anilakkus

The supposedly disastrous real estate crisis that many market observers have been anticipating since the beginning of the year has failed to materialize. And we remain skeptical that U.S. housing market prices would see anything more than a 10% correction in 2023, let alone a crisis. What remains puzzling to us, is the extraordinary confidence exuded by the bears that U.S. homebuilders are bound to suffer heavy losses. The pessimism is so perverse that few are willing to invest in homebuilders even at deeply discounted valuations of just 4.9x TTM P/E with 30% ROEs.

This article investigates the common arguments backing up these doomsday scenarios and reveals how misguided the bears have been. We also highlight how the overwhelming pessimism is likely mainly driven by haunting memories of past housing market bubbles, rather than any real evidence of a crisis.

How Has The U.S. Housing Market Really Performed?

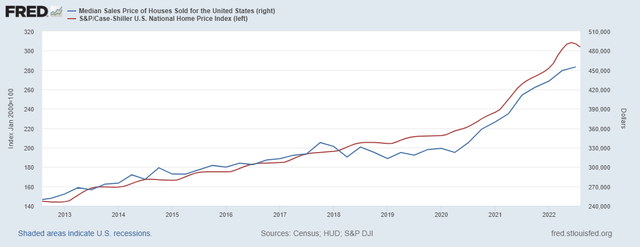

Let’s begin by establishing the facts on how the U.S. housing market has performed. The chart below shows two of the most commonly referenced datasets for home prices: median sale prices of houses sold in the U.S. published by the Census Bureau, and the S&P/Case-Shiller U.S National Home Price Index. Based on the former, median home prices in the U.S. have risen consecutively over the last nine quarters ending in Q3 2022. Monthly data indicate that median home prices increased by 7.99% in September from August, but decreased by 1.92% compared to July. Based on the S&P/Case-Shiller Index, the latest available data show U.S. home prices decreased by 1.51% in August compared to June. On a year-to-date basis, median home prices are still up around 6% to 14% depending on which dataset is used.

fred.stlouisfed.org, Census, HUD, S&P DJI

Some may argue that the past and present are irrelevant to investors and that it is the future outlook for the housing market that should determine current share prices for homebuilders. We completely agree. But even the latest forecasts for home prices for 2023 seem rather benign. According to Goldman Sachs, home prices are expected to decline by around 5% to 10% from the peak in June. Morgan Stanley is expecting home prices to decline by 4.0%. Even one of the most bearish reports on the housing market published by Wells Fargo sees home prices declining by just 5.5% in 2023.

Ignore Home Prices. How About Home Sales?

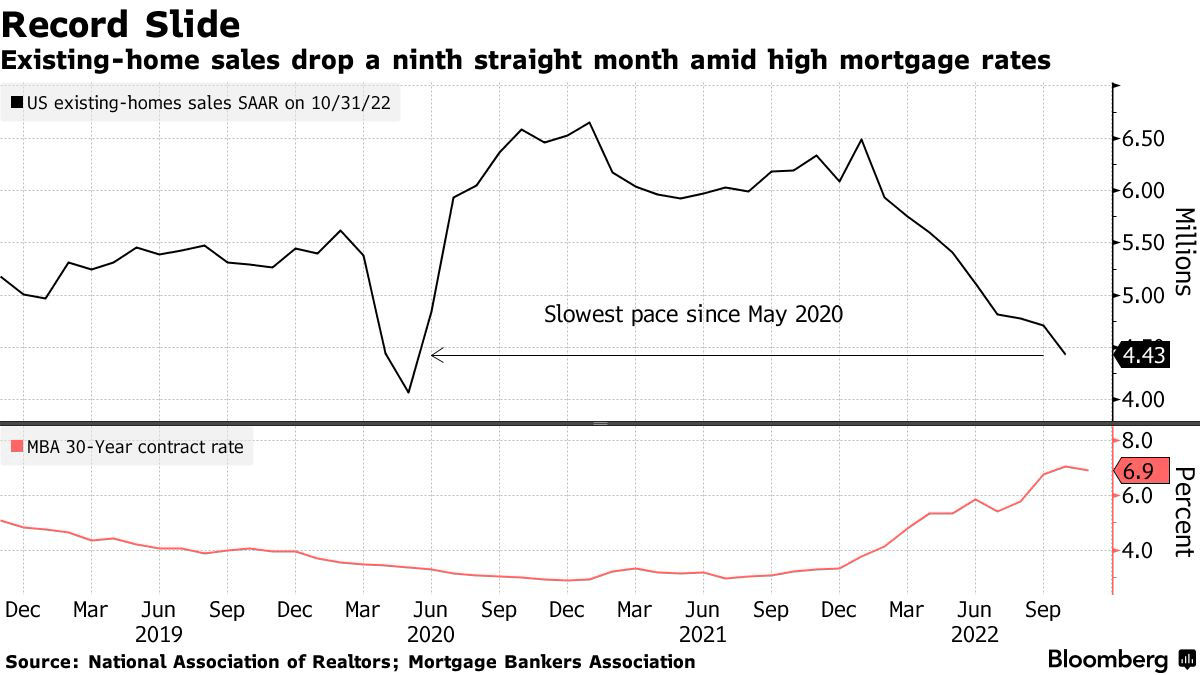

This is where the doomsayers all point to as one of the biggest red flags for a housing crisis. Existing home sales have fallen sharply to the slowest pace since 2020, and rightly so given that 30-year mortgage rates briefly crossed 7% in late October. Not only are homebuilders seeing a pullback in demand due to declining affordability and high mortgage rates, but new listings have also fallen by 24% year-on-year in October according to a recent report published by Zillow.

Bloomberg

On the surface, these numbers simply look horrible. However, it is crucial to understand the underlying factors driving the data, and we argue that the current housing market environment does differ substantially compared to previous downturns.

