Justin Sullivan/Getty Images News

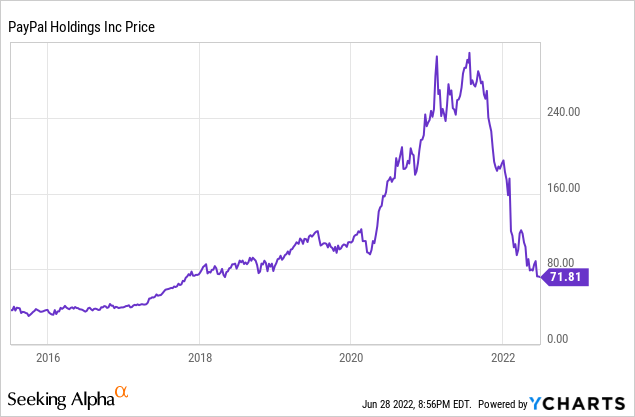

Investment Thesis

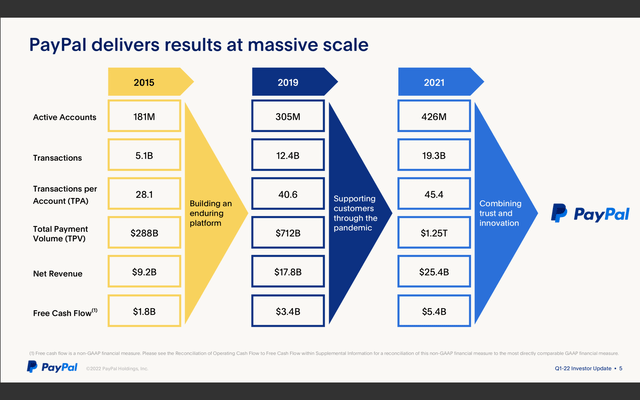

PayPal (NASDAQ:PYPL) had been one of the best compounders since its spin-off from eBay (EBAY) back in 2015. The company’s stock price took off in 2020 as the pandemic significantly accelerated the adoption of online payments and e-commerce. However, the company had been performing badly since last November as investors are now starting to get concerned about slowing growth. Shares are now down almost 80% from their all-time high, trading at $71.82. I believe the adoption of fintech and e-commerce will continue, though at a slower rate. The company’s fundamental remains solid and the valuation is now quite compelling. However, the current uncertainty regarding the macro environment will likely pose further temporary headwinds on the company’s performance. Therefore, I rate the company as a hold and will upgrade it to a buy once we get more visibility on the macro end.

Secular Tailwinds

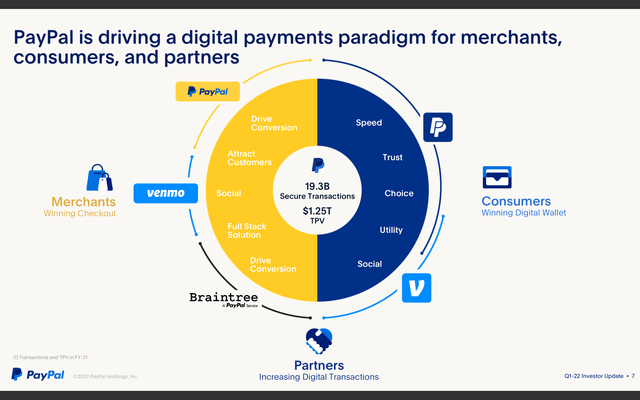

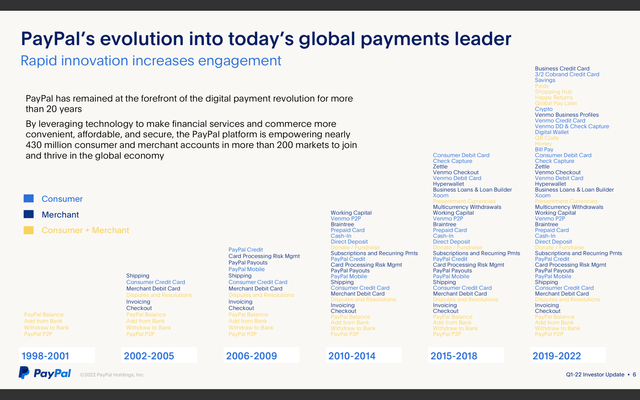

The adoption of fintech is continuing as we move to a cashless age. PayPal is right in the center of this shift with its full suite of offerings. The company offers services like payment processing, peer-to-peer transfer, invoicing, and more. It is also keeping up with the latest trends by offering products like BNPL (buy now pay later) and crypto purchases. It has an ambition of becoming the one-stop shop for fintech where it is able to fulfill all user’s financial needs in one app.

