grinvalds

Thesis

Health Sciences Trust (NYSE:BME) is a closed end fund focused on healthcare equities. The fund’s objective is total return, which includes a combination of current income and capital gains. As per the fund’s literature:

The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

Currently 35% of the portfolio is overwritten with call options. The vehicle has robust long term returns and is currently trading with a 2% premium to NAV. The fund has posted performances which are in line with the SPDR Healthcare ETF (XLV) on a year to date and 5-year time frames. BME at the end of the day is purely a tool to extract dividends from the healthcare equities market since it has not managed to outperform the simple format ETF.

On a sectoral basis healthcare is a defensive sector:

Healthcare has long been considered one of the most reliable defensive sectors—an effective portfolio buffer when equity markets turn volatile. That’s because hospitals, drug makers, medical device firms and other companies across the healthcare sector benefit from steady consumer demand regardless of the economy’s strength.

Source: Alliance Bernstein

Year to date we have seen a bear market develop in equities on the back of a violent rise in rates, which has resulted in defensive sectors outperforming. On a relative basis healthcare has outperformed – it is down only roughly -10% while the S&P 500 is down -20%. Investors need to understand that large asset managers, as per their funds’ documents cannot have idle cash sitting around above certain percentages (usually 5% to 7% of the fund). This means that they always need to be invested, even if they anticipate recessions coming. As a result they allocate more to defensive sectors.

As per Blue Water Portfolios:

Due to the constant demand for their products, defensive stocks tend to perform better in a declining market. There are three main defensive sectors: Utilities, Consumer Staples, and Health Care.

Utilities: Water, gas, and electric utilities are needed in all phases of the business cycle. Utilities are usually classified as US Large Value.

Consumer Staples: Everyday products that are still bought even in recessionary times. These include companies that manufacture food, beverages, household and personal products, and packaging. Consumer staples are generally classified as US Large Value, but there are some funds that are considered US Small Blend.

Health Care: Health care and medicine is always important to people. Health care includes hospitals, pharmaceutical companies, manufacturers of medical equipment & supplies, and long-term care facilities. Health care is generally classified as US Large Blend, but there are some funds in US Small Blend.

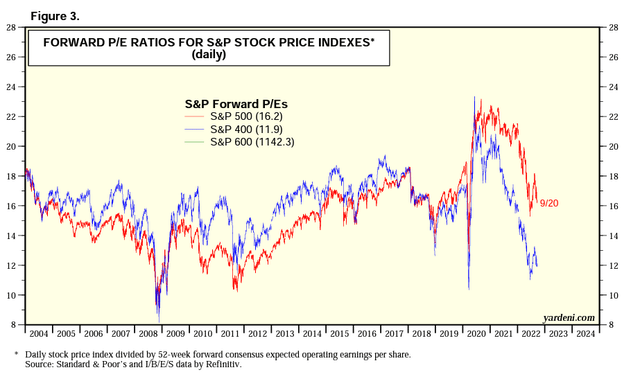

The result of this set-up is a crowding out of defensive equity sectors which have become extremely overpriced. Let us have a closer look. As the market sold-off, the S&P 500 P/E Ratio started to fall towards its historic averages:

S&P 500 Forward PE Ratios (Yardeni)

