Alex Wong/Getty Images News

Introduction

Sometimes, things work out the way you expect them to. That’s the case with Deere & Company’s (NYSE:DE) just released fourth quarter earnings. The company reported blowout numbers as it benefited from high and lasting demand and strong pricing power, allowing the company to offset supply chain issues and high inflation. Moreover, the company came out with strong guidance, indicating that the bull market is here to stay.

In this article, we’ll dive into the details and discuss how to deal with this situation from an investor’s point of view.

So, let’s get to it!

A Quick Look Back

Since 2020, we have discussed at least two key macro themes. One of them is energy. The other is agriculture.

As a part of my bullish view on agriculture (fertilizers, machinery, trade, ethanol, and related), I made Deere the largest agriculture investment in my long-term portfolio.

My most recent update was written on Nov. 14, when I reiterated my bullish stance on this machinery producer from Moline, Ill. ($600 price target).

Essentially, the bull case is built on several pillars. One of them is tight supply, which is worsened due to high demand. 70% of planted acres in the US cover corn and soybeans. 40% of corn is used in ethanol. 25% of soybeans are used to make biodiesel.

Moreover, with the energy supply (production) being tight, this is expected to put a floor under agriculture demand at high levels with more room for growth.

That’s a big issue as supply and demand have diverged a bit. Looking at wheat, we see that demand has outgrown production for three consecutive years. Add to this the geopolitical issues in East Europe, and we have a recipe for disaster.

CME Group

Moreover, the OECD estimates that supply is expected to grow by 1.1% per year for the foreseeable future. Demand, unfortunately, is expected to grow by 1.4% per year.

This means that the focus on efficient production was never as important as it is now. We need to use every inch of arable land as efficiently as possible, which is where Deere comes in.

The company not only benefits from strong agricultural prices but also from the need for high-tech solutions. This is what the Wall Street Journal wrote about Deere’s ability to innovate:

The company this year is rolling out self-driving tractors that can plow fields by themselves, and sprayers that distinguish weeds from crops. Deere, which helped make satellite-guided tractors ubiquitous in the U.S. Farm Belt over the past 20 years, is investing billions of dollars to develop smarter machines that the company said will make farming faster and more efficient than it ever could be with just farmers behind the wheel.

With all of this in mind, here’s how the company performed in its fourth quarter and what this means for the bigger picture.

4Q22 Was Truly Fantastic As Both Demand And Margins Were Strong

Going into the fourth quarter (third calendar year quarter), all eyes were on revenues (demand), margins (supply chain issues/inflation), and outlook (does agricultural strength last?).

In addition to that, the usual things mattered, like relative strength vs. peers and everything else that tells us how the world’s biggest agriculture manufacturer is doing.

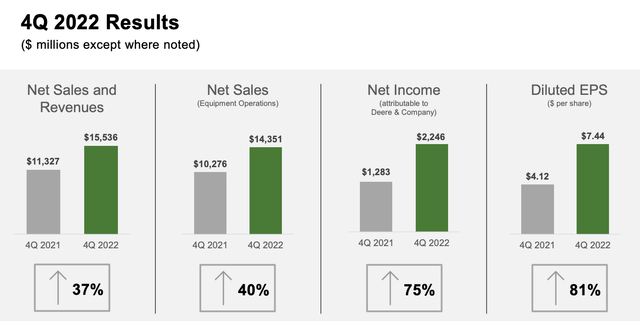

In its October quarter, Deere generated $14.35 billion in revenues. This beat estimates by a whopping $890 million. It helped the company to achieve GAAP earnings per share of $7.44. That’s $0.34 higher than consensus estimates.

Net income rose by 75% to $2.2 billion. This growth rate is 35 points higher than the 40% growth rate of equipment sales. I’m mentioning that for two reasons.

First, it’s great news, in general. And second, it shows that margins improved a lot in the October quarter.

Deere & Company

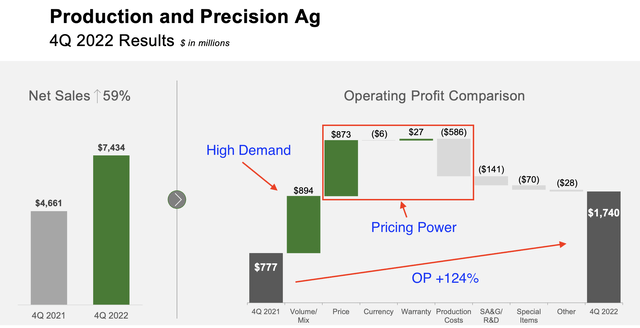

51% of total equipment sales were generated in the company’s Production and Precision Ag segment. This segment is home to its high-horsepower equipment. Its major tractors, combines, and equipment. This is the segment I care most about as this is Deere’s bread and butter and cornerstone of large farmers and its major technologies. Moreover, given the products in this segment, it tells us a lot about the industry and everything related to it.

