industryview/iStock via Getty Images

Although the nature of value investing is to gravitate toward companies that are less volatile, a firm can be both attractive and volatile at the same time. One good example of this can be seen by looking at Avnet (NASDAQ:AVT), a global technology distributor and solutions company that sells electronic components and provides various services to its customers related to the development, prototyping, and testing of products. Although the company’s fundamental condition has been volatile in recent years, the overall picture has been positive. Add on top of this the fact that shares have recently traded at low levels, and it stands to reason that there could be some nice upside on the table moving forward. Of course, these are uncertain times and the picture for any one business can change materially from quarter to quarter. And with the enterprise slated to report financial performance for the final quarter of its 2022 fiscal year on August 10th, investors should keep a close eye on what management is expecting and on what analysts think will occur. So long as there is not anything significantly negative, upside potential for investors could be quite nice. And because of this, I have decided to retain my ‘buy’ rating on its stock even though shares have risen nicely in the past few months.

Avnet’s strength continues

Back in March of this year, I wrote an article that looked upon Avnet in a favorable light. In that article, I said that the enterprise had a history of consistent revenue growth if we ignore the pain caused by the COVID-19 pandemic. On the other hand, I said that profits and cash flows have been more volatile during the past few years. Despite this, I said that shares of the company looked cheap and that recent performance indicated further upside was probably on the table. Ultimately, this led me to rate the business a ‘buy’, reflecting my belief that it would probably outperform the broader market for the foreseeable future. So far, that claim has played out pretty well. While the S&P 500 is down 4% since the publication of that article, shares of Avnet have risen by 18.5%.

Author – SEC EDGAR Data

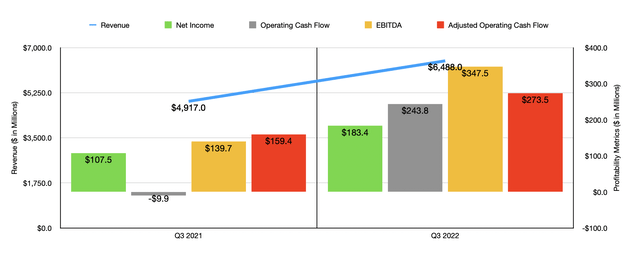

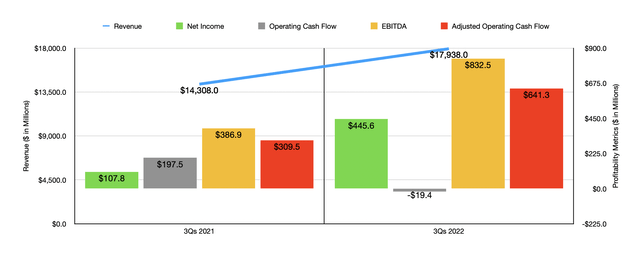

This increase during a down market is not without cause. Consider how the company fared when it reported results for the third quarter of its 2022 fiscal year, the only quarter for which new data is now available that was not available when I last wrote about the business. In that quarter, sales for the firm skyrocketed, rising by 32% from $4.92 billion in the third quarter of 2021 to $6.49 billion the same time this year. Had foreign currency remained stable year over year, sales growth would have been even higher at 35.7%. According to management, this increase in revenue was driven pretty much entirely by strong demand for electronic components and for the services it offers. Thanks to strong revenue in that third quarter, revenue for the first nine months of the 2022 fiscal year remained strong, coming in at $17.94 billion. That’s 25.4% above the $14.31 billion generated just one year earlier.

Author – SEC EDGAR Data

This surge in revenue brought with it a rise and profitability as well. Net income in the latest quarter totaled $183.4 million. That compares to the $107.5 million reported in the third quarter of 2021. Operating cash flow rose from negative $9.9 million to a positive $243.8 million. If we adjust for changes in working capital, it would have risen from $159.4 million to $273.5 million. Meanwhile, EBITDA jumped from $139.7 million to $347.5 million over the same timeframe. These results had the positive impact of helping profitability for the first nine months of the year as a whole. That income, for instance, rose from $107.8 million in the first nine months of the firm’s 2021 fiscal year to $445.6 million this year. Operating cash flow dropped from $197.5 million to negative $19.4 million, while the adjusted figure for this jumped from $309.5 million to $641.3 million. And EBITDA managed to soar from $386.9 million to $832.5 million.

