Just_Super

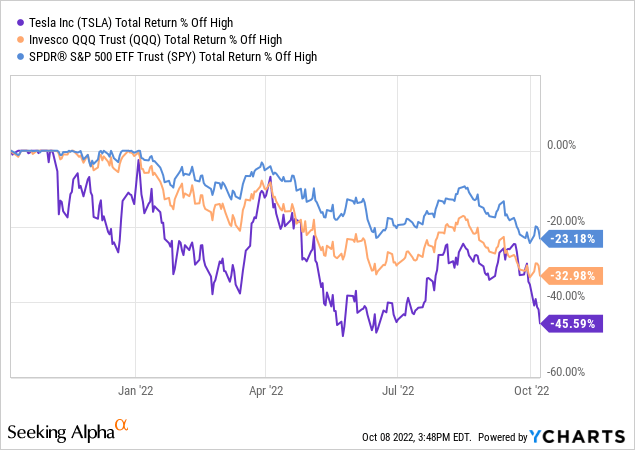

Tesla (NASDAQ:TSLA) introduced its highly anticipated Optimus/ Bumble C robot this week at AI Day. There were also a slew of news announcements from Tesla and others that had very positive implications for the future. Nevertheless, Tesla shares this week seem headed for their longest losing streak since March 2021.

We think that Tesla’s new humanoid robot, in addition to developments in their real world AI, computing and other Tesla products currently represent a very attractive buying opportunity for long-term holders of the stock, and we expect it to outperform broad benchmarks even in times of macroeconomic distress.

Bumble C

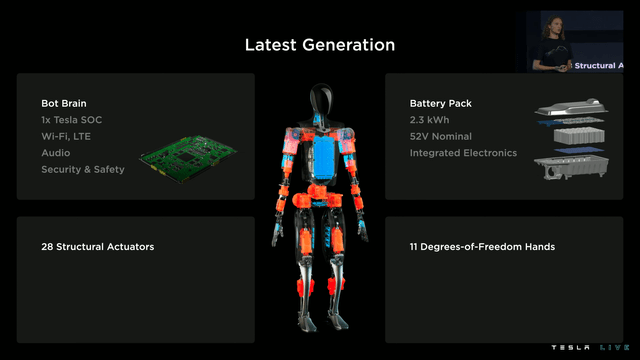

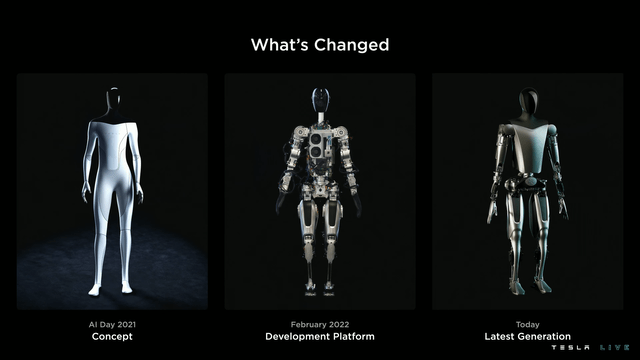

As Tesla’s Humanoid Robot is still under development, they were able to show their prototype “Bumble C,” which is to become a low-cost and mass-producible Optimus robot.

The initial release and demonstration of the product was followed by a variety of reactions from experts in the robotics industry and the investment community. Interestingly, Tesla received high praise from experts from the robotics industry, while there were many skeptics from the investment community.

We want to highlight the key differences between what makes Tesla’s bot so different from competitors such as Boston Dynamics, Honda and others:

- Optimus is intended for mass production (i.e., thousands or millions of units).

- Project progress was made in just 6 to 8 months, compared with decades at competitors.

- The robot is expected to be affordable, costing only US$20K to manufacture, or “significantly less expensive than an EV.”

