BING-JHEN HONG/iStock Editorial via Getty Images

“Markets hate uncertainty” is a saying that is thrown around a lot by market participants and the press. This belief really has mixed substance, in some cases it appears applicable (recent Russia-Ukraine war) and in others (storming of the capital, election) it doesn’t. Many investors will note that the latter events occurred during a large fed QE program where it felt like many equities were entering bubble territory.

Taiwan Semiconductor Company (NYSE:TSM) has been surrounded by uncertainty for a long period of time not just because of China-Taiwan tensions but also due to China-US tensions as well. In fact, as the US-China tech war has started to heat up TSMC looked to hire a geopolitical analyst in February. Yet over the last ten years this uncertainty has largely been ignored. The company has demonstrated its ability to deliver continual outperformance underpinned by shrewd capital allocation which has fuelled its global expansion; TMSC has long been the world’s largest semiconductor foundry yet continues to expand market share without any major hiccups.

After the invasion of Ukraine and the apparent lack of response from China to condemn Russia, Taiwan-China tensions have come to the forefront again and this time it’s under less accommodating conditions. TSMC is expecting a growth slowdown in ’23 while Nancy Pelosi’s recent Taiwan visit has applied more pressure to the precarious triangle. For this reason, I am standing on a ‘hold’ rating for TSMC right now, this is despite the obvious inherent strength of the business and tailwinds in the chip market.

What’s Happened And TSMC’s Position

Nancy Pelosi visited Taiwan on Tuesday last week, marking the first visit by a senior US official in decades. This was met by fury from Beijing which has since followed up by ceasing military and climate change talks with the US. Naturally as the largest semiconductor business in the world and a significant contributor to Taiwan’s economic strength – TSMC was in focus and Chairman Mark Liu even personally met with Nancy Pelosi.

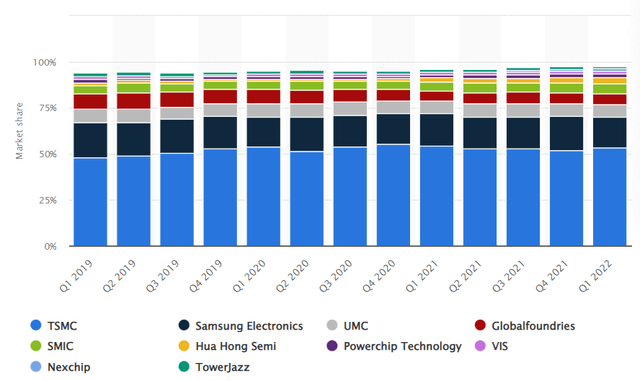

TSMC is responsible for 54% of the global foundry market, this means any manufacturing disruption would have huge ramifications for key clients such as Apple (AAPL) and Nvidia (NVDA).

Foundry market share breakdown (Statista)

Nonetheless, this could also play into the bearish stance as an additional motivation for China to invade. Any form of intervention by China could be catastrophic for TSMC in terms of nationalization risks. Even for those investors who are confident in calling Xi Jinping’s bluff – if the impossible becomes possible there would be a significant downside ahead.

TSMC has started to slowly turn the needle in diversifying its operations and reducing reliance on China over the last few years. The company has a $12 billion chip factory planned for Arizona whilst the proportion of sales to China is now half it was just two years ago. The bulk of operations, however, are still based in Taiwan, and it’s really unavoidable for TSMC to separate itself from the tensions that the country faces as a company that provides a substantial amount of the world’s chips which are nearly all produced in Taiwan.

China has aggressive targets to become the world leader in semiconductor production by 2030, however the United States’ recent promotion of the ‘chip 4’ alliance – a semiconductor cooperation – has affected their chances of achieving that. South Korea recent invitation to join the chip alliance has provided an additional blow to China, this invitation is lucrative for South Korea as opportunities in China are set to decrease as they look to achieve self-sustainability in the chip market. Despite China’s end goals, the country is still heavily reliant on imports. With the US attempting to build its own semiconductor supply chain that checks China, China’s ability to grow in this market without key players like Taiwan and Korea will be hindered. Whilst over the long-run national partnerships like these are positive for TSMC, over the short term it adds fuel to a fire of tensions.