Hence, I made some notes, which can be seen in the PowerPoint slide screenshot below.

Deere & Company (Including Author Notes)

What we’re seeing above are the Production and Precision Ag segment’s sales growth rates and operating profit bridge.

The company turned 58% net segment sales growth into 124% higher operating profit. Volume and mix added $900 million, which shows strong underlying demand. Pricing added another $870 million. Pricing alone was able to offset $590 million in production cost headwinds.

That’s a huge deal.

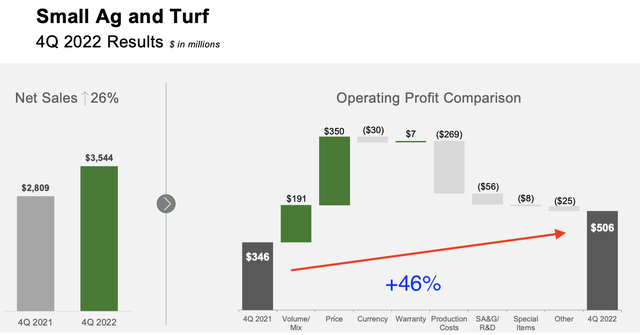

Moreover, the same happened in the Small Ag and Turf segment. This segment is home to smaller tractors and equipment needed for day-to-day operations on smaller farms – to paint with a very broad brush. This segment was unable to turn higher sales into a higher operating profit in 3Q22. I was a bit afraid that the company would once again fail to offset production cost headwinds, yet that didn’t happen.

The company turned 26% higher net segment sales into 46% higher operating profit as pricing more than offset higher production costs.

Deere & Company (Including Author Notes)

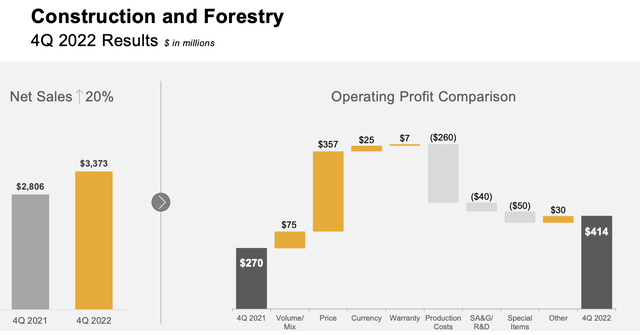

Before I move over to detailed comments, I can say that Construction and Forestry margins also were up.

This segment is extremely dependent on construction and housing. Construction is very cyclical. The same goes for forestry, as lumber prices are dependent on homebuilding activity. And, as I wrote in a just-released housing article, homebuilding sentiment is in a very bad place.

Yet, the October quarter was great. Net segment sales were up 20% to $3.4 billion. Operating profit rose by 53% as pricing more than offset higher production costs.

Deere & Company

The fact that volume/mix added $75 million to operating profit is a great sign of strength in a tricky segment market environment.

Having said all of this, the company made great progress when it comes to supply chains. The company had a lot of partially finished products in inventory. Easing supply chain problems allowed the company to boost shipments.

These headwinds hurt Deere in 3Q22. However, now it’s a tailwind.

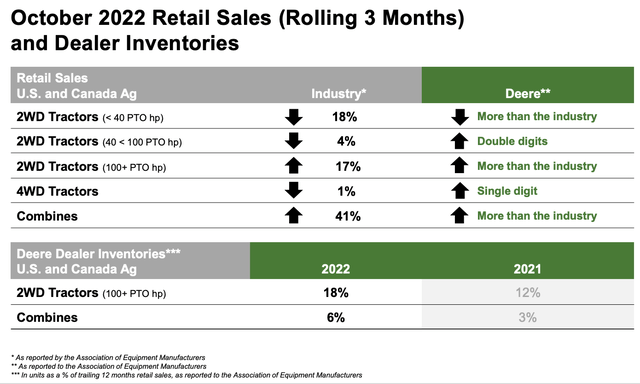

Moreover, I’ve often made the case that Deere has a competitive technology advantage. The company continues to report outperforming retail sales. The company outperformed in every single segment except for small 2WD tractors, which is a minor market for Deere anyway.

