jetcityimage/iStock Editorial via Getty Images

A lot has been written on the GameStop (NYSE:GME) saga since its onset in early 2021. How a niche subreddit was able to move the needle in the stock market was also recently featured in a new Netflix show called Eat the rich. Most importantly from GameStop’s point of view, the meme-stock frenzy quite literally helped save the company, as the management was quickly able in the second quarter of 2021 to raise $1.1 billion in cash by issuing new shares to the hungry crowd of Reddit traders. However, it does not seem like the company invested this capital in any meaningful growth strategy as even the latest result only showed a lot of pain for investors. In the meantime the stock is still trading to historically high valuation, defying investment fundamentals. The stock is purely a momentum trade which should be avoided by any long-term investor. Let’s dive deeper on the company’s recent results and on what is challenging its business model.

A challenged business model

During the latest quarter management has provided an update on the company’s cash position, which is still in a somewhat decent shape but its balance sheet resilience is deteriorating quarter after quarter. GameStop ended Q2 2022 with $908.9 million of cash, down from $1.7 billion the year before. For a chronically unprofitable business experiencing in my opinion a shrinking total addressable market (due to the advent of alternative and more successful digital stores) the rate of cash burning is worrying even if nominally the balance sheet seems in a decent state at the moment thanks to only about $32 million of long-term debt.

Every metric point towards a declining business that is getting weaker and weaker. Gross margins over the past 10 years went from around 30% to the current 21%. Profit margins also are constantly declining and have been negative consistently for just about 4 years. On a free cash flow basis the picture does not improve much as the company has been burning through cash since the onset of the pandemic.

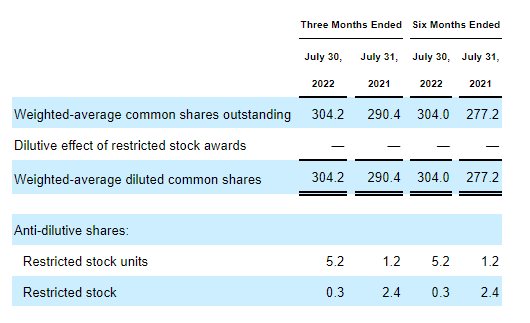

Due to the constant need for cash the company is still issuing new shares and as such diluting existing shareholders. While some shares issuance can be acceptable in cases of high growth stocks that want to preserve cash in favour of stock-based compensation, in GameStop’s case this simply contributes to painting an unfavourable risk-reward scenario as shares dilution directly impacts future price appreciation (all else being equal).

Share dilution (Q2 2022 Earnings Report)

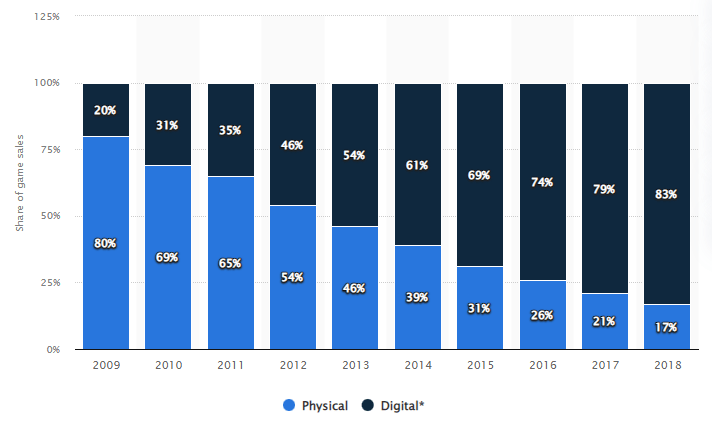

What I believe is most concerning is the lack of vision from management. The company is unable to rely anymore on the sale of physical copies of video games: a clear industry trend is that players around the world overwhelmingly prefer to buy their games in digital formats. As shown in the following chart provided by Statista, in 2009 only 20% of games were sold digital; fast-forward to 2018, this share grew to 83%. GameStop might still have a role to play as reseller of second-hand video games, but the trend overall is clear and the sale of video games will continue to represent a smaller portion of the company’s revenue for the foreseeable future.

Share of physical and digital video games sold (Statista)

Management has stated that one goal for the future is aiming at growing the sales of collectibles, which should contribute to raising the margins. Unfortunately for the past few years all the business’ margins have been deteriorating, indicating that either the collectibles segment is not growing enough, or that the thesis simply is not working.

Sales of collectibles grew in the quarter 26% to $223 million, which represents only 19% of the company’s overall sales. The lion’s share is still Hardware and Accessories, which is the only legacy segment that I don’t believe will be challenged much by the onset of new platforms. As of now gaming hardware could only be replaced by cloud gaming, which however is far from reaching any meaningful scale also considering how Google shut down Stadia.

The most glaring lack of vision is the launch of nonsensical products such as digital wallets for cryptocurrencies and NFTs. GameStop launched these initiatives between late 2020 and early 2021, when the market’s appetite for speculative assets was seemingly bottomless. As of now the company has still to show any number for it, basically asking investors to have blind faith that the endeavour will not only work out, but will actually drive the company’s growth for the future. On this note a partnership with the cryptocurrency exchange FTX has been recently announced based on which GameStop will be carrying FTX gift cards and help the exchange in new e-commerce activities. No specific details have been published about the financial terms of the partnership, nor any details regarding how the two companies can actually work together.

Overall the company’s performance simply spells trouble due to shrinking margins, constant unprofitability, and a challenged business model. And yet, valuation is sky-high. I believe Hardware and Accessories will still play a role for the future but is a highly cyclical business that relies on new consoles being released every 5-7 years. The Collectibles segment is growing nicely but is still unable to right the ship by itself. The big elephant in the room is however the stock’s valuation: short-term traders have bid up the stock to such levels that it is impossible to justify any reasonable investment in a high-risk company such as GameStop.

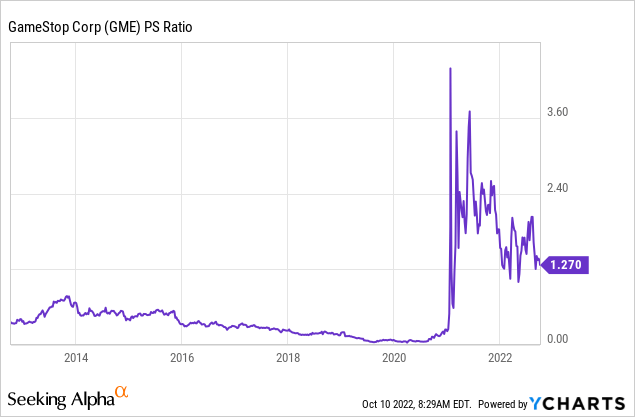

Valuation and key takeaways

While there’s no PE ratio as GameStop is unprofitable, simply on a P/S [TTM] ratio the company is trading at historically high valuations. Below is the chart of the last 10 years for GameStop and it speaks for itself: even when the company was thriving it was not anywhere near the levels at which it is trading today, when its business model is under attack and the company has a constant need of raising cash. There is nothing reasonable about GameStop’s valuation because no one is trading the stock based on fundamentals. It is a pure momentum and speculative play, but I personally have no interest in being part of irrational meme-trading. Fundamentals say that GameStop is a legacy business that is in its declining phase and is in dire need of a considerable business pivot.

YCharts – Seeking Alpha

I believe that any long-term investors should stay away from GameStop. There is always an argument to be made that owning shares might be profitable in the event of another short-squeeze, following the footsteps of the Reddit apes; however, this is as far as it could be from what I consider a sound investment and as such I consider the stock a strong sell.

Be the first to comment