The TAM (total addressable market) for fintech is huge. According to Vantage Market Research, the fintech market size is forecasted to grow from $112.5 billion to $332.5 billion by 2028, representing a CAGR (compounded annual growth rate) of 19.8%. This is largely driven by other major trends like the shift from in-person retail to e-commerce. According to Grand View Research, the global e-commerce market is estimated to grow at a CAGR of 14.7% from 2020 to 2027. I believe there are still a lot of opportunities for PayPal to capture as consumer behaviors continue to shift.

Strong Ecosystem

There are a lot of discussions about the moat of PayPal and I believe its market share is the moat. According to Statista, PayPal owns around 50% of the software payment processing market with Stripe being second at around 15%. People often compare Block (SQ) to PayPal but their core business focuses on different segments. Block focuses mainly on its POS (point of sale) system for SMBs and Cash App. Whereas PayPal is mainly an online payment solution that helps businesses and customers to transact online. The area where Block and PayPal compete is mostly in the C2C segment which is Cash App and Venmo. Besides, Block is currently only available in North America, Europe, and Japan while PayPal is available almost worldwide.

PayPal is also actively seeking to expand its offering, especially on the consumer side as it is trying to build an all-in-one fintech app. The company introduced its own BNPL feature to keep up with the latest trend. Its BNPL TPV (total payment volume) has already exceeded $8 billion annually. It also expanded its cryptocurrency product offerings. Users are now able to buy, hold, and sell cryptocurrency. It also rolled out Cash Back to Crypto, a new way for Venmo Credit Card customers to automatically purchase cryptocurrency from their Venmo account using cashback earned from their card purchases. It is also launching a high-yield savings account and is planning to offer a trading platform in the future too. It also acquired Japan’s leading buy now pay later company Paidy for $2.7 billion which massively increases the company’s Asia’s presence by adding 3 million users with a GMV (gross merchandising volume) of $1.5 billion. PayPal is now offering a full suite of products and a comprehensive ecosystem that competitors are hard to rival with.

Financials and Valuation

PayPal’s first-quarter result was very underwhelming. It reported revenue of $6.5 billion, up 8% YoY (year over year) from $6 billion. Excluding eBay, revenue grew 15%. Despite softness in revenue growth, the company continues to show decent growth on TPV (total payment volume), which increased 13% from $285 billion to $323 billion. This is driven by the increase in payment transactions, which is up 18% from 4.4 billion to 5.3 billion. The company also added 2.4 million net new accounts in the quarter. Venmo is continuing its strong growth with revenue up approximately 60% while volume is up 12%. Total Venmo accounts are now over 85 million. The integration with Amazon (AMZN) is also likely to continue to boost Venmo’s growth. PayPal now expects FY22 revenue growth to be 11%–13%, TPV growth to be around 14%, and non-GAAP EPS to be between $3.81-$3.93.

Unlike the top line, profitability is showing signs of weakness. Non-GAAP EPS for the quarter was $0.88, down from $1.22 a year ago. Operating cash flow also decreased 29% YoY from $1.88 billion to $1.2 billion. This is largely attributed to the integration of newly acquired businesses and the suspension of transactions in Russia. PayPal’s balance sheet remains very strong, with $15.1 billion in cash and $9.2 billion in debt. This gives the company enough liquidity for stock buybacks or other M&A activities.

