Phillip Faraone

Thesis

Block, Inc. (NYSE:SQ) has given up all its post-Q2 earnings gains and more as the market digested its momentum spike. As a result, SQ has been sent crashing back to its late July lows as it attempts to form another bottoming process.

In our previous update in early July, we updated investors that we needed to see a more sustained basing price action before we were confident that SQ could bottom out decisively. Therefore, we are pleased to update investors that we are satisfied that SQ has likely staged a medium-term bottom in June/July, despite the recent pullback.

Block’s underlying metrics should improve further through FY23, as it laps highly challenging comps. Therefore, we postulate that it should help undergird its growth premium. Notwithstanding, Block needs to prove its path to sustainable profitability over the medium-term for the market to re-rate it. However, our analysis suggests that the market has significantly adjusted its expectations of SQ’s valuations. As a result, we believe that it has adequately de-risked the near-term headwinds and medium-term uncertainties, allowing investors a less aggressive entry level to bet on Block’s long-term growth drivers.

Consequently, we revise our rating on SQ from Hold to Speculative Buy. Investors who have been waiting for a deep pullback from its post-earnings spike can consider using the recent weakness to add to their position.

Challenging Comps From FY21 Should Be Over From Here

The company has been lapping some pretty challenging pandemic-driven tailwinds, including the crypto craze that lifted its Bitcoin revenue. As a result, Block faced significant challenges as its growth normalized markedly, which also buffeted its valuation as the company couldn’t sustain its growth cadence.

However, the company is sanguine about posting improved underlying metrics moving forward, as CFO Amrita Ahuja accentuated:

We continue to believe Cash App’s year-over-year gross profit growth rate, excluding Afterpay, will improve in the second half of the year compared to the first half as comparisons become more favorable, as newer commerce and financial services products ramp and with the benefit of certain pricing adjustments. Also consistent with what we mentioned last quarter, for the remainder of 2022, we expect Cash App and Square to sequentially grow gross profit each quarter throughout the year, even excluding Afterpay, assuming the macroeconomic environment remains stable. (Block FQ2’22 earnings call)

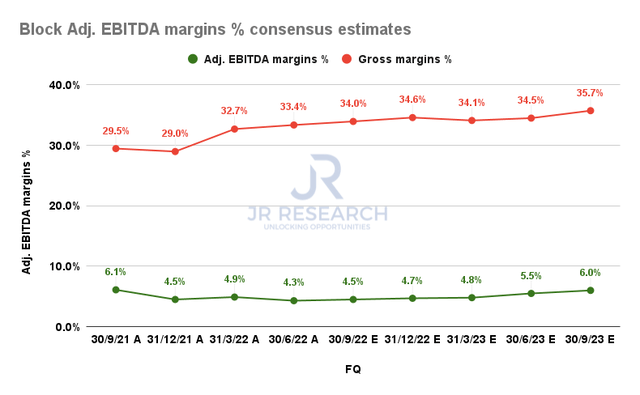

Block gross margins % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) corroborate management’s optimism for a more positive H2’22, seeing its gross margins trajectory improve through FY23. Therefore, it makes sense that it’s accretive to Block’s adjusted EBITDA margins, coupled with its cost rationalization strategies.

While we are positive about the company’s strategic game plan to be an all-in-one app, the journey remains fraught with significant challenges, with its profitability profile as its main impediment.

We posit that the battering seen in SQ over the past year is also attributed to its weak profitability profile that couldn’t justify its high valuations. Therefore, investors need to have a high conviction about Block’s ability to strengthen its grip over its customer base, as CEO Jack Dorsey articulated:

So we believe that Cash App ultimately becomes a place that you want to check not on a weekly basis but every single day because it consistently gives you a good sense of your friends and families, the businesses around you, products and services that you’re interested in, offers such as Boost, all in one place. We believe that the biggest part of our future is around connecting people with commerce and transactions. (Block earnings)

SQ’s Valuations Have Been De-risked

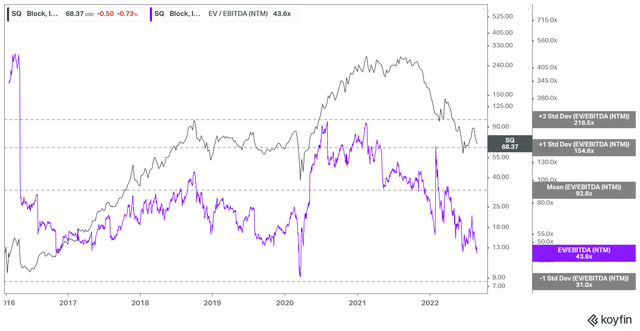

SQ EV/NTM EBITDA valuation trend (koyfin)

Despite the 80% collapse from its August 2021 highs, we posit that the market still attaches a growth premium implied in its valuation, as seen above.

SQ still traded at an NTM EBITDA multiple of 43.9x, or an NTM free cash flow (FCF) yield of 2.23%. So, how do investors make sense of its growth premium, despite its pummeling?

Investors need to consider that if Square could execute its growth strategy accordingly, it should achieve a much higher adjusted EBITDA margin through FY25. The current consensus estimates indicate that it could post an adjusted EBITDA margin of 7.7% in FY25 or an FCF margin of 12.3%.

As a result, we assessed that SQ last traded at an FY25 FCF margin of 8.7%, which should underpin the buying support seen at its June/July lows.

Therefore, we urge investors to look at its medium-term growth and profitability potential when assessing whether its current valuation makes sense.

Furthermore, it last traded close to the one standard deviation zone below its all-time mean, which saw robust buying support at its March 2020 bottom. Therefore, we are confident that SQ’s valuations have been adequately de-risked.

Is SQ Stock A Buy, Sell, Or Hold?

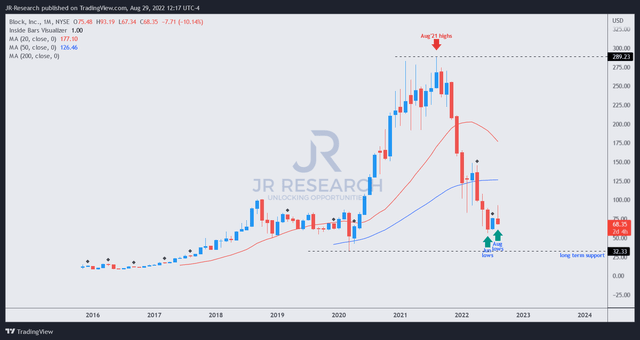

SQ price chart (monthly) (TradingView)

SQ’s 80% waterfall decline from its August 2021 high has likely bottomed out in June, as seen above. Therefore, we are confident that the current basing action seen over the past three months is constructive of an accumulation phase, even as SQ digested its post-earnings recovery.

Therefore, we believe the pullback represents a fantastic opportunity for investors who have been waiting to add exposure but didn’t want to chase its post-earnings momentum.

We revise our rating on SQ from Hold to Speculative Buy, with a medium-term price target of $100 (implying a potential upside of 47%).

Be the first to comment