SIphotography/iStock via Getty Images

In essence, real estate exists to support the basic needs of individuals and businesses, providing shelter and facilitating commerce.

It will always be in demand, it’s only a matter of whether those needs are housed in a different form or location or reflect current preferences, such as residents moving from multifamily apartments in dense cities to suburban single-family homes. As I explain in my new iREIT Masterclass handbook,

“Real estate is everything. It’s the glue that holds the world together. There’s not a day that goes by that you don’t use it and it’s an essential part of our daily routines. We are all involved with it in one way or another.”

It has inherent inflation-hedging qualities that can help investors defend against erosion in buying power resulting from the rising cost of living.

This includes how inflation can restrain new developments by pushing up the price of everything from land to materials and labor, and as a result, landlords are in a better position to raise rents.

Many commercial leases even have explicit inflation links, with rent escalators tied to a published inflation rate. Thus, REITs have historically benefited from inflation surprises, contrasting with the adverse reaction from broad stocks and bonds. As Cohen & Steers explains,

“…in inflationary environments where the economy is expanding, listed real estate has historically benefited from higher demand and less competition as new supply is curtailed due to higher construction costs and construction delays. This is especially the case for sectors with shorter lease durations such as self-storage, where landlords can reset rents promptly as conditions change.”

Cohen & Steers also adds that (emphasis added),

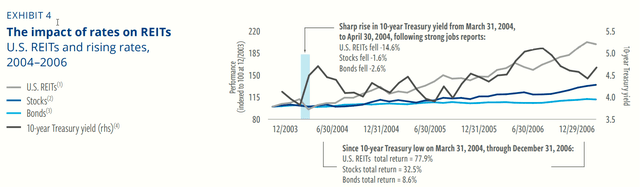

“For REIT investors, rising rates should not typically be cause for concern. Between 2004 and mid-2006, for example, the Fed hiked interest rates 17 times (from 1.0% to 5.25%) amid an improving economy, and yet REITs outperformed stocks and bonds during this period.

While long-term interest rates can affect capital costs, an expanding economy typically drives stronger demand, often leading to higher occupancy levels, which can give landlords the ability to offset rate increases by raising rents.”

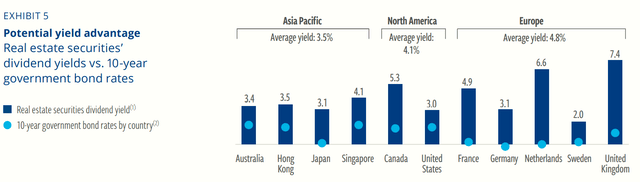

Furthermore, while income levels from traditional asset classes remain at historically low levels, REITs have continued to offer attractive dividend yields of around 4% on average (for U.S. REITs).

REIT dividend yields are well above the respective 10-year government bond yields. In addition, given the strong fundamental backdrop for REITs, the asset class could see above average dividend growth in 2022.

What about the Margin of Safety?

In addition to the potential benefits of growth, inflation sensitivity and income, REITs are attractively valued. According to Cohen & Steers, “global REITs’ earnings multiple of 18.0x is at a 1.1x multiple discount to the broad equity market’s price-to-earnings ratio of 19.1x. That compares favorably with REITs’ 1.3x average premium since 2005.”

We believe this combination of above-average growth potential, inflation-hedging characteristics, positive historical performance in periods of rising interest rates, income potential, and attractive relative valuations suggests that REITs will offer a compelling investment opportunity.

With Q1-22 earnings season upon us, we expect to see positive commentary and solid results given demand that remains strong in most sectors and is even improving in some of the sectors harder hit during the pandemic, such as dominant Malls, select Office markets, and Senior Housing.

Today I want to provide three of my highest conviction REIT picks.

Innovative Industrial Properties, Inc. (IIPR)

40% Estimated in 12 Months

IIPR is a cannabis-focused REIT that owns 105 properties (as of Q4-21) in 19 states and has one of the strongest balance sheets (with no secured debt and no debt maturities this year or next year) in the REIT sector.

The company recently announced a dividend increase of almost 17%, boosting its quarterly payment from $1.50 per share to $1.75 per share (we suspect the company will grow the dividend to $2.00 per share in 2022).