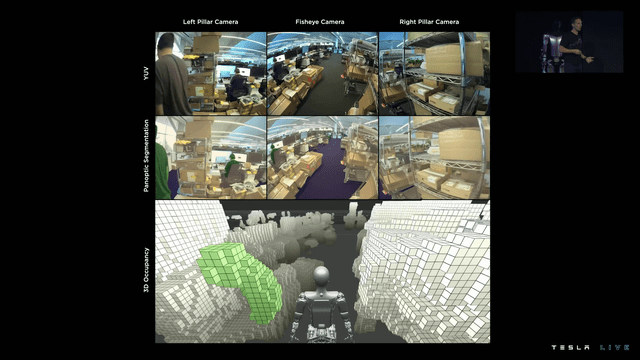

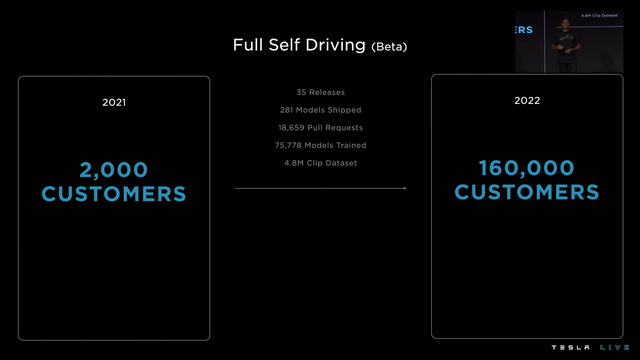

- Tesla has a formidable AI advantage in the real world thanks to data collection efforts such as their FSD beta.

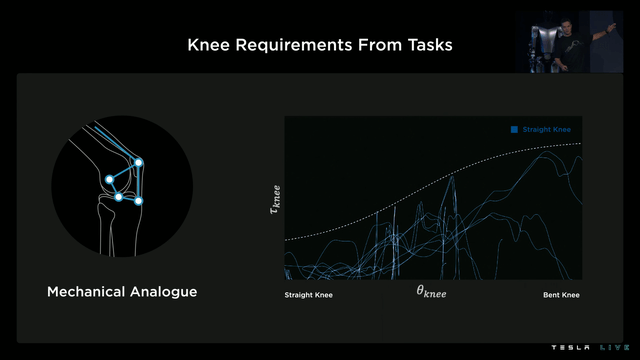

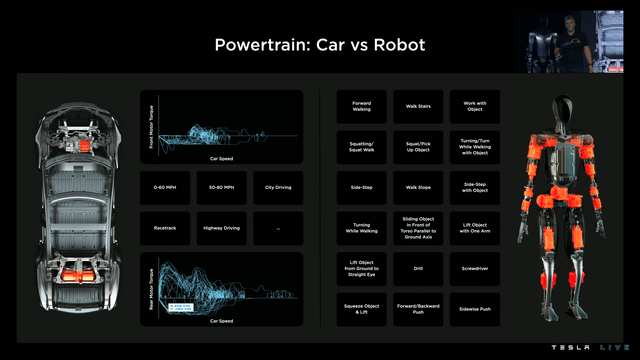

- It is built for efficiency, and optimized for defined tasks rather than optimized for aesthetics.

Critics who compared the Optimus prototype to Boston Dynamics, for example, should note that Boston Dynamics has been around for 30 years, and their humanoid robot Atlas has been in development for nearly 10 years, rather than 6 to 8 months. Boston Dynamics has also shown no intention of mass-producing their Atlas Robot, or at what price. However, their smaller robot dog, Spot, is currently available at a price of about US$75,000. At a price of US$20,000, not only small businesses but also households should be able to afford an Optimus robot.

The same goes for other concepts, such as Honda’s Asimo robot, a humanoid robot that has been in development since the 1980s and was officially created in the year 2000. Although initially intended for mass development, Honda stopped producing Asimo robots to “focus on more practical applications.” None were actually sold, but Honda gave a pseudo quote of as much as $2.5 million per robot.

Tesla’s robot may not have the same dexterity and human-like character because it is not primarily intended to perform tasks such as parkour or dancing. We also believe that Tesla, thanks to its real-world data collection, for example with FSD Beta, and its fleet of more than 3 million cars, has a head start on developing a functional AI-driven humanoid robot.

It is also important to note that this event was not aimed at investors, as the sole purpose was to recruit the best possible talent for Tesla and their Optimus project. We believe that recruiting the most talented engineers and employees at Tesla is a huge advantage for innovation within the company and to stay ahead of the competition.

For example, a recent survey of 49,197 American students by Universum, which specializes in employer branding, found that Tesla and SpaceX were named as their ideal employers. The combination of the ability to attract the best team of engineers, expertise in scaling and mass production, combined with a strong lead in data collection and years of expertise in real-world AI development, leads us to consider that Tesla is poised to become the leading company in humanoid robotics.

The Cost Savings

One of the main reasons Tesla is likely to make robots for a price tag of only US$20K is probably their ability to scale, vertically integrate and simplify concepts by leveraging their advances in automotive technology. Remember, Tesla specializes in “building the machine that builds the machine,” like their Gigafactories.