In addition to benefiting from an increase in sales, the surge in demand allowed the company to push its cost structure lower. Gross profit margin, for instance, improved thanks to sales growth in the higher-profit western regions in which it operates. And with demand so high, the company didn’t have to spend as much, relative to sales, on selling, general, and administrative costs. It’s also worth noting that this strong bottom line performance came even as the company incurred $26.3 million in expenses associated with the conflict between Russia and Ukraine.

At present, the current expectation is for the company to continue to generate strong performance when it reports data for the final quarter of the year. Management previously forecasted revenue of between $6 billion and $6.4 billion for the quarter. That compares to the $4.16 billion the company reported in the final quarter of its 2021 fiscal year. Meanwhile, analysts think that revenue will come in at about $6.29 billion. But if the third quarter was any indication, the firm might overdeliver. In that third quarter, the company beat on expectations to the tune of $779.68 million. And when it comes to profitability, management currently expects earnings per share of between $1.90 and $2. At the midpoint, this would translate to net income of $194 million. One year earlier, earnings per share totaled just $0.53. These numbers are not too far off from what analysts anticipate. At present, analysts believe the company will report earnings $1.82, with adjusted earnings per share of $1.99. It will be interesting to see how current economic conditions impact the end result.

Author – SEC EDGAR Data

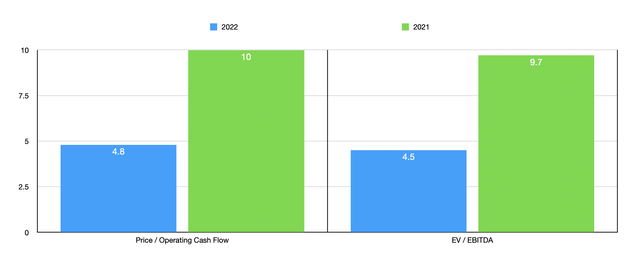

Based on management’s own guidance. Net income for the current fiscal year should come in at about $639.6 million. Guidance has not been provided when it comes to other profitability metrics. But if we assume that the final quarter will look very much like the first three, we should anticipate adjusted operating cash flow of $960.4 million and EBITDA of $1.29 billion. This would imply a price to adjusted operating cash flow multiple for the company of 4.8 and an EV to EBITDA multiple of 4.5. These numbers compare to the 10 and 9.7, respectively, that we get if we rely on 2021 results. As part of my analysis, I also compared the company to the same five firms I looked at last time. On a price to operating cash flow basis, using our 2021 results, the four firms had positive results traded at multiples ranging between 37.2 and 92. In this case, Avnet was the cheapest of the group. This picture changes some when we use the EV to EBITDA approach, with the five companies trading between a low point of 5.7 and a high point of 10.1. In this case, four of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Avnet | 10.0 | 9.7 |

| Arrow Electronics (ARW) | 37.2 | 5.7 |

| PC Connection (CNXN) | 92.0 | 9.5 |

| ScanSource (SCSC) | 52.0 | 6.7 |

| TD SYNNEX (SNX) | 43.7 | 10.1 |

| ePlus (PLUS) | N/A | 8.9 |

Takeaway

Based on all the data provided, I must say that I continue to be impressed with Avnet. Even in the event that financial performance reverts back to what we saw in 2021 instead of matching what the company has seen so far this year moving forward, shares look pretty cheap on an absolute basis. In one of the two ways in which we looked at the valuation of the company, it is a bit pricey relative to similar players. But beyond that, I don’t see much of an issue. Admittedly, the company is rather volatile and it’s possible that volatility will rear its head when management reports financial results for the final quarter of its 2022 fiscal year. But absent something significantly negative taking place, I do think that further upside could still be on the table. And because of that, I have decided to retain my ‘buy’ rating on the company for now.

Be the first to comment