Vacharapong Wongsalab/iStock via Getty Images

Introduction

I’m excited to start covering a company I haven’t covered in the past because of its small market cap. With a $1.0 billion market cap, Baltimore, MD, based MarketWise (NASDAQ:MKTW) is a company operating in the software application industry. While it relies on tech-driven platforms, it is basically a company providing investment tools and advice for investors. In other words, it’s a company that directly competes with what I/we are doing on the Seeking Alpha platform. Moreover, as I have worked for professional sell-side/third-party companies besides Seeking Alpha, I had fun figuring out if MarketWise is a buy. Without being biased, I have to say that the company is walking a thin line between exploiting the massive potential its market offers and being dead money due to competition, rising costs, and ongoing market challenges.

In this article, I will give you my take on this truly interesting company.

What’s MarketWise?

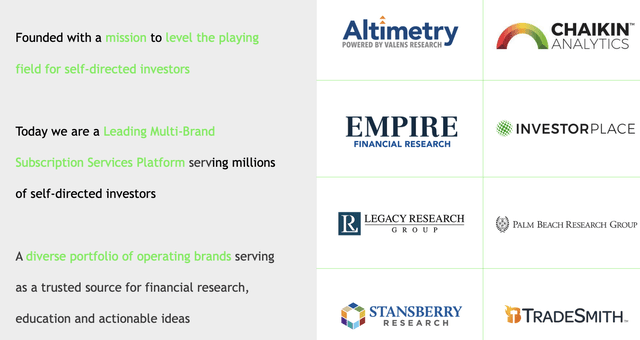

Founded in 1999, MarketWise has become one of the biggest companies when it comes to sell-side research and investment tools.

Its mission is to create a level playing field for self-directed investors. The company is now a leading subscription service platform serving millions of self-directed (retail) investors through its portfolio of brands.

The company uses three types of technologies to service customers: Software as a service, platform as a service, and infrastructure as a service. That’s SaaS, PaaS, and IaaS.

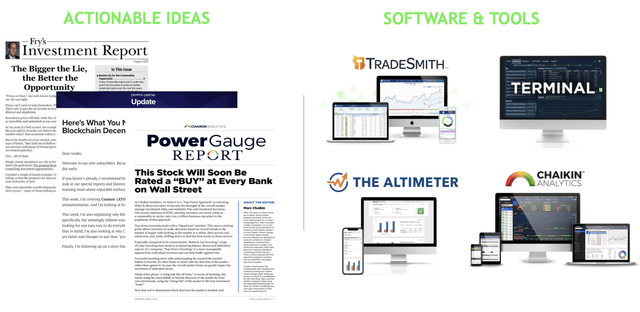

These technologies support the company’s many websites like InvestorPlace, TradeSmith, Chaikin Analytics, and others.

MarketWise

A website like InvestorPlace offers articles for investors to make their own decisions with a history of multiple decades, while Chaikin is a more data-focused service with an automated rating system. TradeSmith is somewhere in between with a selection of daily graphs and investment research that help retail investors to make decisions.

MarketWise

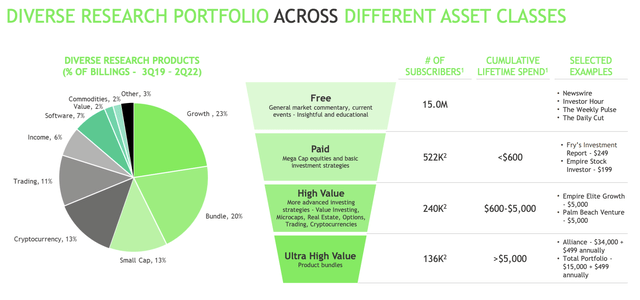

Before I give you my personal opinion on this, there is no denying that the company is attracting a lot of (potential) customers. The company now has 11 customer brands, which is up from five in 2017. It has more than 180 products, an editorial team of 99 people, and 819 employees (as of June 30, 2022).

The company has 16 million digital platform members (45% annual compounding annual growth since 2Q20), roughly 900 thousand paid digital subscribers, and positive free cash flow as the company is now a mix of “value” and “growth”.

The drivers of its success are basically to offer compelling products. A lot of its products are (temporarily) free or offer free aspects, which attracts customers. The company is then engaging with customers to create lasting relationships with them. So far, the company has more than 90% net revenue retention, which means customers like the products the company brings to the table.