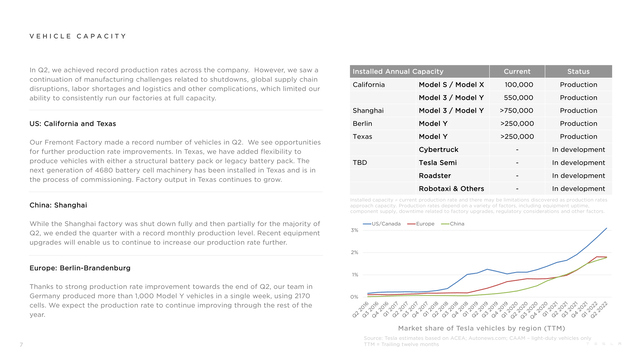

For example, in their Q2 report, they showed that the number of robots in their gigafactory body shop could be reduced by 70% compared to their first Model 3 body shop through large castings and parts consolidation. They are still on a quest for simplification with each new product and factory. Another example could be Tesla, which reportedly removed the ultrasonic sensors on Model 3 and Model Y vehicles because they are more confident in their AI and full self-driving capabilities.

Vertical integration in innovation is always an important concept because the unit price of certain components can drop significantly as a result of Wright’s Law. For example, according to Wright’s law, the cost of batteries drops 28% for every cumulative doubling of the number of units produced. That concept could be accelerated, as some of the robots’ components have similarities to what is used in EVs, and could be vertically integrated. The Optimus robots could also be used in Tesla’s own production chain, producing more cars and robots.

There is still some debate whether Tesla will sell the robots at a fixed price, lease them, or possibly require an annual subscription for the robot and its software. If the Optimus could be produced for US$20K, it could represent a significant cost savings for employers that completely exceeds the output and productivity of an average worker. Tesla’s FSD Beta software alone currently costs US$15K, and sells very well.

Compared to the average US work week, which is about 38.7 hours, Optimus can stay connected 24/7 when working in a factory, bringing the total work week to 168 hours. That’s a 4x increase in output. Let’s say the robot can replace 4 full-time factory or warehouse workers performing boring and repetitive tasks, employers could save up to $29,250 per employee per year.

That makes $117,000 per robot per year, since its output is more than 4 times that of an employee. If the average lifetime of a robot is 8 years, this means a value of $936,000 per robot over its lifetime. This does not include the cost of employing workers, elimination of personnel costs, worker training and productivity loss due to illness or injury. Each year, approximately 2.3 million people worldwide suffer a work-related injury.

With a value of US$936,000 and a COGS of US$20,000 in mass production, each unit produced could generate US$916,000 in value. Suppose Tesla takes a 30% gross margin on the value of this robot, just as they do with their cars, that leaves another US$274,800 in gross profit per unit produced, or US$274.8BN per million units produced.

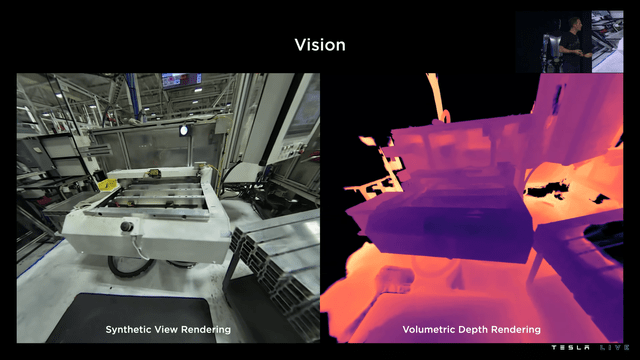

The big difference in why Tesla could succeed in building a truly intelligent robot capable of performing realistic tasks lies in its data advantage and its unique ability to collect data in real time. Even as we speak, thousands of cars worldwide on FSD Beta are collecting data to train Tesla’s AI. It has been collecting such data since 2014, has a dataset of 4.8 million clips and has trained 75,778 models.

