jetcityimage

Opportunity Overview

Telecommunications companies are an interesting investment opportunity for a wide variety of reasons:

- Major US telecom stocks should perform well, as they historically did not experience large drops in revenue during 2009-2010. The pullback in equities will be a result of sentiment rather than poor growth.

- Other emerging market telecom stocks have excellent growth prospects due to the favorable macroeconomic trends in these countries. It is important to add these stocks to your portfolio.

- Many telecom companies also have excellent dividend yields ( 4-7%) and could be good stocks to accumulate during further drawdowns.

- The ETF has a higher weighting in larger tech stocks and less exposure to international stocks.

- These stocks are an inflation hedge and are a safe bet during a recession.

This article covers the Vanguard Telecom Services ETF (NYSEARCA:VOX) and also other options, including US telecom companies and global telecom companies. It is difficult to solely rely on these ETFs to truly gain exposure to the growth of the global telecommunications industry.

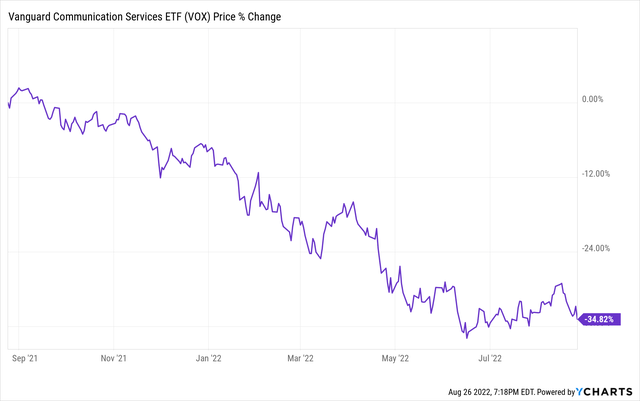

This ETF is down by around 35% in the past year, but this is also a result of the poor performance of some of the larger top holdings.

Protecting Against Inflation and a Recession

Many investors prefer telecom stocks for their ability to outperform the S&P and other growth stocks during poorer economic conditions. Top companies, such as AT&T (T), Verizon (VZ), and T Mobile (TMUS) may be able to benefit from this environment, especially with the increased addition of 5G, which can serve as an additional source of growth.

Lower Cost Competitors

There is also an abundance of low-cost cell phone service providers in the market, which could become more popular during this recession.

|

Company |

Cost |

|

Tello |

$10/month ( 1GB) |

|

Mint Mobile |

$15/month ( 4GB) |

|

US Mobile |

$20/month ( 12 GB) |

|

Tello Unlimited |

$29/month ( unlimited) |

Companies such as Mint Mobile have become extremely popular lately by offering low costs plans and bragging about how they dropped prices after inflation rose. These trends are worth noting when examining other US companies, many of which charge more than $30/month for their plans. However, Verizon had a churn rate of around 1% during 2021 and has not so far been negatively impacted by this trend. Many consumers who are already locked in on a plan (with a loyalty discount) may not see the need to risk switching for minimal savings.

Historical Growth

Historically, telecommunications companies have not experienced a major setback in revenue during recessions. The pullback in equities has largely been a product of market sentiment rather than financial performance.

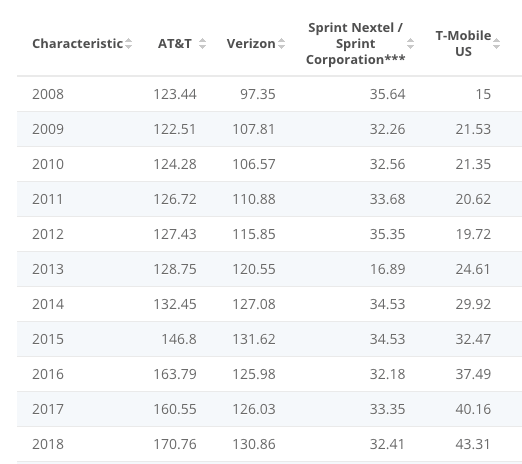

For example, the United States’ telecommunication services industry revenue only fell by 5% in 2009. Moreover, some companies such as AT&T and Verizon were actually able to grow modestly following 2008.

Statista

Similar trends will likely emerge during the upcoming years. Overall, the telecommunications industry experienced modest growth in most regions of the world, although companies may face more challenges in the upcoming years.

