Peerapat_Lekkla/iStock via Getty Images

It’s been just under eight months since I decided to “hold” Johnson Outdoors Inc. (NASDAQ:JOUT) in an article with the very unoriginal title “Holding Johnson Outdoors.” The shares are down about 27.5% since then, against a loss of about 12.4% for the S&P 500. Given what’s happened to the shares, I’m glad I didn’t add to my position, though it’s still painful, since I bought at what appears in hindsight to be a very, uh, “elevated” price. Today I want to conduct a bit of an autopsy on this decision to see if it makes sense to add to the position at current prices, to hold on, or to take my lumps and sell. I’ll make that determination by looking at the most recent financial history here, and by looking at the valuation.

As my regular readers know, I put a “thesis statement” at the beginning of each of my articles. I do this as a service to my readers, because I’m not happy unless I feel that I’ve done everything I possibly can to make you people as comfortable as possible. You’re very welcome. Anyway, I think the financial results for 2022 can be seen to have been “soft” only in comparison to last year, but last year was anomalous. If we compare the most recent three quarters to any other year, 2022 has actually been surprisingly good in my view. Additionally, the capital structure is rock solid, with cash representing about 61% of the balance sheet, and I think the dividend is very well covered. The problem for me is that the shares are not objectively cheap at the moment. Given that I’m in the mood to preserve capital, I’ll be holding off, and not adding to my position. If there were puts available, I’d sell those. Given this, I’ll hold off and either get an even better entry price, or I’ll recover some of my short-term capital losses. I continue to “hold”, and will not add from current levels. Finally, I think the lesson I learned from this episode is to follow the discipline, and don’t become enamored of a stock that doesn’t “fit the bill”, because you like the business.

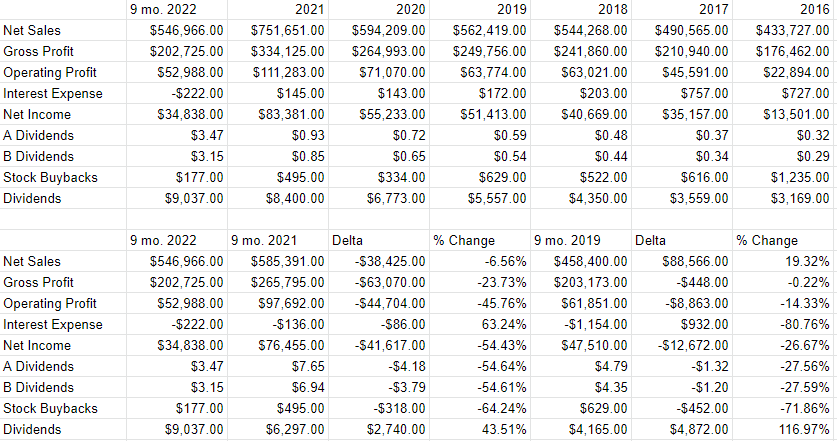

Financial Snapshot

When compared to 2021, the financial history has been soft. Specifically, revenue for the first 9 months of the year is 6.6% lower than it was during the same period in 2021, and net income is lower by about 54%. The company tried to curtail costs, given that marketing & selling, and administrative expenses were down by 7% and 28% respectively. The $19.5 million reduction in these expenses wasn’t enough to make up for the $38.4 million reduction in revenue, though. As a result of this, dividends have cratered, down 55% from the year ago period.

In some sense results during the first nine months of 2022 weren’t that bad, though. The fact is that 2022 wasn’t “soft”, 2021 was anomalously robust. For example, revenue and net income in 2021 were higher by 26.5% and 51% higher than 2020, which was itself a banner year. Thus, I think the 2022 period has been a sort of return to normal. Additionally, I think it’s also worth noting that the first nine months of 2022 saw sales that were greater than all of 2018, which was itself a rather good year. So, results for the first nine months of 2022 were not great only when compared to the same period a year ago. I’m of the view that they were objectively good, though.

Additionally, the capital structure remains very strong. Specifically, there’s currently about $117.6 million in cash on the balance sheet, and there are total liabilities of about $191.6 million. Employing the math skills that were not so lovingly imparted to me by the good sisters at Holy Spirit School many decades ago, I calculate that cash represents about 61% of the total capital structure. Thus, in my view, there’s very little reason to worry about credit or bankruptcy risk here. This cash gives owners time, and I like it when time is on our side. Given the above, I’d be very happy to buy more shares at the right price.

Johnson Outdoors Financials (Johnson Outdoors investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits selling outdoor recreational products, including fishing, camping, and watercraft gear, for example, while the stock is a speculative instrument that gets traded around based on long-term expectations about the business. Given that the financial statement valuation of the business is “backward-looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two.

Additionally, this stock, like all stocks, can be affected by changes in the overall market. The crowd may change its views about the desirability of “stocks” as an asset class, and that will impact individual stocks to some degree. Let me flesh this idea out a bit by using this painful investment as an example. My shares of Johnson Outdoors are down about 27.5% since I last reviewed the name, and the market is down about 12.4% since then. It’s impossible to prove the case, but I’m of the view that some portion of the loss can be “blamed” on the reduced attractiveness of equities as a group.

So, to sum up, the business chugs along, while the stock bounces up and down based on the crowd’s ever-changing views about the future. The crowd is capricious, because the shares are much more volatile than anything that happens at the actual business. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given stock, because those expectations are easier to beat.