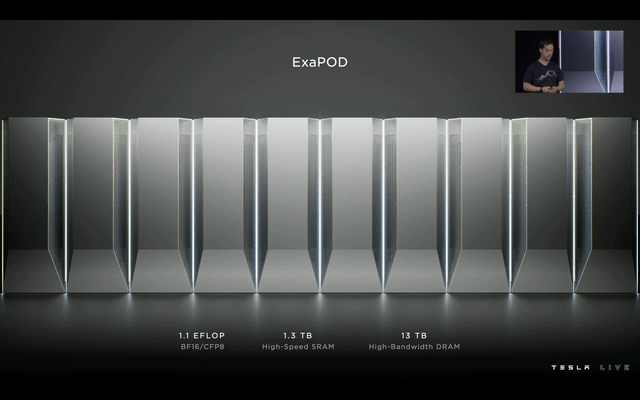

Tesla also showed that it is serious about AI, by giving us a big update on their Dojo supercomputer they are building, and what plans they have for it. Tesla currently still uses a lot of Nvidia (NVDA) GPUs, but plans to increase its own capabilities for training its neural net.

It should also significantly reduce costs, and help Tesla maintain a data advantage. As Tesla’s fleet grows exponentially with increased production and the rollout of FSD beta to more users, the amount of data Tesla and FSD beta collect in real-world applications also scales exponentially. Currently, Tesla has already driven over 35 million miles with its FSD beta cumulatively. Currently, they appear to be adding 10 million miles per quarter and expanding exponentially.

Tesla currently claims that it can replace 6 GPU boxes with just 1 Dojo tile, which they also claim costs less than 1 GPU box itself, further significantly improving their cost efficiency and form factor in building out their AI systems.

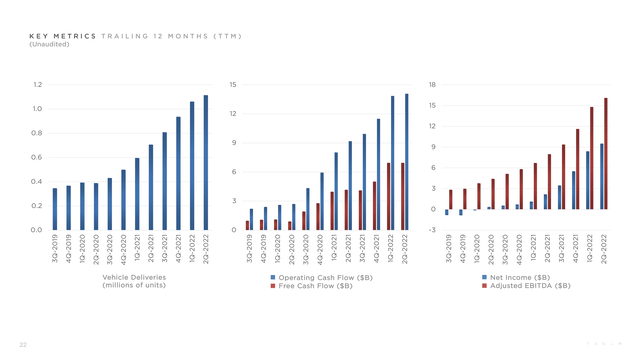

The Automotive Side

Tesla has ventured into many areas, including batteries, solar, AI, self-driving, computers, robotics and more. While all of these ventures are promising and show great potential, we believe Tesla’s auto side itself can generate better returns than broad benchmarks such as the S&P 500 (SPY).

In the transition to EVs, we believe that with Wright’s Law in place, EVs will be on par in price with ICE vehicles by next year 2024, and it will be a no-brainer to buy an EV. Especially as US oil prices remain high. OPEC+, for example, announced this week a production cut of 2 million barrels per day. Not only will it become cheaper to buy an EV, including tax breaks, but it will also likely cost less to maintain and refuel, increasing the adoption rate exponentially.

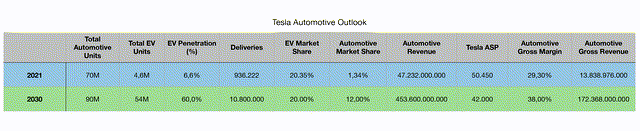

In 2021, the EV adoption rate was 6.6%, and we believe that by 2030 about 60% of car sales will be EVs, as EVs continue to fall below the same price as ICE vehicles as explained in our previous model. Under our assumptions, Tesla’s market share in EVs will remain stagnant at 20% as competition enters the market. If both criteria are met, Tesla is expected to sell 10.8 million vehicles per year by 2030.

This is also in line with Elon Musk’s expectation to have a fleet of more than 100 million cars in 10 years. Tesla has set a goal of producing more than double our estimate of 20 million units by 2030. However, we believe Tesla’s average selling price will drop from US$50,450 in 2021 to US$42,000 in 2030 as a result of a new smaller sedan, with a target price closer to US$25,000-US$35,0000, in addition to a price cut to keep up with competitive pressures.

For a more in-depth explanation of our parameters for our valuation, please read our previous valuation model published here on Seeking Alpha. We expect Tesla to generate approximately US$172.37BN in gross automotive revenue by 2030, with a gross margin of up to 38%.

OpEx is also likely to improve significantly over time, as Elon Musk himself alluded that “OpEx. is embarrassingly high.” Tesla’s adjusted EBITDA margin was 21.6% in 2021, which we predict could reach 32% over the next 8 years. These improvements include cost reductions, historical margin improvement, expansion of software-based revenues and low fixed costs.

