Arand/E+ via Getty Images

Investment Thesis

Bayerische Motoren Werke (OTCPK:BMWYY) has had a tough couple of years. However, smart capex combined with a strong brand image and history of producing market-leading vehicles place the company in the perfect position for a return to form.

Their continued investments into electrifying their line-up of vehicles proves to drive significant revenues for the company while helping to maintain their valuable brand in a positive light.

Nevertheless, current market conditions leave the company facing rising production costs in all aspects of their operations. While strong demand forecast for the close of FY2022 should help drive a record year of revenues, deliveries are expected to remain slightly below their 2021 numbers.

This leaves the company and their stock in a difficult situation as the absolutely bargain price point for shares is shrouded by uncertainty and general bearish tendencies due to prevailing macroeconomic market conditions.

Company Background

BMW is a premium German automaker known primarily for their sporty luxury automobiles and motorcycles. They are headquartered in Munich, Germany. Their primary competitors are the likes of Mercedes-Benz, Audi and Lexus.

BMW Investor Presentation, 2016

BMW’s primary business strategy is to maintain a premium brand image among consumers to ensure they can charge superior prices for their products. The extensive product portfolio of the BMW Group which includes brands such as BMW, Mini and Rolls-Royce allows the company to engage with several segments of the high-end automotive marketplace thus diversifying their reach and increasing brand penetration.

While brand strength is a hugely important element to BMW’s success, their prowess on the technological-side of automotive manufacturing is undeniable. Across the board BMW has proven they manufacture high-quality vehicles which drive an exceptional level of customer satisfaction.

Simultaneously, they have a proven track record of creating reliable cars and motorcycles with market-leading powertrains (both in terms of efficiency and power) being a hallmark of BMW vehicles.

Nonetheless, BMW is not immune to the cyclical and highly competitive environment that is the global automotive industry. The constant threat of new entrants combined with continuously variable consumer tastes poses a huge challenge for any automaker. BMW must continue to innovate and upkeep their favorable image to ensure future profits and growth can be achieved.

The current electric vehicle (EV) revolution taking place in the auto industry places increased pressures BMW as the radical shift towards an entirely new form of propulsion requires significant amounts of costly research & development ((R&D)).

Economic Moat – In Depth Analysis

The primary drivers for BMW’s economic moat are their extensive portfolio of intangible assets and the valuable technological intellectual property (IP) they have with regards to automotive technologies.

BMW has curated a high-end and sporty image for their “BMW” range of automobiles. Their no-nonsense naming scheme allows customers to easily identify the model and drivetrain present in any given vehicle. By maintaining the same numerical model identifiers for decades (such as the 3-series or 5-series of vehicles), BMW has generated significant familiarity among consumers.

This has allowed BMW to become one of the most identifiable automotive brands in the world. Furthermore, by consistently maintaining their performance-oriented models under the famous “M” branding, their SUVs under the “X” insignia and the open-air sports cars using the “Z” identifier, BMW manages to maintain a clear and organized product portfolio.

The company is also acutely aware of the current paradigm shift towards electrification in the auto industry and was one of the first automakers to enter the EV market with their “I” line-up of cars in 2013. BMW’s entire ethos moving forward revolves around combining “sports with ecology” to ensure their product range stays relevant with increasingly ‘greening’ consumer tastes.

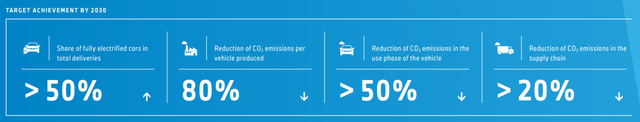

BMW has also made significant strides and commitments to reducing carbon emissions in the production and supply networks for their products by up to 80% by 2030.

This consumer popularity is highlighted by the historic and present prominence of BMW Group cars in the top spots of JD Powers APEAL consumer satisfaction surveys. The primary drivers of customer satisfaction lie in the vehicles feeling premium in quality, a pleasure to drive and packed with useful technological features.

The other main source of economic moat for BMW comes from this aforementioned technological knowhow. BMW consistently produces drivetrains and power units which top the competition both in fuel consumption and performance metrics. Their B58 Petrol/Hybrid engine won both the Ward Auto – Best Engine award along with the International Engine of The Year Award in 2020.

Multiple auto magazines such as Auto Bild rate BMW vehicles incredibly highly with particular note given to the reliability and exceptional driving characteristics of the vehicles. BMW has also featured on numerous occasions in the JD Power Initial Quality Survey.