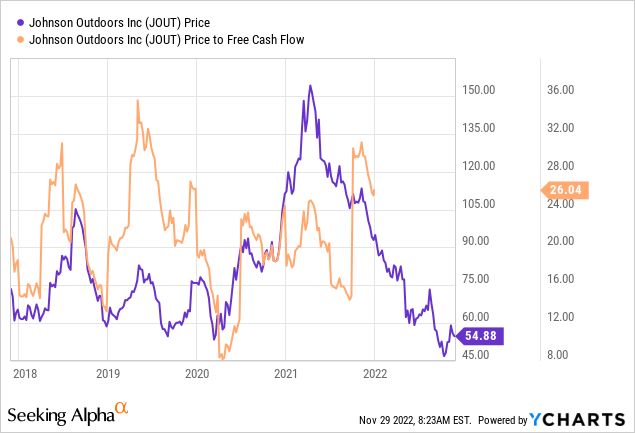

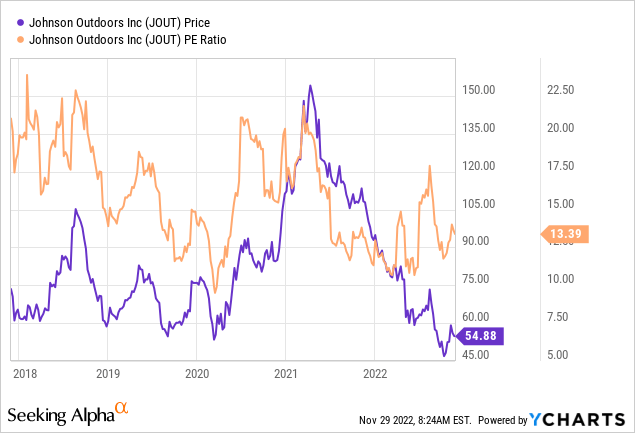

Another way of writing “down in the dumps about a given stock” is “cheap.” I like to buy cheap stocks because they tend to have more upside potential than downside. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. When last we met Johnson Outdoors stock, the shares were trading at a fairly rich price to free cash flow ratio of 26 and PE of about 10.8. There is no free cash at the moment, which is somewhat troubling, so it’s impossible to value the stock based on that measure per the following:

In spite of a collapse in the share price since I last reviewed the name, the shares are now about 23% more expensive on a PE basis, per the following. This is also a disturbing development, but I will acknowledge that the shares are historically relatively cheap compared to the history here:

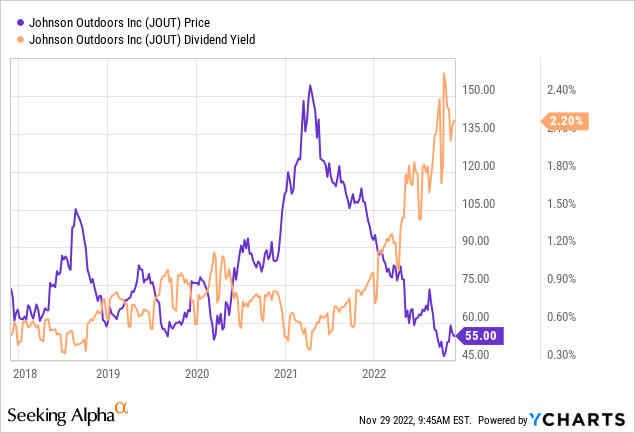

At the same time, the drop in share price has caused the dividend to explode higher. Given that I’m of the view that the dividend is very well covered, and that the capital structure remains quite strong, this has me intrigued.

As my regulars know, in order to validate (or refute) the idea that the shares aren’t objectively cheap, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If the crowd is assuming great things from the company, that’s a sign that the shares are generally expensive. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Johnson Outdoors at the moment suggests the market is assuming that this company will now grow profits at a rate of about 12.4% from here. That is a very optimistic forecast in my view, which doesn’t fill me with a strong urge to buy more shares.

Once again, I’m on the horns of a dilemma. The dividend yield is both relatively high and sustainable, and that’s supportive of price in my view. At the same time, the shares are obviously not objectively cheap, so I’m both “betwixt” and “between.” If there were options available on this stock I’d sell puts, but that’s not possible in this case I’m afraid. For that reason, I’m going to hold off buying more, on the principle that it’s better to preserve capital than to chase a 2% dividend yield. As the economy slows, there’s a good chance that the shares will fall further, and I’d rather not go on that ride. In the worst-case scenario, the shares continue to fall from current levels, and in that circumstance it’s better to have fewer shares than more shares. If the shares rise from here, I’ll recover some of my short-term losses, which would, of course, be an acceptable outcome. Given that I’m in a more cautious mood, I’m going to hold against buying more shares at current levels.

Lesson Learned

I think my experience here can be a cautionary tale for other investors. Way back in 2021, in the midst of the most anomalously profitable years in the company’s history, I decided that ~15 times free cash flow was a “great” entry price. Even if it wasn’t fairly clear that the company would have a weaker 2022, it’s not obvious that 15 times free cash is “great.” I became enamored by the rapid growth, and was blinded to much else. I may have also been smarting somewhat for having missed out on the 11% gain that the stock had enjoyed since I recommended caution in my previous piece on the name. I was of the view that this uptick in stock price was a small taste of what we could expect from this fast-growing company. That’s the lesson I learned from my mistake here: maintain the discipline, even when you really like a company. Given my experiences with many Seeking Alpha readers, I’m sure that if I missed something, and made more mistakes here, I’ll read all about them in the comments below. Words can’t describe how much I’m looking forward to reading those comments.

Be the first to comment