imaginima

Occidental Petroleum Corporation (NYSE:OXY) has been the best performing stock of the year, and it still has plenty of room to grow. Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) has been cleared to take its stake to as much as 50%, so investors will have support in their trade. The company’s free cash flow is growing at a phenomenal rate, and is available at a very attractive price. In addition, Occidental Petroleum’s profitability is at historic highs.

Market Sentiment

Occidental Petroleum is the best-performing stock of the year, up over 140%, as the S&P 500 edges toward its worst year since 1965, with the S&P 500 down nearly 13%.

Source: Google Finance

This is a stunning turnaround for a company that seemed to peak in March 2018, before heading toward a precipitous fall, before bottoming in November 2020. The company’s performance since then is an example of the inverse relationship between stock price valuation and future returns. As the company’s share price collapsed, its ability to deliver returns for new shareholders rose.

The company’s share price performance has been driven by high oil prices, and a strong first half of the year, and speculation that Warren Buffett’s Berkshire Hathaway will increase its stake in the company to as much as 50%, having received clearance to do so. What better incentive do you need to look at the company?

Analysts are overweight Occidental Petroleum and expect the company to at least hit $75.77 per share, which it may hit very soon, but I think there’s lots more juice left. With earnings per share (EPS) at $1.58 for 2021, analysts expect the company to each $10.17 in 2022. In the trailing twelve month (TTM) period, the company’s EPS stands at $10.17.

The Oil & Gas Capital Cycle

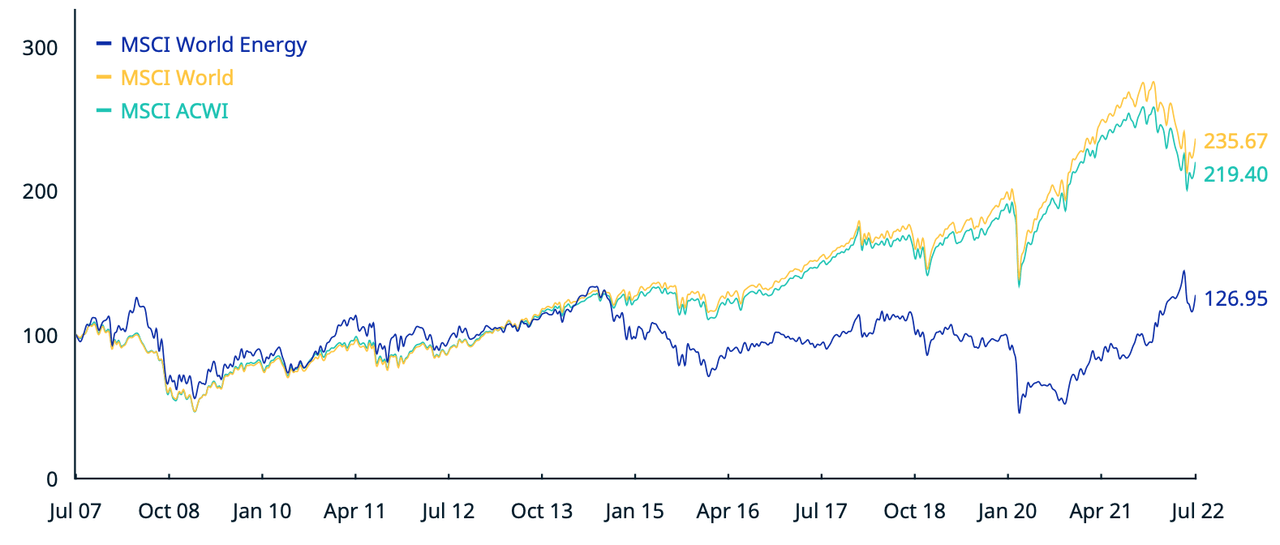

The company’s success on the market is part of a broader trend, with oil & gas companies being the best performing companies on the market. Year to date, the MSCI World Energy Index is up 32.49%, compared to the MSCI World Index, which is down 14.19% year-to-date. This is a reversal of the post-2013 trend which saw energy basically fall of a cliff, as the stock market’s cumulative gains shot past the energy sector’s.