With that in mind, there’s something called “TAM”, which stands for the total addressable market. It’s the size of the market one tries to penetrate.

In the case of MarketWise, the TAM is $129 billion. This covers investment research and asset managers. In order for this TAM to make sense, asset managers need to switch to the “retail” side. That isn’t going to happen as I am aware of the products and solutions that the “big guys” use.

However, in 2021, the TAM for self-directed investors (retail) was $75 billion, which is still a huge market.

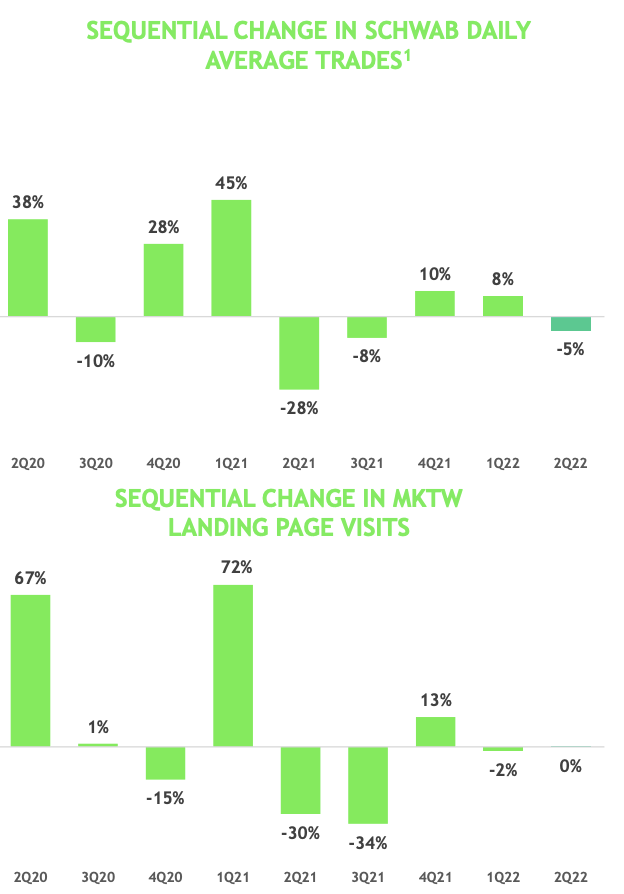

As you may have seen in this article, the company mentioned 45% compounding annual growth in its digital platform members between 2Q20 and 2Q22. 2Q20 was the pandemic-related sell-off bottom. Back then, it triggered a huge inflow of retail money as people were sitting at home trading the market. It was a total best case for MarketWise.

After all, it also benefits from a rising trend in self-directed customers. For example, 17% of the US population is older than 65. 10,000 people retire every day, which creates new demand for retail investing. Retail investors already present 20% of trading on an average day, up from 10% in 2010.

Also, 72% of millennials identify as self-directed investors. That’s $22 trillion of net worth waiting to get support in decision-making – at least, that’s the bull case.

And here’s the catch, retail investors have a 3-year return performance lag versus the S&P 500 according to MarketWise. This means two things:

- Retail traders shouldn’t rely on fancy tools and just buy defensive investments and/or ETFs.

- It’s a huge opportunity to get retail investors to invest better.

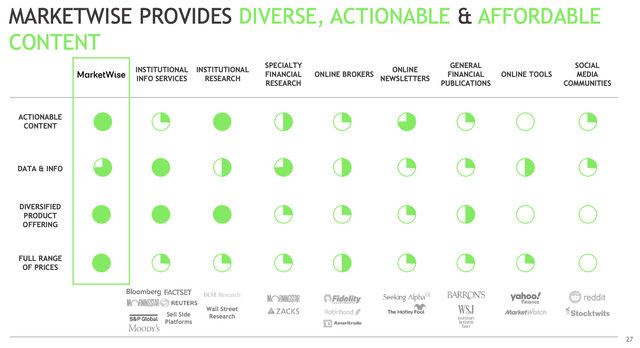

However, and this almost goes without saying, there is a lot of competition. The company competes with companies in at least eight categories. The company itself lists 21 competitors, with different capabilities and a unique set of qualities.

MarketWise

Given this list and my own research, I have to say that the company makes things look better than they really are. For example, the company does not offer significantly better info than its peers in the online newsletters segment, one of them is Seeking Alpha.

Needless to say, I’m not paid to say that.