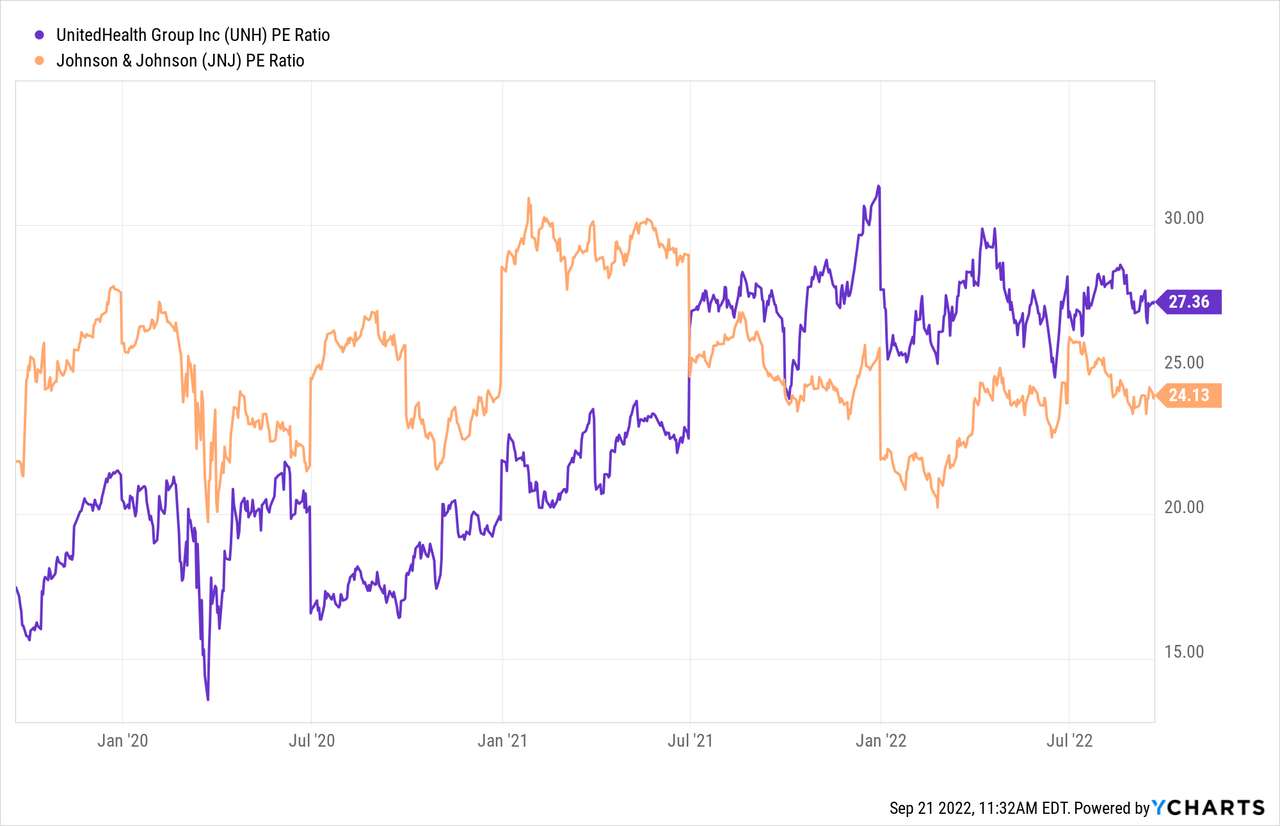

Yet for healthcare stocks, the opposite occurred:

We can see from the above graph that the largest two holdings in the fund experienced a substantial increase in P/E ratios this year, even as the wider market did the opposite. Again, this is the result of managers flocking into defensive sectors which, in our opinion, are now grossly overpriced.

Healthcare now is reminiscent of Technology in 2021 – the P/E ratios no longer make sense, but people crowding into the trade keep the prices up. Just like technology stocks, healthcare equities will probably mean revert as the overall market bottoms out. When managers start being more aggressive and rotate out of defensives there could be a move back to long term average in healthcare and BME. It is just a matter of time. A retail investor currently long the name would do well to get out of the name and move into 4% yielding treasuries or short dated funds or even corporate bonds term fund which now expose very attractive yields with a guaranteed maturity pull to par.

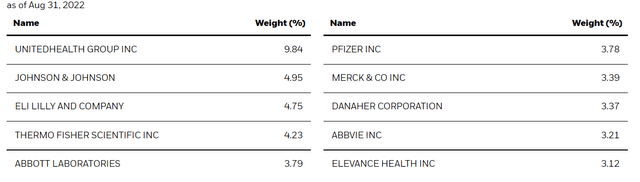

Holdings

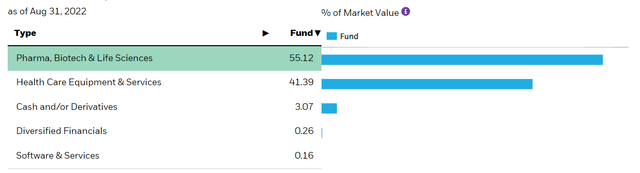

The fund holds Pharma and Healthcare stocks:

Its largest holdings are as follows:

Performance

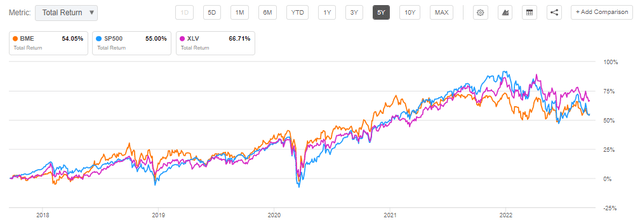

BME has a performance which is in line with XLV on a year to date basis:

YTD Total Return (Seeking Alpha)

On a 5-year basis BME lags both XLV as well as the index:

5Y Total Return (Seeking Alpha)

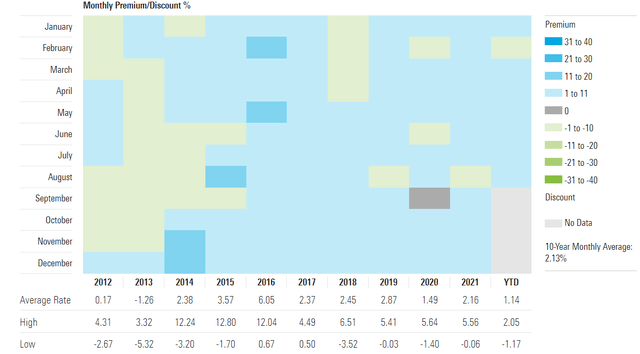

Premium / Discount to NAV

The fund has traded generally at a premium to NAV in the past decade:

We can see a fairly tight range for the fund’s average premium to NAV from the above table, which speaks to the general low volatility for the overall sector.

Conclusion

BME is an equity closed end fund focused on healthcare stocks. Although it is down -10% year to date the CEF has been able to outperform the S&P 500 given the defensive nature of the asset class. BME exposes the same total return performance as the low fee healthcare ETF, XLV, but as a CEF it transforms equity market returns into dividends. The fund currently pays a paltry 6% dividend yield which is becoming extremely inadequate given the rise in risk free rates. A retail investor can now get 4% yields on 1-year treasuries with no risk. As the S&P 500 Index has de-rated seeing its P/E ratio move lower towards historic averages in 2022, the BME holdings have done the opposite. Due to the crowding out in defensive stocks, BME holdings have seen their P/E ratios go up substantially in 2022. BME is now overpriced from a P/E valuation perspective and its paltry yield does not compensate for the risk taken given where risk free rates currently reside. A retail investor would do well to get out of the name and buy short term treasuries until the current bear market bottoms.

Be the first to comment