Feverpitched

The Invesco CurrencyShares British Pound Sterling Trust (NYSEARCA:FXB) is up 10.1% since the British pound fell to record lows against the U.S. dollar. That relief rally is still in place despite last week’s sobering meeting of the Bank of England’s Monetary Policy Committee (MPC). In that meeting, the members openly and directly discussed a projected recession for the United Kingdom. The coming economic malaise likely motivated the MPC to caution market participants that projections for peak bank rate are too high: “Inflation will begin to fall back by middle of next year. To make sure that happens, Bank rate may need to go up further but less than what is priced in financial markets.” Central Banks rarely discuss the prospects for recession, and they can skirt the issue given the difficulty of predicting recessions in advance (in the UK, a recession is simply defined as two consecutive quarters of sequentially negative growth, unlike the more nuanced definition in the U.S.). So the MPC’s discussion augurs poorly for the future value of the pound. The reduction in rate expectations places further downward pressure on the currency relative to other currencies like the dollar where rate expectations remain higher even with today’s celebration of a lower inflation rate in the U.S.

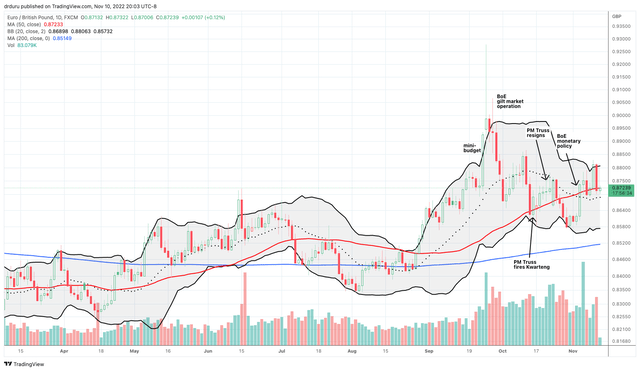

The pound sold off in response to the MPC’s press conference. The chart below maps out the euro versus the pound (EUR/GBP) to give a clearer picture of pound-specific moves than FXB can give. The pound is still negative relative to the euro since the MPC meeting.

The British pound has been buffeted in recent weeks by major economic and political events. (TradingView.com)

Recession in the United Kingdom

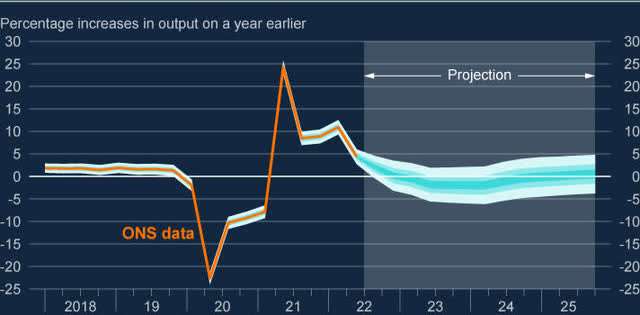

The MPC projects a recession starting in Q4 of 2022 and extending through 2023 and into early 2024. From the Monetary Policy Report:

“Following growth of 0.2% in the second quarter, UK GDP is expected to have contracted by 0.5% in 2022 Q3, and is projected to fall by 0.3% in Q4…

GDP is projected to continue to fall throughout 2023 and 2024 H1, as high energy prices and materially tighter financial conditions weigh on spending. In the Committee’s central projection, calendar-year GDP growth is -1½% in 2023 and -1% in 2024… Four quarter GDP growth picks up to around ¾% by the end of the projection…, although GDP growth is expected to remain well below pre-pandemic rates.”

This economic weakness begs a question: why is the MPC still planning to increase bank rate? Governor Andrew Bailey provided a simple answer in his introductory remarks: “We are increasing Bank Rate because inflation is too high. And it is the Bank’s job to bring it down.” Most importantly, “if we do not act forcefully now, it will be worse later on.” This decision to pick the lesser evil has been a common theme across major central banks currently hiking rates.

