7activestudio/iStock via Getty Images

Q2 2022 saw BioCryst Pharmaceuticals (NASDAQ:BCRX) beat its revenue estimates by $1.71 million to close at $65.53 million (+31.17% YoY). In its earnings call, CEO Jon Stonehouse was optimistic that it was on track to exceed $250 million in annual revenue fueled by a growing subscriber base.

Thesis

BioCryst is expected to increase its market share in the treatment of hereditary angioedema (HAE) using ORLADEYO into 2023. Rival company, KalVista Pharmaceuticals (KALV) announced that it had terminated KVD824 Phase 2 Komplete Trial for the treatment of HAE. BioCryst also hopes to repeat its successful ORLADEYO implementation with other pipeline molecules for other patients suffering from rare diseases. Additionally, in a bid to secure shareholder value, the company intends to seek alternative financing sources (to prevent share dilution) such as debt to raise project funds.

Orladeyo gains after KVD824 is terminated

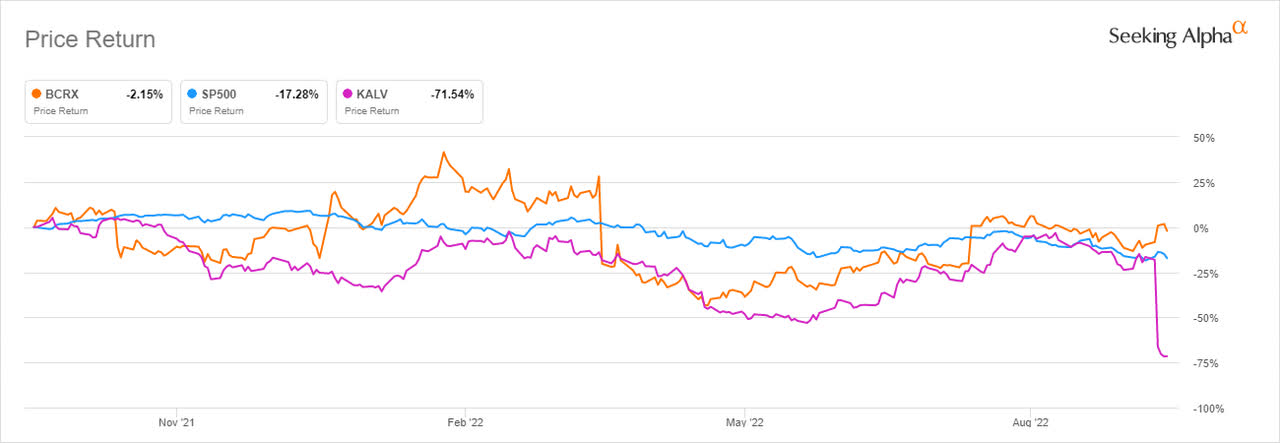

BioCryst’s share price returns reduced its losses to -2.15% (YoY) while KalVista declined 71.54% (YoY) after the latter ended its mid-stage study (Komplete) phase 2 clinical trial for KVD824 for the prevention of attacks in people with HAE.

Seeking Alpha

KalVista indicated that some patients in the trial had shown increased levels of liver enzyme, which if unchecked could cause liver damage. In his remarks, KalVista’s CEO Andrew Crockett stated,

We made the difficult decision to terminate KOMPLETE because we concluded that the emerging safety profile of the current formulation will not meet our requirements for a best-in-class oral prophylactic therapy.

A key benefit of this termination is that it would allow, KalVista to conserve its financial resources and advance sebetralstat through the phase 3 program and towards a planned 2024 new drug application (NDA) filling in 2024.

This withdrawal by KalVista will mean increased market presence for existing drugs from Takeda Pharmaceutical (TAK) through its TAKHZYRO drug, CSL Behring (through Haegarda), and BioCryst’s (ORLADEYO). These products have the option to work in two ways: to either prevent attacks and also treating HAE symptoms when they occur in patients.

