bjdlzx

Civitas Resources, Inc. (NYSE:CIVI) came to be originally with the Bonanza Creek (BCEI) merger to Extraction Oil & Gas (XOG). Then the company went on an acquisition spree to acquire Prestone Peak Resources. Somewhere in the process, HighPoint Resources (HPR) was acquired. The final company composition was of the four companies (even if I have the actual order not quite accurate). Three of these companies (all except Prestone) have bankruptcy in their history.

It is not unusual for bankrupt companies to combine with another company to try to obtain better valuation than the typical bankruptcy discount allows for. However, this was a combination of a lot of companies with financial stress in their history. The main idea is that one large company can compete better than all of them could separately.

In addition to that, Colorado made the papers trying to revise some ancient regulatory laws. During the process, there was a fair amount of coverage of the issues of urban areas encroaching upon producing or formerly producing areas. All of that press and related topics needs time to die down so that the “Colorado discount” is not applied by the market.

Colorado actually has reasonable regulation along with a healthy industry. But bad press sometimes overrules a lot of reasonable conclusions.

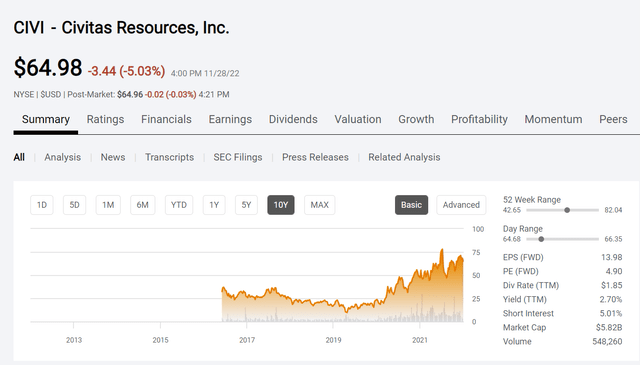

Civitas Resources Common Stock Price History And Key Valuation Measures (Seeking Alpha Website November 28, 2022)

Civitas’s stock has been around long enough that the stock may well be considered seasoned. That may mean the various bankruptcies are declining in significance now that there is some history. The company itself has largely managed to stay out of the headlines (which is always good for business). Probably the biggest risk factor here is the location of production.

Urban Risk

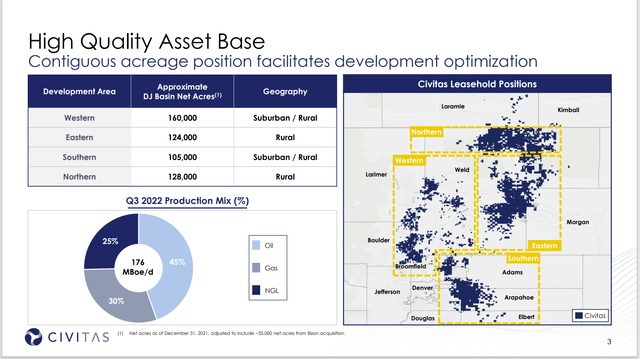

Like most producers, Civitas has a fair amount of operations in Weld County, which is a rural county that supports the industry.

Civitas Resources Map Of Operations (Civitas Resources Earnings Conference Call Presentation Third Quarter 2022)

Unlike much of the industry, this company has considerable urban exposure in a state that has fairly rapid population growth. The “bumping” of urban areas into industry areas of operations is not exactly going very smoothly. Although, both sides have cooled off somewhat compared to the past. Of course, the modernization of Colorado regulations has helped as well. Still, there is a risk of operations here that is not present with a lot of oil and gas upstream companies.

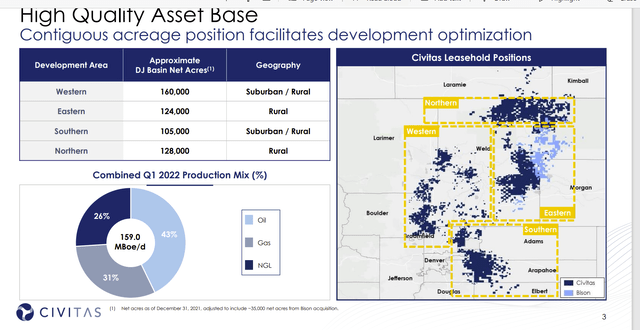

Civitas Map Of Latest Acquisition And Rural To Urban Exposure (Civitas Resources August 2022, Corporate Presentation)

The company recently did the Bison acquisition that resulted in more acreage located away from populated areas ((Good!)). But that population exposure is something that calls for extra operating care, because any mistake in a populated area is likely to make the headlines as well as bring the politicians into the picture.