Moreover, having worked with institutional research, the company does not have better data and info. We’re now talking about expensive information from major sell-side companies, but ignoring pricing, data isn’t better.

I can continue, but as my goal isn’t to make MarketWise look bad, the key takeaway here is that competition is fierce. Moreover, entry barriers are very low, and I can name at least 10 more serious sell-side companies that offer retail services at competitive prices.

However, despite my criticism:

The Numbers Add Up

What’s important is that the company is turning “free” users into paid customers. For example, the company has 15 million free customers, which is almost all of its customers. Yet, it has 136 thousand ultra-high-value customers, which spend more than $5,000 on MarketWise products during their customer lifetime. The company also has close to a quarter of a million in customers with at least $600 in lifetime spending.

MarketWise

$600 doesn’t seem like a lot, but MarketWise has a business model that is easy to leverage. Unless every single customer tries to engage with customer services every day, there’s a lot of money to be made – even on smaller accounts.

Adding to that, the company runs a successful customer acquisition strategy. 60% of its marketing channel is direct to paid. This strategy is based on ads via Facebook, Yahoo!, and Google – among others – which result in an order form conversion rate of 5.5%, which I believe is decent in a highly competitive industry.

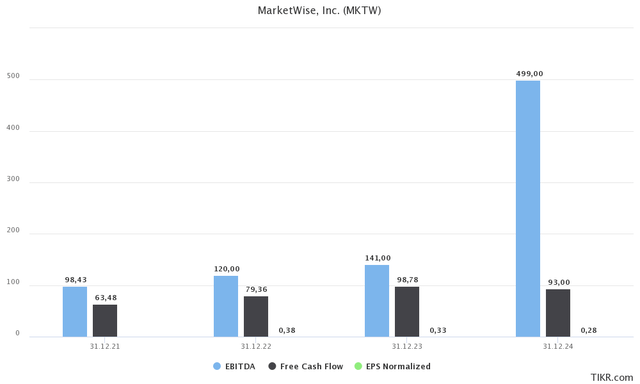

On top of that, the company does have a good growth outlook. In 2024, analysts believe the company can do $500 million in EBITDA, generating almost $100 million in free cash flow (10% implied FCF yield), and $0.28 in normalized EPS (that’s the number at the very bottom).

TIKR.com

Unfortunately, the large secular bull case is facing tough headwinds.

MarketWise, which is now a Russell 2000 member reported revenues of $128 million in 2Q22. That’s a miss of $3.0 million and a 9.9% decline versus the prior-year quarter.

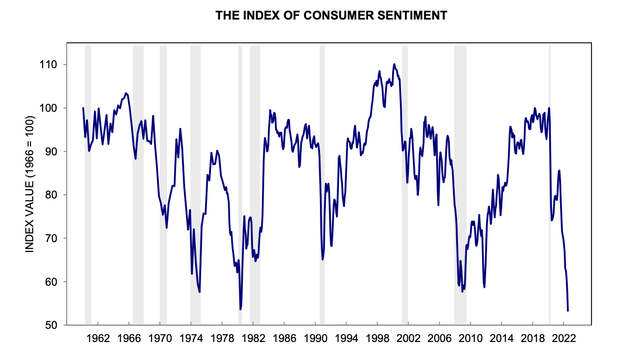

As everyone knows by now, inflation is high, economic growth is slowing, and consumer sentiment has imploded.

University of Michigan

One can imagine what this means for companies depending on retail investment spending.

Charles Schwab reported 5% lower transactions in 2Q22. MarketWise reported zero growth in landing page visits (people visiting its websites) after a decline of 2% in 1Q22.

MarketWise

Overall, it looks like the bigger picture benefitted from two good quarters since the end of the pandemic, which isn’t something that makes me feel good about the situation.

In its 2Q22 earnings call, the company mentioned higher volatility, high inflation, and an aggressive Federal Reserve as reasons that caused investors to behave in a more defensive manner.

It caused billings to fall by 36.5%.

The company isn’t worried as it has seen these issues during the dot-com crash and during the Great Financial Crisis.

To respond to these changes, the company is adjusting its content to better assess the current investment environment (I think that should be a given as it’s the company’s bread and butter), on top of cost-saving initiatives, including data science and artificial intelligence for data analysis.

This includes improving content and improving the conversion rate. in other words, getting a bigger share of potential buyers to sign up to (partially) offset cyclical headwinds.

