PM Images/DigitalVision via Getty Images

|

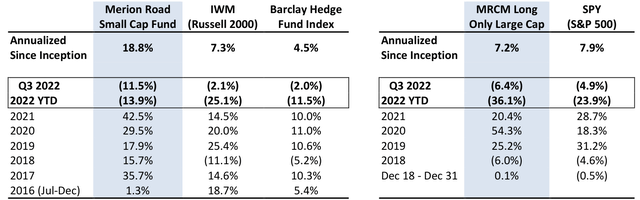

Note: All returns are net of management and performance fees. Past performance is not indicative of future results. Returns for the Merion Road Small Cap Fund for the period prior to fund launch (01/13/22) reflect a basket of SMAs. |

This was a disappointing quarter. I feel the pain both as an investment manager with the desire to do well for my clients, and as an investor in the fund. Maintaining an even keel when emotions are running high is a critical determinant of long-term success. Our investment horizon naturally shrinks when facing losses. While this urge makes sense from an emotional standpoint, it is not necessarily in our best interest. Rather we should extend our investment horizon exactly when others shorten theirs.

The Long Only portfolio fell a bit over 6%. Portfolio returns continued to get dragged down by some of our core holdings in large-cap technology like Alphabet (GOOG, GOOGL). The market positioning and long-term opportunity set for these companies has not changed. Current prices obviously reflect increased macroeconomic risks and risk-free rates/premium. But it’s hard to argue that these risks are not reflected in the price or that GOOG should be disproportionately hurt by rising rates when it is trading at a mid-teen multiple of free cash flow.

In any case, GOOG is a secular winner when we look beyond a few months or years. Or take Ferguson (FERG) which continues to languish at its lows. Earnings over the next twelve months will likely be lower than the past twelve months. But investing in a moat-y business in a fragmented industry with a strong balance sheet/free cash flow profile should work well over the course of a cycle.

Peloton (PTON) is quite a different story. You may recall from my Q1 letter that I initiated a position in the stock given the potential for a new CEO to leverage the company’s passionate and engaged userbase. The investment had meaningful upside potential (multiples of the then trading price), but also presented real downside risk; as such, I kept our exposure to just a few percentage points of the portfolio.

Fast forward six months and underlying trends like churn, engagement, and new users weakened dramatically. I sold our shares as the likelihood for the company to achieve financial success has become increasingly remote.

I am actively looking for new ideas and started dipping my toe in Six Flags (SIX). SIX is another turnaround situation. Unlike PTON, SIX is backed by hard assets and has a history of stable earnings. New management is looking to grow EBITDA to $700mm vs. the $525mm range over the past several years, covid aside. Their strategy is to effectively reduce traffic and increase price, while prioritizing capital spend on high return projects. Results have admittingly been mixed so far. But even assuming no benefit from the new initiatives, the company is trading at a reasonable valuation of 11x EBIT.

The Long Short portfolio had its worst quarter since inception in what was a benign period for the Russell, despite significant volatility. I maintained a relatively constant beta exposure of ~0.30 so this was not a function of trying to time the market and getting caught off-sides. Our positions simply did not perform as expected.

This is reflected in the alpha (stock performance irrespective of the market) of negative 11.5%. Up until this point, my worse quarterly performance from an alpha perspective was negative 4.9% in Q4 2020; interestingly enough, the Russell was up over 30% during that period and I just had a hard time keeping up.

The question is what happened and what do I have to do to prevent a reoccurrence. Our short positions benefitted returns by almost 2%, a more than acceptable outcome given our exposure. The long book, on the other hand, accounted for a 13% loss. Positions where I believe the market is entirely too bearish, and I have been holding or adding, represented 7%. I do not want to entirely dismiss these mark-to-market losses as assets are fungible.

But it would be a mistake to conflate errors with idiosyncratic movements over relatively short horizons. Given our focus on small cap names, it does not take a lot of selling or buying pressure to move a stock. The largest detractor in this bucket was Westwood Holdings (WHG), which fell 30%. It’s easy to understand why WHG would face pressure in a tough economic backdrop, but at an EV/AUM of just 0.2% valuation is strikingly low.

Small asset managers have routinely been acquired at a median of 1.0% of AUM. Our prior holding, Manning & Napier (EXDAX), has agreed to be acquired at 0.9% of AUM and Pzena (PZVEX) management announced in July that they would take the company private at an EV of 1.7% of AUM. In either case, I anticipate a meaningful increase in both margins and earnings once WHG closes on their acquisition of Salient.

The remaining 6% of losses on the long side relate to positions where I got it wrong. Our largest loss came from a position that I have held since covid. I erred in owning a cyclical company that would be disadvantaged during a sustained slowdown (lacks the balance sheet or business quality to take advantage of opportunities that may arise).

It was a painful reminder of anchoring bias and the need to constantly look at the portfolio with a fresh set of eyes. On the positive side, these detractors were partially offset by our position in BBQ Holdings which was acquired for $17.25 vs the Q2 close price of $10.42.