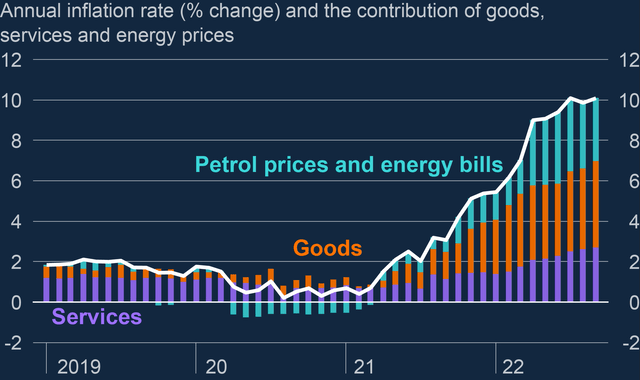

Still, despite the coming recession, a tight labor market is helping to compel the MPC to keep pressing forward with higher rates for now. UK unemployment sits at its lowest level since 1974. Bailey explained that a smaller labor force is a major driver of the tight labor market (unfortunately, many of the inactive people reported long-term illnesses). During the Q&A of the press conference, the MPC explained that the resulting upside risks to inflation are at their highest point in 25 years. The chart below shows what is at stake as the prices of energy and goods put the most upward pressure on inflation through the end of this year.

Inflation is soaring in the UK (TradingView.com)

The MPC held out a sliver of hope on the recession forecast by pointing out that small changes in the economic outlook could swing the projection out of recessionary territory. Accordingly, the MPC counseled that it is not focused on getting to a theoretical neutral rate. Instead, it is more important for them to monitor supply in the economy and in turn to make sure that “inflation does not persist longer than it should.” The chart below shows the MPC’s range of potential outcomes for year-over-year GDP growth (the band represents 90% confidence).

Projected GDP growth has downside risks until the second half of 2024. (The Monetary Policy Report (November, 2022))

Who Follows Whom?

In the U.S., we are accustomed to a cat and mouse game in monetary policy where the Fed tries to nudge financial markets in the desired direction before setting policy as close to market expectations as possible. In this press conference, the MPC insisted that “we do not follow the market, but we condition on the market…It’s the market’s job to follow us, we don’t follow them.” This bit of central bank bravado stood in stark contrast to the Bank of England’s swift move to come to the rescue of the British pound in the wake of a crash in UK bond markets. Yields on UK government bonds (gilts) soared as part of the crisis of confidence in the economic policies of the now former Prime Minister Liz Truss and her Chancellor Kwasi Kwarteng. The Bank of England took off the anti-inflation fighting gloves long enough to go back to buying up gilts in an effort to prop up the market. This flashback to the old days (just last year!) of quantitative easing worked magic on the markets. The market groaned, and the Bank of England followed with timely medicine.

The Bank’s gilt purchases put a floor on prices and gilt yields settled back down. The 10-year gilt yield is not quite back to where it was before the crisis of confidence erupted, but the impact of the BoE’s intervention was as dramatic as the plunge that prompted action.

The yield on the 10-year gilt has finally roundtripped back to its level right before the crisis of confidence. (FT.com)

The Trade

The trade in the British pound from here is a bit tricky.

The pound turned the tide on the U.S. dollar, but it remains locked in a trading range against the euro (see the chart above). The chart below shows how today’s 3.2% surge pushed FXB above the primary downtrend line.

FXB is finally breaking out of a downtrend that has lasted all year. (Seeking Alpha)

The end of one extreme, a near year-long downtrend, combines with the dramatic end of the extreme lows from September. Perhaps the extremes of September’s crash flushed out the most motivated sellers of the pound. The Bank of England demonstrated its willingness to play superhero, so the next catalyst that has the potential to drive the pound much lower will likely run up against the Bank defending parity (100 on FXB). With these tailwinds, the British pound looks like it is making a bullish turn. However, the pound is not likely to sustain a notable advantage over other currencies that were not already trading at their own bullish extremes like the U.S. dollar was doing.

Before today, I maintained a bearish outlook on the pound. Now, the technical turn of fortune has changed my perspective. The looming recession should put a cap on the British pound, but it is hard to know where that point rests in the short-term. FXB’s 200-day moving average (not show above) is currently at 118 and coincides with FXB’s last peak. So that convergence looks like the next point of “natural” resistance. Otherwise, until the next big setback for the currency, the path of least resistance looks upward (thus, my buy rating on FXB).

Despite the bullish positioning, I still prefer shorting FXB when the technicals realign with the fundamentals for the currency. FXB’s latest lift comes thanks to what looks like a topping in the U.S. dollar. I prefer playing the Canadian dollar and the Japanese yen against weakness in the U.S. dollar (for example, see my piece “Finally Bullish Catalysts for the Japanese Yen“).

Be careful out there!

Be the first to comment