Hereditary Angioedema (HAE) affects approximately 50,000 people. It is a rare lifelong disorder that leads to quick swelling of hands, feet, limbs, face, intestinal tract, or airways (such as the nasal passages).

BioCryst’s Orladeyo and KVD824 by KalVista were touted as a potential disruptors to the large market share enjoyed by CSL Behring’s Haegarda (approved by the FDA in 2017) and Takhzyro by Takeda. Now with KVD824 off the market, Orladeyo will enjoy a stronger market presence since it was the first oral treatment for the HAE disorder after its approval in December 2020. Analysts also predicted that Orladeyo could reach a third of the preventive HAE market by 2021 and advance its sales to $300 million by 2023.

After approval in December 2020, Orladeyo’s sales hit $10.9 million in Q1 2021. Furthermore, 50% of patients using the drug had switched from other medicines. Since Q4 2020, BioCryst’s quarterly revenues have increased by more than 1,530% (from $4.0 million to $65.5 million) indicating robust Orladeyo’s revenue contribution through the quarters.

In 2021, it was established that an estimated 1 in 10,000 people to 1 in 50,000 people had the HAE disorder. Since most treatments have been injectable therapy, BioCryst has had success with its oral Orladeyo drug treatment. In a bid to capture the market, BioCryst set a lower price of $485,000 per patient per year for Orladeyo. It came below Takeda’s price for Takhzyro at $566,000 and Haegarda by CSL at $510,000. BioCryst’s switch strategy, therefore, involved patients coming from injectable HAE treatment to a well-controlled novel oral treatment.

BioCryst’s robust guidance of $250 million for this year – 2022 – is consistent with the company’s growing prescriber base as evidenced by the 96-week data. In its Q2 2022 earnings call, BioCryst’s management explained that it had seen a surge among the top 500 physicians that treat 50% of HAE patients. Of these, 60% are tier-one physicians that were prescribing Orladeyo and accounted for two-thirds of prescriptions in the quarter. In explanation of this aspect, BioCryst’s Chief Commercial Officer, Charlie Gayer, stated,

There are roughly 120 physicians in the top three deciles, accounting for 30% of the HAE market opportunity. And they prescribed 32% of the ORLADEYO prescriptions in Q2. Roughly 1,400 physicians represent the next 40% of the opportunity, and that group accounted for 48% of prescriptions.

Pipeline Development

Cumulatively, Orladeyo’s success has made BioCryst improve its pipeline for other patients suffering from rare diseases.

BioCryst announced at the end of August 2022 that the FDA had granted orphan drug designation for BCX9250 for the treatment of fibrodysplasia ossificans progressiva (FOP). This announcement comes months after the company announced that the FDA had granted Fast Track Designation for BCX9250 ALK-2 Inhibitor. The company completed the phase trial of BCX9250 in healthy humans which was declared safe and well-tolerated at all doses studied. A clinical linear trial study conducted by the company of the phase 1 trial supported BCX9250’s potential for once-daily dosing.

Fibrodysplasia ossificans progressiva (FOP) is a lifelong irreversible condition that gradually turns muscle, tendons, and ligaments into bone. While its prevalence varies, confirmed cases of FOP occur in roughly 1 out of every 1 to 2 million births. Globally, about 800 patients have been diagnosed with FOP with about 97% of patients harboring the same genetic variant as of 2006.

In its announcement, BioCryst stated that the FDA’s granting of this designation (on a disease affecting less than 200,000 individuals in the U.S) meant that it was eligible for incentives including tax credits for qualified clinical trials, exemption from user fees, and 7 years of market exclusivity post approval.

On the same front, BioCryst announced that its oral factor D inhibitor, BCX9930 had shown>99% (median) suppression of the alternative pathway (AP). An additional >98% (median) suppression was kept for 24 hours post-dosing in patients with C3 glomerulopathy (C3G). This is a rare renal disease featured by dysregulation of the AP of the complement system.

