Win McNamee

The Fed minutes told the tale of a Fed that will likely slow the pace of rate hikes at the December FOMC meeting. But more importantly, the minutes suggested that the Fed now sees a higher terminal rate than previously forecast at the September FOMC meeting.

The one wrinkle in the equation that was not expected and is even more concerning is that the Fed acknowledges in the minutes that they are aware of the increasing risk of a recession.

A Higher Terminal Rate Overshadows A Slower Pace

If the stock market has been rising on expectations of rate hikes slowing, it’s in for a shock when it realizes the speed has no bearing on the destination. The Fed has made it clear over several previous meetings that it wants the economy to grow at a below-trend pace, the unemployment rate to rise, and to move monetary policy into a restrictive territory and maintain that stance for some time.

Based on messaging from Fed governors over the past two weeks, it seems more likely than not that the terminal rate is probably to head above 5% and potentially to as high as 5.25% over the next few meeting. The pace at which we get there is unlikely to change the outcome.

Financial Conditions Need To Tighten

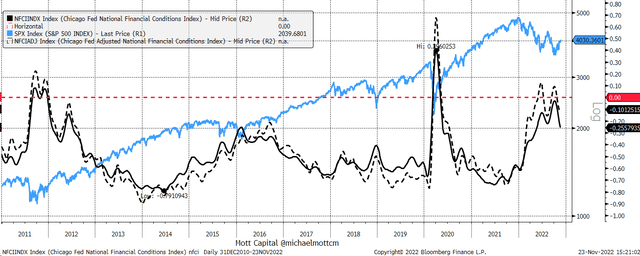

It’s not bullish for stocks, implying that financial conditions will need to tighten further and stay there for some time. The Chicago Fed National Financial Conditions Index has eased considerably in recent weeks, which helped lift equity prices. As financial conditions begin to tighten to the Fed’s desired level, it will lower equity prices, making the November rally a destination to nowhere.

Bloomberg

The chart shows that financial conditions have eased back to where they were in August before Powell’s Jackson Hole speech. At that point, the Fed wasn’t pleased with the market’s strong performance and easing of financial conditions and pushed back very hard against that easing. It seems likely that the FOMC minutes today are the first step in the Fed pushing back against the recent easing of financial conditions, reinforcing a higher terminal rate.

If it’s the case that the terminal rate is heading toward 5% to 5.25%, and the Fed wants financial conditions to tighten more, then rates need to rise, the dollar needs to strengthen, and credit spreads need to widen. That should result in higher implied volatility and lower equity prices.

The news of the rate of hikes slowing is not bullish and not a pivot. It’s common sense. It’s obvious that at some point, the Fed would slow the pace of rates.

The big takeaway from these Fed minutes is that the terminal rate is heading higher than projected at the September FOMC and is likely to be above 5%.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

See why Reading The Markets has been one of the fastest-growing Seeking Alpha marketplace services in 2022.

Reading the Markets helps readers cut through all the noise by delivering stock ideas and market updates.

Be the first to comment