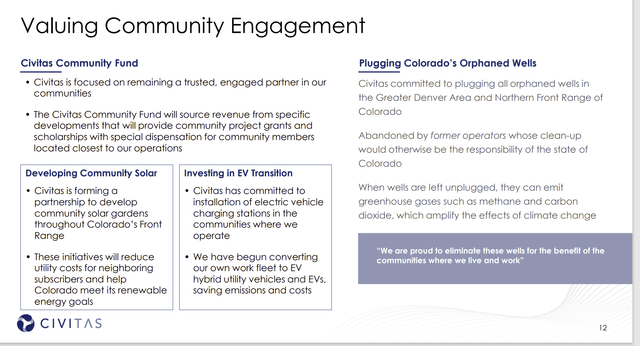

Community Engagement

This company is obviously in the forefront of community engagement due to the location of operations in urban areas.

Civitas Public Relations Efforts (Civitas August 2022, Corporate Presentation)

Those of us who have followed the Colorado industry know the importance of properly plugging and abandoning wells. Colorado has a huge issue of old wells that were “left behind” when things were different. As a result, the industry is in the unique position of properly abandoning old wells on leases.

Much of the industry has little worry of well abandonment. Colorado is a huge exception. This includes checking to make sure they do not leak (ever) even into the surrounding ground.

In addition to this, there is the changing demographics of the Colorado population. The rapid growth has been accompanied by a more liberal bent politically than was the case in the past. The industry is learning to accommodate the changing politics.

The policies adopted are meant to assure a reasonable future for the industry. So far, the money contributed by the industry through taxes and other revenue raising (both directly and indirectly) have kept things reasonable. But there is a risk of a more liberal attitude towards the industry that could have unfavorable consequences (especially for an operator in urban areas).

Basin Production

The basin itself as shown in the slide above has a combination of oil, natural gas, and natural gas liquids. Depending upon the well, the production mix is usually equal amounts of oil and natural gas (roughly) with a significant amount of natural gas liquids.

This is less profitable than say the oil window of the Eagle Ford. But the basin has extremely low lease operating expense costs that often more than make up for the less-than-optimal production mix. The result is a basin with a fairly low breakeven cost.

The challenge here is that a lot of the best acreage is near growing urban areas. That can make things “dicey” for what is normally a straightforward operating decision.

Balance Sheet

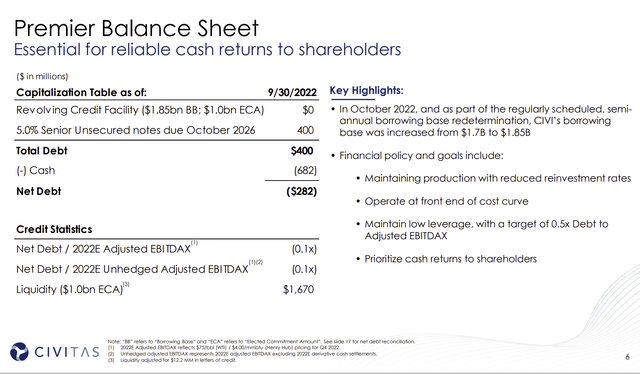

Just about “everyone” operating in Colorado has a rock-solid balance sheet (including this company).

Civitas Resources Key Debt Ratios And Finance Issues (Civitas Resources Earnings Conference Call Presentation Third Quarter 2022)

Most of the Colorado producers have debt ratios far less than one. When there are extra risks, then the first risk to minimize is the financial risk. Most of the industry in Colorado operates in that fashion.

This company does own a fair amount of midstream which definitely helps efficiency. Sometimes (as well) safety considerations are easier to monitor when everything is “under one roof.”

The Future

Much of the industry has adopted well to the Colorado business climate. The state itself is somewhere in the middle between pro-business states like Texas and the exact opposite in California (and New York). However, there is a future risk of more movement towards a liberal political bent as the state’s population continues to grow rapidly.

So far, the industry has been navigating the change. Those operators that have operations solely in rural areas can operate largely as the industry does just about anywhere else. This company has extra considerations due to the urban location of some leases and production.

The business itself is very low cost. Production has benefited from the robust pricing of all commodity prices currently. If it was just the oil and gas business as a consideration alone, this company has a great future with above-average profitability. This is one of the more profitable basins in which to do business.

Investors in Civitas Resources, Inc. need to decide if they want the risk of doing business near urban areas. There are companies like California Resources Corporation (CRC) that operate in urban areas without so much as a whisper of problems. The difference in Colorado is the growth is encroaching upon what was once rural, and those rural areas have wells that need to be properly abandoned. The state and the industry are now on top of the issue. But the immediate future probably demands a fair amount of close watching by any potential Civitas Resources, Inc. investor.

Be the first to comment