The intellectual property the BMW Group is able to generate from their R&D facilities is quite clearly market leading. I believe this gives the automaker a genuine competitive edge over the competition. BMW are masters at driving innovation (currently the electrification of vehicles) in a direction which pleases consumer tastes and corporate targets.

However, BMW is still engaged in the global automotive manufacturing industry. This means they are subject to customers who have continuously changing tastes.

While BMW customers exhibit high levels of brand loyalty towards the automaker, the truth is that essentially non-existent consumer switching costs means customers can just as quickly buy a Mercedes-Benz (OTCPK:MBGAF) or Audi as they could a BMW.

I believe BMW has a sizable economic moat relative to other automakers thanks to their excellent brand management and genuine technological advantage over the competition.

Nevertheless, it is prudent to remember how quickly consumer tastes and preferences can change, especially with regards to luxury goods which are often viewed as trends.

Financial Situation

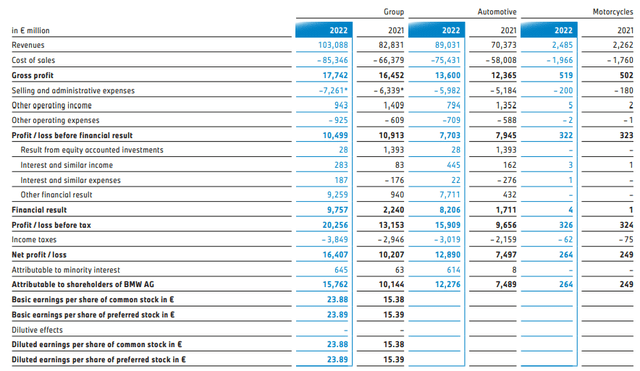

BMW has had a remarkably profitable history, especially given the general trends in the automotive sector. From an income statement perspective, the company remains a profitability powerhouse delivering consistent year-on-year revenues topping $95.8B in 2021. For the period of January 1 2022 to September 30, BMW Group experienced revenues of $103B compared to only $82.8B in the same period in 2021. This 24% increase in group revenues is complemented by a growth in net profits by 60% growing to $16.4B at the end of Q3 in 2022.

This healthy and continued growth on the income statement has resulted in their TTM ROIC growing to a historically high 22%. Their 5Y average ROIC is 11.78%, which while not stellar, does not illustrate the full picture of BMW’s situation. Since 2019 their operating margins have grown significantly from just 7.26% to 12.09% in 2021.

These increased revenues and margins primarily resulted from an overall increase in total income from the sale of their automobiles and motorbikes which remained strong despite an overall contraction of 9.9% in the number of total vehicle sales in the first three quarters of 2022.

Nonetheless, BMW forecasts an increase in deliveries in the fourth quarter, compared to the third quarter of 2022. BMW expects deliveries for the full year to still be slightly lower than in 2021, although sales of fully-electric vehicles should double compare to 2021. This is expected as BMW continues to expand their EV product portfolio.

However, BMW’s COGS for the same period in 2022 grew by 28% particularly due to an increase in manufacturing costs for their vehicles. This means that overall, the profitability of their automotive manufacturing segment has decreased in 2022 compared to 2021.

The reason BMW has managed to maintain such a healthy net profit in 2022 stems from the revenues they earn from their financial segment, BMW Finance. Credit losses remained at a historically low level for the firm. At the same time, earnings benefited greatly from the high remarketing proceeds generated from lease returns, particularly in the US and European markets.

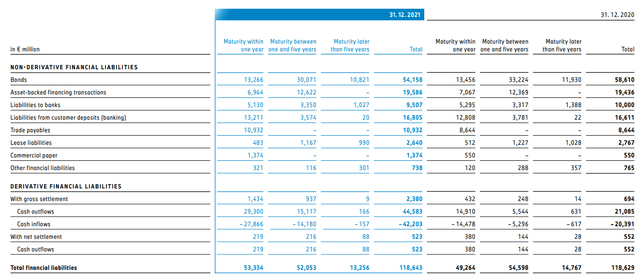

From a balance sheet perspective, BMW looks to be in healthy shape. Their total current assets since January 1, 2022 to September 30, 2022 amount to $260B while their total liabilities only total $154B. BMW has a respectable quick ratio of 0.79 (current assets – inventory divided by current liabilities). Their current ratio is an even stronger 1.14 (current assets divided by current liabilities). Therefore, it is safe to say BMW is not struggling with any major liquidity risks in its current financial situation.