Deere & Company

Moreover, dealer inventory levels improved a bit, yet they won’t reach normal levels until 2024, according to the company.

What’s Next?

So far, I’m happy with the numbers. Demand was high, easing supply chain issues allowed the company to boost margins, and even construction remained strong.

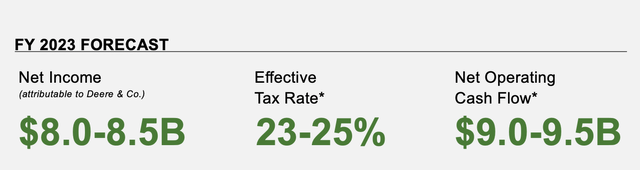

However, the (FY2023) outlook is much more important as investors are forward-looking. Moreover, I spent a lot of time discussing my industry outlook. Getting input from Deere is important.

Here are the raw numbers:

- Production and Precision Ag

Net sales growth between 15% and 20%. An operating margin improvement from 19.9% to the 22.0% to 23.0% range.

Net sales growth of 0% to 5%. Operating margins are expected to end up in the 14.5% to 15.5% range. That would be an improvement vs. 14.6% in 2022.

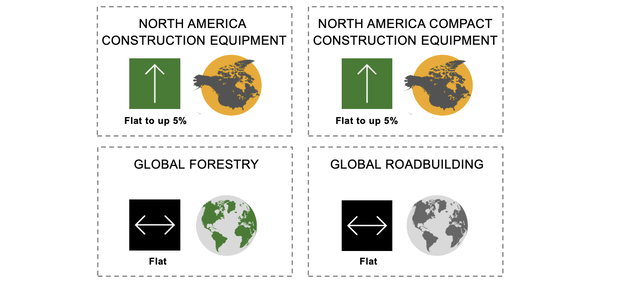

- Construction and Forestry

In this segment, the company expects 10% net sales. The operating margin is expected to be a bit flat-ish, with a guidance range of 15.5% to 16.5%. In 2022, that number was 16.1%.

Total company net income is expected to end the 2023 fiscal year in the $8.0 to $8.5 billion range. Net operating cash flow is expected to be at least $9.0 billion. The median estimate expected net income guidance to be close to $7.8 billion, which is another win for Deere.

Deere & Company

Now, onto more detailed comments. In its large agriculture segment, the company sees strong demand. So strong that it doesn’t expect production to be able to keep up. Demand is boosted by strong agriculture fundamentals and an aging equipment fleet. Farmers finally have the funds to replace old equipment. Especially now, as new technologies make farming much more efficient. This creates a great environment for farmers to pull the trigger on new equipment purchases.

In its small agriculture segment, demand is expected to be negatively impacted by utility tractors and turf equipment, as both products are tied to the global economy. Dairy and livestock sales remain strong.

Strength is expected to persist in Europe, South America, and Asia as well.

In construction, the company remains positive despite weakening economic growth.

According to Deere:

End markets overall are expected to remain steady as oil and gas, U.S. infrastructure spend and capex programs from the independent rental companies offset moderation in the residential sector.

Deere & Company

Roadbuilding and forestry sales are expected to remain flat. I’m happy with that as I expected a worse outlook.

Moreover, the following comment hit the nail on the head. Demand is truly fantastic. According to CEO John May:

As I look ahead to fiscal year 2023 and beyond, I truly believe our best years are still ahead of us. In the near term, order books across our businesses are full into the third quarter. And it’s important to note that not only do the order books continue to fill when we open them, but the velocity of orders has remained strong. We opened North American combined EOP back in August. Like our crop care EOP, it was on an allocations but it filled in two months. That’s noteworthy because we normally have the EOP open for five to six months. And since our order books are still on allocation for retail sales, we have yet to begin replenishing dealer inventory.

May also is extremely positive when it comes to new technologies that will allow customers to produce even more efficiently.

Valuation

Deere is up more than 5% while I’m writing this. That’s a well-deserved price movement due to everything we just discussed. However, it doesn’t make the valuation more attractive – obviously.

