FrankRamspott

Jim Roemer video on the next potential big hurricane (www.bestweatherinc.com)

The potential next big hurricane

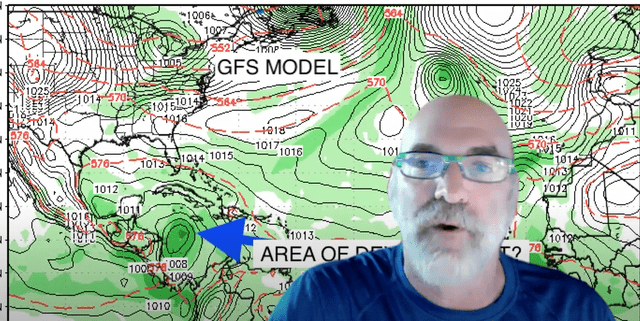

The video above talks about how the “initial development” of a tropical depression and storm is critical in where the next hurricane (GASTON) will go by September 28th-29th. It discusses the loop current that represents extremely warm ocean temperatures brought on by global warming.

Those so-called “pundits out there” who keep discussing that volcanic eruptions will cool the planet, or that solar cycles will offset greenhouse gas emissions, are not looking at the “science.” Do you really think the warmest summer in 200 years in Europe and the worst drought out west causing Lake Mead and the Colorado River to be at the lowest level in 1200 years is just a cycle? Come on! How about the fact that in the annals of history, there have never been 5-7 category hurricanes in the Gulf of Mexico within a 5-year period?

What could be hurricane Gaston (currently a tropical storm) next week will have implications, not only on some commodities – also it could affect the current tenuous supply chain.

There will be some pretty big moves (up or down) in cotton, natural gas, orange juice, crude oil spreads, and natural gas based on the exact track.

The video talks about the following:

1) How important initial development is and how the GFS and EUROPEAN computer model, shows entirely different tracks; 2) An historical look at hurricanes that hit Florida and where they originated; and 3) Why the loop current is important for explosive development. Oceans have warmed so much over the past 10 years (never seen in history) that hurricanes have often become stronger than models predict.

Natural gas (UNG) prices will be very sensitive to the movement of this next hurricane. However, it will take a cold European and U.S winter to likely see prices anywhere close to $10 again.

In the case of orange juice futures, if Florida gets hit, OJ prices could rally. However, Florida produces less than 50 million boxes of OJ, well less than more than 200 million boxes prior to the disease citrus greening. Hence, the impact of a hurricane is often more psychological than anything else

Cotton (BAL) prices will get a lift if it hits Mississippi, Louisiana or Georgia. However, recessionary fears and the stronger dollar are much more important than a short-term impact in the U.S. This would change, however, if incessant October and November wetness returned to Pakistan (#3 exporter of cotton in the world) and/or Texas and the Delta have a very wet fall harvest.

More importantly, of course, is the safety of millions of residents along Florida, Texas, and the Gulf coast who have been battered by numerous category 4-5 hurricanes over the last 5 years. We will be watching this 16 hours a day and also using our own in-house models to predict (hopefully early) where Gaston may go.

Conclusion:

With potentially more recessionary fears from rising interest rates still upon us, the weather will only be one factor in the commodity markets. However, South American weather will become super important to the grain market (CORN) (SOYB) after the U.S. harvest.

In the case of trading at the end of the hurricane season and the potential big one next week: if we see sharp rallies in markets such as natural gas (BOIL) and cotton next week because it goes into the Gulf of Mexico, often this is a “buy on rumor, sell on fact” situation. For now, there is no track just yet of where Gaston may go, opening the door for some potential fireworks.

For a hurricane to affect crude oil (CO) crack spreads, Gaston would have to go into Texas and hopefully, this will not happen.

Finally, the U.S. economy cannot afford any more supply chain issues. A major U.S. hurricane could just exacerbate the present concerns.

Be the first to comment