Recently, IIPR issued 1.5 million shares at $190/share, and as I informed iREIT on Alpha members,

“IIPR priced the offering as aggressively as it could, in order to continue to fund the acquisition of properties in the pipeline. IIPR was also able to upsize the transaction by more than 50% from the original launch, which is reflective of the strong level of investor interest in this offering.”

The bigger news recently was the short attack from Blue Orca Capital, and my subsequent reply,

“I truly believe that Blue Orca is confused with the sale/leaseback mechanism in which a property seller (and new lessee) can convert an illiquid fixed asset into cash and increase its working capital.

This concept is nothing new, as many REITs including W.P. Carey (WPC), Realty Income (O), Store Capital (STOR), VICI Properties (VICI), and Medical Properties (MPW) use sale/leasebacks on a frequent basis.”

I just finished up a Ground Up podcast interview with STORE Capital’s former CEO, Chris Volk, in which I asked him about the sale-leaseback concept. He is intimately familiar with the financial tool, as STOR transacts many sale-leasebacks.

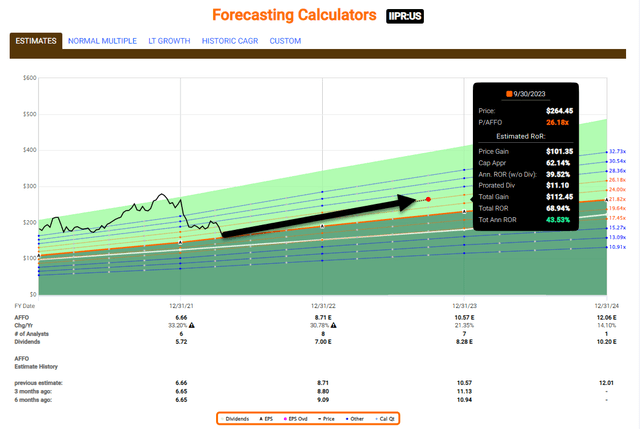

IIPR remains a top conviction buy at iREIT on Alpha and we strongly suggest holding a position. As most know, shares are now trading at an extreme discount – 22.5x P/AFFO and a dividend yield of 4.3%. Shares have not traded this low since 2020.

Meanwhile, the growth engine is intact, as analysts expect AFFO per share to grow by another 30% in 2022. My conservative model has IIPR returning 40% annually. I just added shares to my “Real Money Portfolio.”

As a side note, I would like to see the company split shares (4-1) and I plan to meet with the CEO and CFO next week while I’m in San Diego.

Safehold Inc. (SAFE)

45% Estimated in 12 Months

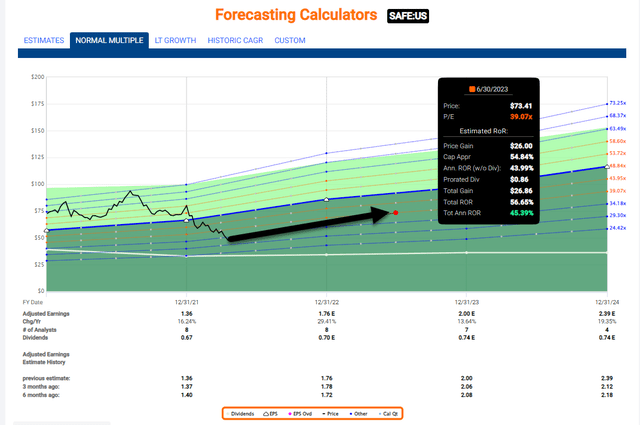

SAFE is one of the most beaten down names in the REIT sector, as shares have fallen by over 40% year to date.

This unique net lease REIT focuses on ground leases, that is, the land underlying the types of buildings. In many ways, the company can be compared to other net lease REITs, however, the growth drivers (for ground leases) are rooted in the high fragmentation that exists.

In 2021, SAFE closed over $1.5 billion of ground leases and broke into several new markets. The company originated a record 17 ground lease transactions for $777 million in Q4-21, representing the second best quarter-by-dollar amount ever and the best quarter since the beginning of the pandemic. Since its IPO (6-22-17), STAR has grown 14x – from $.3 billion to $4.8 billion.

At the end of Q4-21, SAFE had $3 billion of debt, comprised of approximately $1.5 billion of nonrecourse secured debt, $750 million of unsecured notes, and $272 million of debt on ground leases (own in partnership). The weighted average debt maturity is 23 years.

