Edwin Tan /E+ via Getty Images

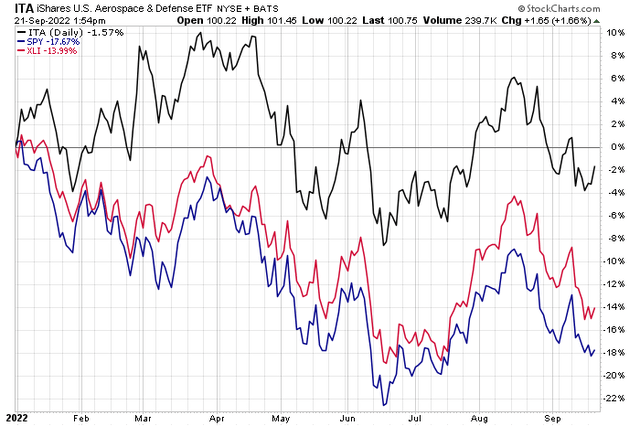

Looking for some winning stocks in a year of high volatility? The aerospace & defense industry is about flat for 2022, as measured by the iShares U.S. Aerospace & Defense ETF (ITA).

Several large caps in the fund have weathered the equity storm well given an ongoing conflict in Ukraine and now renewed tensions caused by Putin. Unfortunately, one small-cap stock in the industry has not performed so well compared to the big players.

Defense Stocks Tread Water in 2022, Beating Industrials & the S&P 500

According to Bank of America Global Research, Maxar Technologies (NYSE:MAXR) is a space technology and intelligence company that participates in two distinct areas of the satellite market. Earth Intelligence is associated with imagery – both capturing and analyzing. Space Infrastructure is associated with designing, building, integrating, and testing space-based communication satellites (both LEO and GEO).

The firm has been working on diversifying its business model and deleveraging its balance sheet. It has faced hurdles and increasing costs with the Legion constellation, however. Downside risks include negative impacts should the U.S. federal government not renew key contracts. Demand for satellite imagery is also an important wild card.

The Colorado-based $1.6 billion market cap aerospace & defense industry company within the industrial sector trades at a high 32.3 trailing 12-month GAAP price-to-earnings ratio and pays a scant 0.2% dividend yield, according to The Wall Street Journal.

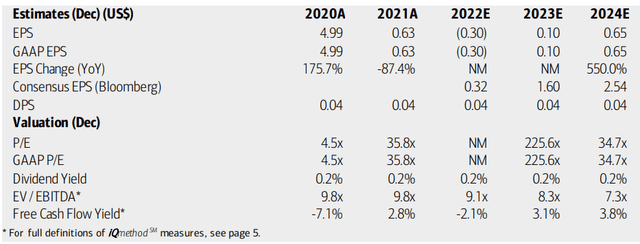

On valuation, BofA analysts see negative EPS this year, both on an operating and GAAP basis, but free cash flow and profits should turn positive looking out to next year and 2024. The Bloomberg consensus EPS estimates are more sanguine, though. Maxar’s dividend will likely remain minuscule. The stock trades near its historical EV/EBITDA multiple. So the shares look about fairly valued here.

Maxar Earnings, Valuation, Dividend, and Free Cash Flow Forecasts

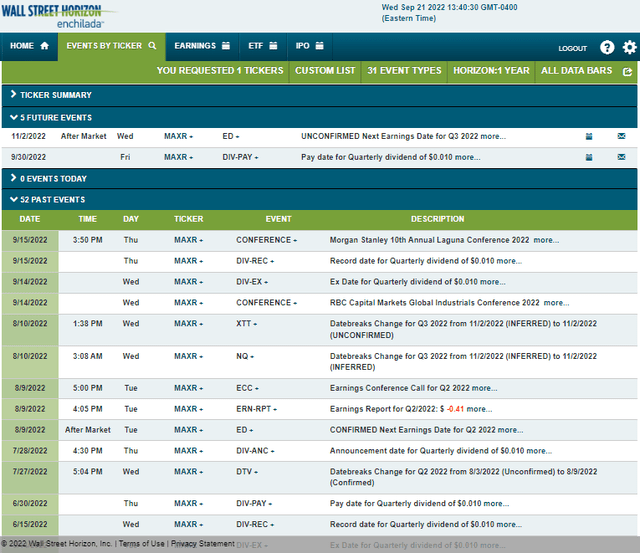

Looking ahead, Wall Street Horizon shows an unconfirmed Q3 earnings date of Wednesday, Nov. 2 with a dividend pay date Friday next week (9/30). After Maxar spoke at a pair of recent conferences, the corporate event calendar is light until the next profit report.

Corporate Event Calendar

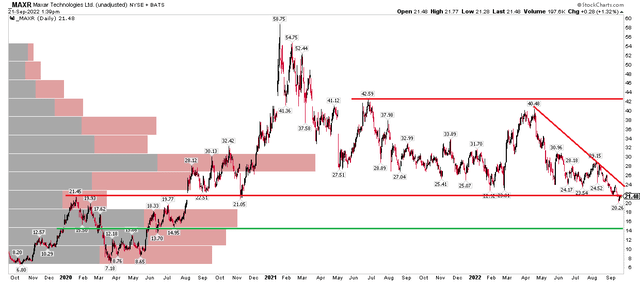

The Technical Take

With an uneventful calendar until Q3 earnings and a mixed valuation picture, what can the chart tell us about where MAXR is headed?

Shares sit at a critical level right now.

I see support in the $21 to $23 range, and the stock is under $22 currently. A long position right here with a stop under $20 makes sense, but I have a hunch Maxar wants to move lower to next support around $14 to $15.

On the upside, noting a descending trendline that could be problematic on rallies. Moreover, there’s a high amount of shares traded in the $27 to $30 range as evidenced by the ‘volume by price’ indicator on the left portion of the chart.

While about double where the stock is now, there’s more resistance in the low $40s. There are better relative strength names in the industry such as Lockheed Martin (LMT) and Northrop Grumman (NOC) that investors in aerospace & defense should consider owning.

MAXR: Shares Teetering at Support

The Bottom Line

Maxar has dropped hard off its early 2021 peak, but the stock is not a tremendous value here. The chart is also susceptible to another bearish move down. I would avoid this one for now and seek other companies in the industry with more stable profits and better relative strength.

Be the first to comment