During the quarter I initiated a position in America’s Car-Mart (CRMT). CRMT is a used auto retailer and financing company serving low-end consumers. Given their focus on rural areas with limited public transportation, CRMT offers an essential service – a way for poor credit quality customers to get to work. As you might expect, loan charge-offs have averaged 25% annually and typically occur when a customer loses their job or the car breaks down. To offset this risk, CRMT charges a hefty 16% annual rate.

You might wonder why I would buy this given the economic sensitivity of the low-end consumer and falling auto prices. Should unemployment pick-up we will likely see increasing loss incidence rates. And with falling auto prices it would be logical to assume that their upfront margins would compress and loss recovery rates would fall.

Over the past two decades CRMT loss reserves peaked two times to the 32-35% range. In both of these periods CRMT loss expenses exceeded actual charge-offs of 30-33% as the company had to increase their balance sheet reserves. The good news is that, today, balance sheet reserves are already at the high end of the range at 22.4%. Even considering those previous catch-ups, CRMT has been profitable in every year over this time frame.

Of course, it is entirely possible that we enter another period of high charge-offs. But these are relatively short-term loans (42 months on average) where the majority of defaults occur within the first twelve months. Given the quick turnaround, CRMT has the opportunity to adjust its underwriting standards in real time. As of last quarter loan’s delinquent 30 days or more stood at 3.6%, slightly below the long-term average.

Furthermore, in April of this year the company financed half of their loans via a non-recourse securitization. Not only does this diversify their funding sources, but it also helps ringfence some risks to the enterprise.

Regarding used auto prices, deflation is not necessarily bad for the company. CRMT’s customer is extremely price sensitive. Given the recent lack of supply and run-up in prices, CRMT took the strategic decision to sacrifice on upfront margin to get people on the road. Additionally, some customers were simply priced out of the market. While it is possible that falling prices will hurt near-term margins as the company works through old inventory, long-term lower prices are preferable.

CRMT has a strong history of creating shareholder wealth through organic growth and capital returns. This is no surprise as management and directors own 12% of the company. Over the last decade they have shrunk shares outstanding by 32% while increasing tangible book value by 150% (tangible book value per share has increased 270%). Their unique approach to auto sales and loan generation has allowed the company to generate ROEs in the mid-teens.

We can buy this company today at just 0.85x TBV (i.e. 17% “normalized” annual returns exclusive of multiple expansion), an attractive entry point when we look out beyond the immediate term.

Sincerely,

Aaron Sallen

General DisclaimerThis material does not constitute an offer or the solicitation of an offer to purchase an interest in Merion Road Small Cap Fund, LP (the “Fund”), which such offer will only be made via a confidential private placement memorandum (the “Memorandum”). An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. All statements herein are qualified in their entirety by reference to the Memorandum, and to the extent that this document contradicts the Memorandum, the Memorandum shall govern in all respects. This material is confidential and may not be distributed or reproduced in whole or in part without the express written consent of Merion Road Capital Management, LLC (the “Investment Manager”). The information and opinions contained in this document are for background purposes only and do not purport to be full or complete. Unless otherwise stated, the information in this document is not personalized investment advice or an investment recommendation on the part of the Investment Manager. The performance data discussed herein do not represent the performance of the Fund, but rather, represent the unaudited performance of a basket of separately managed accounts managed by the Investment Manager pursuant to the same strategy expected to be implemented for the Fund. Results generated in the Fund once outside capital is admitted could be materially different than those results shown. The results shown reflect the deduction of: (i) an annual asset management fee of 1.5%, charged quarterly; (ii) a performance allocation of 15%, taken annually, subject to a “high water mark;” and (iii) transaction fees and other expenses actually incurred. The management fee and performance allocation were applied retroactively and do not reflect actual fees charged. None of the results shown reflect the deduction of certain organizational and operating expenses common to investment funds, which would serve to decrease profits or otherwise increase losses. Results were achieved using the investment strategies described in the Memorandum. Results are compared to the performance of the Russell 2000 Index, the Russell Micro-cap Index, and the Barclay HF Index (collectively, the “Comparative Indexes”) for informational purposes only. The Fund’s investment program does not mirror any of the Comparative Indexes and the volatility of the Fund’s investment program may be materially different from the volatility of the Comparative Indexes. The securities included in the Comparative Indexes are not necessarily included in the Fund’s investment program and criteria for inclusion in the Comparative Indexes are different than criteria for investment by the Fund. The performance of the Comparative Indexes reflects the reinvestment of dividends, as appropriate. This material contains certain forward-looking statements and projections regarding market trends, investment strategy, and the future asset allocation of the Fund, including indicative guidelines regarding position limits, exposures, position sizing, diversification, and other indications regarding the Fund’s strategy. These projections and guidelines are included for illustrative purposes only, are inherently predictive, speculative, and involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. The guidelines included herein do not reflect strict rules or limitations on the Fund’s investment program and the Fund may deviate from the guidelines described herein. There are a number of factors that could cause actual events and developments to differ materially from those expressed or implied by these forward-looking statements, projections, and guidelines, and no assurances can be given that the forward-looking statements in this document will be realized or followed, as described. These forward-looking statements will not necessarily be updated in the future. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

|

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment