helloabc

Chinese video platform Bilibili Inc. (NASDAQ:BILI), backed by Alibaba (BABA) and Tencent (OTCPK:TCEHY), has a target to expand and diversify its userbase that appears to be on track. However, losses continue to swell, and with the country’s regulatory environment changing in favor of outdoor games and sports, along with extremely stiff competition, the company’s path to profit could be an uphill climb.

Rapid growth in revenue, MAUs, and engagement

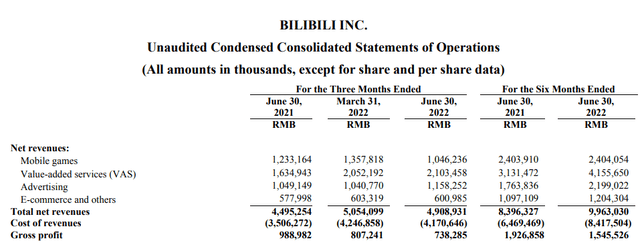

Bilibili Inc. net revenues were up 9% YoY to CNY 4.9 billion in Q2 2022. All segments except Mobile Games reported robust growth; revenues from Bilibili’s biggest revenue stream, Value Added Services (which includes premium subscription services which offers exclusive access to premium content) rose 29% YoY to CNY 2.1 billion, while Advertising revenues rose 10% YoY to CNY 1.16 billion, a standout performance against a backdrop of sagging digital ad spending around the world, including in China. eCommerce and other revenues inched up 4% YoY to CNY 600 million and Mobile Games revenues, hurt by the Chinese government’s freeze on approvals for gaming licenses imposed in July 2021, declined 15% YoY to CNY 1 billion.

Bilibili Q2 2022 quarterly report

MAUs (monthly active users) reached a record 306 million in Q2 2022, up 29% YoY, while the platform had 13.2 million total monthly average content submissions, up 56% YoY from 3.6 million monthly active content creators, up 50% YoY. Average monthly paying users (MPUs) jumped 32% YoY to 27.5 million.

At 89 minutes spent on the platform daily as of Q2 2022 (a 9 minute increase compared with the same period last year), Bilibili users are more engaged than Youtube users (who spend around 74 minutes a day).

Near-term tailwinds from Covid likely to recede

Over the past few quarters, Bilibili benefited from near-term tailwinds, notably covid, which meant more time on watching videos and playing games. However, as China loosens mobility restrictions under its zero-covid policy, user engagement could take a hit.

Looking ahead, Bilibili continues to work on strategies to drive future growth.

Further monetization opportunities from expanding userbase, original content

Bilibili is aiming to grow MAUs to 400 million by 2023 (there is ample runway for growth considering homegrown short video rival Douyin has about 715 million MAUs, and global video giant Youtube has about 2.6 billion MAUs). Towards that end, the company is expanding its content offering to cater to older groups. Original content (known as (OGV or Occupationally Generated Video) including documentaries, and education content have helped increase the popularity of Bilibili’s platform beyond its core ACG (anime, comics, games) audience, and this in turn opens monetization opportunities, notably through advertising (particularly with OGV commanding the most expensive ads). China’s digital ad spending is expected to grow around 10% in the years to come, and as the only mid-to-long form video platform with a sizable portfolio of user-generated content, Bilibili could be positioned to capture some of that digital spend.

Sina.com

International expansion

Most of Bilibili’s revenues are derived from China but the company has been expanding overseas seemingly starting with Southeast Asia, which is not surprising considering the region’s vast Chinese-speaking diaspora (more than 80% of the world’s 50 million or so overseas ethnic Chinese reside in Southeast Asia). Bilibili launched localized operations in Thailand and Malaysia in December 2020, and in 2022 the company has been stepping up recruitment efforts in other Southeast Asian nations, including Vietnam, Indonesia, and the Philippines.

Risks and challenges

Likely to remain unprofitable in the foreseeable future

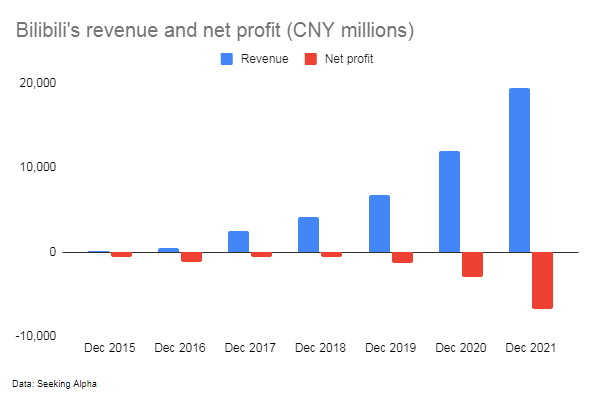

Bilibili has been unprofitable since inception, and the company’s rapid topline growth has come with swelling losses as well.

Author

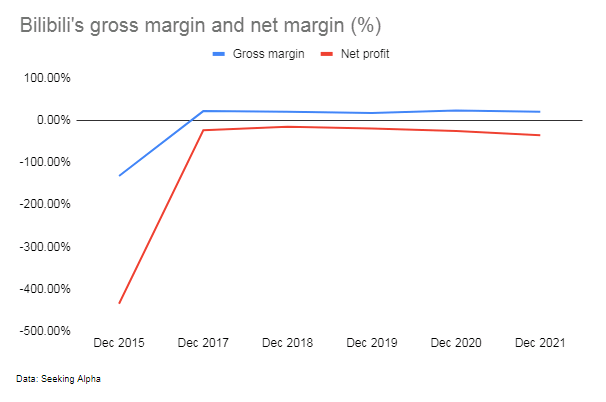

Margins have also largely trended sideways.

Author

Bilibili’s heavy investment in original content may help draw a wider audience, however, if domestic rivals such as iQIYI are anything to go by. Such a strategy can lead to massive losses and heavy cash burn, particularly in emerging markets, where consumer purchasing power is much lower. Rising content development costs combined with Bilibili’s marketing and user acquisition costs under its international expansion efforts (which are so far concentrated on emerging markets in Southeast Asia) suggests Bilibili is likely to remain unprofitable in the foreseeable future.

Recent resumption of gaming restrictions provides temporary relief but long term trajectory appears weak

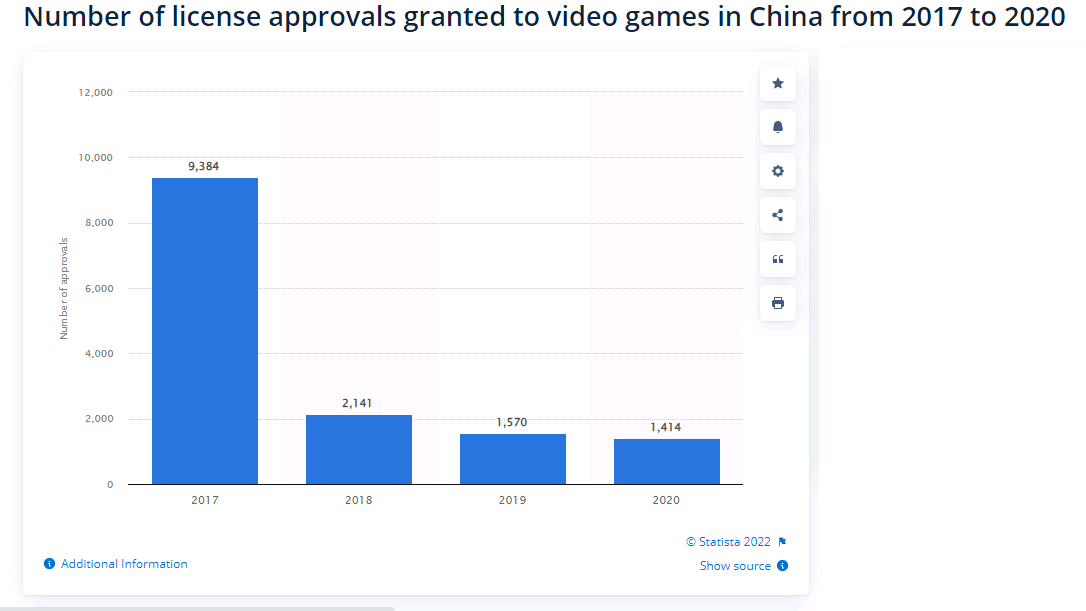

Bilibili’s Mobile Games segment was largely affected by the Chinese government’s crackdown on the country’s tech sector whereby approval for gaming licenses was suspended. The government, however, resumed license approval this year, a near-term relief for gaming companies like Bilibili, but long-term prospects don’t appear to be rosy. The number of licenses approved in China have been steadily declining over the years (China approved 755 licenses in 2021, down from just over 2,000 in 2018 and 9,369 in 2017).

Statista

The Chinese government is generally not enthusiastic about Chinese minors’ video game addiction and is now placing greater emphasis on encouraging their citizens to engage in physical games rather than virtual, i.e., online games. More time spent playing outdoor games rather than indoor games suggests soft prospects for the country’s video game space. It could also mean less time spent watching videos in general, which may hurt advertising revenues as well.

Ad budgets affected by near term macro challenges

Macro headwinds can constrain ad budgets in turn potentially impacting ad revenues and although Bilibili’s advertising division has so far bucked the trend, this performance could slow or even reverse as economic conditions worsen. Global media giants have been reporting weak results as a result of challenging conditions in the global digital media ad market; Google (GOOG, GOOGL) reported weaker than expected earnings and revenues largely because of weaker than anticipated YouTube ad revenues which rose just 14% (against a 25% expected increase). Meanwhile, Chinese superapp Tencent’s revenues have fallen for two consecutive quarters, driven by weak ad revenues (social ads dropped 5% YoY in Q3 2022 while video ads slumped 26% YoY).

Stiff competition

Longer term, stiff competition can impede growth prospects; there is no shortage of ad-supported online video platforms, from platforms offering original video content (such as Youku, Tencent Video, iQIYI (IQ), and global video streaming giant Netflix who launched an ad-supported tier this month) to platforms offering user generated content (including mid-to-long video platforms such as Youtube, Xigua Video and Bilibi, to short video platforms such Kuaishou (OTCPK:KUASF) and Douyin in China, and TikTok internationally).

Summary

Bilibili has had a rough year as China’s crackdown on the tech sector impacted gaming revenues. The resumption of license approvals for mobile games could provide near term relief, but video game license approvals in the country have been on a downtrend over the past few years. With the government aiming to encourage outdoor games rather than virtual ones, the gaming industry could face growth headwinds. Macro challenges meanwhile could impact advertising revenues as companies slash ad budgets.

Longer term, Bilibili is expanding its userbase which could help increase advertising revenues but increasing content development costs as part of its attempt to diversify its userbase, and increased user acquisition costs as part of its international growth ambitions suggests the company is likely to remain unprofitable in the foreseeable future. Additionally, stiff competition may further challenge the company’s ability to turn a profit.

Bilibili’s stock is down nearly 80% YTD and at its lowest levels since 2019, but with challenging near-term conditions due to macro headwinds and uncertain profitability prospects, investors should opt to wait and see.

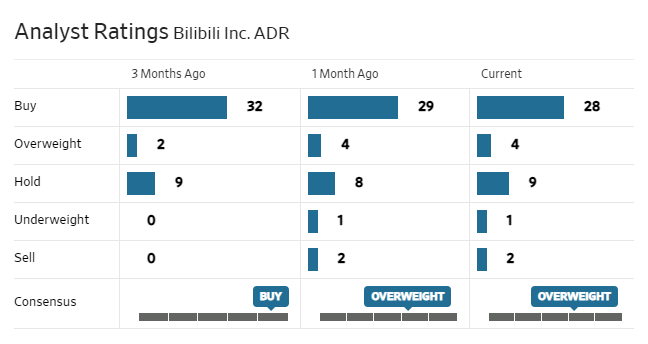

Analysts are generally bullish on the stock.

WSJ

Be the first to comment