Most of BMW’s long-term liabilities exist as non-derivative financial instruments. Bonds take up the top spot with a significant portion consisting of liabilities to banks and to consumer respectively. BMW fails to describe the true nature of their long-term debt structuring, apart from stating that around $630M in cashflow may be compromised in 2022 by currency exchange losses. However, they do illustrate that within the next year, only $53M in debt will be maturing, with a further $52M maturing between now and the next five years.

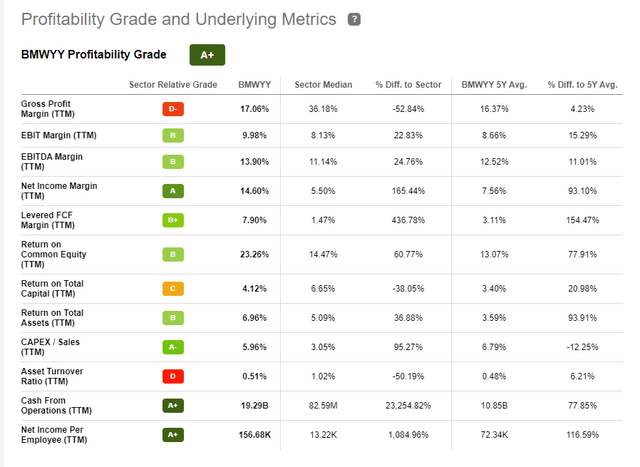

Seeking Alpha BMWYY Profitability

Seeking Alpha’s Quant assigns BMW with a profitability grade of “A+” which I believe is representative of the cash flow and general value generation abilities of the company.

Cash flow from operations for BMW Group amounted to $18B in 2021, with the past TTM totaling $19.2B. In 2021, BMW spent over 41.6% of operating cash flows on capital expenditures. In the past TTM, BMW has spent $7.6B on capex, with $1.7B being dedicated towards the construction of new manufacturing and assembly facilities in South Carolina.

The firm continues to invest heavily in R&D with spending over the past nine months increasing to $4.8B as they seek to develop market-leading EV technologies. I believe these strategic capital expenditures will absolutely allow BMW to take full advantage of the EV revolution and remain a step ahead of the competition.

BMW has also achieved a Q3 GAAP EPS of $4.25 which is much welcomed news for shareholders. This EPS growth has been bolstered by a significant increase in demand in September for their cars.

The consolidation of BBA into the BMW Group (completed on February 11) has also provided an additional $89M in revenues from their new EV production facilities over the past nine months. BMW has reinvested $4.8M into enhancing the capabilities of these Chinese manufacturing facilities.

Valuation

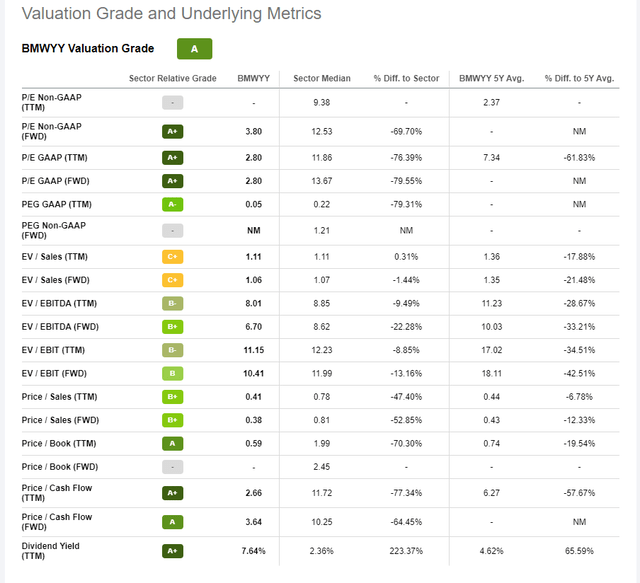

Seeking Alpha BMWYY Valuation Grade

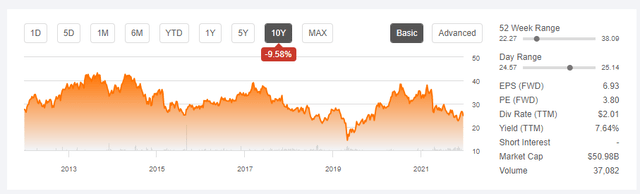

Seeking Alpha’s quant system has assigned an “A” Valuation rating for BMW, which I am largely inclined to agree with. Their FWD P/E GAAP of 2.80 is outstanding, especially considering a sector median of 13.67 and a 5Y average of 7.34. This is supported by a FWD EV/EBITDA of 6.70 compared to a historical 5Y average of 10.03 and a sector median of 8.62. Equally, their Price/Cash Flow FWD multiple is only 3.64 compared to 10.25 as a sector median.