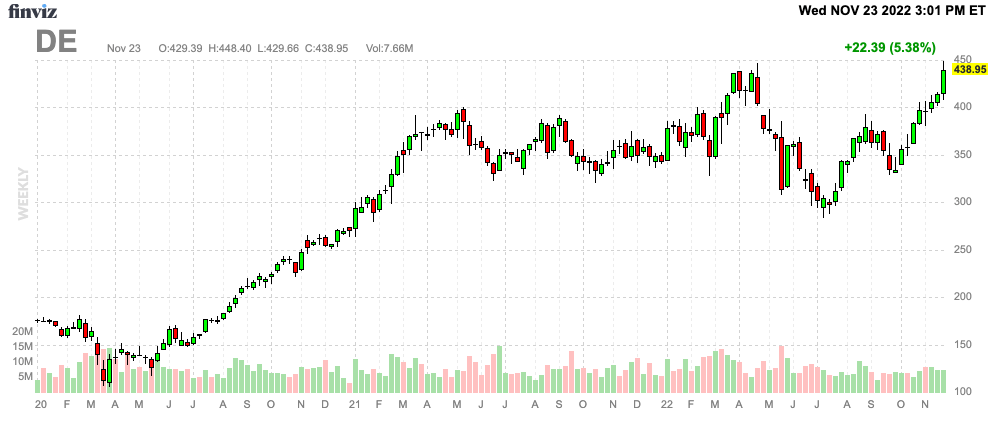

FINVIZ

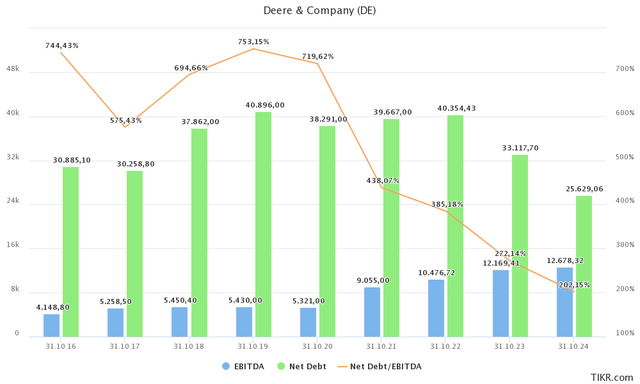

The company is trading at 13.8x 2023E EBITDA of $12.2 billion. That’s based on its $168.4 billion enterprise value, consisting of its $132.4 billion market cap, $33.1 billion in 2023E net debt, and $2.9 billion in pension-related liabilities. Note that net debt is expected to decline to 2.7x EBITDA. The company has an A2 credit rating.

TIKR.com

With that said, I stick to my long-term price targets. I believe that Deere should be trading at a market cap of $182 billion. For now, that’s my 2024 (year-end) target.

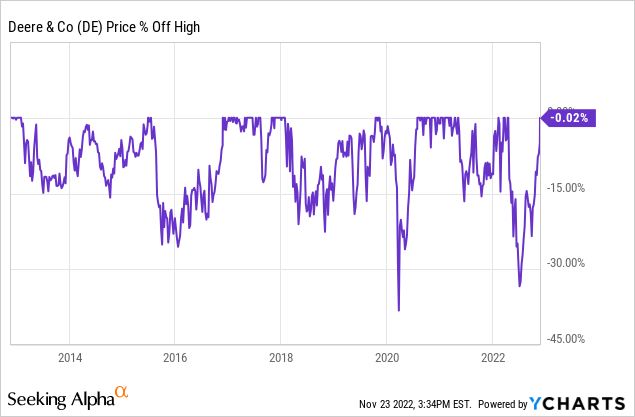

However, I hope for a 10%-15% stock price pullback before I add to my position. That’s based on elevated general economic risks and the fact that I never buy stocks during a rally.

Moreover, Deere has a history of buyable pullbacks during bull markets.

Takeaway

In this article, I reiterated my bullish thesis for Deere & Company. The agriculture equipment manufacturer benefits even more from industry tailwinds than I expected. Its order books are filled and rising faster than the company can turn orders into finished equipment.

Moreover, strength is expected to last and likely to more than offset headwinds caused by slowing general macroeconomic conditions and ongoing supply chain issues.

The company has made tremendous progress when it comes to sourcing supplies, allowing management to report a steep increase in margins. I expect this to continue as supply chain bottlenecks continue to ease.

Also, the company is outperforming its peers when it comes to retail sales. I expect this to last as well as DE has cutting-edge technologies and a bigger footprint in the strongest areas of the industry.

Long story short, I remain very bullish on Deere. I will use any pullbacks to add to my position.

(Dis)agree? Let me know in the comments!

Be the first to comment