Elenarts108/iStock via Getty Images

Investment Thesis: I take a long-term bullish view on Nestlé S.A. owing to strong sales growth in an inflationary environment as well as potential undervaluation on a P/E basis.

In a previous article back in September, I made the argument that while Nestlé S.A. (OTCPK:NSRGY) has seen encouraging sales growth, inflationary pressures could see customers potentially switching to cheaper brands along with higher net debt and a lowering quick ratio being of concern to investors.

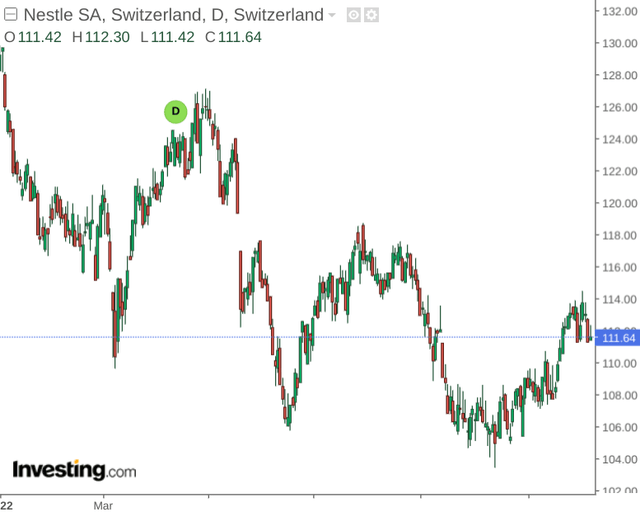

Nestlé is up by over 9% since my last article. However, the stock remains significantly below levels seen in 2022:

The purpose of this article is to assess whether the recent rebound we have been seeing in the stock can continue, taking into account the concerns posed in my last article.

Performance

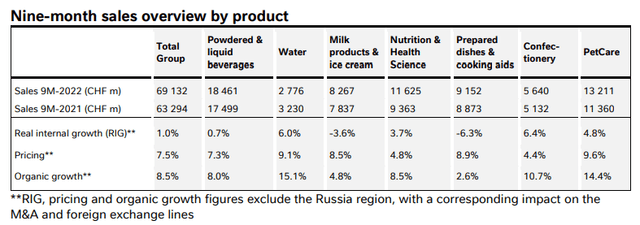

When looking at nine-month 2022 sales data for Nestlé, organic growth came in at 8.5%, with pricing of 7.5% reflecting substantial cost-based inflation.

When analysing sales by product, it is interesting to note that the Water segment saw the second highest pricing growth of 9.1% but had the highest real internal growth of 6%. PetCare saw real internal growth of 4.8% despite having the highest pricing growth of 9.6%, while Confectionery saw the highest real internal growth at 6.4%.

Press Release: Nestlé reports nine-month sales for 2022

From the above, higher prices do not appear to have particularly hindered growth across the company’s primary business segments – although the Powdered & Liquid Beverages segment saw modest real internal growth of 0.7%.

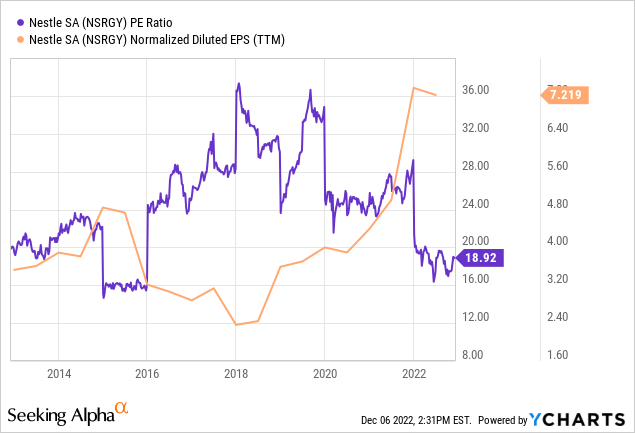

Previously, I had argued that with Nestlé’s P/E ratio trading near a 10-year low and earnings near a 10-year high, that the stock could be significantly undervalued and potential upside could lie ahead.

ycharts.com

This does not appear to have changed since September, and as such the stock could be in a position to see further upside if earnings growth continues.

Looking Forward

In spite of the inflationary pressures seen this year, Nestlé S.A. appears to have seen resilient sales growth.

Going forward, it is quite possible that Purina PetCare could continue to lead growth across the North American and European markets. Pet ownership has shown a trend of long-term growth in the United States, with 70 percent of U.S. households reportedly owning a pet – up from 56 percent of households in 1988. Given that we have seen PetCare continue to lead overall sales growth for North America – the fact that demand has continued to rise in spite of higher prices is highly encouraging.

The fact that price rises have driven growth is welcoming so far. However, that is not to say that Nestlé might not face a sudden reversal of demand if recessionary activity becomes particularly acute. Given that a significant portion of Nestlé’s offerings are centered around discretionary goods, there may be a limit to the extent that customers will tolerate price rises and a downturn in economic activity could make cheaper brands more attractive.

With that being said, there has been no evidence so far to suggest that consumers are reducing demand in the face of rising prices – just the opposite. From this standpoint, I am more confident that Nestlé can continue to generate sales growth going forward.

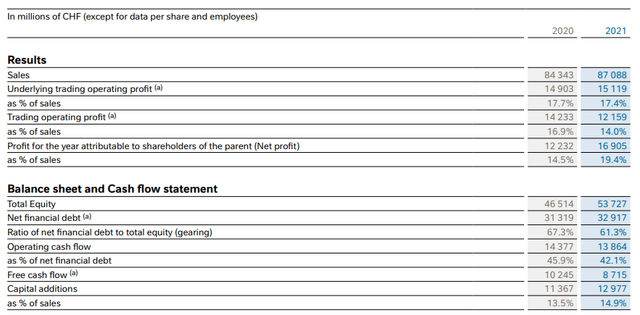

Looking forward to the company’s eventual full-year performance for 2022 – investors are likely to pay close attention to balance sheet metrics such as free cash flow and debt to equity.

For instance, we can see that while net financial debt to total equity decreased from 2020 to 2021, free cash flow also decreased over the same period.

It is likely that investors will look for evidence as to whether Nestlé can continue to reduce its debt levels and bolster free cash flow with the rise in sales growth. Should this not be the case, then it might be an indication that cost inflation has eaten in to the company’s potential to utilise revenue growth to improve the company’s cash flow and lower its debt.

Conclusion

To conclude, Nestlé S.A. has seen encouraging sales growth as a result of rising prices. Going forward, I take the view that investors will pay close attention to the company’s year-end balance sheet to see if such revenue growth can improve Nestle’s cash and debt position.

That said, the company’s performance so far has been encouraging and I take a long-term bullish view on the stock.

Be the first to comment