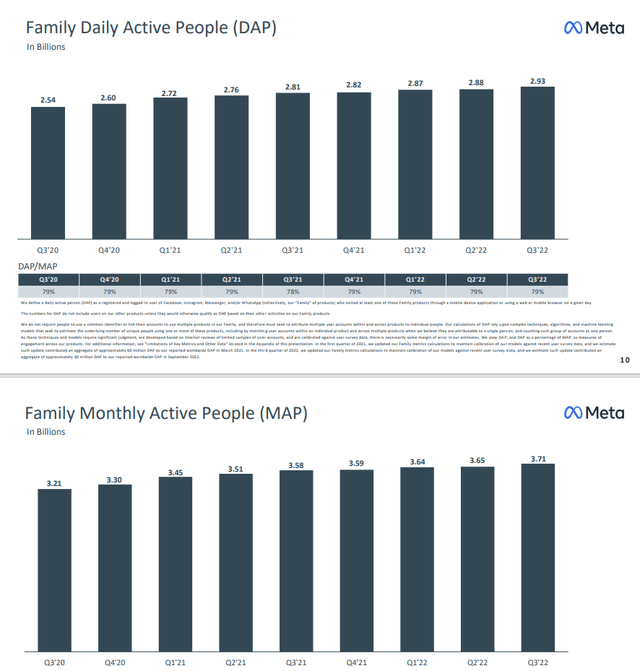

In addition to the numbers, META’s products, including Facebook, Instagram, and WhatsApp, have created the largest social conglomerate in the world. In Q3, META’s user growth grew across the board QoQ. Family Daily Active People grew by 1.74% (50 million) QoQ, Family Monthly Active People grew by 1.64% (60 million) QoQ, Facebook Daily Active Users increased 0.81% (16 million), and Facebook Monthly Active Users increased by 0.82% (24 million) QoQ. Facebook is still growing, and that’s a testament to its continued relevancy throughout society. META is also still a cash cow, and over the first 9 months of 2022, has generated $84.44 billion in revenue, despite macro headwinds. There are now more than 140 billion Reels plays across Facebook and Instagram each day which is a 50% increase from 6 months prior. In Q2, Reels crossed the $1 billion annual revenue run rate level, and the META just announced that the combined run rate across Facebook and Instagram has grown to $3 billion just 3 months later.

Conclusion

META has fallen -64.72% YTD, and it’s clear that Mr. Zuckerberg’s cost reduction strategies haven’t been enough to get investors excited. The Metaverse is not going over well, and unless Mr. Zuckerberg can put everyone at ease, there is a possibility that the negative stigma will overshadow everything else pertaining to META. There is one catalyst that is somewhat of a longshot, but if TikTok gets banned in the U.S. it would be a bullish event for META as Facebook, Instagram, YouTube, and Snapchat would probably be the go-to platforms to fill the void. Based on the numbers, META is still a cash cow, and I believe shares are undervalued by just over 50%. Some of the valuations in big tech don’t make much sense regardless if it’s to the up or downside, but META is trading at 11.99x it’s FCF, and has 39.19% of its market cap in total equity on the books. If several things go right and the markets rebound in 2023, META could be an interesting investment that generates significant capital appreciation from its current levels.

Be the first to comment