It helps that the company has positive free cash flow and $170 million in expected 2022 net cash (more cash than gross debt). The company will not get into financial turmoil and it has room to invest without the need for external funding.

This is what the company commented on the need to lower costs, especially considering the lower conversion rates it is dealing with:

And given the persistent high unit subscriber acquisition costs and lower conversion rates, we tightened our marketing metrics through the second quarter to preserve margins and enhance profitability. We are also targeting total overhead expense reductions of approximately $37 million on an annualized basis which we hope to have completed in the next month and much of which has already been completed.

So far, the company has had success when it comes to acquiring potential clients as free subscribers increased by 500 thousand, or 3.1% quarter-on-quarter.

Unfortunately, total paid subscribers fell by 11 thousand, or 1.2% versus the first quarter.

With all of this in mind, the company is trading at 11.9x expected normalized 2024 EPS of $0.28. This number could come in much higher as the company is expected to do close to $500 million in EBITDA by then. That’s half of its current market cap excluding negative net debt.

In other words, the stock could very well double or triple by then.

So, here’s the bottom line.

Takeaway

MarketWise is a very interesting company, which has its ducks in a row. The company has a healthy balance sheet, positive and strong free cash flow, and a business portfolio used to generate high (expected) future growth.

If the company is able to further penetrate its addressable market, it is in a good spot to double, or even triple its stock price in the 2-3 years ahead.

However, there are some issues that I need to address. Right now, growth is slowing significantly. Paid subscriptions are under pressure as a result of a weakening consumer and the fact that subscription spending is one of the first things families cut when cash is tight.

Moreover, while the total addressable market is large, competition is fierce. It’s one of the most fragmented markets in the world, which is dominated by large players in each area. This includes expensive sell-side professionals who guide “smart money”, and various established firms in the retail space. This includes Seeking Alpha.

Adding to that, there is a lot of great free information out there. It does not take a lot of guidance to get smart retail investors to invest in the right stocks. At least that is what I get from interacting with my followers on this platform since 2015.

The reason why I like companies like Moody’s (MCO), S&P Global (SPGI), and Nasdaq (NDAQ) is because the services they offer are very advanced and often rely on the data they gather themselves. It’s very hard to compete with that.

Guiding retail investors toward financial goals is a different game.

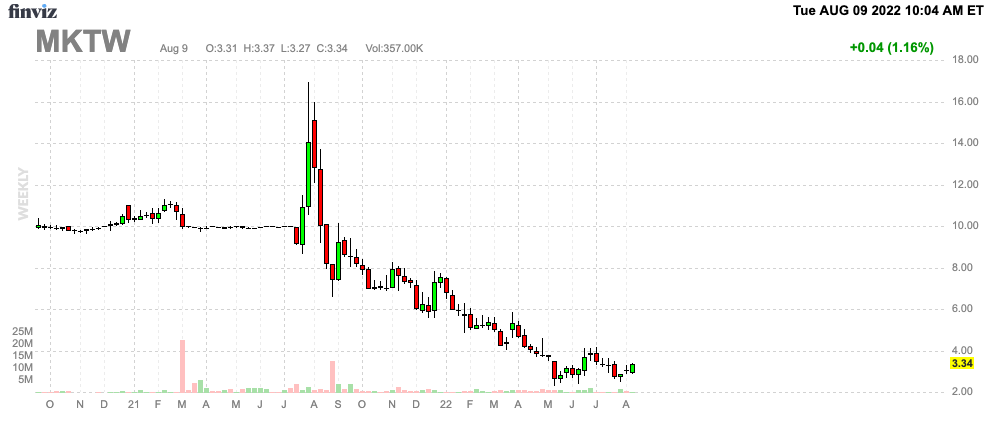

Please don’t get me wrong. I am not “hating” on this company. It offers good products and the numbers back it up. However, it’s not a no-brainer. There is a reason why the stock is down almost 60% year-to-date, and I do not disagree with investors who were selling.

FINVIZ

Right now, the stock has a short float of 9.1% according to FINVIZ, which means there are chances that the post-earnings rally continues. After all, cost-cutting will give the company more breathing room. Also, it keeps acquiring new “free” users, which it will benefit from when confidence comes back.

Nonetheless, I do not recommend investors and traders to buy MKTW. Maybe the stock doubles and I look like a fool, yet that’s a risk I’m willing to take as I don’t consider the MKTW ticker to offer a great risk/reward for new investors.

(Dis)agree? Let me know in the comments!

Be the first to comment