On Balance: TSM Is Still A Fundamentally Strong Business

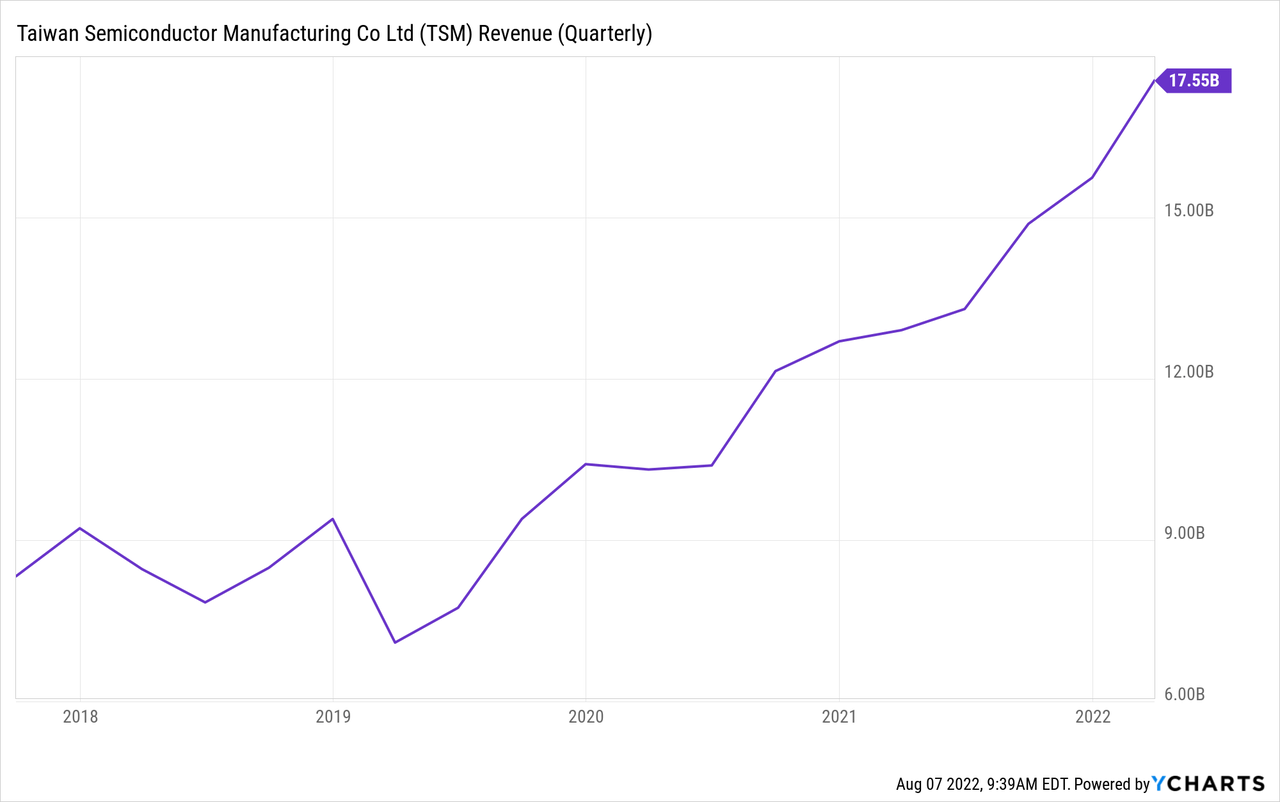

TSMC has not just rested on its laurels and ridden market tailwinds in the high-growth semiconductor industry but has also continued to steadily grow its market share. This has underpinned consistent revenue growth, in the last quarter TSMC achieved revenues that were 146% higher than the same period in 2019. This is seriously impressive considering TSMC’s size and rightfully puts it in the ‘serial outperformers’ bracket.

Net income in the last quarter came to $7.2B construing a margin of 44.4% up 300 basis points sequentially. TSMC’s moat is wide and has been continually strengthening amongst chip shortages and increased demand. This is further driven by TSMC’s expertise edge, for example, it is one of only two companies that can produce certain forms of 5-nanometer chips. Considering this edge and the world’s reliance on chips, it’s unsurprising that TSMC has achieved a compound annual sales growth rate of 17.5% since its IPO in the early 1990s.

Growth is expected to slow down in ’23 (+10%). Intel’s tGPU chipset that was set to be manufactured by TSMC in early ’23 has been delayed again till the end of ’23, this has affected TSMC’s production expansion plan and the company is now set to reduce CAPEX in 2023. This is a shrewd move from TSMC’s to ensure the marginal impact of Intel’s move during the early stage of 3nm production is minimal, however investors should still expect some margin pressure in relation to this delay in early ’23. This is largely already baked into the forecasts, net income is expected to decline 8% in FY’23

The company’s capabilities combined with the lack of competitors that can match TSMC’s resource pool make it a great stock to play the high-growth chip market. Many fund managers such as Chris Chan and Bjarne Gier hold over 10% weighting of TSMC in their funds, understandable when looking at its historic financial performance and the future growth prospects of the chip market (the key building block of tech).

The Bottom Line

TSMC is a high-quality business that continues to trade at reasonable prices (19.6x P/E and ~10x OCF) in consideration of its historical strong operating performance. Despite this, there are a lot of things that are out of TSMC’s control, most notably – China. Following China’s actions over the last week, tensions have once again started to build. There was no initial stock price reaction to these tensions as the broader market rallied (bizarrely to many). I do however think a continuation of tensions will apply near-term pressure to the stock price, particularly if the broader market relief rally starts to abate. For that reason, TSMC is a ‘hold’ and I would adjust to a ‘buy’ stance if tensions start to cool down.

Be the first to comment