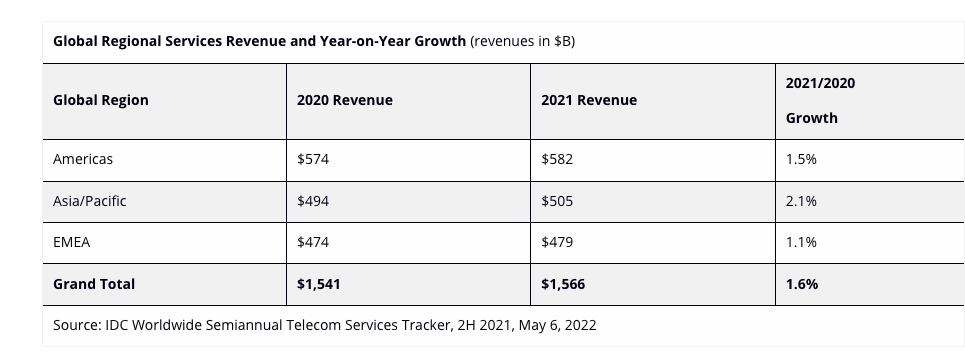

IDC

Growth was strongest in the Asia Pacific region. Moreover, there are still more rapid growth trends in certain emerging markets, as penetration rates are still low and incomes are rising. Companies in APAC and Latin America may be gems and could be a solid addition to a global telecom portfolio. Many of these companies, such as Telefonica Brazil (VIV), have been outpacing the industry’s growth.

5G adaptation may be a major catalyst for growth moving forward, although this will also likely result in increased cybersecurity risks that need to be addressed. Companies in the US that can be successful in the 5G space, are likely to perform well if other traditional segments take a hit at the same time.

Thoughts on the Vanguard ETF

The Vanguard Telecom Services ETF is a common vehicle used to gain exposure to telecom stocks. I merely chose to assign a hold instead of a buy for the following reasons:

-

I want to avoid exposure to large-cap stocks and stocks that I don’t view as a suitable choice (Netflix (NFLX), Alphabet (GOOG)(GOOGL), Disney (DIS), etc). My main goal is to diversify away from stocks like this, which is why I am interested in this theme.

-

I would prefer to have stronger exposure to Verizon and other US stocks that offer an attractive dividend yield (superior to the ETF).

-

I want to have exposure to emerging market stocks, as there are clear sources of growth in many of these countries.

-

I would like to build a portfolio that has an above-average dividend yield. This portfolio will include a combination of US and emerging market stocks.

Recent Performance

The Vanguard Telecom Services ETF is designed to deliver modest single digital appreciation, along with reasonable dividend income.

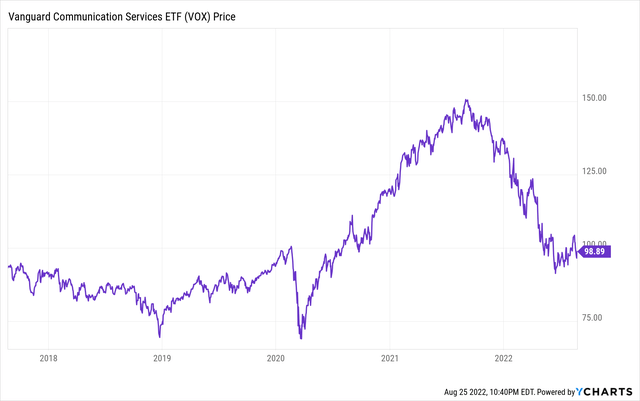

The ETF has experienced a massive selloff in the past year, which makes the entry point somewhat interesting. The ETF is trading at pre-covid levels and has crashed by circa 50% from its peak in 2021.

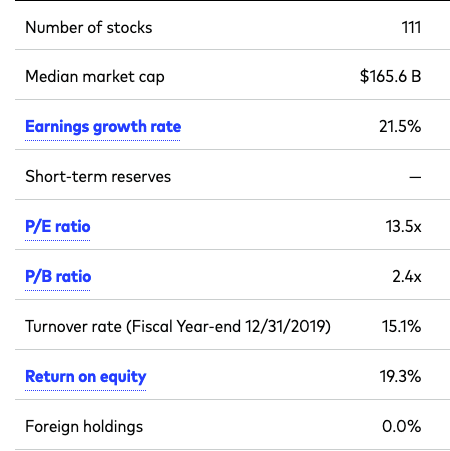

ETF Holdings

Like most Vanguard funds, this ETF charges an extremely attractive management fee of 10 bps. This ETF has also done an excellent job of tracking its benchmark ( 6.52% per annum since 2004 compared to 5.99% for the benchmark). The ETF is also down by around 30% this year, which makes now an interesting time to monitor it/potentially accumulate it.