I believe these metrics illustrate that BMW is currently trading at prices well below its intrinsic market value.

Their significantly increased GAAP Q3 EPS along with a proven cash flow generating ability suggest that the BMW Group continues to outperform the auto industry as a whole.

In the short term (3-10 months) it is difficult to say what the stock will do. I believe the stock price may still exhibit some bearish tendencies due to the difficult macroeconomic environment. However, strong demand in September and the much-awaited Q4 and FY2022 reports should bring a boost to the share price if results are as positive as we are expecting.

In the long-term (2-4 years) their strong position as a market leader combined with an efficiency-focused operations model should allow the automaker’s stock to rise back towards a price-point which better reflects its intrinsic value.

If the share price falls another $3-$5, it would in my opinion firmly place the firm in a deep-value position making it an attractive possibility for long-position oriented investors.

Risks Facing BMW

The primary risks for FedEx arise primarily from the highly cyclical industry in which it operates as well as from fierce industry competition. A quick look at BMW’s stock price illustrates the predictably cyclical nature of the industry which largely depends upon the prevailing macroeconomic conditions present in the marketplace. Careful consideration of global economic factors is critical when investing in the auto industry.

If we consider the current nature of the cycle, I believe we are beginning to near the bottom of the crash. This is supported if we look at the historic share prices for BMW and especially when we look at the trends over the previous 10 years.

Equally, from an ESG perspective, BMW has a relatively high exposure towards changing government legislations and social demands regarding the production of carbon emissions. The threat of ever tightening emissions regulations by governments creates a difficult situation for all automakers as they race to produce EV’s and hybrid-powertrains.

While this absolutely poses a threat to BMW’s profit generation strategies, I believe the company is in a position better than most to comply with these government regulations. Furthermore, their extensive and market leading expansions into EV’s along with strong consumer demand for these products should allow the firm to efficiently and effectively capture the attention of customers in this growing market segment.

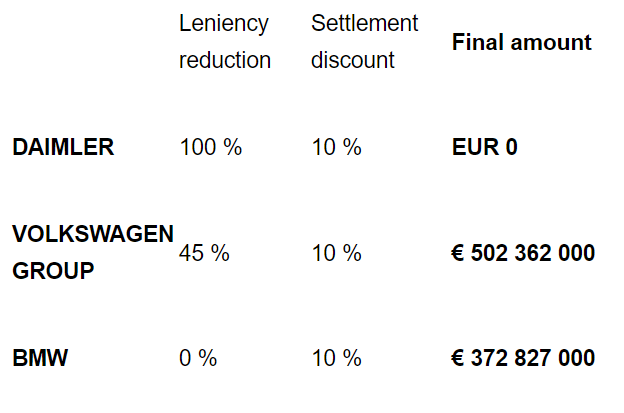

European Commission Press Release – Antitrust Case

The other factor still creating risk and uncertainty for BMW lies from its inclusion in the infamous EU “diesel gate” anti-trust investigation. They potentially face a significant fine for their business reporting malpractices with regards to the manner in which AdBlue (a urea-based liquid injected into diesel engines combustion chambers to decrease harmful NOX emissions. The EU imposed a fine of €372M against BMW.

The primary uncertainty which arises from this against BMW is the potential lack of business ethics present at the firm. However, BMW has illustrated an undeniable dedication towards electrification since these events. Furthermore, the EU noted that BMW’s offences were significantly less severe than those of others such as the Volkswagen Group (OTCPK:VWAGY). Therefore, I believe this saga should no longer severely affect BMW’s operations.

Summary

BMW has not had a great couple of years leading-up to 2022. However, solid business fundamentals, smart capital expenditure and a new focus on efficiency have allowed the company to grow significantly while remaining profitable throughout. In my opinion, share prices are yet to reflect the value generated by the group.

As a short-term investment, I believe there is still some volatility for the stock as uncertainty surrounds supply chain costs and potential future demand-side headwinds due to inflationary market pressures. However, in the long-term I believe their undeniable position as a market leader in the automotive segment combined with exceptional brand strength place BMW in the perfect position for a much-awaited rebound.

I will carefully be watching the stock for the next couple of months as I believe share prices are reaching the end of their current bearish tendencies. If the goal is to increase portfolio exposure towards the automotive sector, I see BMW as a potentially attractive choice.

Be the first to comment