Felipe Gustavo S Borges/iStock Editorial via Getty Images

In a previous report, I discussed the reasons why acquiring an airline such as Atlas Air (NASDAQ:AAWW) makes sense. However, at the time, what was missing was any indication about what the transaction value could look like and, at the end of the day, the prime question will be what will be paid for Atlas Air. The first indications on a transaction value are now in and I will discuss it in this investor report.

Why Buy Atlas Air?

For a more detailed analysis of why anyone would be interested in acquiring a company such as Atlas Air, which specializes in air freight transport and passenger charters, I would like to refer you to my previous report. However, what governs intention to acquire the airline is a mix of e-commerce growth driving demand for express shipping solution, momentum in the merger and acquisition space for airlines, diversification and integration in horizontal as well as vertical direction. As an air cargo operator, the value of Atlas Air and its peers have become painfully clear over the course of the pandemic.

Is AAWW Stock A Buy For Stockholders?

Atlas Air Boeing 747-8F (Boeing)

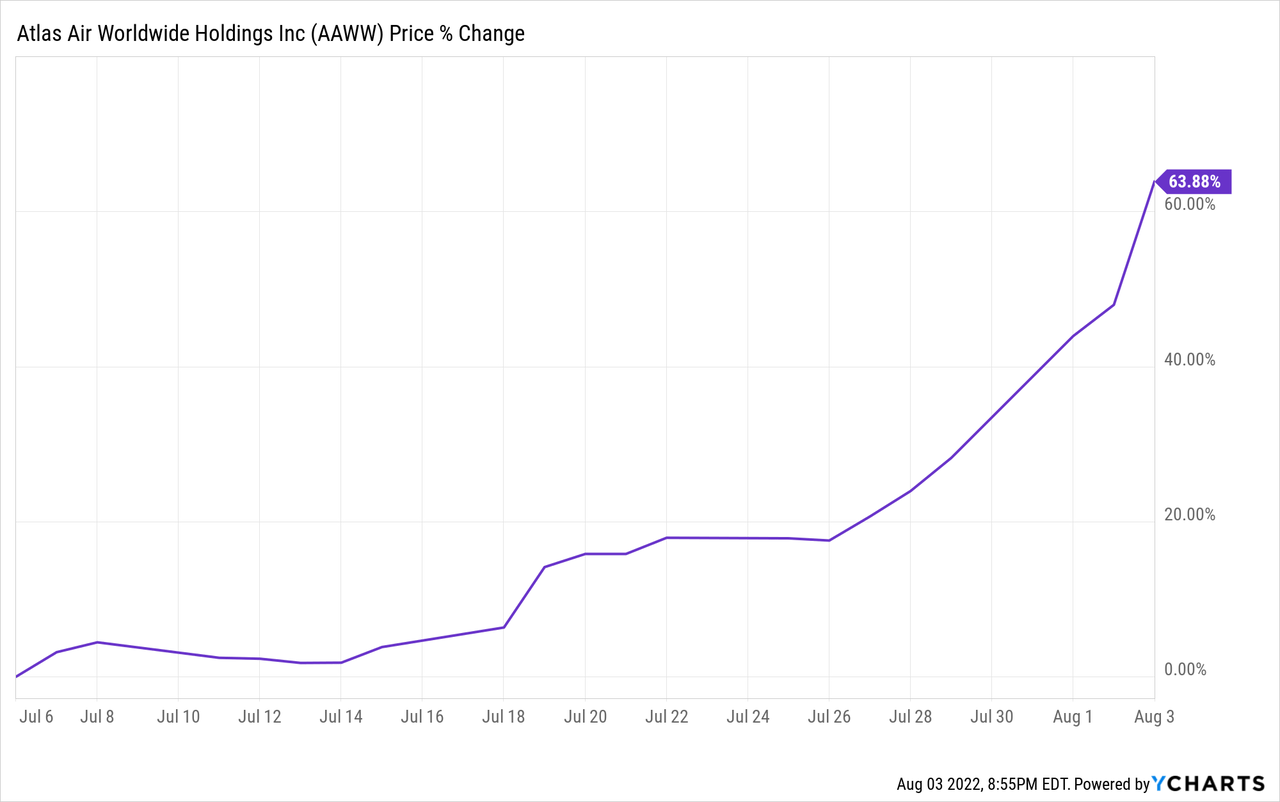

The initial reports that highlighted interest in Atlas Air did not contain any indication of what value would be offered for the airline, but I had been looking for a 50% premium as a minimum. The first reports with an indication on the transaction have now been released and while there is no formal offer for Atlas Air yet, I believe it is worth having a look at what those first indications look like.

According to sources familiar with the matter, an Apollo led group will buy Atlas Air for $3.2 billion or $102.5 per share. We recently saw JetBlue (JBLU) offering $3.8 billion for low-cost carrier Spirit Airlines (SAVE), but of course airlines differ in sizes, operations and financial strengths. However, I am interested in looking for parallel cases to see the premium strengths compared to previous trading levels.

I will use the day on which Frontier Airlines (ULCC) and Spirit Airlines agreed to combine operations as a reference to determine the premium that is paid for Spirit Airlines. Prior to any merger announcement, which really put some momentum in the airline consolidations, shares of Spirit Airlines were trading at $21.73, meaning that if the deal is consummated there is a 54% premium and up to 57% depending on the timing of the closing as JetBlue is paying a ticking fee. Going back to Atlas Air, the airline of interest, a $102.50 offer would indicate a 33% premium. Absent of a bidding war for Spirit Airlines, the premium paid for the airline would be closer to 20%.

Interesting to note is that the bid for Spirit Airlines came at a moment the airline’s stock was trading near 52-week lows. So, measuring the premium for Atlas Air from a somewhat arbitrary point in time for its stock price might not be fully useful. Important to note is that this point is not completely arbitrary as it marks the point where airline M&A momentum really picked up. However, I do believe that measuring against a 52-week low, like was the case with Spirit Airlines, might be more appropriate. When doing so, it was observed that the 52-week low was reached recently at $58.70. If we apply the JetBlue premium, the implied offer for Atlas Air would be $90.50 to $92.25 per share. So, the current price in my view is extremely generous and reflects appreciation for the prospects of the company with a 75% premium.

I believe that a 75% premium is good. Wall Street has a 12-month target of $108.40 per share which is 6% higher than the potential $102.50 per share offer, but that might be a price investors are willing to pay to balance the positive time element of being able to cash now instead of 12 months from now.

From current price levels there still is 6% upside which might materialize once a formal offer is made. However, a big chunk of the upside has already materialized. Since publication of my previous report discussing the acquisition of Atlas Air, shares surged another 15%. So, most of the upside has materialized over the past day and prior days and I would mark this a buy for people who want to park their money and earn a 6% premium for doing so.

Conclusion: A Fair Premium For Atlas Air Stock

I do believe that the premium that could be offered for Atlas Air should be measured against the recent 52-week low as was the case for Spirit Airlines. For Atlas Air that indicates a 75% premium. Alternatively, I use a 20% premium that I believe should be somewhat of a standard for airlines and 33% for airlines that are high in demand. And, when doing so, we see that the premium as compared to the stock price before any buying rumors is 35% which I would say is a nice premium.

Be the first to comment