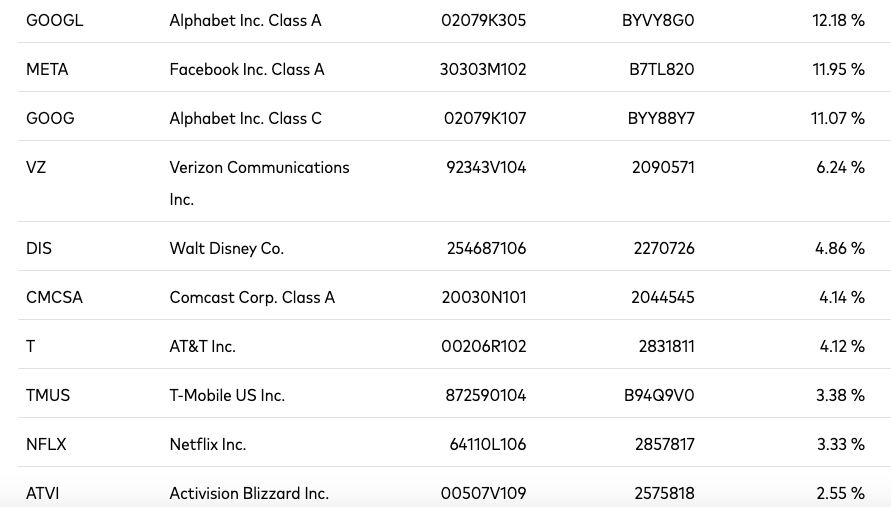

Vanguard

However, after taking a look at the top 10 holdings, it is clear to see why this ETF is moving in tandem with the S&P. The top three holdings include Alphabet Inc (Class A/Class C) and Facebook (META), and these collectively account for around 34% of the fund’s total assets. If you wanted to diversify away from this, then it would be better to buy a basket of stocks like T-Mobile, Verizon, or AT&T Inc.

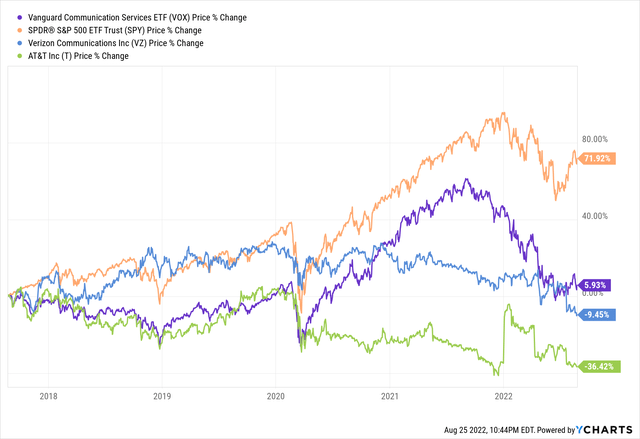

The ETF performed in line with the S&P, before splitting off to begin underperforming in 2020. Larger telecom stocks also underperformed the ETF slightly. This shows that 1) post-2020 positive performance of the ETF has partially been attributable to the addition of growth stocks, 2) The ETF is like a combo of the S&P 500 and telecom stocks, and 3) Select telecom stocks are at a relative 5-year low. It may make sense to take advantage of the pullback and attractive dividend yields ( 5+%) of AT&T and Verizon.

Lack of International Exposure

The valuation is compelling, but the fund does not invest directly in equities that operate in other markets.

Vanguard

One of the appeals of investing in emerging market telecom equities is the relatively lower penetration rates in these countries. There are plenty of countries where 10-30% do not have access to these services. Furthermore, there is ample room for companies to raise prices over the long term, as wages in these regions have been on an uptrend. For example, smartphone penetration in Latin America is only around 70%. Growth rates in many of these regions are also superior. For example, the emerging market APAC telecom industry should grow by 4.6% through 2026, while the African entertainment and telecommunications market will experience 11% growth in the next 5 years according to Mordor Intelligence. Frontier markets and smaller emerging markets with frontier characteristics will easily benefit due to demographics and the current low penetrations. Meanwhile, saturated markets like South Korea can benefit by being dominant in tech and 5G. South Korea, which is classified as an emerging market by MSCI, actually outpaced other countries and became the first country to launch a nationwide 5g campaign.

Dividend Yield

The dividend yield of this ETF is only around 1.2%, mainly because it invests in large caps. However, some individual companies, such as Verizon and AT&T have attractive dividend yields. The following stocks pay a dividend yield of 4% or higher: AT&T, Verizon, Telefonica Brazil, SK Telecom (SK), and Telecom Argentina (TEO). These stocks are currently on my watchlist.

Takeaway

If you are trying to diversify away from growth stocks and gain exposure to global telecommunications, it is best not to solely rely on the Vanguard Telecom Services ETF. One could either build their own portfolio by picking individual stocks or simplify things by investing in this ETF and adding other US companies and ADRs in foreign markets.

Be the first to comment