This would lead us to a final adjusted EBITDA of US$145.15 billion for the automotive section. If 5% annual share dilution is also taken into account, that would lead to adjusted EBITDA of US$31.42 per share by 2030. At a reasonable multiple of 16x, we expect Tesla’s auto section to propel Tesla to $502.67 per share, or a CAGR of 10.7% that exceeds the historical average return of the S&P 500.

We used the mean of the S&P 500 multiplier, but Tesla could be trading higher at that point because it could also be valued as a software company trading at much higher multiples. Also note that the S&P 500 is more likely to trade below its historical average return because economic growth is currently stalling.

Developments, Macroeconomics & Risks

While many critics expect Tesla to have a demand-side problem, we believe the opposite is true. Tesla historically and still has a huge order backlog, and has recently had to raise prices again to ensure that the customer experience does not suffer from immense wait times.

According to Teslike, which tracks Tesla data, the company still has a backlog of 317,000 vehicles despite price increases. This continuous backlog of orders could also serve as a great buffer if we are heading for an earnings recession by the end of this year, as we and many economists expect.

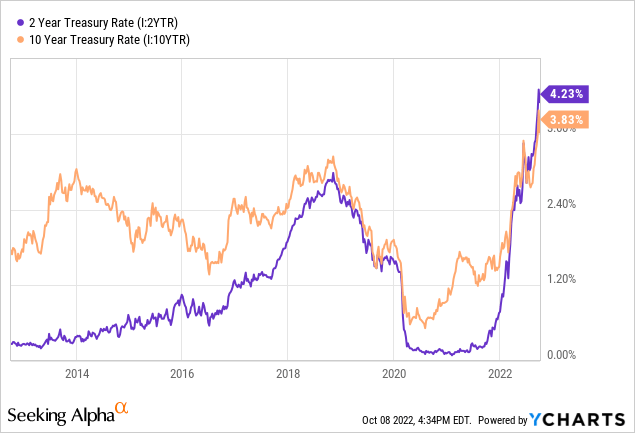

In contrast, looking at economic indicators, we see an environment of rising yields, which are expected to rise to 4.5-4.75% by next year, making it more expensive for Tesla to expand operations, raise additional capital to build new Gigafactories and ramp up production as previously planned in a 0 interest rate environment, they face macroeconomic headwinds.

On the other hand, OPEC+ announced this week its intention to cut production by 2 million barrels per day as the group seeks to keep crude above $90 per barrel. This would also boost demand and accelerate the use of EVs as they reach the same price as ICE vehicles. Another big risk for Tesla is the production, or scaling up of its batteries, specifically 4680s in the future.

Tesla also announced this week its deliveries for Q2 2022: 365,923 vehicles were produced and 343,830 delivered, which was less than the deliveries expected by Wall Street. While some investors thought it was due to a “demand-side problem,” Tesla mentioned that it was actually due to the fact that it is “increasingly challenging to secure vehicle transportation capacity, and at a reasonable cost during peak logistics weeks.” We think Tesla made the right decision, saving capital for investors rather than placing hasty orders toward the end of the quarter to meet Wall Street’s expectations.

Tesla also recently received an investment grade rating for its bonds for the first time, meaning they are rated BBB by S&P global and are no longer “junk bonds.” Even more good news came this week, as Elon Musk also hinted that Tesla will start production on December 1st and deliver its first Semitruck to customer Pepsi. This means that Tesla could be sending us a positive signal about its 4680s battery production and is ready to disrupt a new segment of the auto industry.

The Bottom Line

Optimus could give Tesla a huge boost in cash flow, if it manages to solve and integrate true AI into its Optimus robot and can mass produce it at very low cost. According to our assumptions, Tesla looks like an attractive investment, as the company is expected to outperform historical average benchmarks such as the S&P 500 with its automotive operations alone.

Other complementary activities that generate cash flow, such as solar, batteries, Optimus, AI, computer applications and others, have great potential and could push the company’s valuation beyond the $502.67 per share target, giving investors additional alpha if the projects succeed and are widely implemented. We believe Tesla’s expertise in “building the machines that make the machines” puts them in pole position to dominate the innovative sectors in which Tesla operates.

In essence, we fully support Elon Musk’s view at AI Day that Tesla is essentially a succession of tech start-ups trying to solve some of the most difficult problems. All the recent positive news, amid one of Tesla’s biggest one-week declines, makes Tesla stock all the more attractive to buy at this time, in our opinion.

Be the first to comment