EschCollection/DigitalVision via Getty Images

Shares of Blackstone Mortgage Trust (NYSE:BXMT) have produced a total return of -12% year-to-date, outperforming the broader REIT market index (VNQ) as earnings have benefitted from rising interest rates and increased spreads. While BXMT has significant exposure to office collateral (41% of loan book), most of this is Class A office real estate which is holding up much better than older, non-amenitized properties.

Looking ahead I believe BXMT’s office exposure is manageable. I believe that the company is well positioned to benefit from current dislocation in commercial real estate markets as lending terms have become more favorable.

Current Conditions

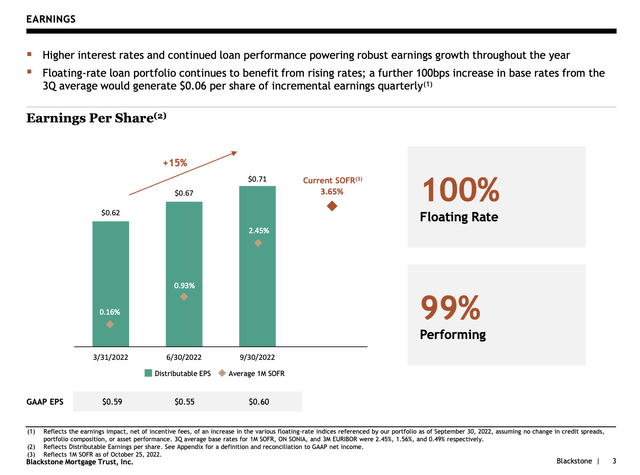

While nearly all REITs have seen large declines in 2022 on the back of large interest rate increases, BXMT is actually a beneficiary of rising interest rates. 100% of the company’s loan book is floating rate which has lead to rising interest income.

Current Performance (3Q22 Supplemental Report)

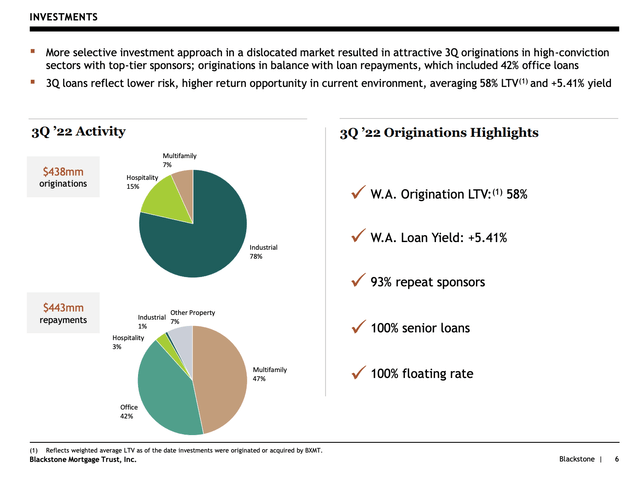

The dislocation in the commercial real estate lending market is creating opportunity for BXMT, which should translate into increased earnings going forward. BXMT has seen improved terms on new loans underwritten by BXMT. As shown below, it has been able to achieve higher initial yields while taking less risk (lower loan to value) on recently granted loans.

New Loans (3Q22 Quarterly Supplemental)

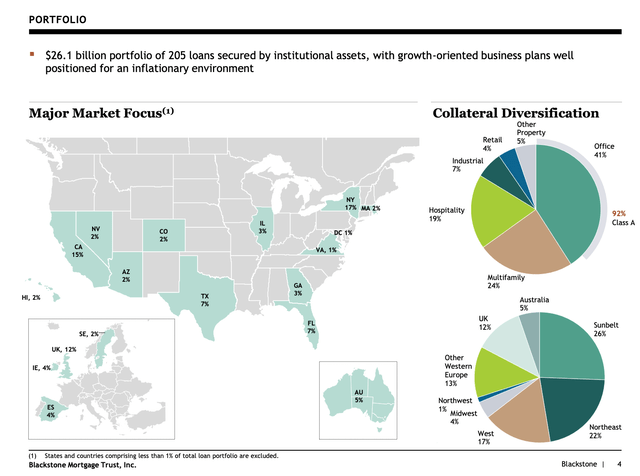

The Elephant in the room: 41% exposure to office collateral

Thus far BXMT has experienced very few bad loans. However some investors may be concerned about outsized office exposure. Office real estate has been in the penalty box since the onset of the pandemic in 2020. Concerns about the office market have grown during 2022 as work-from-home trends have persisted and office attendance remains below pre-pandemic levels. Worry over the future of the office have increased given recessionary fears/corporate downsizing. As shown below, office real estate comprises the largest loan category for BXMT at 41% of collateral.