Source: MSCI World Energy Index

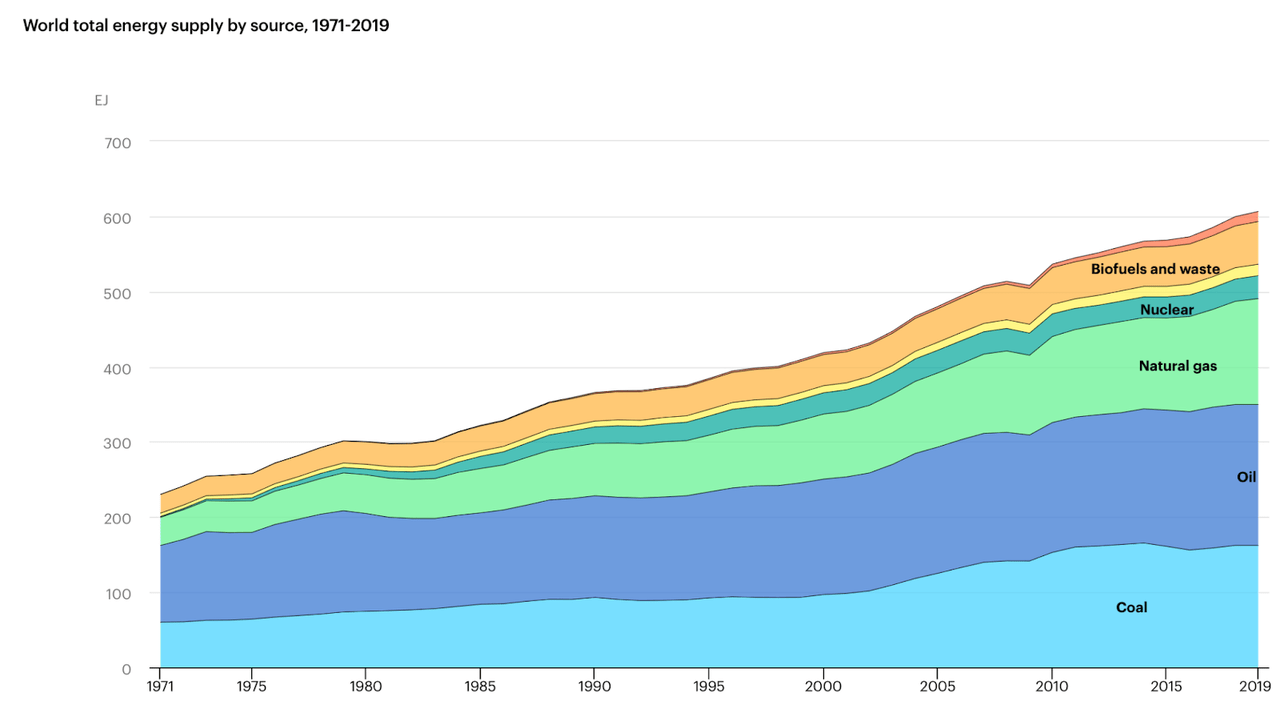

In recent years, investors have bought into the narrative that oil & gas are headed toward an Armageddon, and that they will be fast replaced by renewables. This notion has always been bunk: data from the International Energy Agency shows that fossil fuels have formed over 80% of the world’s primary energy supply throughout the 1971 to 2019 period.

Source: International Energy Agency

Rather than a fast transition, the world is characterized by energy inertia, as Vaclav Smil has argued.

There is an inverse relationship between asset growth and future returns that is particularly potent in commodity industries. This phenomenon is due to such industries following a cobweb model in which there is a time lag between supply decisions and price changes. This creates a capital cycle in which rising prices are followed by industry-wide capital raising to fund capital expenditure, which pushes supply to a point at which it is far in excess of demand, the bubble bursts, firms are forced into retreat cleaning up their balance sheets, with many firms forced into bankruptcy, and the industry forced into a period of consolidation, until profitability returns to the market.

Prudential Capital Allocation

That period of sanitizing balance sheets followed the start of the pandemic and, in truth, began before that. Since 2019, Occidental Petroleum has reduced its total debt from $39.4 billion to $22.33 billion in the trailing twelve month (TTF) period, and its assets have shrunk from over $107 billion to more than $74 billion. The company’s success at returning the company to profitability is such that Buffett remarked that, having read the earnings release in February this year, “I read every word, and said this is exactly what I would be doing. She’s running the company the right way,” referring to the company’s CEO, Vicki Hollub. “We started buying on Monday and we bought all we could.”

In addition, we experienced capital exiting the market due to ESG concerns, and as many investors gave up on the industry as stock performance stumbled, and with many calling time out on oil & gas. Investors have fallen over themselves to declare the industry noxious and immoral. With capital exiting, profitability has risen. In 2019, Occidental Petroleum had a return on invested capital (ROIC) of just 1.4%. You don’t have to calculate the cost of capital to figure that the company was destroying shareholder value. The following year, thanks to the pandemic, ROIC plunged to -13.4%. Since then, ROIC has risen to 13.7%, its highest level since 2013, when the company enjoyed a ROIC of 14.4%.

Strong Financial Performance

Since 2019, revenue has grown from $21.75 billion to over $34 billion in the TTM period, driven by soaring energy prices. In that time, gross profitability has risen from nearly $6.4 billion to nearly $14.3 billion. Net income has risen from -$985 million in 2019, to nearly $10.2 billion in the TTM period, its highest level ever. Free cash flow (FCF) margins have shot up from 3.5% in 2019 to 33.7% in the TTM period, their highest level ever. FCF has compounded at 88.92% per year from $901 in 2019 to nearly $11.48 billion in the TTM period, its highest level ever.

Valuation

When a company is up by so much, it’s tempting to think that it’s no longer a good investment and that the train has left the station. Selling winners is one of the worst mistakes investors make. Yet, with a FF of $11.48 billion and an enterprise value of $90.45 billion, Occidental Petroleum has a FCF yield of around 12.69%, compared to an FCF yield of 2.04% for the S&P 500, according to data from New Constructs. This shows that the company’s growing FCF is trading at a very attractive price and that the company’s future stock performance will be strong. For anyone who thinks Occidental Petroleum is done, this is the signal that it isn’t.

Conclusion

Occidental Petroleum has not been left out of the oil & gas sector’s balance sheet sanitization in recent years. The industry’s underlying economics have improved as a result of industry consolidation and its lack of fashionability, which has dramatically reduced asset sizes. Occidental Petroleum is likely to continue to do well on the stock market, and investors are advised to buy its fast growing FCF when valuations are still so attractive.

Be the first to comment