More recently, SAFE announced this so-called Caret transaction that allows investors to tap into the UCA (unrealized capital gains) value with a small group of sophisticated investors.

Granted this is a small deal – SAFE sold and received commitments to purchase 1.37% of Caret units for $24 million (at a value of $1.75 billion) – but it’s a path to creating liquidity that could provide a public market listing for Caret units.

As I told my son, the Caret units are better than NFT’s, whereby there is tangible value to the future value of the ground leases, and SAFE has begun to demonstrate a pathway to monetizing these unrealized gains.

Share are now trading at $47.71, with a dividend yield of 1.4%. We believe SAFE is edging closer to internalizing with iSTAR (STAR), and this could serve as a catalyst that provides more transparency (and value) to the combined companies.

Similar to IIPR, SAFE’s growth engine is intact, as analysts are forecasting EPS growth of 29% in 2022. The Caret concept is hard to grasp, but if SAFE can create a sustainable market for monetizing its unrealized gains, SAFE’s cost of capital could become supercharged. We estimate shares returning 45%+ over the next 12 months.

Medical Properties Trust, Inc. (MPW)

25% Estimated in 12 Months

MPW is a “pure play” hospital landlord that owns 438 properties (46,000 beds) in 9 Countries. Although MPW has outsized exposure to Steward (~19%), no Steward regional market represents more than 6% of the total portfolio and no single Steward property represents more than 2% of pro forma assets.

The properties are mission critical.

MPW’s credit rating is a notch below investment grade – or BB+ – by S&P and it has 6.4x debt to EBITDA (goal is 5x to 6x). Around 96% of MPW’s $11.28 billion debt is fixed, with interest rates between 2.5% and 5.25%.

MPW also utilizes JV’s to diversify its portfolio and take advantage of attractive and flexible capital. Pro forma for MPW’s expected JV proceeds is $1.3 billion. That will repay the outstanding interim credit facilities with liquidity exceeding $1 billion in cash and revolver resources.

For Q4-21, MPW reported normalized FFO per diluted share and AFFO of $0.36. That continues the extraordinary double-digit year-over-year quarterly growth. On a full year basis, MPW’s normalized FFO was $1.75 and AFFO was $1.37, also representing the continuation of double-digit growth, a record virtually unmatched.

Over the past 10 full years, MPW has delivered normalized FFO and AFFO per share at compound annual growth rates in the mid-9s and mid-6s, respectively. The company recently boosted the dividend by around 4% (from $.28 per quarter to $.29 per quarter).

MPW shares are now trading at 13.9x P/AFFO, compared with the normal (5-year) average of 15.3x.

We believe media headlines (and a very weak short hand) have inspired much of the selloff, as MPW is trading as if its largest tenant were filing BK. Give the mission-critical components to the business model, we see no sign of that, which of course represents a buying opportunity for value investors like us.

MPW has a healthy dividend yield of 5.9%, and analysts are forecasting growth of 7% in 2022. Combining the sum of the parts, we are maintaining a Safe Strong Buy with a targeted 12-month total return forecast of over 25%.

In Times Of Uncertainty, Buy REITs

As I explain in my iREIT Masterclass handbook,

“This REIT industry track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has provided investors with attractive total return performance for most periods over the past 45 years compared to the broader stock market as well as bonds and many other assets.”

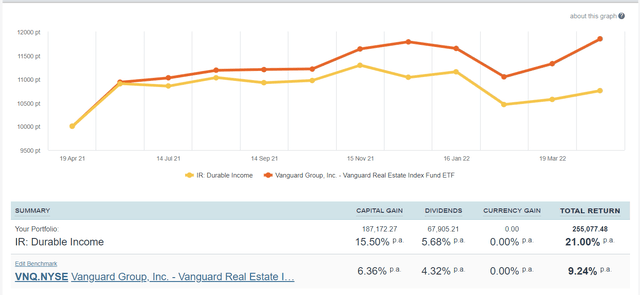

Although fear is elevated, for many reasons, owning real estate – in a security wrapper – is one of the very best investments you can make in times like today. But don’t just take my word for it, the proof is in the pudding- the Durable Income Portfolio has returned 21% annually since 2013.

By purchasing shares in high-quality, beaten-down REITs, we have been able to deliver significant alpha for our members (at iREIT on Alpha).

“An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Benjamin Graham

Be the first to comment