Collateral by Prop Type (Quarterly Supplemental)

While BXMT has outsized exposure to office collateral, there are some offsetting positives. Notably 92% of BXMT’s office collateral is considered Class A. Class A offices are newer and feature more amenities than Class B and C properties. Class A office has proven to be more resilient post-pandemic, exhibiting better leasing performance and lower vacancy.

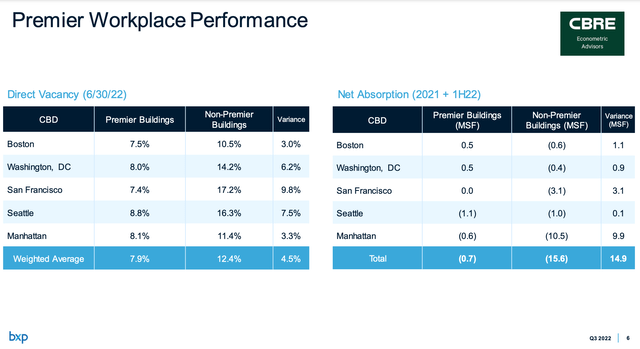

Office Vacancy by Class (Boston Properties Investor Presentation)

As shown above Class A (Premier Buildings) have meaningfully outperformed office properties as a whole, exhibiting lower vacancy rates and better leasing performance. Providing newer, more enticing office space has become more important for employers trying to coax workers back into the workplace. Moreover, as shown below, 1/3 of BXMT’s office real estate collateral consists of brand new buildings. These properties generally have higher occupancy, longer term leases, and better tenant quality (more durable cash flows) which greatly reduces the risk of default.

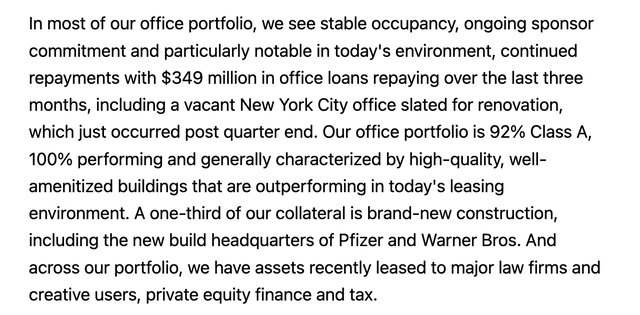

3Q22 BXMT conference call transcript (Seeking Alpha)

Thus far, 100% of borrowers continue to make payments on office loans. While we may see a hiccup or two going forward, this is very encouraging, especially given all of the negative headlines we are seeing in the office sector.

Valuation & Stress Testing

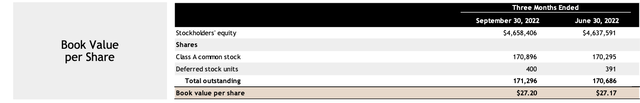

At its current price of $24.70 per share, BXMT trades at a 9% discount to tangible book value per share.

Book value per share (BXMT 3Q22 Supplemental Report)

While I expect that most of the company’s office borrowers will continue to perform, let’s consider that we may see some defaults in the future. In total BXMT has $11 billion of office exposure of which nearly $4 billion are newly constructed properties. I assume there will be zero defaults on these properties, which as I mentioned above, have more durable cash flows to service debt obligations. Of the remaining $7 billion, let’s assume that 25% or $1.75 billion, default on their obligations.

Assuming a 15% loss on defaulted loans (i.e. BXMT eventually sells the property for 15% less than the outstanding loan amount) would result in a hit of just over $1.50 to book value per share (resulting in a post loan loss book value of ~$25.65). While a 15% hit might not seem to be a very conservative assumption, consider that for its portfolio as a whole, BXMT estimates a loan-to-value (LTV) of 64%. This implies that the original estimate of the collateral value for these loans was $2.7 billion. In assuming a 15% loss on the loan, this implies that the value is 45% lower than BXMT had originally estimated.

While this is a rough guesstimate with some implicit assumptions, it illustrates that BXMT can weather a fairly significant hit to its office portfolio without seeing a big decline in book value.

Conclusion

Current conditions are favorable for BXMT as interest rates rise and interest income increases. Despite having 41% exposure to office collateral, I don’t expect to see a big downward adjustment to BXMT’s book value. With shares trading at a 9% discount to book value and yielding 10%, I see Blackstone Mortgage shares as being a reasonably attractive investment for yield seeking investors.

Be the first to comment