In its Q2 2022 earnings call, BioCryst indicated that it was working towards allocating capital to redeem and renew studies to identify an effective dose with BCX9930. The company revealed during the call that the FDA had lifted the partial clinical hold of the BCX9930 program. This removal signaled a resumption of pivotal trials for renal conditions. BioCryst explained that the enrolment would include a dose level of 400 mg twice daily coupled with hydration and additional safety tests for the first few months in every patient. The dosage was to be calculated to ensure patients would avoid the risk of elevated serum creatinine levels.

Risks to the Downside

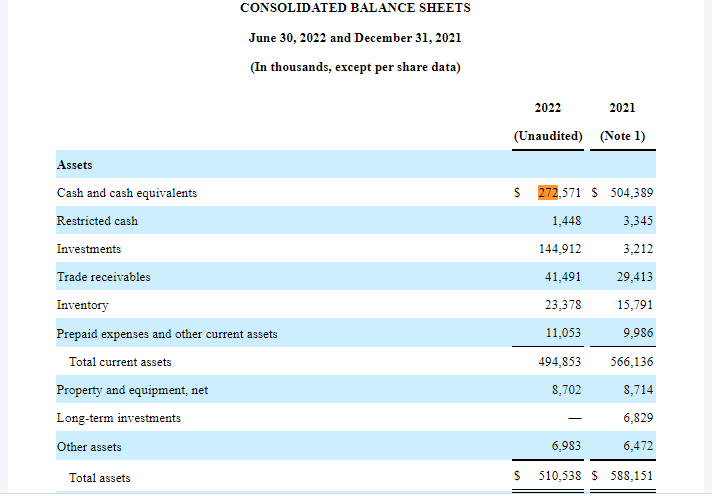

BioCryst’s asset level is lower than its liabilities. BCRX’s cash balance as of June 30, 2022, stood at $272.57 million bringing the total current asset level to $494.85 million and total assets to $510 million. However, total liabilities had increased by 4.61% (QoQ) to $723.8 million and accumulated losses hit a high of $1.34 billion indicating an increase of 4.6% (QoQ). Additionally, in the six months that ended on June 30, 2022; BioCryst’s loss increased by 23.79% (QoQ) to $133 million.

The company indicated that it would seek additional debt to finance its pipeline development. At the moment the company’s total debt balance stands at $630.5 million which is higher than its fixed assets at ⁓$510 million.

BioCryst indicated that it had enough liquidity to fund its operations until June 30, 2023. However, in funding its operating activities, BioCryst used $105.557 million in cash up 22.14% (YoY) together with a net cash expenditure of $135.91 million in investing activities. A combination of these two activities means that BioCryst spent $241.47 million in the six months leading to June 30, 2022.

BioCryst Q2 2022 10-Q

Taking the cash position (the principal source of liquidity) at $272.6 million, then it means the company’s liquidity is sufficient to cover the company’s expenses for the next 6 months that it until December 2022 before it seeks additional funding. To counter this situation, the company explained that it would seek to maintain the revenue threshold to draw an additional $75 million in debt tranches from a cerium Pro form of cash which is at about $492 million. This drawdown will be necessary as it recommences its patient enrolment in the BCX9930 program.

Bottom Line

BioCryst is looking to reap big from the hereditary angioedema (HAE) market after the withdrawal of KalVista’s KVD824. The company has witnessed an increase in revenue since Q1 2021 after it launched Orladeyo indicating successful drug penetration in the market. Additionally, the consistent patient growth since the launch alongside more patient prescriptions in Q2 has deepened pipeline development into Q3 2022. After the FDA removed the partial clinical hold on the BCX9930 program, it allowed a resumption of enrolment of the clinical trial. BioCryst also announced that its oral factor D inhibitor had shown 99% suppression of AP. The main challenge faced by the company is its weak liquidity position against operating and capital expenditures that may deplete cash reserves in 6 months. To contain this headwind, BioCryst is looking to draw on its debt tranche which totals $492 million. For these reasons, we recommend a hold rating for the stock.

Be the first to comment