Weak U.S. home sales do not necessarily imply that home prices will crash or even see anything more than a 10% correction in our view. Astute investors would be suspicious of financial media reports that only compare current home sales to 2020 figures and not further back in 2009 when home prices did indeed crash.

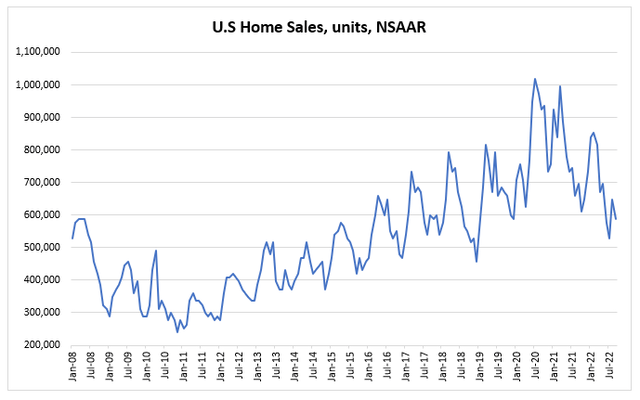

As the below chart shows, current home sales levels are actually broadly in line with the historical uptrend since 2009. In fact, weak 2020 sales during the height of the pandemic were partly responsible for the pent-up demand that created the housing boom in 2021. And given that substantially more homes were sold in 2021 relative to the long-term trend, it is normal to expect home sales to cool even without mortgage rates running at 7%.

Stratos Capital Partners, U.S Census Bureau

We should indeed be expecting the slowdown in home sales to be much worse, but this does not necessarily mean homebuilders are in deep trouble. Even with home sales falling, we believe that home prices will remain resilient due to two key factors.

Firstly, higher mortgage rates are not the only factor explaining the decline in home sales. Pessimism over the economy and lower affordability are important factors too. With the financial news headlines constantly highlighting doomsday scenarios such as stagflation, economic hurricanes, housing bubble, and even world war 3, it makes sense that buyers may choose to delay buying a new home. Lower affordability may also be encouraging existing homeowners to refurbish their homes instead of buying a new home, and for young couples to choose to live with their parents longer.

But these reasons only create pent-up demand, which ultimately drives prices even higher. Pent-up demand due to lower affordability essentially creates a floor on home prices, which is a common phenomenon across the developed world. Should home prices correct even moderately, a wave of buyers would be ready to pounce on the opportunity to secure a home.

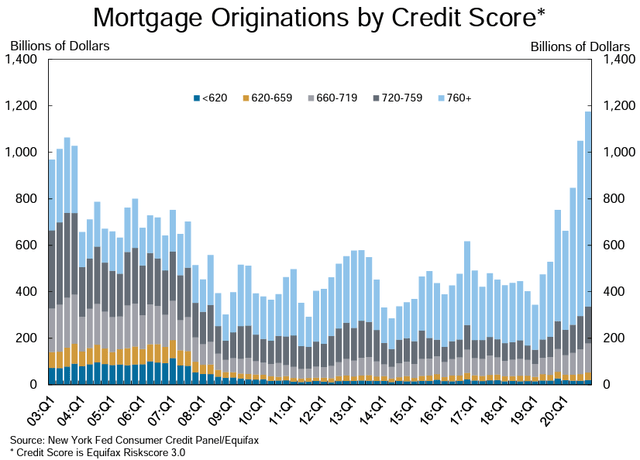

Secondly, new listings have fallen because many homeowners who have previously locked in 30-year mortgage rates at under 3% are unwilling to sell their existing homes to upgrade to a larger one. We would be more concerned if the decline in listings were due to homeowners pulling out of the market entirely because they were unable to secure a sale without heavily discounting the sale price. The present environment certainly does not suggest that homeowners are at risk of being forced to sell their homes at a loss due to foreclosures that resemble the 2008 crisis. The vast majority of homeowners are actually sitting on pretty strong home equity gains due to the steady rise in home prices over the years. Furthermore, current home mortgages are also backed by much stronger credit scores compared to 2008.

Homebuilders Are Priced At A Heavy “Fear Discount”

We do not deny the fact that the U.S. housing market is in a downturn, at least in terms of sales but not so much in terms of price. Our base case for 2023 sees a relatively mild downturn with further declines in home sales, but for overall home prices to fall by just 5% from current levels. Overall, we just don’t see earnings turning negative for leading homebuilders such as D.R. Horton (DHI) and Lennar Corporation (LEN). We published an article on October 18 featuring DHI as our favorite deep value pick among homebuilders.

In terms of valuations, we note that leading homebuilders such as DHI are in good shape to weather a much larger downturn. With TTM EBITDA margins of 23% and gross margins of 30%, we see room for DHI to price more competitively if needed. Besides, home prices are still up 6% to 14% year-to-date. This means that the unsold inventory of completed homes held by homebuilders is still sitting on positive year-to-date gains. Home prices will likely have to fall by more than 10% to 15% before we see a material impact on EPS.

Homebuilders across the board are trading at a deep “fear discount” with DHI and LEN specifically trading at around just 4.9x TTM P/E. Even if we force a bearish case for earnings to crash by 50%, DHI would still trade at just 10x P/E.

In Conclusion

We reiterate our bullish view on deep-value U.S. homebuilders and maintain our “Strong Buy” rating on DHI. For better diversification, investors may also consider adding exposure to homebuilders more broadly through the iShares U.S. Home Construction ETF (ITB) or the SPDR Homebuilders ETF (NYSEARCA:XHB).

XHB in particular has both DHI and LEN as their top two holdings, which we think will outperform the broader market due to their deeply discounted valuations.

We initiate our coverage of XHB with a “Buy” rating.

Be the first to comment