AndreyPopov/iStock via Getty Images

Introduction

In 2022, monday.com Ltd. (NASDAQ:MNDY) has fallen 68 percent due to macroeconomic headwinds (particularly the strong USD) and continued unprofitability. High-growth companies have underperformed the market this year as the Federal Reserve raises interest rates, causing valuations to contract, especially for companies that aren’t turning a profit.

Despite the ongoing challenges, MNDY continues to march towards profitability by demonstrating strong revenue growth compared to cash burn. We believe MNDY is a “BUY” as the worst of the macro storm is behind us, and they have continued their streak of beating 4 straight earnings estimates.

Company Overview

monday.com Ltd. is a Tel Aviv-based software company that offers product solutions for marketing, CRM, software development, and other B2B services. The business seeks to change the way that people work and businesses operate. MNDY IPO’d in mid-2021 as the business rapidly grew:

– 2020 Revenue: $161M

– 2021 Revenue: $309B

– 2022 Projected Revenue: $510M

– 2023 Projected Revenue: $663M

monday.com offers three main products via a subscription-based SaaS (Software as a Service) model:

– monday sales CRM: contact management, sales pipeline, performance tracking, email sync

– monday work management: project management, marketing projects, design planning

– monday dev: roadmap planning, feature backlog, bug tracking, feedback management

They market and sell their products to businesses of all types, serving teams in 200+ countries and 200+ business industries. MNDY targets a total addressable market (“TAM”) of $56B, comprised of the following areas: CRM, marketing campaign and management, project management, collaborative applications, and software development.

Earnings Analysis

On November 14th, MNDY released its Q3 2022 earnings report. Revenue for the quarter came in 65% higher than a year ago at $136.9M, helping the firm decrease its net loss from -$28M in 3Q2021 to -$23M this year. EPS improved from $-0.26 to $0.05, an unexpected profit and beat.

Co-CEOs Roy Mann and Eran Zinman were optimistic in the announcement, guiding for the rest of FY22 to revenue of $511M, above the consensus of $501M.

Sound Fundamentals

The company is focused on improving its upmarket expansion, and they continue to succeed. As of Q3 2022, they posted 116% YoY growth in the number of enterprise customers with more than $50K ARR. This metric displays the fundamental value-add they provide by focusing on security, control, and governance, which drives new enterprise deals and expansion.

For software application firms, a crucial part of the growth story is retention. monday.com shines in this area, posting 4 straight quarters of >135% net dollar retention rate among customers with 10+ users and >120% for all customers.

Annual expenses continue to trend downward as a percent of revenue, displaying quality operating leverage management while investing in growth.

Valuation

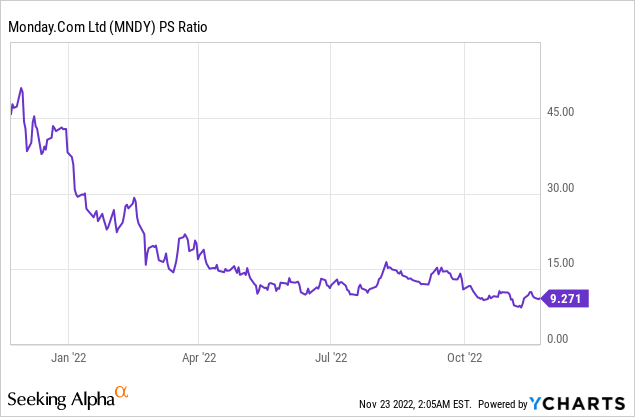

MNDY currently trades at just a 9.39x P/S ratio, which is a historical low for a SaaS company with so much growth potential.

Yahoo Finance

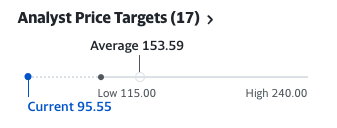

Wall Street analysts remain optimistic about the stock as well, with an average price target of $153.59. Following the Q3 earnings report, both Goldman Sachs and Credit Suisse have maintained their bullish ratings on MNDY stock.

Risk

Macro headwinds continue to plague the global financial markets as the Federal Reserve tightens economic conditions. The rate hikes we’ve seen this year have compressed growth stock valuations across the board, and it’s challenging to believe that we’ll see rate cuts any time soon. Further, if the Fed’s war on inflation results in a deep recession, MNDY’s earnings growth could slow or miss projections.

Finally, MNDY primarily serves customers outside of the U.S. The strong U.S. dollar has negatively impacted results and continues to challenge revenue growth. If the dollar’s strength doesn’t abate, MNDY’s customers may have to pull back on spending. A valuation re-pricing would then be likely, which is dangerous for a growth stock already facing increased costs of capital.

ESG

Being a SaaS company, the security of customers’ data has been a priority for MNDY. Its security measures have attained rigorous certifications, and the company conducts annual security audits and penetration tests. In its operating history, MNDY has only seen one data breach, which was not the fault of MNDY systems but a result of a breach from a third-party SaaS provider. MNDY responded quickly, and no customer Personally Identifiable Information (PPI) was tampered with.

The company also seems to foster a great working environment, with 97% of employees saying “it’s a great place to work.” It has been recognized in Fortune Best Workplaces since 2021. To accommodate employees, MNDY has resource groups for underrepresented groups within the company. It also provides an anonymous hotline for employees to bring up concerns. Finally, to retain employees in such a competitive industry, it has implemented a Personal Development and Growth program. All of these efforts have put the company turnover rate at just 17%, below the average tech turnover rate.

Should You Buy?

Despite MNDY stock being obliterated this year, management is confident in its ability to continue growing while managing expense rates. We believe the market is oversold on monday.com Ltd., as the company is suffering only from temporary headwinds. Its fundamental business has shown resilience and its valuation is trading at a bargain. For those reasons, we place a “Buy” rating on monday.com Ltd.

Be the first to comment