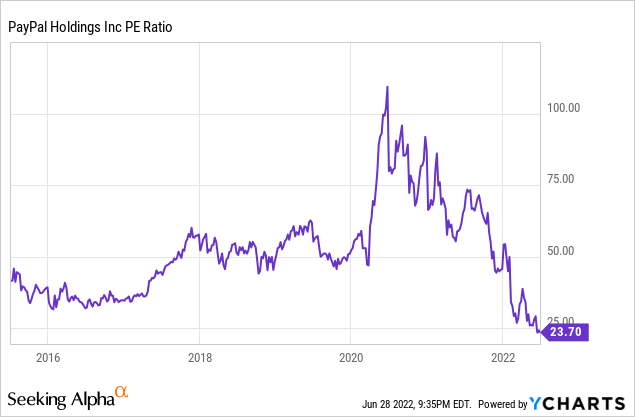

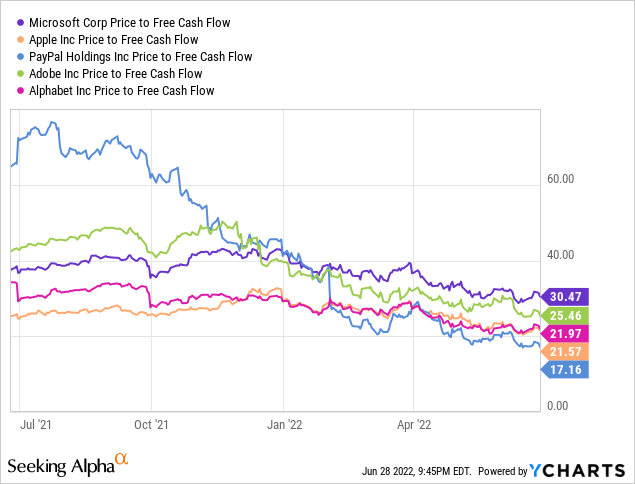

After the massive drop in share price, PayPal is now trading at a much more compelling valuation. The current price implies a P/E ratio of 23.7 and a price to FCF ratio of 17.2. From the chart below, you can see that this is the lowest valuation since its IPO. Despite a slowdown this year, according to Seeking Alpha’s analyst estimate, the company is forecasted to post a 20%+ growth in EPS and a 14%+ growth in revenue from FY23–FY25. This is in line with the company’s historical growth. It is also now trading at a discount compared to other large-cap tech companies. From the second chart, you can see that PayPal is cheaply valued on a price-to-FCF basis when compared to the likes of Microsoft (MSFT), Google (GOOG) (GOOGL), and Apple (AAPL). Technology Select Sector SPDR ETF (XLK), another benchmark for tech companies, is now trading at a P/E ratio of 25.1, or a 6% premium compared to PayPal. I believe PayPal’s valuation got ahead of itself with shares trading at a P/E ratio of over 100x, but now with a P/E ratio of 23.7, while revenue growth remains solid, I believe the company’s valuation is quite compelling.

Macro Headwinds

The macro-environment has been very unstable in recent months. The inflation rate remains at high levels while the economy is weakening. There is also a possibility that a recession may happen later in the year. We are already seeing signs of cracks with companies like Coinbase Global (COIN) laying off employees and Target (TGT) lowering guidance. The turbulence is likely to continue which will post significant headwinds on PayPal. It is very exposed to the macro economic factors as it relies heavily on the TPV from consumer spending. As inflation persists, consumers are likely to save more and spend on essentials rather than discretionary items. The higher interest rate and QT (quantitative tightening) used to tackle inflation will cause a shrink in liquidity. A weakening economy will also significantly reduce overall spending with unemployment rising.

Daniel Schulman, CEO, on macro outlook:

I would like to now discuss our outlook for Q2 and the year. While we are pleased that we delivered Q1 with a beat on revenue and EPS, 2022 remains another challenging year to forecast. In laying out our 2022 outlook several months ago, we noted that if macro pressures persisted, we would trend towards the lower end of our range.

Conclusion

In conclusion, I believe PayPal is a hold for now. The company’s fundamentals remain intact as it is actively growing its product offerings like BNPL and crypto to attract new users and improve engagement rates from existing users. It is also making strategic acquisitions to increase its presence in overseas markets. The rising adoption of fintech and e-commerce will continue to provide secular tailwinds for the company in the long run. The company is also now trading at a historically low valuation while forecasted to post decent growth for the next few years. However, the heavy headwinds from the macro economy are likely to weigh on earnings in the short run. If earnings were to decrease, we will see a rise in P/E which causes a re-rating on valuation. Therefore I believe the company is a hold until the economy starts to show signs of stability and trend upwards.

Be the first to comment